Relief and pain—this year, the monsoon caused both, and in equal measure. The showers provided the much-needed relief from the searing heat, but in some places they caused massive floods, uprooting people, and destroying crops and infrastructure. Assam, Uttarakhand, Maharashtra and Andhra Pradesh—no part of India was spared the fury.

While we cannot do much about floods and nature’s way, what we can do is take adequate insurance cover to monetarily protect against the damage caused by floods.

Here are the common insurance covers for flood-related damages.

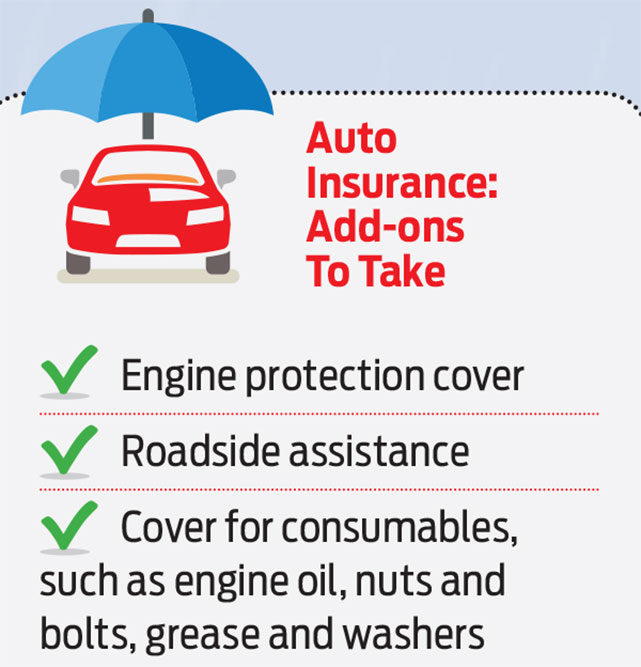

Car Insurance

Car insurance policies (both standard as well as comprehensive coverage) provide protection against damages caused by accidents and natural calamities. But they do not cover damages, such as engine damage in floods, tyre burst, or breakdown.

Says Rakesh Goyal, director, Probus Insurance Broker, an InsureTech platform: “Even a comprehensive insurance plan won’t cover things like ‘engine not working due to flooding’. Also, insurance companies don’t pay for any depreciation on the replacement and repair of parts. So, policyholders should buy engine protection cover, spot assistance, and depreciation covers.”

According to him, these covers are usually available as add-ons or riders, which need to be purchased along with the existing car insurance policy.

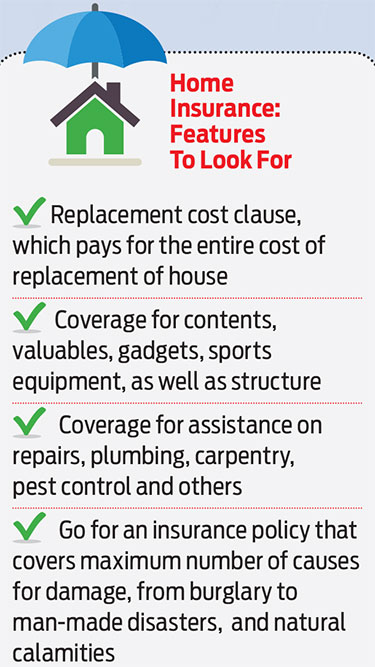

Home Insurance

Rain and flood can damage your home in more than one ways. A thunderstorm accompanied by rains can damage the structure, while water seepage can damage the roof, electrical wiring, and the contents of the house, including the furniture, thus causing major financial losses.

A home insurance policy can prove handy in such situations. Unfortunately, the penetration of home insurance is very low in the country. “The house insurance business in India is expanding at a very sluggish rate due to lack of knowledge and misinformation among the bulk of the people,” says Gurdeep Singh Batra, national head, retail non-motor underwriting and co-insurance, Bajaj Allianz General Insurance, a general insurance company.

That said, there are a few things you need to keep in mind before buying home insurance in India. “The policy should provide coverage against ‘acts of god’ as well as other unpredictable incidents. You could also buy a home insurance plan for a longer period (multiple years), as it will prove to be more cost effective,” adds Singh.

You should look at a comprehensive home insurance cover. “Look at burglary and theft cover, personal accident cover, loss of rent in case of occupation of tenant, additional expenses for alternate accommodation, workmen compensation cover for your house helps, cover for valuables, such as paintings and jewellery, among others,” says Singh. In addition, you can also include a third-party liability cover.

If you have made some changes in your house during the rebuilding and renovation process, ensure that you mention the correct valuation at the time of buying the cover. Adds Singh: “It is also important to have a cover if your house remains vacant for long periods. The correct address, correct valuation of property is equally important so that there is no liability to be borne by the insured person.”

If you want to insure the contents individually, make a list of items with the serial number and model etc. You can also go for a replacement or reinstatement cover, if required.

“In the home insurance space, you choose between a market value cover and a reinstatement cover. Under the market value cover, you get the value of your house after factoring in depreciation. In case of reinstatement cover, you get the full value of reconstructing your house. For instance, if there is a flood, you would need to rebuild your house. In such a scenario, a reinstatement cover will be more useful,” says Sanjay Datta, chief, underwriting, claims, and reinsurance, ICICI Lombard General Insurance.

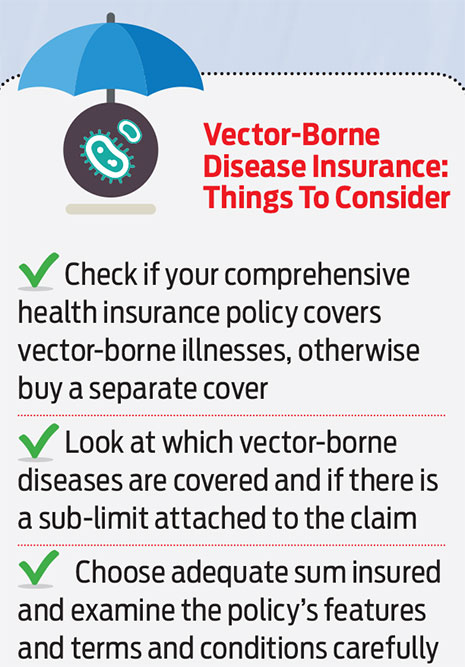

Insurance For Vector-Borne Disease

It’s common to hear of vector-borne diseases, such as dengue, malaria, viral fever, typhoid fever, diarrhoea and chikungunya, during monsoon.

Vector-borne diseases are basically infections transmitted by the bite of infected arthropod species, such as mosquitoes, ticks, triatomine bugs, sandflies, and blackflies. During the rainy season, the incidences of mosquitoes and other vector-borne illnesses, like dengue and malaria, increase significantly. If not treated in a timely manner, many of these illnesses may become life threatening.

Malaria and dengue fever are two of the most contagious and life-threatening vector-borne illnesses in India. Every year, these ailments infect millions of individuals and claim many lives.

In case of hospitalisation, the costs can dent your finances.

Says Bhaskar Nerurkar, head, health administration team, Bajaj Allianz General Insurance, a general insurance company: “Those without comprehensive health insurance must consider purchasing a vector-care insurance coverage for themselves and their families, which will cover financial difficulties that may arise because of medical treatment for vector-borne illnesses.”

The cost of treatment can be quite high. It takes about 8-10 days or more for a patient to recover from dengue. According to estimates by Policybazaar, the room rent in a hospital in a metro could cost Rs 1 lakh, while single transfusions could make you poorer by Rs 40,000. One typically needs four or more transfusions.

The insurance industry now offers specific vector-care insurance. Vector-borne health insurance, typically, covers dengue fever, malaria, filariasis (claim payable only once in a lifetime), kala azar, chikungunya, Japanese encephalitis and zika virus.

“You may buy a disease-specific health insurance cover that takes care of the high medical expenses incurred on vector-borne diseases if your basic health insurance policy doesn’t cover them. Dengue and malaria are the two most common diseases in India, and it makes sense to have a cover for them,” says Amit Chhabra, business head, health and travel insurance, Policybazaar.com.

Enjoy the rain, but protect yourself financially with the right cover.

With inputs from Kundan Kishore