The job market reopened in 2022, after prolonged disruption due to Covid, but towards the end of the year, there was news of mass layoffs by major companies, such as Meta and Amazon.

Landing a job in such tough times is surely to be cherished. But note that this may not just change your career graph, but also your tax life.

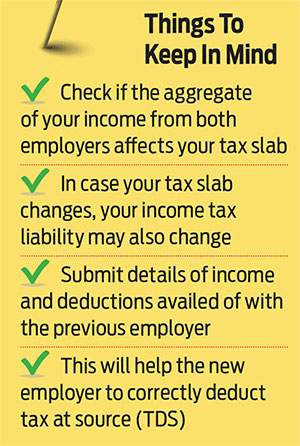

If you change jobs in a single financial year, a salary hike could put you in a higher tax bracket, thus increasing your tax liability. Besides, if you are not careful in providing the necessary documents to your new employer, you could find yourself burdened with unpaid tax at the time of filing your income tax returns (ITR).

Change In Tax Bracket

Your income tax slab would be arrived at by clubbing all the incomes from the various companies you would have worked at during the financial year.

In some cases, the slab may not change even after a hike. For instance, if you were drawing a salary of Rs 36,000 per month in company A till October 2022 and started earning Rs 48,000 per month from November 2022, the total income for the year will change, but the slab would remain the same.

Here’s the calculation: Your annual income would come to Rs 4.92 lakh (Rs 36,000 x 7 + Rs 48,000 x 5), up from Rs 4.32 lakh, but you would still remain in the Rs 2,50,001-5 lakh slab, taxable at 5 per cent.

But, say your monthly pay increased to Rs 50,000 in company B, then your annual income would come to Rs 5.02 lakh (Rs 36,000 x 7 + Rs 50,000 x 5). You would fall in the Rs 5,00,001-Rs 10 lakh slab in the old tax regime, taxable at 20 per cent, or in the Rs 5,00,001-Rs 7.50 lakh slab in the new tax regime, taxable at 10 per cent.

Any change in the tax bracket will also affect your tax liability, depending on the tax regime you choose.

Other Details To Deal With

There are also few other important matters you need to keep in mind.

Form 12B: You will have to collect Form 12B from your last employer and submit it to your new employer.

Says Ruchika Bhagat, managing director, Neeraj Bhagat & Co., a New Delhi-based CA firm, “The employee has to submit Form 12B to the new employer at the time of joining. It helps the new employer to correctly deduct tax at source (TDS) for the remaining financial year and generate Form 16 with correct details.”

If the old employer delays issuing Form 12B or does not even give it, then it can create problems as the Form 16 might have incorrect details of salary and deductions availed of.

Provide Deduction Details: If you have made any investments that qualify for Section 80C of the Income-tax Act, 1961, or under any other section offering deduction, you should furnish the details to the new employer.

Vinita Krishnan, director, direct tax, Khaitan & Co., says that while there is no penal liability for not furnishing such details, it is advisable to avoid any shortfall in taxes deducted, which can potentially create an advance tax liability for the employee and interest liability if such advance tax is not paid on time.

TDS And Advance Tax: One should take care that while providing details of the tax deduction to the new employer, the benefit does not get counted twice—by both the old and new employers. In that case, TDS will be lower than the actual tax liability.

Let’s say you earned Rs 6 lakh over six months from the first employer and received a deduction of Rs 1.5 lakh under Section 80C. Your taxable income will come to Rs 4.5 lakh. If the second employer, who, say, pays you Rs 8 lakh over the remaining six months of the FY, also gives the same benefit, your income will reduce to Rs 6.5 lakh. So, your total taxable income would be Rs 11 lakh with a Rs 3 lakh benefit, though it will be taken as Rs 12.5 lakh for actual tax computation because the overall limit under Section 80C is Rs 1.5 lakh.

Similarly, you should be careful about how much advance tax you are paying. “There is no reasonable justification regarding first paying excess tax in advance and then claiming the refund, which could lead to temporary blockage of your funds,” says Bhagat.

It is always advisable to correctly estimate the total income and the tax liability and accordingly pay the advance tax (bit.ly/3Hw9rmO).

letters@outlookmoney.com