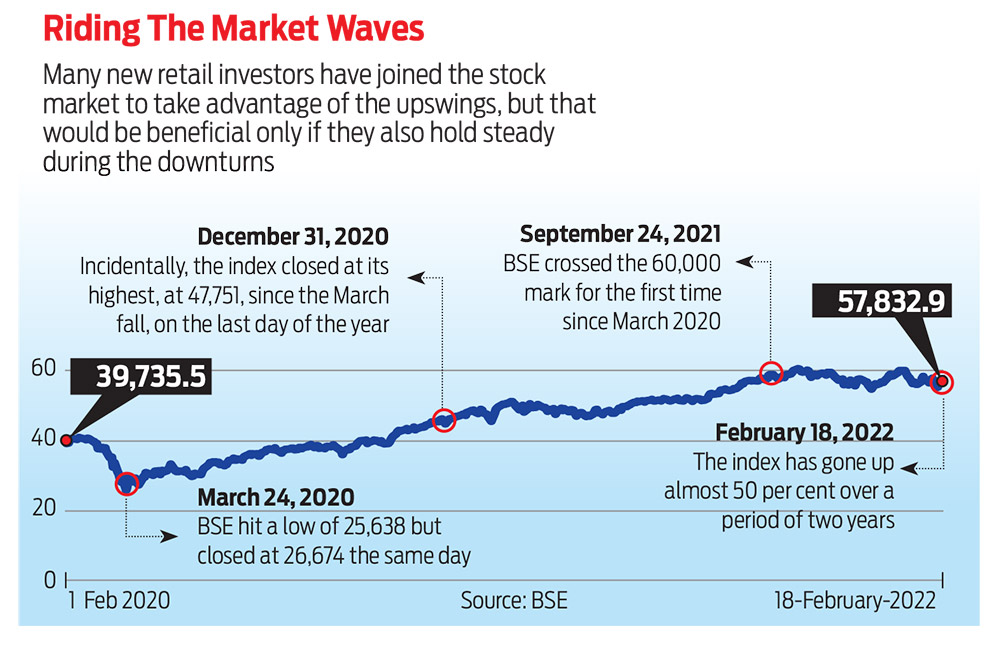

The stock market has been hyperactive since the benchmark Sensex index touched a low of 25,638 points almost two years back, on March 24, 2020, reeling under the first shock of the Covid pandemic. But within a year-and-a-half of the initial shock, the Sensex had climbed up to reach a peak of 60,000 points in September 2021. However, typical to its nature, the journey has not been consistent; there have been phases of high volatility. For instance, in January 2022 alone, the Sensex stayed over the 60,000 mark for about seven trading days in a row (it was at 61,308 on January 17), but then lost more than 6 per cent to touch a low of 57,200 on January 28.

A look at the journey between March 24, 2020, and February 15, 2022, shows that the Sensex gained 126 per cent. However, that does not mean that all the stocks listed on the index saw similar gains during this period. For instance, ITC was trading at Rs 147 on March 24, 2020, when the market touched a low. On February 15, 2022, the share closed at Rs 223. The stock gained 51.28 per cent during that period. There are many stocks that have either gained or lost more than the broad indices, Sensex and Nifty.

Market volatility notwithstanding, retail participation in the market has been on a sharp rise. As of January 31, 2022, Central Depository Services and National Securities Depository had 83.14 million accounts held by individuals. While increased retail participation is good news, it is also important that new investors take calculated risks instead of investing willy-nilly or based on hearsay.

Risks are inherent to market investing, but they get sharper when you are picking individual stocks. The impact of volatility is harsher if you choose the company or sector without due understanding. Not everyone may be in a position to do what’s required. In such a case, it is better to either invest in the market via mutual funds or consult a financial advisor. However, if you are confident of being able to make the effort that’s needed, then here are some basics to start off with before you plunge into picking stocks on your own.

Starting With The Fundamentals

In a hurry to earn quick returns, most investors ignore the need to collect basic information about a company they plan to invest in. Don’t just pick a company that’s in news or you have heard about; collect basic information. The company’s line of business, promoters’ holding, debt equity ratio, capital expansion plans and management stability are some of the details that can help define the possibility of the company’s success or assess the potential of this business.

For instance, higher promoter holding can mean he or she has confidence in the business. The debt-equity ratio will give an idea of how leveraged the company is. High leveraging means higher interest outgo, which can squeeze the margin. Price-to-earnings (P-E) is one of the most commonly used valuation metric as it gives an idea about the pricing of the stock. Comparing a stock’s P-E with that of other stocks in the peer group indicates whether it is trading at a premium or discount.

“Along with valuations, study the execution capability of the management and the corporate governance practices to get a holistic view,” says Prateek Pant, chief business officer, WhiteOak Capital Asset Management.

Look at not one or two but multiple metrics, and in the right context. For example, some companies may appear cheap as they may be trading at a lower P-E multiple as compared to peers. However, they may not have stable cash flow. If there is stable cash flow, high debt-equity ratio may mean the majority of the funds are being used to service debt.

Playing Monopoly

Investing legends like Warren Buffett are known to park a major chunk of their investments in shares of monopoly businesses. In India, IRCTC, Hindustan Aeronautics (HAL) and Coal India are some examples as these companies have the lion’s share of the market. Monopoly businesses can be attractive since they supply goods or services that are otherwise unavailable in the market. Undeniably, they have a huge market share in the absence of any competition. But is that enough? Tanushree Banerjee, co-head of research, Equitymaster, an independent equity research firm, says, “It is not the absence of competition or the market share that determines the true wealth-creating potential of monopolies. Rather, it is the moat that allows them to consistently compound their shareholder returns. A monopolistic moat is something that must be consistently nurtured.”

An economic moat is the company’s inherent competitive edge. It is the ability of the company to run its business and create wealth for its shareholders in such a way that no other company can disrupt its business model easily. For example, Reliance Jio disrupted the telecom market by offering low fees and free Internet service. In a moat-based business model, this would not have been possible because it would be extremely difficult to offer a better alternative.

However, the very fact that monopolies have little to no competition also poses the risk of them stagnating. Therefore, it’s important to monitor such a company’s growth and future plans.

“Constant product innovation, adapting to the latest technology, strengthening the supply chain, etc. can all help companies enjoy monopoly-like fortunes,” says Banerjee. To continue enjoying their monopoly status, traditional companies often have to pivot their business models. So, don’t be surprised to find automakers investing in electric vehicle technologies or banks investing in fintech-like applications to remain in leadership positions.

“Some solid monopoly stocks have been big gainers in the market rally over the past 24 months. But not all will retain their edge. Most do not have the virtues to make them permanent wealth creating franchises,” adds Banerjee. Therefore, it is important to evaluate your favourite monopoly stock like any other business, and exit if it doesn’t warrant your attention.

Eye On the Future

A company only works in the long run if it has a viable business, which is why companies have to adapt to change in consumers’ preferences or create a new market. The demise of Nokia is a case in point. The company, which was highly successful initially, was not able to adapt to changing customer need as competition intensified and the market expanded. In early 2000s, Nokia was the world leader in mobile phones but a slowdown in the mobile phone market, battery-related recalls and advent of Android saw it slip and it never recovered. Apple, Blackberry, Samsung, HTC and others captured the market. In 2013, Nokia was acquired by Microsoft. There are many such examples. When picking a stock, it is important to see whether the company can reinvent itself. It should have the ability to keep an eye on the future.

Penny For Your Stocks

Buy low, sell high is among the most fundamental mantras of stock investment decisions. Adept investors identify stocks that are available at low valuations but have strong growth potential. However, novice investors misinterpret this idea by investing in cheap a.k.a. penny stocks to earn higher gains when the market is bullish.

Investing in penny stocks is highly risky because they “usually lack liquidity and volume and are susceptible to high volatility. Retail investors might get into them on account of market tips or speculation, but exit could become extremely difficult due to the above reasons. While the reward looks very exciting, risk must not be ignored,” says Tarun Birani, founder and CEO of TBNG Capital Advisors.

Investing in the shares of a company that shows consistent performance will yield higher and more reliable returns than paying for thousands of penny stocks that are not worth the risk.

If you are keen to invest in stocks directly and on your own, the first few steps can make or break your portfolio in the long run. It is imperative to check the fundamentals and quality of a company, irrespective of whether it is a blue chip or a penny stock. Learn the starting lessons well so that you can reap full benefits of your choice.

***

What After You Have Picked Your Stocks?

Stock selection is a critical part of building a portfolio, but maintaining the portfolio is also an important ingredient to the recipe of wealth creation

Think Long-Term

Many retail investors make the mistake of booking short-term gains. After the market crash in March 2020, when the market recovered to 47,000 levels by the end of 2020, a lot of investors rushed to book profits. While those reeling under financial pressure due to Covid may not have had another option, others clearly missed the market rally that followed in 2021, when the Sensex first touched 50,000 on January 21, 2021, and then 60,000 on September 24, 2021.

Avoid Re-Investment Risk

Too much activity does not always mean ‘too much’ returns. “Whenever we buy and sell stocks frequently, we are also exposing ourselves to re-investment risk, i.e., the risk of finding a better stock/company than the one already chosen. Great companies with strong tailwinds held for large periods earned returns rivaling that of short-term traders or even better. Short-term profit booking also leads to an excess tax bill,” says Tarun Birani, founder and CEO of TBNG Capital Advisors.

Track Your Portfolio

The stock investments may be for the long term, but the portfolio has to be checked more frequently. “This allows you to determine whether they are on track to accomplishing your financial goals,” says Prashant Sawant, co-founder, Catalyst Wealth. Your kitty of stocks may need to change according to the amount of risk you can take. The asset allocation—how you divide your money across different types of investments—will alter.

letters@outlookmoney.com