Last year, Sarika, an IT professional based in Noida who did not want to reveal her real name, spent Diwali with children at Saikripa, a non-governmental organisation (NGO) that works for homeless and abandoned children. The family, consisting of her husband and son, decided to not spend anything on crackers, expensive lighting and new clothes, and re-channelled the money as a donation to the NGO.

She says, “We wanted to have a different experience on Diwali with underpriviledged children. It was a wonderful experience. My son was hesitant in the beginning, but was happy at the end of the day.”

Everyone may have different reasons and modes of donating, but for most donors, charity generates positive emotions. A research paper, The Emotional Rewards Of Prosocial Spending Are Robust and Replicable in Large Samples, published in the Harvard Business School’s publications in December 2022, confirms that. In the paper, Harvard Business School assistant professor Ashley Whillans, Canadian researchers Lara Aknin of Simon Fraser University, and Elizabeth Dunn of the University of British Columbia, said that spending money on other people can increase happiness among donors.

Like Sarika, many people prefer to donate during the festive season, though many do it throughout the year. Anant Arora, chief sustainability and communications officer, The Akshaya Patra Foundation, says: “Many people choose to donate at monthly intervals, ensuring consistent support. However, some donors prefer to contribute during festivals, aligning giving with the spirit of celebration and sharing.”

The decision to do charity, however, is only the first step. The next and more crucial step is to select an NGO or a cause close to your heart. For Sarika, choosing the NGO was easy, because she found it in her neighbourhood and felt for the cause.

How To Select An NGO?

There are approximately 3 million NGOs in India working for different causes, according to various estimates. NGO-DARPAN, the government portal launched in 2015, where NGOs can self-declare their information, has 173,757 registered NGOs and voluntary organisations (VOs), as on September 13, 2023.

Choose The Cause: Anupam Roongta, 40, a research analyst based in Jaipur, feels for the cause of education and has been a regular donor for almost 10 years. Roongta, who picked up the habit of charity from his father, donates to several charities, including the Akshay Patra Foundation, which provides food to schoolchildren under the PM POSHAN Abhiyaan (formerly the Mid-Day Meal Scheme) in partnership with the government.

Charity organisations work in varied fields, from humanitarian to environmental causes. Therefore, it makes sense to choose the cause you feel connected to.

NGO-DARPAN shows that Uttar Pradesh has the highest number of NGOs registered with it, followed by Maharashtra, Delhi, West Bengal and Tamil Nadu. The highest number of NGOs are working in the field of education and literacy, at 100,464. The health and family welfare sector is being catered to by 68,122 NGOs, followed by those focusing on children at 63,879.

Filter out the ones working in the area you feel passionate about, be it about uplifting underprivileged children, women empowerment, education, or global warming.

As it is a voluntary act, instinct plays a role in choosing the cause.

As for Sarika, the choice of Saikripa was an instinctive one. “While I was exploring NGOs to donate, I found Saikripa, called them and felt that it would be the right choice,” she says.

Check The Genuineness: Once you have zeroed in on the organisation, make sure you check how genuine and authentic it is. Do a basic search on the internet and check its website. If possible, visit the NGO to find out more details about its work. If you know someone who already donates to the NGO, you can check with them about the impact it creates on the ground. You may also want to compare it with a few other NGOs working in similar areas.

Moreover, if you want to donate to derive satisfaction, you may want to know whether your money is reaching the right people. Ensure that the NGO answers your queries to your satisfaction on how the funds are being utilised and the impact it is creating.

Anupam Roongta 40, Jaipur

The research analyst has been donating for the last 10 years, having picked up the habit from his father. He offers subscription-based stock recommendation service, and the online fee paid by his clients is redirected to the NGO

***

For instance, according to Roongta, Akshay Patra Foundation shares the utilisation certificate to each donor, disclosing the amount they donated, how it was utilised, in which particular district, which kitchen and how many students were impacted.

Arora says: “Each meal costs us Rs 15.57. Of this, Rs 8.56 is provided by the government in the form of subsidies and grains, while Rs 6.56 is raised through donations from corporate and individual donors from within the country and abroad. As for state-wise funding, it varies from state to state, depending on the number of schools and students covered under the programme in each state.”

In 2022-23, the foundation received approximately 53 per cent of its donations from corporates, 19 per cent from individual donors and about 27 per cent from trusts and other foundations.

Likewise, Smile Foundation receives around 10 per cent of its donations from individual donors. “Value-wise, individual donors contribute 10-11 per cent of our annual funds received on average. The remaining funds come from corporate and institutional supporters,” says Shived Saxena, head, Individual Giving, Smile Foundation.

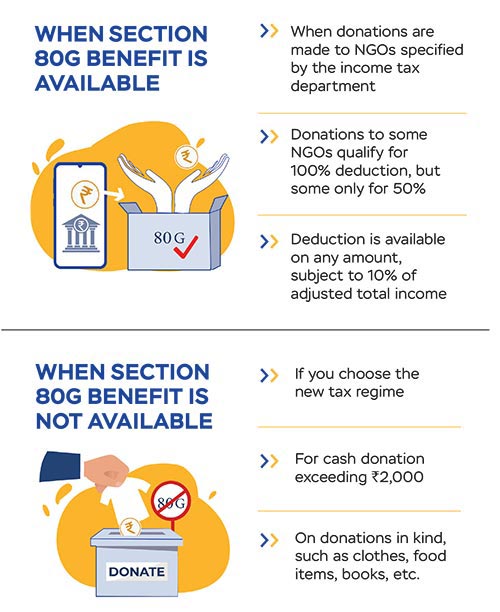

Consider Tax Benefit: Besides the emotional benefits, charity also offers tangible benefits—you may get a 100 per cent tax deduction on the donation amount under Section 80G of the Income-tax Act, 1961.

This deduction is, however, available only on donations made to specific NGOs. The list is notified by the income tax department. For example, many private trusts do not have 80G registration and donations to such NGOs won’t qualify for tax benefits.

Says Gopal Bohra, partner, direct taxation, N. A. Shah Associates: “Section 80G (1) and (2) of the Income-tax Act, 1961 deals with the deduction on donation made by a taxpayer to any charitable organisation. There are around 10-20 items that are specified for a 100 per cent benefit; donations for the rest offer a 50 per cent benefit on the donation amount. These are subject to 10 per cent of the total income.”

For instance, donations to Smile Foundation, which has been working for the underprivileged since 2002, get tax benefit up to 50 per cent of the donated amount.

For instance, donations to Smile Foundation, which has been working for the underprivileged since 2002, get tax benefit up to 50 per cent of the donated amount.

However, if you are making your decision to donate on the basis of this criteria, do remember that the deduction under Section 80G is not available under the new income tax regime.

Says Saxena: “We have observed that individual giving picks up after September each year and goes on till March, which marks the period for filing of income tax returns. April to August marks the relatively lean season in terms of individual giving in India. The month of October heralds a long festive season, and it applies across India.”

How To Donate

Money is only one of the ways in which you can do charity. Some other ways include volunteering, spending time with the beneficiaries and others.

Roongta is not able to spend time with the beneficiaries he donates to, but he has found an innovative way to continue donating. He offers subscription-based stock recommendation service, and the fees his clients pay online on his website go directly to the NGO.

When it comes to money, it is advisable to avoid donating in cash. That’s because Section 80G benefits are not available for any donation in cash exceeding Rs 2,000 in a year.

Amid the evolving fintech space, these charitable organisations and NGOs also receive donations through different modes, such as cash, cheque, unified payments interface (UPI), among others.

Says Arora: “Akshaya Patra Foundation accepts donations through monthly electronic clearing system (ECS), UPI, credit card, digital wallet, QR code on its website, bank and wire transfer, and cheques.”

In the end, it is up to you to think of charity as a one-time donation or a way of life but, more importantly, choose the one you feel for.

As for Sarika, she plans to go back to the same NGO this year, but this time she has also invited her extended family to partake in the festivities with the underprivileged children so that they too can experience the joy of giving.

versha@outlookindia.com