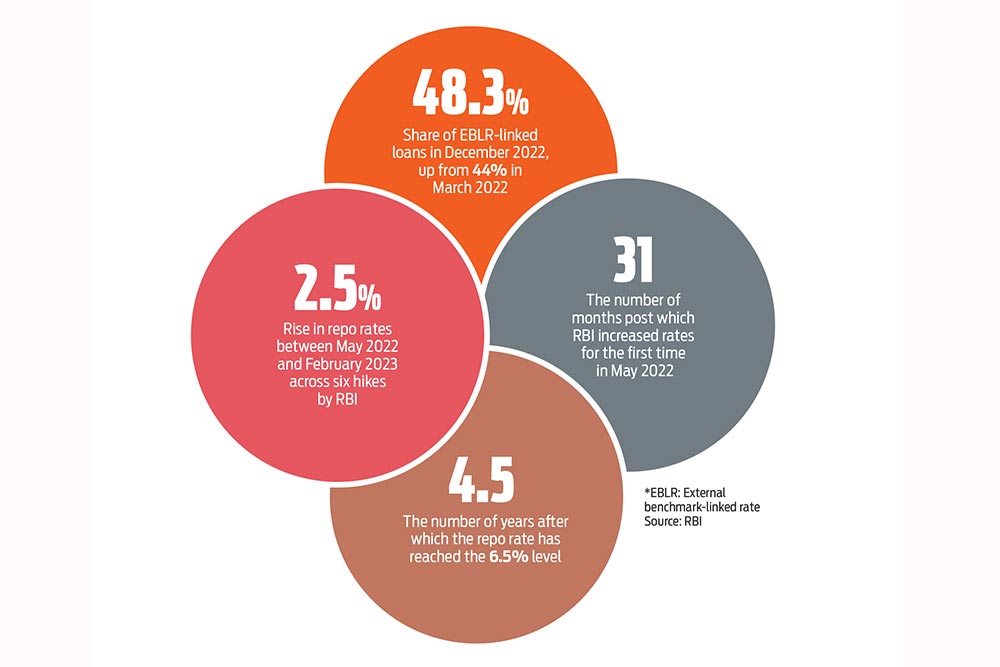

In May 2022, soon after geopolitical concerns took centrestage and the Covid threat started abating, the Reserve Bank of India (RBI) increased repo rates for the first time after 31 months to control inflation. Ever since, RBI has been on a rate hike spree, pausing only recently in April 2023, with an indication that this may not be the end of the rate hike cycle yet.

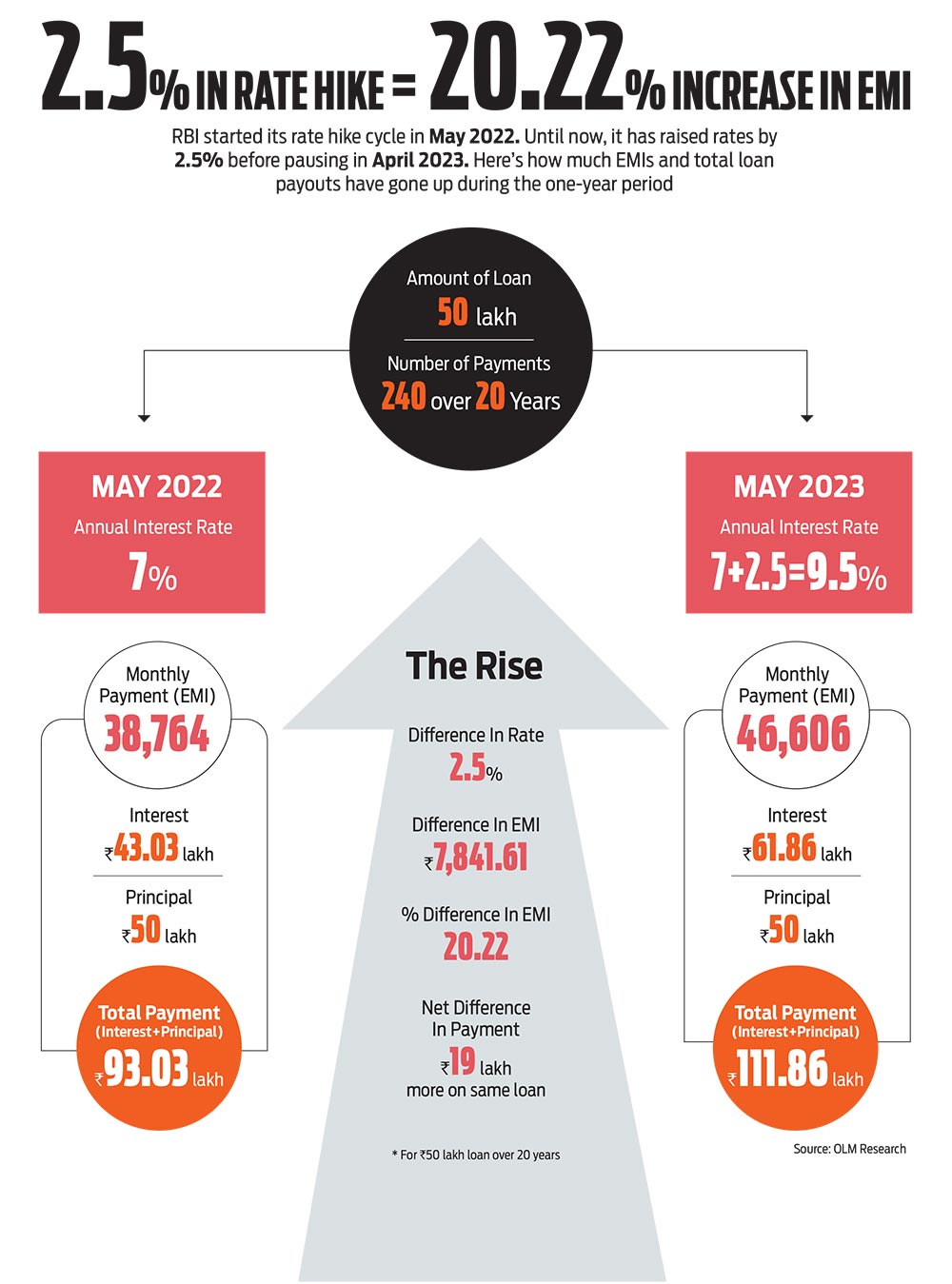

In the last one year, the central bank has raised interest rates by 2.5 per cent or 250 basis points (bps), and repo rates have reached the 6.50 per cent level after four and a half years. The 2.5 per cent number may not look alarming, but it has left a trail of misery for borrowers who have seen equated monthly instalments (EMIs) go up by a huge 20 per cent for a home loan amount of Rs 50 lakh over a period of 20 years, at the cost of compromising with other expenses or remaining indebted for a longer period.

The recent policy action by RBI has kindled some hope. The pause in rate hikes in the first bimonthly policy announcement for financial year 2023-24 has given rise to the cautious expectation that EMIs may not go up further, stopping short of being optimistic about a rate cut.

The development throws up key issues for borrowers, both new and existing. The first, of course, is where are the interest rates headed. The second is relevant for new borrowers who may have been waiting for a rate hike pause and would now be wondering if the time is right for them to take the plunge. The third involves existing investors, who need to put a strategy in place if they haven’t done so already, especially now that they may not have to realign their cash flows every two months with every RBI monetary policy announcement. Before dealing with those, we take stock of the pain the rate hikes have caused over the past year.

Photo: Suresh K Pandey

Tejeesh Nippun Singh, 49, Delhi-based art gallery owner

He bought a Honda City car for which he took a five-year loan of Rs 6 lakh from SBI

“The loan was on a fixed rate and the EMI has been the same as it was before the RBI rate cuts.”

Borrowers Bore The Brunt

The rate hikes have left borrowers, with floating rate of interest on loan, in despair as they were forced to adjust their repayment tenures or cash flows.

Krishnanga Chowdhury (32), an electronics engineer based in Kolkata, who works at a consulting multinational company took a home loan in April 2022, just before the rates started rising. The joint home loan of Rs 50 lakh that he took along with his wife, so that both of them could avail of the tax benefits, cost 6.4 per cent at the time. The couple is now paying 8.9 per cent for the same loan.

“Even before I paid my first EMI, the interest rate had increased. My first EMI was deducted in June 2022, and interest rates started increasing in May. It has been difficult for us as interest rates kept rising and so did the EMIs,” says Krishnanga, who bought the house on the outskirts of Kolkata for Rs 75 lakh. The pinch is harder because the house is still under construction and the couple is paying rent as well.

The couple has chosen to pay the same EMI, which means the tenure has gone up to 23 years from the original 15 years. “The interest payout on the loan will double over the 23-year tenure,” he adds.

Amit Mishra, a 41-year-old resident of Pune, plans to borrow some money from his parents to reduce the EMI burden that has started affecting his monthly budget. “My EMI has increased around 20 per cent in the last year because of the rise in interest rates,” says Amit.

The Worst Hit: The borrowers who have been hit the hardest are those who have home loans based on external benchmark-linked rate (EBLR). Typically, banks consider repo rate as the external benchmark rate. According to RBI data, EBLR-linked loans now dominate outstanding floating rate loans, with their share increasing from 44 per cent in March 2022 to 48.3 per cent in December 2022.

Most home loans were linked with repo rates after October 2019. At that time, this put borrowers at an advantage, as repo rates were reduced during the Covid period to contain the pandemic-led disruption and provide relief to the citizens. The tide changed when RBI started increasing rates to tame inflation.

The rapid increase in EBLR has led banks to either increase the loan tenure or the EMI, or both, depending on the age of the borrower and the residual tenure of the loan. “Banks revised upwards their EBLRs by 250 bps during May 2022-March 2023 in tandem with the increase in the policy repo rate,” RBI wrote in its May bulletin.

According to an SBI research report published in March 2023, of the 5.5 million home loan accounts linked to EBLR, 4.7 million have suffered the higher rate burden. Of this, merely 820,000 borrowers have the capacity to prepay the loan.

Photo: Tribhuvan Tiwari

Jyoti Malhotra, 46, Delhi-based merchandising professional

She was among those who were not hit by the RBI rate hikes. That’s because she took a personal loan of Rs 10 lakh in December 2020 at a fixed rate of 10.49 per cent for a period of five years

“I needed the loan to fulfil certain immediate requirements and consolidate some other loans. After two-and-a-half years and several rounds of repo rate hikes, I still pay an EMI of Rs 21,489 as I signed up for a fixed rate of interest.”

Our calculation shows a similar increase in the EMI. The EMI for a Rs 50 lakh home loan at 7 per cent floating rate of interest, taken over a period of 20 years, will go up to Rs 46,607 from Rs 38,764, adding the 2.5 per cent hike in interest rates (9.5 per cent) in tandem with the repo rate rise. This translates into an increase of 20.22 per cent in EMI outgo per month.

The Least Hit: Those who did not have EBLR-linked loans were the least hit in the floating rate segment. “The marginal cost of funds-based lending rate (MCLR)—the internal benchmark for loan pricing—rose by 140 bps over the same period. The weighted average lending rate (WALR) on sanctioned fresh rupee loans increased by 173 bps and that on outstanding rupee loans by 95 bps during May 2022 to February 2023,” wrote RBI in its May bulletin. These rates were much lower than the EBLR rates that increased by 250 bps.

Some banks still offer home, personal and car loans at interest rates linked to internal benchmarks, including MCLR. Also, the ones who locked themselves into fixed rates before the hikes were at an advantage.

Jyoti Malhotra, a 46-year-old Delhi-based professional, took a personal loan of Rs 10 lakh in December 2020 from Axis Bank at 10.49 per cent for a term of five years. She needed the loan to fulfill certain immediate requirements and to consolidate some other loans that she had. After two-and-a-half years and several rounds of repo rate hikes, Jyoti still pays an EMI of Rs 21,489 because she signed up for a fixed rate of interest.

Car loan borrower Tejeesh Nippun Singh, 49, also seems to have been spared the burden of paying extra EMI. Tejeesh, founder of an art gallery in Delhi, says the hike in repo rates never translated into higher EMIs for his loan of Rs 6 lakh, which he took from State Bank of India in December 2019 at a fixed rate. He has been paying an EMI of a little over Rs 9,700. At the same time, he never benefitted from the lower rates when RBI cut interest rates in April 2020. “I guess whatever they had been charging me during the lockdown period, when the repo rates were reduced for a while, has been squared off now with the hike.”

The bank approached Tejeesh to opt for a six-month moratorium during the lockdown, but he refused as that would have added to his EMI burden. “The initial EMIs are heavily loaded with interest. Only a small part of the principal amount is deducted from the loan. Had I taken the moratorium, not only my tenure would have been extended by six months, I would have also paid extra interest on my loan.”

Where Are Interest Rates Headed?

Many hopeful borrowers see the April 2023 rate hike pause as a sign of an impending rate cut. RBI, however, has specified that the recent policy action is not a pivot, but only a pause. In other words, the pause may not signify a shift in the policy rates. However, uncertainty remains, and people are now keenly waiting for the next policy meet scheduled for June 6-8, 2023.

Central banks across the globe have been raising interest rates to tackle higher inflation, and so has been RBI. But the tide seems to be turning now to some extent. The recent banking crisis in the US has led to fears of a recession, and central banks of both developed and emerging markets are now turning dovish. While RBI has paused rates, major central banks have slowed down despite higher inflation. The European Central Bank (ECB) slowed the pace of its interest rate increases with a 25 bps hike in May 2023 despite an inflation of 7 per cent. The US Federal Reserve, which wants to tame the inflation in the 2 per cent band, increased rates by a mere 25 bps even though the prevailing inflation is at 5 per cent. Given that inflation in India is within its upper tolerance band, RBI is unlikely to take any chances.

Photo: Sandipan Chatterjee

Krishnanga, 32; Nisha, 29, Kolkata-based electronics engineer; computer engineer

He took a joint home loan of `50 lakh with his wife in April 2022, just before the rates started rising. At that time, they were paying a rate of interest of 6.4 per cent, which has now risen to 8.9 per cent

“Even before I paid my first EMI, the interest rate had increased. It has been difficult as the EMI is rising and the house is still under construction. I will save lump sum to prepay the loan. The idea is to save up every year and reduce the burden.”

Further, the ray of hope in India is that inflation has started moderating. India’s consumer price index (CPI)-based retail inflation declined for the third consecutive month, and was recorded at a 15-month low of 5.7 per cent in March 2023 and an 18-month low of 4.7 per cent in April 2023. The inflation rate is still high, but falls within RBI’s upper tolerance limit of 6 per cent. The other factor that works in India’s favour is the fall in crude price.

The experts Outlook Money spoke to do not expect rates to go any higher, but most do not rule in favour of a rate cut anytime soon either. Says Upasna Bhardwaj, chief economist, Kotak Mahindra Bank, “We expect RBI to stay on prolonged pause through most of this year. While headline inflation has been moderating lately, concerns on monsoon and elevated core inflation remain.”

Aditi Nayar, chief economist at ICRA Ltd, believes that the intensity of the monsoon will set the tone for interest rate movement in the future. “By the time the MPC meets at its next scheduled meeting in June 2023, the timeliness and intensity of the monsoon onset would be known. This information would feed into whether the MPC’s CPI inflation projection of 5.2 per cent for FY24 needs to be modified. We expect there’s a high possibility of a pause in the June 2023 MPC review. However, a pivot to rate cuts appears quite distant.”

Some experts are cautiously optimistic, however, as the April inflation number was below RBI’s estimation of 5.2 per cent, which may bode well for a rate cut. Says Murthy Nagrajan, head of fixed income, Tata Mutual Fund, “The situation seems favourable, as CPI inflation has come down after a long time, and the current account deficit is also narrowing, while oil prices have also come down significantly. Therefore, we are expecting inflation to go down further, and this augurs well for a rate cut of 25-50 bps in the latter half of the year.”

A research report released by Emkay Institutional Equities on May 5, 2023, supports Nagrajan’s inflation target. “Retail inflation is likely to ease well below the 6 per cent aim of the central bank. The CPI inflation will likely slip below the 5 per cent level later this year and average 5.2 per cent for CY23,” it says.

Growing Loan Books

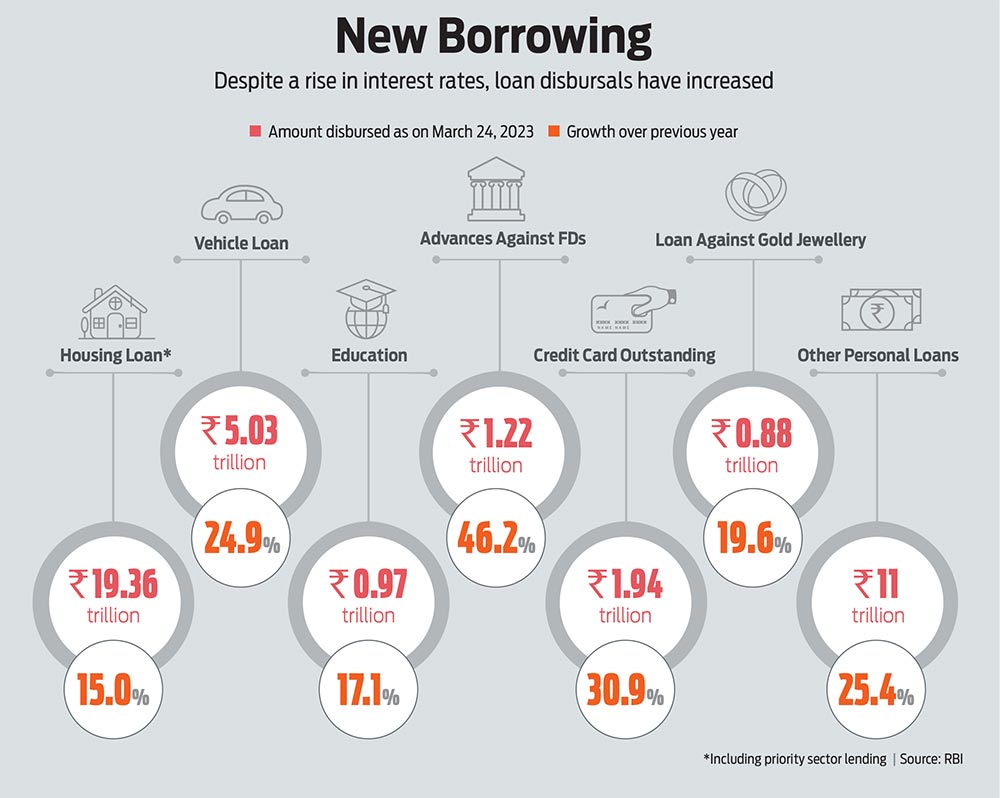

Despite the hike in interest rates, the pace of borrowing did not slow down in the past year and has grown instead.

RBI data shows that housing loans (including priority sector lending) were worth Rs 19.36 trillion, as on March 24, 2023, clocking a 15 per cent growth over the previous year.

The amount of vehicle loans extended was Rs 5.03 trillion, as on March 24, 2023, with a 24.9 per cent growth over the previous year. Overall, the personal loan category, which includes loans on consumer durables, loans against securities and fixed deposits, credit card outstanding, education loans, gold loans, among others, the annual growth was 20.6 per cent.

According to a report by Equifax and Andromeda, India Retail Loans Overview, April 2023, Vol-II, there has been significant growth in the personal and home loan disbursal in the one year ended December 2022. Retail lenders disbursed Rs 31 crore worth of loans, which reflects a 40 per cent growth in retail lending over the previous year. From January 2022 to December 2022, 34 lakh home loans were disbursed worth around Rs 9 lakh crore. Overall, the outstanding portfolio of home loans grew by approximately 16 per cent from December 2021 to December 2022, says the report.

The pace of loans grew on the back of pent-up demand and increased incomes, following the sluggish movement during the Covid period. Says Virat Diwanji, group president and head of consumer bank, Kotak Mahindra Bank, “There’s a lot of pent-up demand after Covid, and with rising income levels, people are now more confident about making large purchases. Also, discretionary spending has seen an uplift in FY23. Youth and millennials are forming a large group contributing towards increase in credit growth with their unlimited aspirations for big houses, luxury goods, international travel, etc., resulting in higher demand for personal loans, consumer durable loans and credit cards.”

Another reason is digital transformation. Besides stability in monthly income, now there’s instant availability of retail loans, says Sanchay Sinha, senior general manager and country head, South Indian Bank. “Digital transformation in the last three years has made retail loans more accessible to the common man. None of the lenders want to market their retail products with beyond 30-minute turnaround time for sanction or disbursal,” he adds.

What Should New Borrowers Do?

RBI has paused rates, but it has given no indications of rate cuts yet. In fact, in the April monetary policy, it highlighted that

“inflation has persisted at elevated levels across the world and in India” and that it “remains focused on progressively aligning inflation with the target. Geopolitical hostilities, volatile global financial markets and climate shocks are the key risks to the growth and the inflation outlook”.

Even though central banks in developed countries have also turned somewhat dovish, uncertainty remains. In such times, it’s best for investors to focus on their own needs, goals and affordability rather than looking at the macro environment.

For instance, if you want to buy a house you like and in which you plan to live, and you can afford it, you should go for it even if the interest rates are high. Since home loans are available on floating interest rates for a longer term and most of them are linked to EBLR, the cost may go down when the interest rate cycle turns.

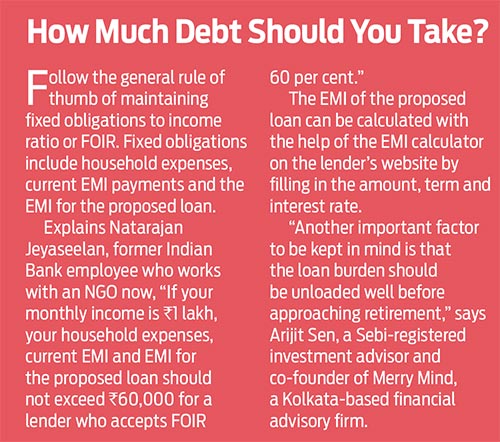

However, ensure that it’s a well-weighed decision, as miscalculating your cash flow can land you in debt that you may not be able to deal with. “Any loan should be supported by sufficient cash flow. So, borrowers should maintain a healthy ratio between fixed obligations and income levels,” says Diwanji. Typically, experts advise borrowers to not use up more than 40 per cent of their income for liabilities, such as loans.

Strategies For Existing Borrowers

There are two-three strategies that can work for existing borrowers. Consider the most suitable and practical one in keeping with your circumstances to alleviate the EMI burden and ensure timely repayment of your home loan.

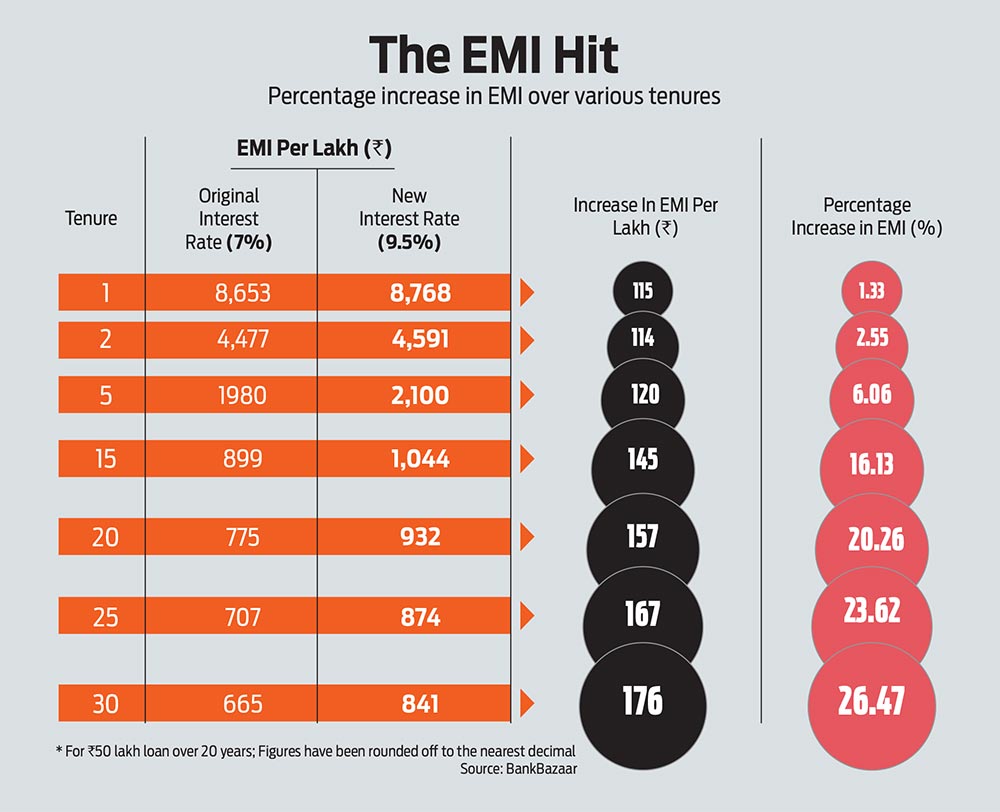

Increase Tenure Or EMI: The first option is to increase the tenure as that would not hit your immediate cash flow and other expenses and continue with the same EMI. But remember that increasing the tenure will increase the overall interest outgo multifold.

“If cash flow is not permitting you to increase the EMI, then a 20-year loan of Rs 50 lakh, whose interest rates have gone up from 6.80 per cent to 9.25 per cent, will take 45-plus years to be repaid as against the original tenure of 20 years. Thus, the interest outgo will be humongous,” says Arijit Sen, a Sebi-registered investment advisor and co-founder of Merry Mind, a Kolkata-based financial advisory firm.

Another thing you should keep in mind is that you may not be able to increase the tenure beyond a certain limit. In the example used earlier in the story (see 2.5% In Rate Hike = 20.22% Increase In EMI), if borrowers opt to increase the tenure, they will have to keep repaying for 60 years. In reality, though, most banks do not allow you to take a loan beyond 30 years. This means that you cannot stretch your tenure beyond a point. If you increase your tenure to the maximum limit of 30 years, your EMI will still go up by 8.45 per cent.

The best course of action would be to cut all discretionary expenses and increase the EMI to the limit required.

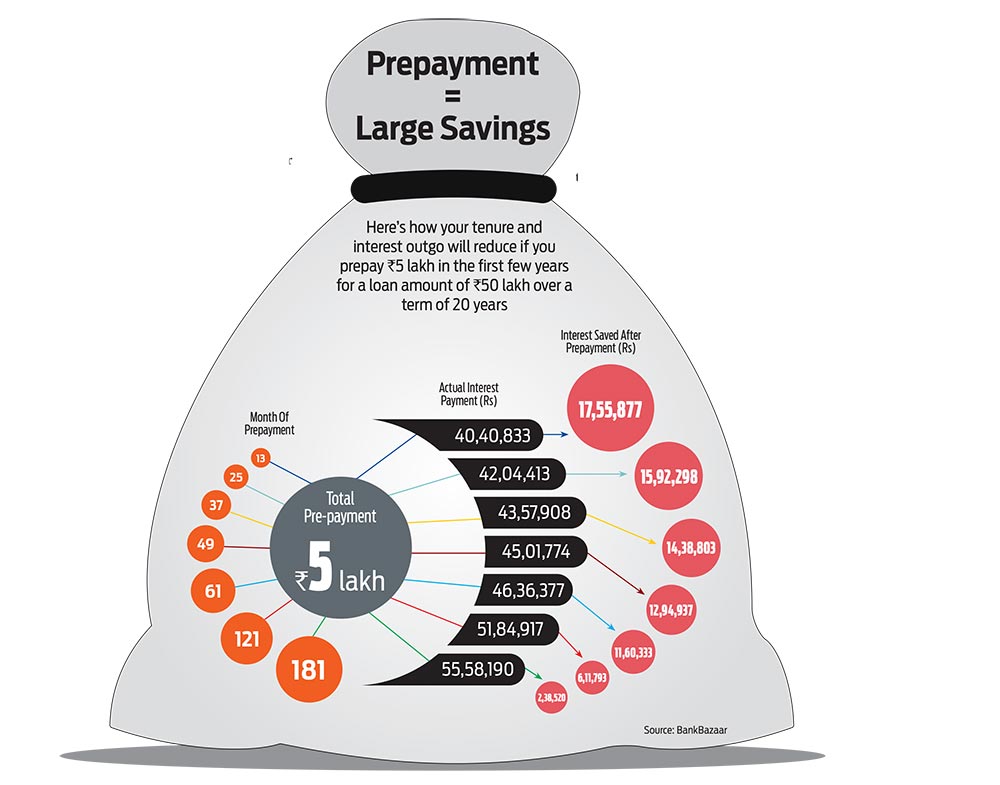

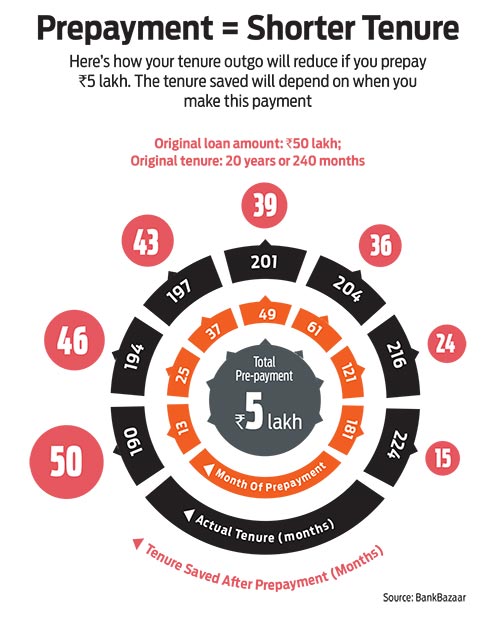

Prepay By Increasing EMI: An effective strategy to bring down the interest outgo, which would have increased due to the high rates, is to increase the EMI that you are supposed to pay after rate hikes. The amount by which you increase the EMI fixed by your bank will go towards prepaying the capital amount.

By allocating a portion of each payment exclusively to the principal, you can ensure that the outstanding loan balance decreases at a faster rate. This reduction in the outstanding balance will lead to a shorter loan tenure.

Once the tenure is reduced, the total interest paid over the loan’s lifetime will also be reduced. This happens because the interest component is calculated based on the outstanding loan balance. With a smaller outstanding balance, less interest accrues over time.

Says Vishal Raheja, managing director, InvestoXpert.com, a real estate agency: “Increasing the EMI by even a small amount, such as Rs 5,000, allows borrowers to pay off the loan faster and save on the total interest outgo. It is a prudent strategy to reduce the financial burden associated with the loan and become debt-free in a shorter duration.”

Assume a Rs 50 lakh loan at 9 per cent interest for 20 years. The EMI comes to Rs 44,986. The total interest payable over the lifetime of the loan comes to approximately Rs 58 lakh. If you reduce the tenure to 15 years, your EMI goes up to Rs 50,713—an increase of Rs 6,000—and the interest comes down to Rs 41.28 lakh. That’s a savings of over Rs 16.68 lakh over the lifetime of the loan, according to a calculation by BankBazaar.com, an online fintech portal.

Says Adhil Shetty, CEO, BankBazaar.com, “If you prepay Rs 5,000 every month, then your tenure comes down to 15 years and 6 months, and the total interest outflow is Rs 42.8 lakh.”

Prepay Using Lump Sum: For those who can afford to or who have a windfall to fall back upon, lump sum prepayment is another option. Amit is planning to make a prepayment by borrowing money, as managing his monthly cash flows is becoming a challenge with the increased EMI.

Krishnanga believes prepaying is the only way to reduce the interest outgo. “I will save lump sum amounts to prepay the loan. The idea is to save up every year and reduce the burden,” he says.

Radhamohan Singh, 36, who works at a large private bank, owns a two-room apartment in southwest Delhi. He took a loan in 2019 from a non-banking financial company (NBFC) at a higher rate than market rates. But the NBFC helped him fast-track the paperwork.

Says Radhamohan, “Home loan rates are usually higher at NBFCs than at standard banks, but we never thought something like Covid-19 could hit us. While that may have wreaked havoc in our lives, it brought some relief financially, as banks temporarily suspended their EMI collections from customers and reduced their interest rates, in our case, from 9 per cent to 7.5 per cent.” The pandemic was a smooth ride, but as the situation improved, banks increased their lending rates for most products, including home loans, in early 2022.

Radhamohan faced a difficult choice—whether to continue with the higher revised interest rates or pay the outstanding amount in full. He found that his home loan interest rate was back at its earlier level; besides, he suspected that rates will only increase thereafter.

At this point, he repaid the loan in full because he had enough savings to cover the mortgage by then. “We decided to repay the loan since we knew that from then on, the rates would continue to increase. Had I waited, it could have disrupted our budget. Moreover, we thought why pay the bank more than we originally bargained for when we already had the money to repay the loan.”

However, consider a few factors before doing a lump sum repayment. “First, the planned amount should be in multiples of the EMI. This ensures that the repayment aligns with the regular payment schedule and makes it easier to track the progress of the loan. For example, if the EMI is Rs 10,000, one may plan to make a lump sum repayment of Rs 50,000 or Rs 1 lakh,” says Raheja.

Before opting for a lump sum repayment, evaluate if there are any prepayment penalties or charges associated with the loan. “Assess the potential return on investment if the lump sum amount is invested elsewhere. Consider your overall financial goals and liquidity needs. It’s crucial to strike a balance between debt repayment and maintaining an adequate emergency fund,” says V. Swaminathan, executive chairman, Andromeda Loans and Apnapaisa.com, a lending company.

Borrowers should also ensure that the lump sum repayment amount does not exceed the allowed limit to avoid incurring any additional charges. Another thing to keep in mind is the timing of prepayment. “It is a good strategy to prepay a loan especially early in the tenure as one pays a major part of their EMI towards interest payment then,” says Abhishek Kumar, founder and chief investment advisor at SahajMoney, a financial planning firm. For example, for a Rs 1 crore loan at 9 per cent for 20 years, one pays nearly 30 per cent of the total interest amount in the first four years, he adds.

The prepayment strategy depends on various factors such as your financial situation, the rate of interest on the loan, prepayment penalties, tax deduction benefits, and investment opportunities. “It’s advisable to assess these factors and determine whether it’s more advantageous to prepay the loan or utilise the funds for other investments,” says Swaminathan.

Photo: Vikram Sharma

Radhamohan Singh 36, Delhi-based banking professional

He took a home loan from a non-banking financial company (NBFC) and repaid his loan in full with his personal savings

“As the situation improved after the pandemic, banks increased their lending rates. We decided to repay the loan in full since we knew from then on the rates would continue to increase. Had I waited, it could have disrupted our budget. Moreover, we thought why pay the bank more than we originally bargained for when we already had the money to repay the loan.”

Get The Loan Refinanced: Many people face this dilemma at some or other stage of their loan journey, but getting a loan refinanced to a lower rate of interest can reduce the payout in many cases.

But don’t go for refinancing just because the other lender is offering a lower rate of interest. Make sure that the lower rate of interest is worth the trouble and there’s a sizeable difference, because refinancing may involve a lot of paperwork.

Krishnanga understands this well. “Even if I go to another bank, it would almost be the same rate of interest. Nobody would give me a loan at a much lower rate of interest. It would be a maximum difference of 0.1 per cent or 0.2 per cent,” he says.

In case of home loans, you could go for another lender if the variance in the rates is more than 0.75 per cent, says Sinha, adding that you could also explore the option of asking your bank for a rate correction.

“In personal and vehicle loans, the remaining tenure and rate difference seems to be the decision factor. We suggest that the difference in tenure should be more than three years and that in the rate should be at least 1 per cent,” adds Sinha.

Sometimes the existing bank also charges a foreclosure fee, which may increase the cost of refinancing, making the deal unattractive. One must consider processing fee, loan to value, pre-payment, bounce charges, etc. before deciding the best option or justifying refinancing. Says Natarajan Jeyaseelan, who worked with Indian Bank for over 22 years before joining the Dindigul-based NGO Virutcham Academy for Social Changemakers, “Lenders normally consider 70-80 per cent of the asset value as loan.” Therefore, it may be a vital point to consider.

Borrowers may also face the dilemma of opting for a fixed or floating interest rate. Says Soma Sankara Prasad, managing director and CEO, UCO Bank: “It depends on the customers’ perception of how the interest rates would move. So, if the view is that the interest rates will go down, then there is no reason why they should opt for a fixed rate of interest. On the contrary, if they believe that the rates will go up, then they can opt for a fixed rate loan because they will be protected against rising interest rates.”

However, fixed rates may not make sense for long-term loans, as rates move up or down in cycles. “Over the past year, we have seen a 250 bps increase in interest rates because the repo has gone up, and now there is a pause. On the other hand, there might also be a time in future, say, in one or one-and-a-half years, when the rates might go down. So, since there are cycles in a longer tenure loan, it doesn’t make sense to go for fixed rates,” says Prasad. Even for short- to medium-term loans, one needs to have a view on the interest rates, he adds.

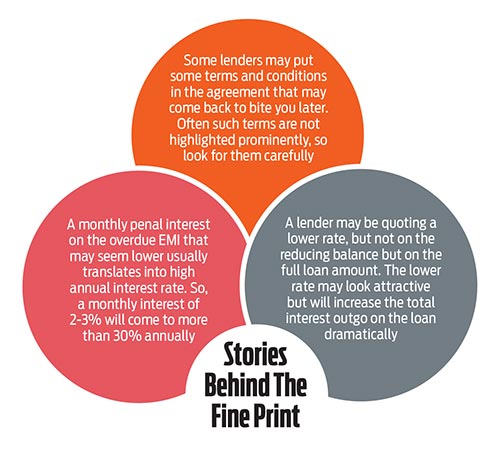

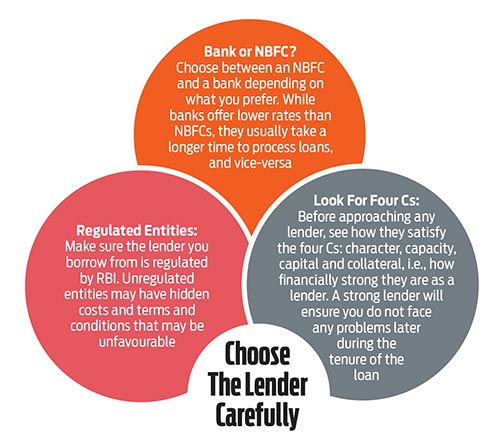

Changing from fixed to floating in such a circumstance may also have a cost later. Interest rates are one part of the research for the search for a prospective lender. For instance, one should find whether the lender is regulated by RBI or not. Regulated entities are, typically, commercial banks, cooperative banks, regional rural banks, small finance banks, and NBFCs, which adhere to RBI guidelines and provide client protection. There have been cases where unregulated entities, like private lenders, may offer loans with hidden terms.

For example, says Jeyaseelan: “They may quote an interest rate of 7 per cent, which is much lower than the prevailing rates, but it may be on the full amount and not on the reducing balance, as regulated entities do. So, the borrower will end up paying double the interest, equal to 14 per cent, on reducing balance.”

Interest rates move depending on a lot of factors, ranging from geopolitical developments to domestic factors such as inflation. Any loan that you take should be dependent on your individual circumstances, such as the capacity to repay and your needs. But if you are already repaying a loan, the best course is to get rid of it as soon as possible by reducing the interest payout as much as possible. Strategise well to live debt-free.

With inputs from Sutirtha Sanyal | letters@outlookmoney.com