Priya Sunder Co-founder and director, PeakAlpha Investment Services

Assets Under Advice Rs 1,300 crore; 5,000 clients, 1,000 families

Practising Since 2006

***

Though there are fewer women who participate in financial conversations compared to men, but those who do have an innate capacity of understanding the crux of goal-based planning.

Priya Sunder, co-founder and director, PeakAlpha Investment Services, has experienced that several times during her about two-decade experience in the advisory space.

One of her clients once asked her in a review meeting why the family portfolio was not in sync with the current stock market valuations, a common question she encounters from men. In the same conversation, the spouse intervened to say that didn’t really matter because their son’s education goal got met, and the fund meant for it was protected against the vagaries of the market.

“It’s always an aha moment for me when conversations like these happen. Women have the ability to tie investments to the goals, whether they are short- or long-term in nature. That kind of focus towards one’s goals is the essence of financial planning because, ultimately, the plan is yours and not someone else’s,” says Sunder, adding that it is possible to have specific and focused conversations with women about money.

Another quality that stands out among women is their ability to be committed to a plan. “In the above example, the woman was committed to the goal of funding her son’s education. Even in other cases, women have been seen to be committed and emotionally attached to their goals, whether it is planning for a holiday or other long-term goals. They trust in the plan to take care of a goal. The commitment doesn’t waver because of the market conditions or other factors,” she says.

It’s examples like these and insights gained from her experiences that make her believe that women should take responsibility for their own as well as the family’s finances.

Self-Reliance Is The Key

Sunder learnt the importance of making her own decisions as a child. “While growing up, our (my brother and I) parents inculcated a sense of ownership in us. It started with letting us choose the subject we wanted to study and being responsible for our career choices and future. So, from an early age, we learnt to make decisions for ourselves and not leave that responsibility to someone else, and play the victim later,” she says. That translated into the way they handled their money, too.

She finds that early learning of self-reliance very relevant for women, who she thinks sometimes wilfully resist engaging in conversations and decisions around money.

“If I’m having a conversation with the husband, and the wife is not around, it almost becomes a financial plan for that one person. If women are not involved in the financial planning process of the family, then in a way, she is willing away her future life to somebody else’s decision which may not gel with what she wants from life,” says Sunder.

She says women need to learn to take charge of their own lives and make decisions on their own and not leave that responsibility to someone else (husbands, fathers, etc.). “It’s up to women too to break those biases as much as it is up to the husbands and even the advisors,” says Sunder.

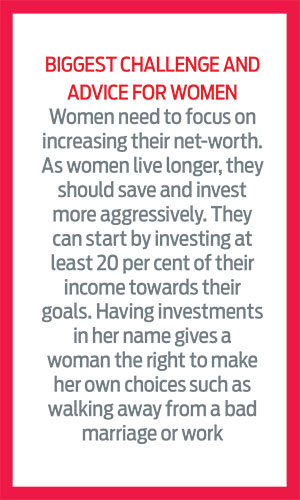

She cites the situation of separations or divorce that is not so uncommon anymore. “We assume that the marriages will go strong, but things may go wrong. Women often don’t think about having investments in their names, while paying equated monthly instalments (EMIs), tuition fees, utility bills, etc. They are total masters at stretching the rupees but often not for themselves,” she says.

Besides, they need to consider the fact that women live longer than men, and at some point, they may have to shoulder the responsibility on their own. “I tell this to my male clients, too. Would you want your wife to face a situation that she is incapable of handling at a later stage? Because at that point, they may be under emotional stress already,” she says.

What can work for them, Sunder says, is to focus not just on the expenses and small savings, but also on investing and growth.

“Women have to move to the next level, because saving a few hundreds here and there will not make a material difference to their lives. They have to think of building their own independent net-worth. We talk about women empowerment in other walks of life, but not saving money in a bank or investing it can take away the power from us,” she adds.

The single-most powerful attitude women can have towards their future is self-reliance, and it is really up to them to take care of themselves and nobody else, says Sunder.

Shirking from holistic engagement and engaging only with the daily expenses of the household usually comes at the cost of women’s own financial independence, she adds.

Leading By Example

Sunder is a co-founder in the company that she runs along with her husband, but her professional life is her own. Though she has faced sceptics, who assume “that her husband is the main person and she is just helping out or is in a supporting role”, she has a defined role within her company. In fact, the entire financial advisory team reports to her directly.

In 2005, she and her husband returned from the US to settle back in India to start their own financial advisory firm, spurred by their own experience of being mis-sold “toxic” products. “We saw the experiences were similar around us. Since we both had a background in finance, we decided to take the risk and we are happy we did that,” she says.

In the initial days of her advisory, she did meet clients who preferred a male advisor over a female one, but she interacted with them and convinced them by answering all their doubts and questions.

“I have faced some amount of gender bias when interacting with clients when we started out initially, but they have been few and far between. But when interacting with the distributor community, that’s an issue that I still grapple with and it upsets me sometimes,” says Sunder.

But she also sees a change in their attitude after an interaction or after listening to her talk at conferences and other events. “That’s when they will come for advice to me,” she says.

A large chunk of the workforce in her company comprises women. She feels that there are more women in financial advisory than before, but it’s still a long way to go. “This is not something that women pick on their own. They are seen more in the back office or other support functions, but they need to be out there into client-facing roles,” she says.

That’s because just like women bring a unique perspective to their own family’s finances, they can make a lot of difference to customers’ lives, too. “Clients perceive them to be a lot more trustworthy and they are stable in their careers. They are excellent listeners, are great at building relationships, and making clients comfortable. That quality is very important for a financial planner because when you are planning your life, you need to give holistic advice and not just base it on excels and numbers,” she says, adding that it would be a disservice if women are not brought into the financial advisory fold.

nidhi@outlookindia.com