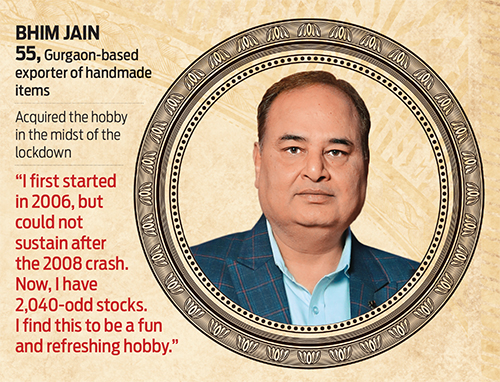

We have all heard of people with a penchant for collecting art, coins or stamps, but have you heard of a hobby that involves collecting stocks? Gurgaon-based Bhim Jain, 55, an exporter of handmade items, acquired that rare hobby a few years ago in the midst of a pandemic-induced global lockdown, though he was contemplating about it for years.

“I first started investing in 2006, but after the 2008 market crash, I was unable to sustain it at the time,” says Jain. This time, however, there is no looking back, and in the past couple of years, through the market ups and downs, Jain has collected 2,040-odd stocks. “This is fun, refreshing, and a good warm-up before doing my regular work,” he says.

What Jain calls a hobby is perhaps an offshoot of scripophily, which refers to the collection of old and rare stocks and bonds certificates, often considered highly valuable from a historical perspective.

Rarest of The Rare

Before the digital era, companies used to issue stocks and bonds in physical format. Scripophilists value these either for their historical significance, say the certificate of the first airline company, or the ornate, detailed designs and motifs that they come with.

“Each certificate is a different piece of history. It describes the company, the type of instrument (usually stock or bond), the year, signatures of officers or officials, who it was issued to, the printer, the due date for bonds, and much much more. Many of the certificates have pictures or vignettes showing anything from cars to trains to leaders to nothing at all,” according to information provided on Scripophily.com, which provides collectible stock and bond certificates and other old paper items, among others.

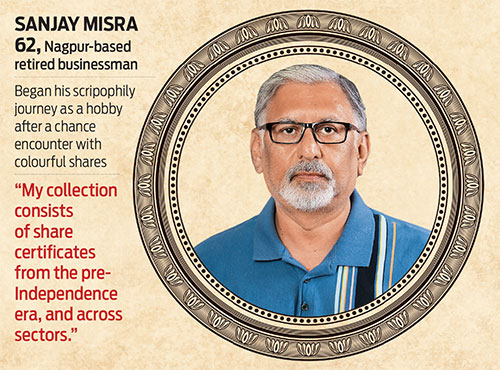

Sanjay Misra, a Nagpur-based retired businessman who pursues scripophily as a hobby, began his journey in 2005 after a chance encounter with what he shares was a “very colourful and eye catching” certificate. It has a unique history too. “A friend of mine brought a very old certificate which was huge in size. The company had ceased to exist, and as such there was no financial valuation. The name of the company was Savana Societe Anonyme De Filature and it was registered in France and operated in erstwhile Pondicherry. It was a textile mill based in Pondicherry, which was under French rule,” says Misra.

The 62-year-old went on to collect over 1,200 different certificates. “My collection consists of share certificates from the pre-Independence period, too. Some of the certificates he has are from gold mining companies, railways, electric companies, banks, textile mills, jute mills, coal mining, etc.”

Though reports suggest that Scripophily became popular internationally in the 1970s, back in India, it is still at a nascent stage.

Where Do You Buy Or Sell Them?

Obtaining such certificates is difficult in India. Misra says the reason for this is the “lack of awareness and availability of forums and member bodies”. He says: “There may be 50-100 collectors, but there are no forums where members can interact among themselves or exhibitions where collectors can transact in these”.

There are a couple of Facebook groups dedicated to Indian scripophily, such as ‘Ancient indian stocks & bonds—scripophily’, with a few hundred members, where limited information on scripophily and availability is exchanged.

Misra believes such forums can help popularise scripophily, because he has seen the role they can play in another hobby he avidly pursues—numismatics, the study and collection of rare bank notes and coins.

Numismatic exhibitions are held across major cities in India and are a one-stop destination for collectors.

“It is in these exhibitions that some dealers also offer scripophily collectibles,” he explains, adding that it’s not easy to transact in Indian scripophily material. Scripophily is also considered a specialised field within numismatics.

Misra, who is a member of the International Bond and Share Society (IBSS), United Kingdom, an association which deals with all aspects of scripophily, including auction of certificates, has sourced some of his collection from international dealers and auction houses.

“Although IBSS provides international scripophily, but I found quite a few articles of interest relating to Indian scripophily,” says Misra.

Given the limited resources in India, selling them is equally challenging. They can be sold to dealers of old papers and documents at exhibitions, depending on the demand. One can also try selling these to international societies or auction houses, but again that will depend on the demand, quality, rarity and other factors associated with the certificate.

How Much Do They Cost? In terms of their general valuations, at present, the cost of these certificates have a rather wide range, as some are available for as low as Rs 100, while others can cost over Rs 2,000. “Some rare pieces come for Rs 50,000 and upwards,” says Misra.

According to information available on IBSS website, the cost may depend on factors, such as the decorative quality, historical importance, autographs, age, rarity and the condition of the certificate.

International certificates can cost a few to several thousand dollars or more.

Is It More Than A Hobby?

If you are wondering if these certificates have any investment value, the answer is no, because they have no intrinsic financial value.

Most of the companies, for which these certificates were issued, are defunct now—they are either not operational anymore or have been merged or taken over by other companies, and in some cases, by the government.

Some companies such as Meta (formerly Facebook), Martha Stewart Living, and Pixar did issue paper certificates for collectors, but these were stamped non-redeemable and non-transferable, according to a CNBC report of 2012. Also, these were issued in accordance with the rules of US Securities and Exchange Commission (SEC).

“These certificates only have collectible value,” says Misra, who is hopeful that this value assigned by collectors will go up eventually as was seen in the case of numismatics.

That hope, however, comes with a fair amount of investment risk, which is the case for any form of collectors’ items. In the case of scripophily, in particular, lack of demand in India can create a liquidity crunch, apart from the valuation issue.

“Some time ago, India Post came up with replicas of stamps issued on momentous occassions in gold-plated silver ingots. They sold like hot cakes, but that may not happen in the near future for scripophily. Maybe the next generation will be able to consider it when it becomes popular in India, too. Scripophily should be pursued only as a hobby and not as an investment,” says Vikaas M. Sachdeva, managing director, Sundaram Alternate Assets, a wholly-owned subsidiary of Sundaram Asset Management Co. Ltd.

Nidhi Manchanda, a certified financial planner, Fintoo, an automated financial planning platform, agrees. “Pursuit of such hobbies should never be mixed with an individual’s investments and goals, even if they revolve around any form of financial history,” she says.

Fortunately, Misra understands this and despite his belief that the value of vintage stock certificates will go up one day, he strictly keeps his financial portfolio separate from his hobby. As for Jain, all his investments are in demat form. While he initially started investing in stocks with the goal of funding his retirement, now it’s all about creating a legacy for the family.

With Inputs from Rimme Dirchi