In an ever-evolving market, where the dynamics of investment choices change with every season, mid- and small-cap indices have taken the centerstage now. In the last three years, they have delivered stellar returns, and funds tracking them have also followed suit. The BSE Small Cap-TRI index, which serves as a barometer for the small-cap segment, posted an impressive compounded annual growth rate (CAGR) of 36 per cent in the last three years. In the last six months also, they have rewarded investors with impressive returns. So, if you think you have missed your chance, you can still start with your investment now and make gains.

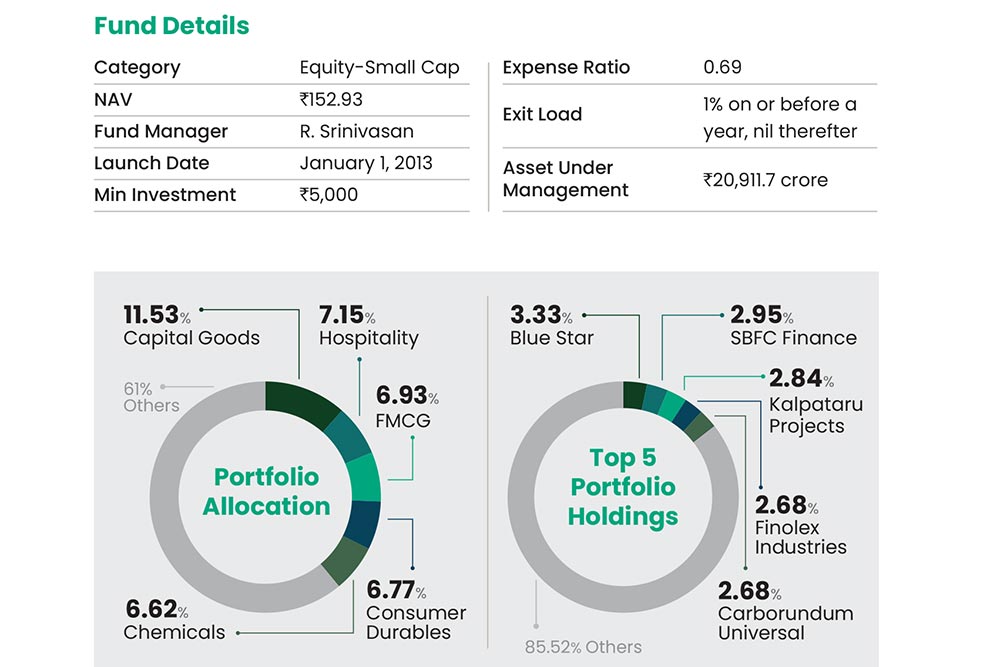

If you are thinking of adding a small-cap flavour in your portfolio, you may like to consider SBI Small Cap Fund. The fund has a proven track record of rewarding long-term investors, by posting an impressive CAGR of 28.34 per cent in the last 10 years. However, the fund has lagged on performance in the last one and three years. It delivered 18.90 per cent in the last one year against the category average of 24.40 per cent, and over three years, 32.35 per cent against the category average of 35.85 per cent. The recent underperformance should not be a cause for concern though as no fund remains the top performer forever.

In terms of portfolio composition, the fund follows a focused approach where quality takes precedence over quantity. In comparison to other small cap funds, which have an overloaded portfolio of 100-plus stocks, SBI Small Cap has invested in 55 companies from 22 sectors. The top five sectors that dominate the portfolio are capital goods, consumer durables, FMCG, chemicals, and construction. In the last one year, the fund has gradually increased its exposure in hospitality and, given the rally in the sector now, it bodes well for investors.

However, it should be noted that small-cap funds come with a higher level of risk when compared to mid-cap and large-cap funds. The reason is that they invest in relatively smaller and often lesser known companies, but at the same time, they have the potential to offer long-term returns. So, if you are thinking from a long term perspective of say 7-10 years, you may like to add this fund in your portfolio. Given higher volatility, it’s best to invest by way of systematic investment plans (SIPs).

kundan@outlookindia.com