Buying a home is arguably one of the key goals in most people’s lives. While a lot of Indians prefer to buy their own house, many others prefer living on rent.

Making this choice can be crucial for those sitting on the fence, especially now when property prices are on an upward trend, after a phase of relative stagnation during the Covid pandemic, and home loan interest rates are rising as well.

But the answer to the question, whether you should buy a house or rent one, has many strings attached. Votaries for owning a house feel it’s an investment that will serve them for life and help them live the way they want to, while those on the other side of the fence feel that owning a home could tie them down and they could miss out on certain perks, such as the freedom to opt for a transferable job, living in proximity to offices and schools, lack of affordability in the preferred location, and so on.

Some of these variables, such as the cost of borrowing, property prices and rent can keep changing, depending on the demand and supply in the sector, interest rates and other factors. Thus, making the right decision at the right time can make a huge impact on your finances.

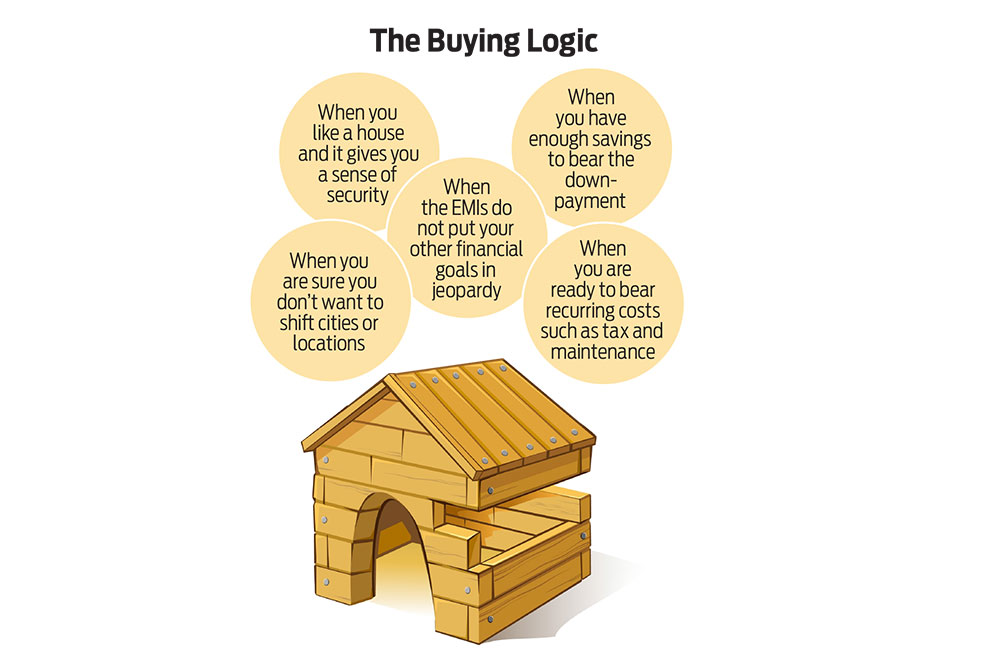

Let us now understand what do buying and renting entail so you can arrive at a conclusion easily.

Photo: Dinesh Parab

Nirav Vyas 34

Lives in Mumbai with wife Shweta, 34, and son Vivaan, 7

“In Mumbai, you get too little for too much money. Ahmedabad (his hometown) is a big enough city to move to and live comfortably later, when I would move in with my parents to take care of them in their old age. We just bring the basics and live on rent here.”

***

What It Takes To Own A House?

Buying a house requires a lot of planning and financial discipline. The most important questions to ask yourself are: Can you really afford to buy a house? Are you financially prepared for making a long-term loan repayment commitment?

Mrin Agarwal, founder director, Finsafe & Co. and founder of Womantra, suggests considering financial preparedness when planning to take a home loan. “Check if you can pay 25-40 per cent as downpayment. This will help reduce the interest cost. Limit the equated monthly instalments (EMIs) to 30 per cent of the take-home salary. It is important to buy a house within this limit,” she says. Lastly, don’t forget to take an insurance cover on the home loan amount, she advises.

Buying a home is a long-term commitment. To start with, you need to be financially prepared to pay the downpayment, stamp duty and registration fees. The downpayment is usually 10-25 per cent of the property value.

You also need to assess whether you will be able to afford the EMIs in the long term. The memories of families feeling the pinch of paying high EMIs during the Covid pandemic due to pay cuts and job losses are still afresh.

It’s also important to prepare in advance to meet recurring expenses, such as maintenance charges, property tax, society charges, and so on. These vary depending on the city, size, value of the property, and amenities on offer.

Importantly, ask yourself whether your decision to buy a home will affect your other financial goals?

Says Agarwal: “Buying a home is an emotional decision as one feels a sense of security by owning an asset. However, one must remember that when a home is bought on a loan, one is paying almost double the amount due to the interest cost over the years. There is a tendency to buy a house much beyond one’s means, due to peer pressure. As such, people end up paying almost 50-70 per cent of their income towards EMIs, and the balance money is used up for expenses, thus leaving nothing for other financial goals.” She explains that people who do not start saving for other goals in a timely manner would have to save a much larger amount later, and that may become impossible later.

But if you think you can indeed afford the cost and have found one that suits your requirements, in terms of location, size and city, then buying one can indeed be beneficial in the long run.

Photo: Vikram

Kunal Chopra 41

Lives in Noida with wife, Shaveta (39), and sons Nikunj (8) and Saksham (12)(not in picture)

“It was a ready-to-move-in flat and the EMI was slightly more than the rent in Gurugram. The work also shifted to a work-from-home mode, and I didn’t need to stay near my office, either.”

***

When Kunal Chopra, 41, working with a Gurugram-based IT company, spotted a lucrative deal in Noida in 2017 from a renowned developer who fell on tough times, he went for it. “It was a ready-to-move-in apartment. The EMI for the house was only slightly higher than the rent I was paying in Gurugram. Later, my employer moved to work-from-home permanently. That meant I didn’t need to stay near my office anymore, and I also saved on the commute cost,” says Chopra.

Since Noida has the required infrastructure and good schools, he is also assured of his family’s smooth life at the location. “The amount I was paying for rent is now getting invested in building an asset of my own,” he says.

Says Ajay Sharma, managing director, valuation services, Colliers India, a real estate consultancy firm: “In the long run, ownership of a home is beneficial, as there will be escalation in the property value. The difference in rent and EMI that people save and invest will need to earn adequate returns to match up for that.”

That said, price escalation may not be a guarantee. It could depend on various other factors, such as the location, infrastructure around the property, and quality of construction, among others.

The decision to buy should also be taken after evaluating all the scenarios, including price advantage, expected rate of interest rate during the loan tenure, expected rise in the value of property, existing and future financial responsibilities, impact on your tax liabilities, and your capacity to survive a financial emergency.

When Does Renting Make Sense?

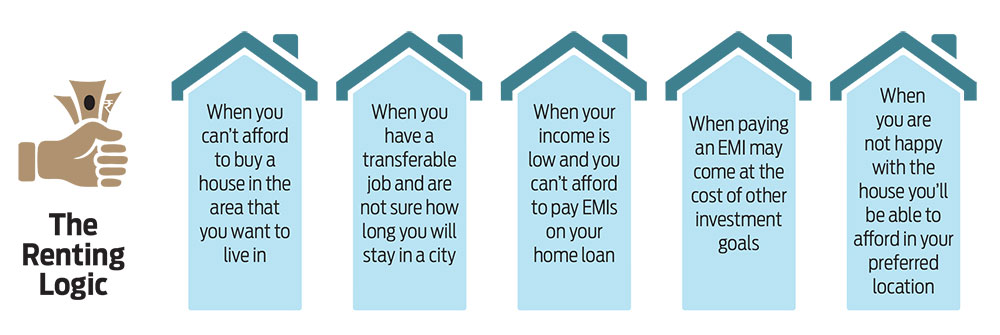

Lack of affordability is one of the major reasons why people prefer renting over buying. Other factors include things like where you want to finally settle, convenience, and flexibility. It is often preferred by those who have transferrable jobs.

For Amit Jain, 36, who works with a Kolkata-based stockbroker, affordability and flexibility to shift quickly are the biggest factors behind staying on rent. In the past, Amit has worked in Delhi, Ahmedabad, Mumbai and currently lives in Howrah across Kolkata. He is open to shift to another city in the future for better career opportunity.

“It’s difficult to manage your own property when you have to frequently shift from one city to another. Also, rented property can be an affordable option if you have financial limitations. You can always shift to a smaller or bigger home, depending on your income and lifestyle requirements,” says Amit.

In some cities, the cost of property can also be prohibitive. Nirav Vyas, 34, who works with an investment bank in Mumbai, says, “In Mumbai, you get too little for too much money.”

Vyas, who lives in a rented accommodation in Borivili along with his wife Shweta, 34, a homemaker, and seven-year-old son, Vivaan, has invested in a house in his hometown Ahmedabad along with his father. “Ahmedabad is a big enough city to move to and live comfortably later, when I would need to move in with my parents to take care of them in their old age,” he says.

Vyas moved to his parents’ place in Ahmedabad when his employers allowed work from home during the Covid lockdown. “It was easy to move back temporarily as I was not tied down with a house in Mumbai. Now I have moved back to Mumbai for my new job, but then that’s also convenient because we just bring the basics along and choose a furnished apartment for rent,” says Vyas, who is open to moving to other cities in the short term, depending on where his career choices take him.

He doesn’t even consider it a reasonable investment. “I don’t have enough money to buy a house in cash, so it can’t even be an investment decision. Moreover, buying or selling house is a tiresome process, and I am better off with other investment options,” says Vyas.

Experts agree that it is not easy to sell real estate at short notice as it is an illiquid asset. “Distress sales happen when an owner has to immediately sell a property. This could be either when he/she is under some financial duress or when they look to buy another physical asset elsewhere or relocate within or outside India. At such times, it is usually not very easy to sell the property at the right price, and many a times people sell it at a lower price than the actual market value. Many times, sellers don’t even have the time to make the necessary repairs, which eventually drags the property value down. There are times when one can strike a good deal if the seller gets lucky and the property is at a prime location with all the state-of-art amenities,” says Santhosh Kumar, vice-chairman, Anarock Group, a real estate firm.

But there can be downsides to renting, too. To start with, finding a house of your choice may not be easy. There have been several instances in recent years where landlords have refused to rent their property due to religious incongruity, marital status, food habits, and contrasting lifestyles, among others. Also, if you are specific about your choices for interiors and décor, you may find it very expensive to spend on such aspects every time you shift.

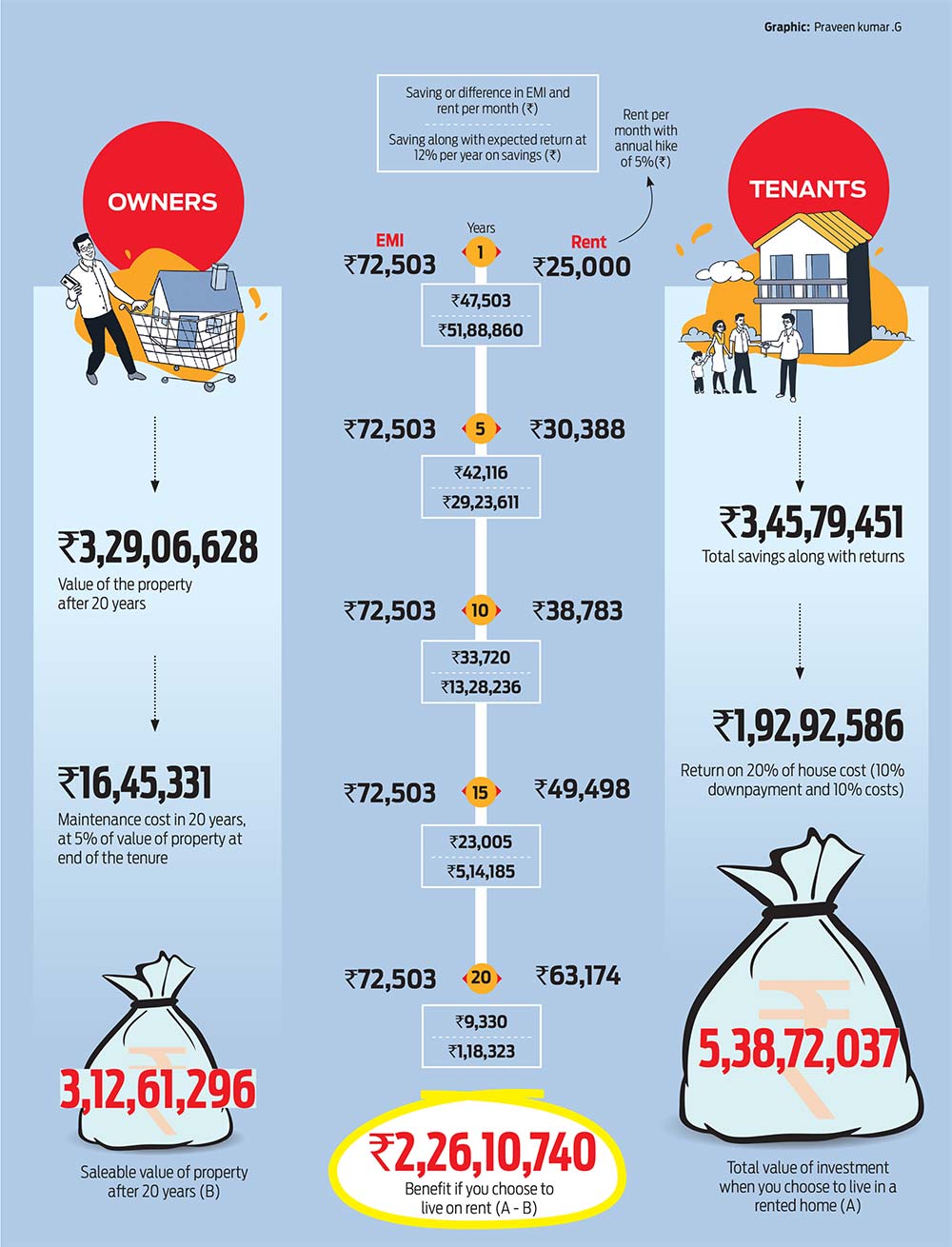

Renting Vs Buying: Number Game

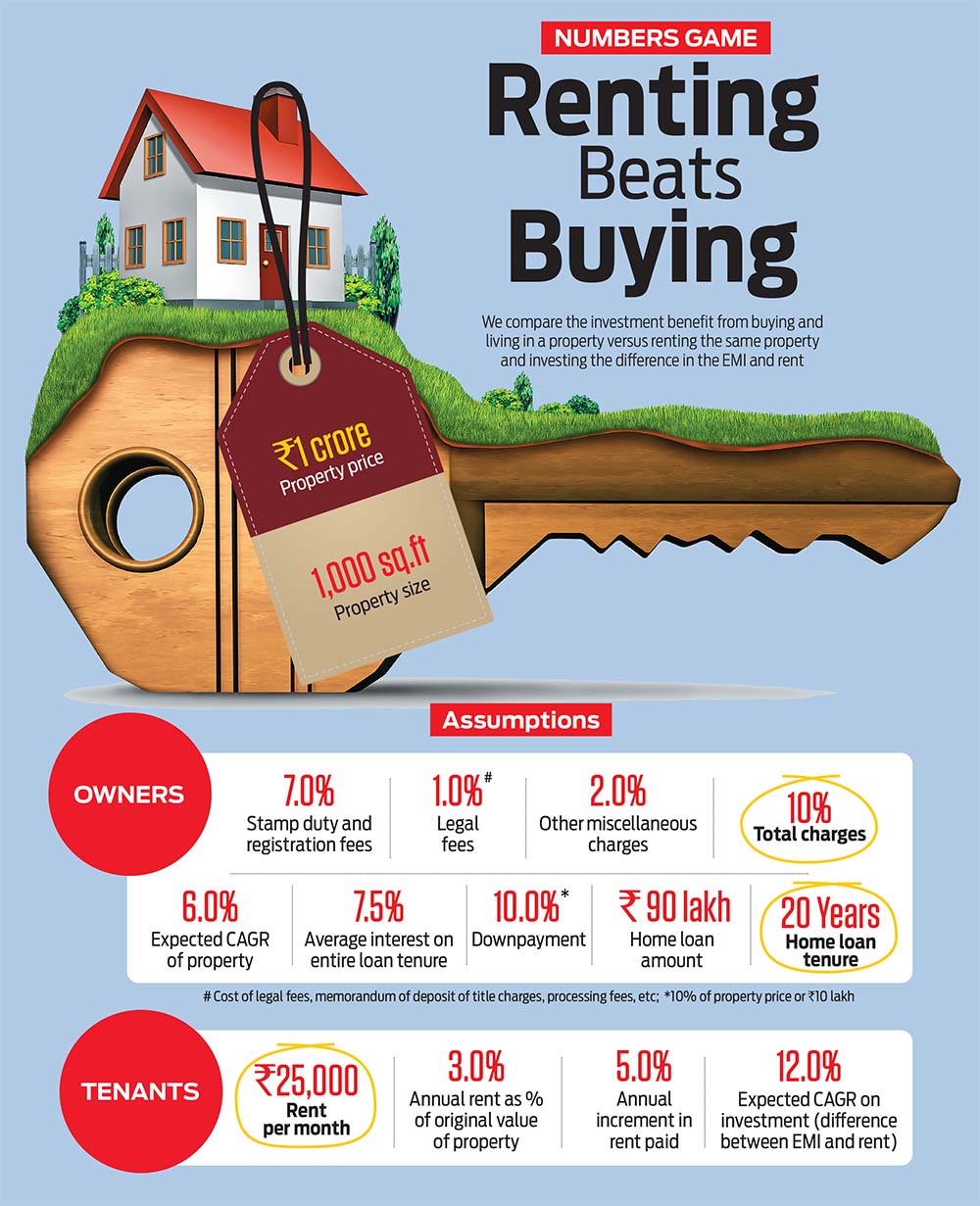

Besides these aspects, let us also look at how buying and renting weigh against each other in terms of cost to help you arrive at a decision.

Photo: Sandipan Chatterjee

Amit Jain 36

Stays in Kolkata on rent

“It’s difficult to manage your own property if you have to frequently shift from one city to another. A rented property can be an affordable option if you have financial constraints. You can always shift to a smaller or bigger home depending on your income.”

***

For the calculation, we came up with a set of assumptions after speaking to industry experts on the average rent, property price, expected growth rate, and other parameters. It may be noted, however, that property value and the rent change over a period of time and often vary based on factors, such as inflation, rate of interest, location, infrastructure, demand and supply, and so on. Our estimates are based on selective data from X-class cities (cities/town classification for grant of house rent allowance or HRA to central government employees) such as Hyderabad, Bengaluru, Pune and Kolkata.

Our calculations show that you will gain if you rent out the property which you plan to buy, assuming you take it on a loan for a tenure of 20 years, and invest the difference between the rent and EMI in a systematic investment plan (SIP) that gives a compounded annual growth rate of 12 per cent. The gain comes to more than Rs 2.26 crore (see Renting Beats Buying).

However, the financial parameters keep changing. If the rate of interest remains at a low level for the long term, while the rental yield keeps going up, the scenario may look totally different. Also, it may not be easy to get double-digit return on investment with lower risk exposure in the long run.

The Tax Conundrum

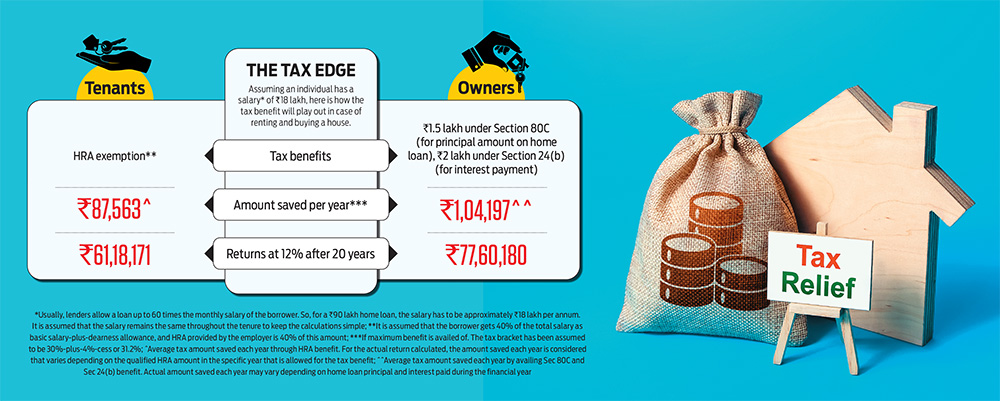

We also analysed the tax incidence when renting or buying. You get tax benefit under HRA if you are living on rent, while there are tax deduction benefits available on home loans.

Says Sharma, “Tax benefit for homeowners who have taken a home loan is the tax deduction under Section 80C of the Income-tax Act, 1961, where principal payment up to Rs 1.5 lakh can be availed of, provided the house is not sold within five years of taking possession. Further, stamp duty and registration charges paid for the house can be claimed in the year of registration within the limit mentioned under Section 80C. Also, under Section 24 (b) of the Act, deduction on the interest on the loan can be claimed up to Rs 2 lakh for a self-occupied house. This can be claimed only after the completion of the unit.”

For under-construction properties, where pre-EMIs are being paid, the interest paid can be claimed in five instalments from the date of the completion of the unit up to Rs 2 lakh under Section 24(b) of the Act, Sharma adds.

Those who rent a house are eligible for tax benefit on the rent paid under Section 10(13A). This is part of the HRA component where the least of the HRA received, or 50 per cent of the basic plus direct allowance for those living in metro cities, and 40 per cent of basic plus direct allowance for those living in non-metros is allowed. If the person is staying on rent and has also purchased a house, he/she can claim both the deductions.

We compared the tax benefits in both the scenarios and our calculations showed that renters could earn Rs 61.18 lakh, while owners could earn Rs 77.60 lakh, if both were to invest the amount saved in tax (see The Tax Edge).

What Should You Do?

The decision as to whether you should own a property or live in a rented house should not be evaluated and decided solely based on financial factors, especially if you are an end-user.

Says Sharma: “The money saved from the difference between the EMI paid to rent paid plus the tax benefits accrued for renting a house, make a lot of sense if the person is investing the entire amount prudently and creating wealth in the short term with no liability. However, in the long run, the impact of inflation, shifts in property market pricing, degrading liability to asset ratio etc. will put a strain on those continuing to stay on rent, especially with a specific lifestyle value. Therefore, in the long run, buying a house may be a more financially prudent choice, irrespective of the city where the person is living.”

With the change in the economic condition, the entire picture may change altogether, but with the assumptions that we have considered, renting a home seems to be a lucrative option compared to buying a home on a loan.

Also, such decisions depend largely on individual life circumstances and choices. So, weigh your options before taking the final call.

The author is an Independent Journalist