What You Need To Pay Attention To

- Charges are not standardised so an investor who wants to pay as less as possible has to go to each crypto exchange’s website or app to calculate what it will cost him or her to join/trade/withdraw

- Check the deposit options and limits. Some exchanges have a minimum limit of Rs 50,000 if you are using bank transfers. Using UPI or a payment wallet, the minimum may be just Rs 100

- There may be a charge for moving money to and from the crypto exchange. This is the service fee that payment gateways charge

- While the taker/maker fees are not high, the more frequently you trade, the more it costs

- If you are trading using small amounts, say, Rs 1,000, and earn Rs 35 on it within a day, you could be paying more than 50% of that as deposit+withdrawal charges and maker/taker fee in many cases

***

Giving in to the current buzz around cryptocurrencies, many retail investors are incorporating them into their portfolios and opening accounts at crypto exchanges to trade and invest. According to industry estimates, there are 10-15 million cryptocurrency investors in India. According to the World Bank and crypto.com data, the number is 990 million investors globally.

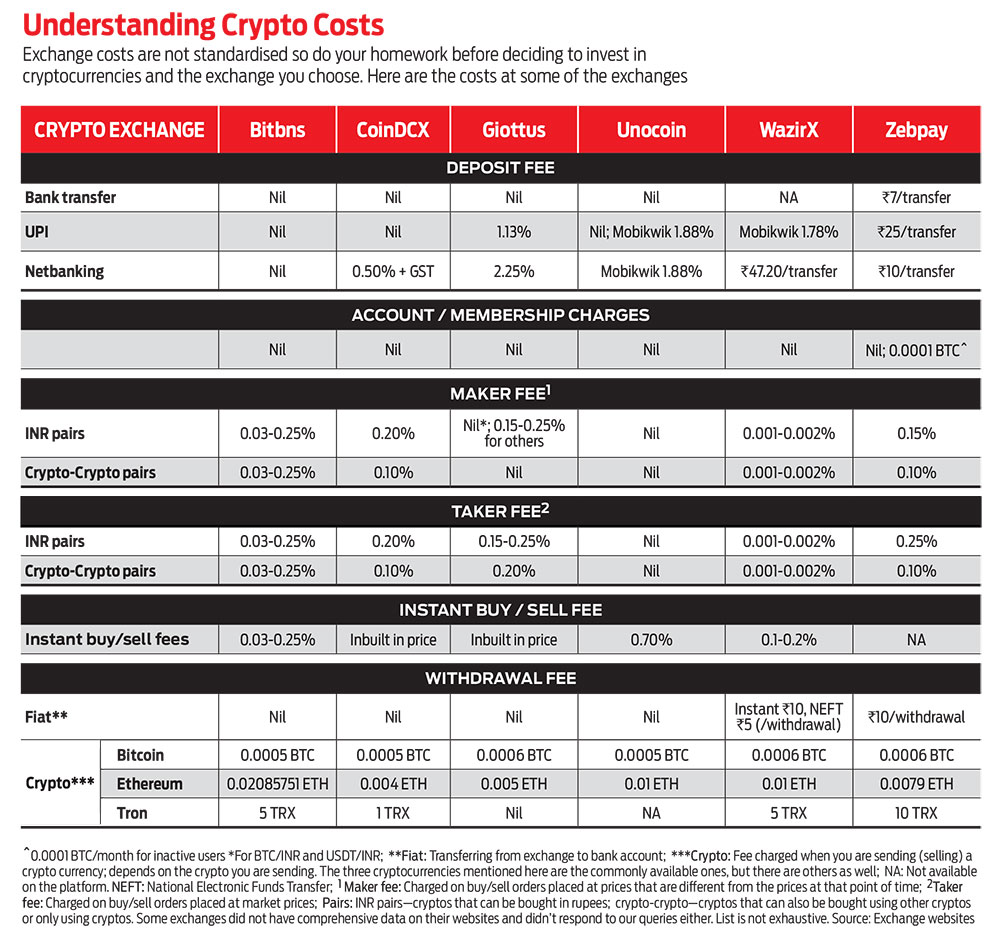

Despite the enthusiasm, these are still early days and investors not only need to understand what these products are but also consider the costs associated with trading in cryptos. These costs vary across exchanges, so it is important to understand not only what the costs mean but how much they add up to.

The most common cost heads that a user will encounter include joining fee, deposit fee, taker and maker charges and withdrawal charges. Here’s a look at what they mean and how they affect your investible amount.

Joining Fee

Major cryptocurrency exchanges in India, including Bitbns, ZebPay, Giottus, WazirX and Unocoin, do not levy any joining fee. However, there may be a small membership fee that is levied on inactive accounts. To join, one has to register and complete the KYC (know your customer) process. Most of the exchanges, which are constantly looking to garner more investors, offer an incentive to join. Some exchanges offer crypto coins initially as an incentive. For example, Unocoin gives Bitcoin (BTC) worth Rs 300 on joining, while Giottus gives cryptos worth Rs 50 on signup and coins worth Rs 50-70 based on a spin-and-win wheel game.

Some exchanges have slabs based on the level of usage. If you expect to trade frequently or with high amounts, you can choose an appropriate slab, which may work out to be cheaper. However, these are usually meant for professionals or brokers and traders.

Deposit Fee

To start trading, a user needs to deposit money, which is where exchanges start levying a fee. This comes into play when you transfer money or coins to the crypto exchange to start buying or selling. It is possible to register free of cost, but to deposit any money or coin, you need to start paying.

Some exchanges charge a deposit fee, some don’t; and the amount depends on how you are moving the money (via UPI, Netbanking or bank transfer). If you wish to use Netbanking, first check if the crypto exchange has a tie-up with your bank or not. Usually, bank transfers are the cheapest option.

Most exchanges do not accept cards. “We are not accepting debit or credit cards to avoid instances of fraud and to keep costs low for users. Using cards would mean paying 5 per cent or so,” said Srivathsan A.R., chief marketing officer of crypto exchange Giottus.

If you already have crypto coins, you can deposit them into another exchange but the original exchange, where you held the coins, may charge a fee for this.

Trading Charges

This is the most expensive and complicated part of the whole chain. How frequently you buy or sell, at what price, and which units you choose to trade in (crypto-crypto or rupee-crypto pairs) impact your total cost. Crypto-crypto pair means you will use crypto (instead of rupees) to buy another crypto. For example, using USDT to buy Dogecoin (DOGE). Rupee-crypto means you use money (rupees) to buy the crypto.

Two things to understand here are maker and taker fees. “Taker” is an order that trades at the market price. So, if you buy/sell at the price visible then (market price), you will pay a taker fee. If the buy/sell order is placed at a price that is different from the market price, you pay a maker fee. “Takers are usually low-frequency traders, such as individual investors, who want the convenience of simply placing their order at the price then,” said Srivathsan. Such orders reduce liquidity as the trade takes place immediately. Hence, the term ‘taker’.

Makers are often users who trade frequently and/or for high amounts. Their orders are placed for prices that they see fit and not the market prices. Such trades increase liquidity as they create more opportunities for price movement (hence, ‘maker’).

Taker fee is often higher than the maker fee. These trading charges vary across exchanges. The range is nil to 0.25 per cent at present in most exchanges.

Apart from maker and taker fee, there is intraday trading fee. This applies if your buy and sell orders are both placed on the same day. Intraday fee is usually lower than the taker and maker fees. Post-midnight, for the intraday orders, the excess charged as maker/taker fee is calculated and added back to the investor’s account. Trading fees are charged when the order is executed.

Here’s an example to understand how this impacts your investment. Say, you have Rs 1,000 and want to buy Coin X. The price is Rs 100 per coin. If you place your order at the market price (taker) and the taker fee is 0.2 per cent, you can buy/sell coins worth Rs 998; Rs 2 is cut as taker fee. If you place your order at a set price (maker) and the maker fee is 0.1 per cent, you can buy/sell coins worth Rs 999; Rs 1 is the maker fee. If over a longer period, you place orders worth Rs 1 lakh, Rs 100-200 will be the maker/taker fee.

Another thing to note is the price reflected on the exchanges. “In Indian crypto exchanges, the prices are displayed in Indian Rupees (INR). These prices are higher than the US dollar price of the same coin because there is lack of liquidity in the Indian market. Also, there is a spread involved as the exchange takes on the risk,” said Srivathasan, adding that a backend algorithm decides the spread, which can be 0.5-1 per cent. Spread is the difference between the buy and sell prices quoted for a cryptocurrency.

Withdrawal Fee

Withdrawing money is essentially a two-step procedure. You place your sell order (instant or at set price) and when the funds reflect in your wallet with the exchange, you can withdraw the money fully or partially, into your registered bank account. Some exchanges levy a charge when you withdraw into fiat and some don’t. You can also withdraw in coins, which usually has a cost attached. If you don’t want to pay this, you can choose to withdraw into a zero-charge crypto. For example, at Giottus, Ripple (XRP) and Tron (TRX) are no-charge cryptos.

The Overall Math

As mentioned at the beginning, the costs involved in crypto trading are not standardised. But let’s do a rough calculation to get a broad idea on how much you pay in charges. Say, you have Rs 1,000. You transfer that to the wallet exchange using a free bank transfer. You find the crypto of our choice and buy it using rupees at the market price (taker). Let’s assume that the taker fee is 0.1 per cent, which means Rs 1. This mean you will be able to buy coins worth Rs 999. After a few days, the crypto price rises by 5 per cent (Rs 999 + Rs 49.95 = Rs 1,048.95). You decide to sell right away (taker fee of 0.1 per cent on the amount). This means you will get about Rs 1,047.90 into our wallet. You can withdraw the whole amount back into your bank account through a bank transfer at no cost.

Cryptocurrencies are a new and highly volatile asset that are traded globally. Therefore, one has to be cautious and make the effort to understand the details before registering with an exchange to avoid getting a rude shock later.

kaveri@outlookindia.com