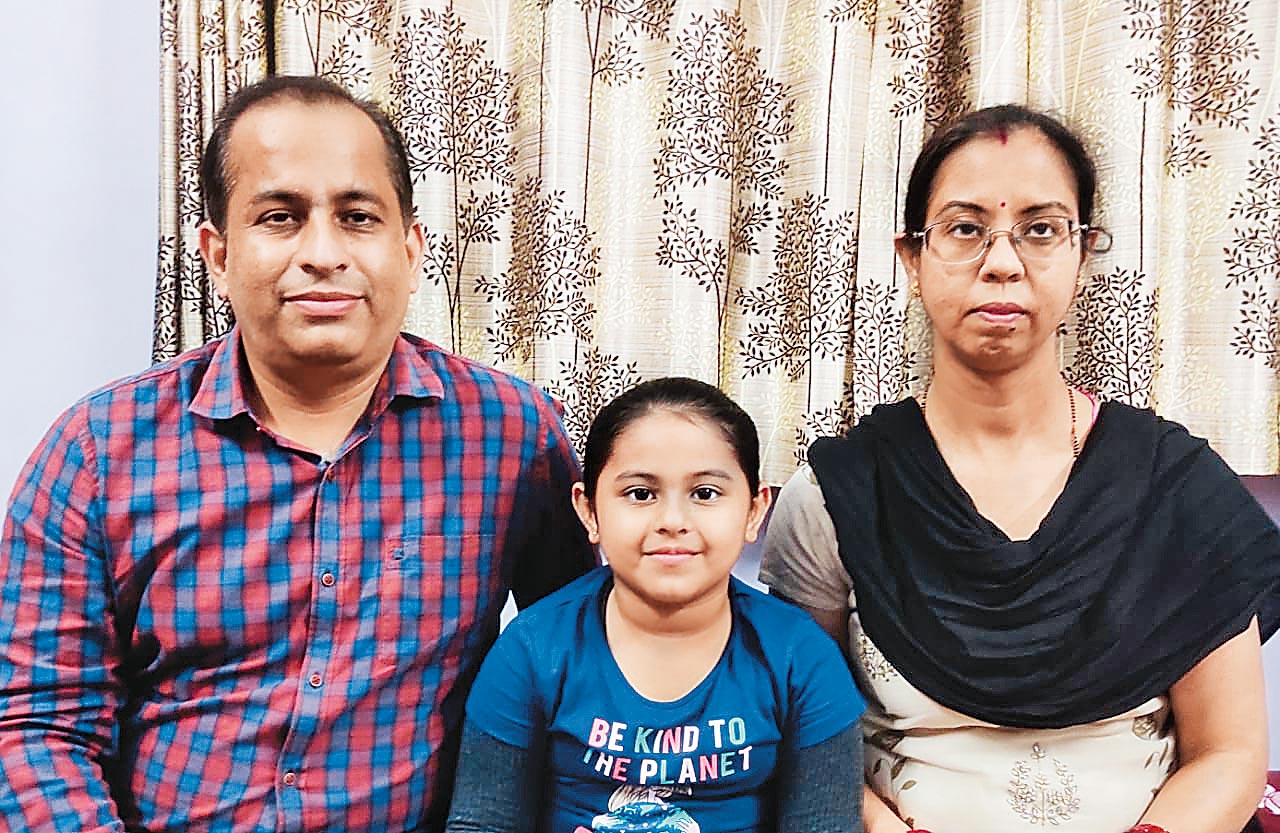

Kamlesh Thakkar, 42, is a chartered accountant working at a premier management institute in Jamshedpur. His wife, Prerna, is also a chartered accountant, and they have a six-year-old daughter, Nishtha. Kamlesh had a fair idea and understanding of the financial markets and the prevailing investment options due to his professional qualification. However, one thing lacking in the investing strategy was that his investments were primarily random; even though consistent, they were not structured through a financial plan. Alok Prasad from AP Wealth Managers had his task cut out when he met Kamlesh first in 2019.

As a first step towards financial planning, Alok and Kamlesh had various discussions regarding his financial goals and methods. His financial goals primarily revolved around retirement planning and his daughter’s education and marriage, apart from short-term goals like regular family vacations, home renovation, etc.

His risk appetite was also considered while formulating a prudent financial plan to achieve his financial goals. “It was not difficult to convince Kamlesh to invest in mutual funds, even though he was a little sceptical in being overweight in equities. With the goals being mostly long term, equity mutual funds featured as a majority in the systematic investment plan (SIP) list for his financial goals. However, debt funds were also selected, for short-term goals and to maintain a prudent asset allocation for Kamlesh and his family,” says Prasad.

While a year of investing had been delightful for Kamlesh, the timing for the annual portfolio review with Prasad coincided with the sharp corrections in the equity markets owing to the Covid pandemic. The sudden outbreak caused mayhem in the global equity markets as uncertainty prevailed over fundamentals. This sent stock markets worldwide crashing to levels not witnessed since the global financial crisis of 2008. Kamlesh, like the majority of equity investors, had a tough time during the Covid-19 crisis, as he was experiencing the heat of market volatility. However, Prasad guided him in securing the family’s investment portfolio by switching the investments to liquid funds until the uncertainty prevailed. This timely action helped Kamlesh prevent a deep correction in portfolio valuations. At the same time, Prasad and his team kept a constant watch on the equity markets for the right time to switch back.

Sharing his experience of tackling the Covid-19 crisis, Prasad says, “Covid-19 came with an opportunity to invest into a few sectoral allocations, which was the need of the hour. Pharma and technology sectors were underperformers for some time and the Covid crisis gave a new opportunity to invest in these sectors. We shifted most of our portfolio to healthcare and technology sector funds, and our sectoral plays turned out pretty well for the portfolio. We recovered well before the indices reached their pre-Covid level and generated more than 100 per cent absolute returns in case of healthcare and pharma funds and more than 150 per cent absolute returns from technology funds.”

Timely action of switching the portfolio predominantly to debt instruments and then back to equities benefited Kamlesh in both directions, protecting the downside and making the most of the rebound with prudent sectoral allocation. However, the thing that mattered the most was his trust and confidence in Prasad.

A prudent investment strategy and timely switches between different asset classes helped Kamlesh tide over the Covid-19 outbreak-led market correction.

Make sure your investment portfolio is designed in a prudent manner that suits your financial goals and risk appetite aptly. Happy investing!

***

Kamlesh Summarises His Investing Journey With The Following Investing Mantras:

1) Patience Is The Biggest Virtue: Since Kamlesh had been familiar with financial markets and market volatility, the deep market corrections due to the Covid outbreak did not shake his confidence in the equity markets. Even while he switched to debt funds soon after the crisis, under Prasad’s guidance, he had enough confidence to move back into the markets, especially when the markets were falling and any rise seemed like a ‘sell-on-rise’ rally. His patience with investments has paid off immensely as the portfolio stands with healthy valuation gains over the last year. His investment gains have further helped him upsize his financial goals.

2) Proper Goal Planning Is A Must Before Investing: When it comes to financial planning, the first and foremost step is to lay down clear financial goals. This tends to motivate a person towards regular and consistent investing towards such goals. Further, the investment horizon set out in the financial goals also enables the investors to select suitable asset classes as per the horizon. While some asset classes tend to be more suitable for the long term, other asset classes may be more appropriate for short-term goals. For example, equities have been considered great wealth compounders over the long term, even when equity markets may be highly volatile over the short term. Similarly, debt tends to provide stability to the investment portfolio but is unsuitable for long-term goals due to lower returns.

3) Always Trust Your Financial Advisor: Despite his professional qualification in finance, Kamlesh always trusted his financial advisor, which has also reaped healthy benefits for him. “Patience is the key to any investment, and as an advisor, our role is to look for an opportunity to generate maximum returns for the investor. Handholding was the key to retaining and giving confidence to the investor, which resulted in generating an excellent return. While it was easier with Kamlesh to discuss finances owing to his finance background, it was also a challenge to satisfy an informed client, for they may be quick to spot any lapses in the investment strategy,” says Prasad. With luck also playing its part with periodic portfolio review being due in the midst of Covid-19-led market corrections, Prasad was also quick enough to spot the market trends and suggest timely action in Kamlesh’s best financial interest.

Alok Prasad, Promoter, AP Wealth Managers

Disclaimer

Financial Planning of Amit Chawla is based on the “personal opinion and experience” of Sourabh Mahajan, Founder & Financial Coach, True Wealth. It should not be considered professional financial investment advice. No one should make any investment decision without first consulting their advisor and conducting research and due diligence.