Flexibility allows for quick decision-making, swift adaptation to challenges, and seizing of emerging opportunities. In mutual funds, the flexi-cap strategy allows fund managers the freedom to invest across market capitalisations without restriction. Fund managers can adjust their portfolio allocation based on market condition and valuation, thereby allowing them to capitalise on opportunities and navigate the market with ease.

If you wish to take advantage of this strategy, you could consider investing in Parag Parikh Flexi Cap Fund. It will not only help you to take advantage on the domestic front, but also globally through business disruptors like Microsoft Corporation, Alphabet Inc., and Meta Platforms, Inc.

Capital markets regulator, Securities and Exchange Board of India (Sebi) introduced the flexi-cap category on November 6, 2020, in order to offer more options to investors. Accordingly, on December 14, 2020, Parag Parikh Financial Advisory Services (PPFAS) Mutual Fund changed the name of Parag Parikh Long Term Equity Fund to Parag Parikh Flexi Cap Fund. Also, the category of the scheme was changed from multi-cap to flexi-cap.

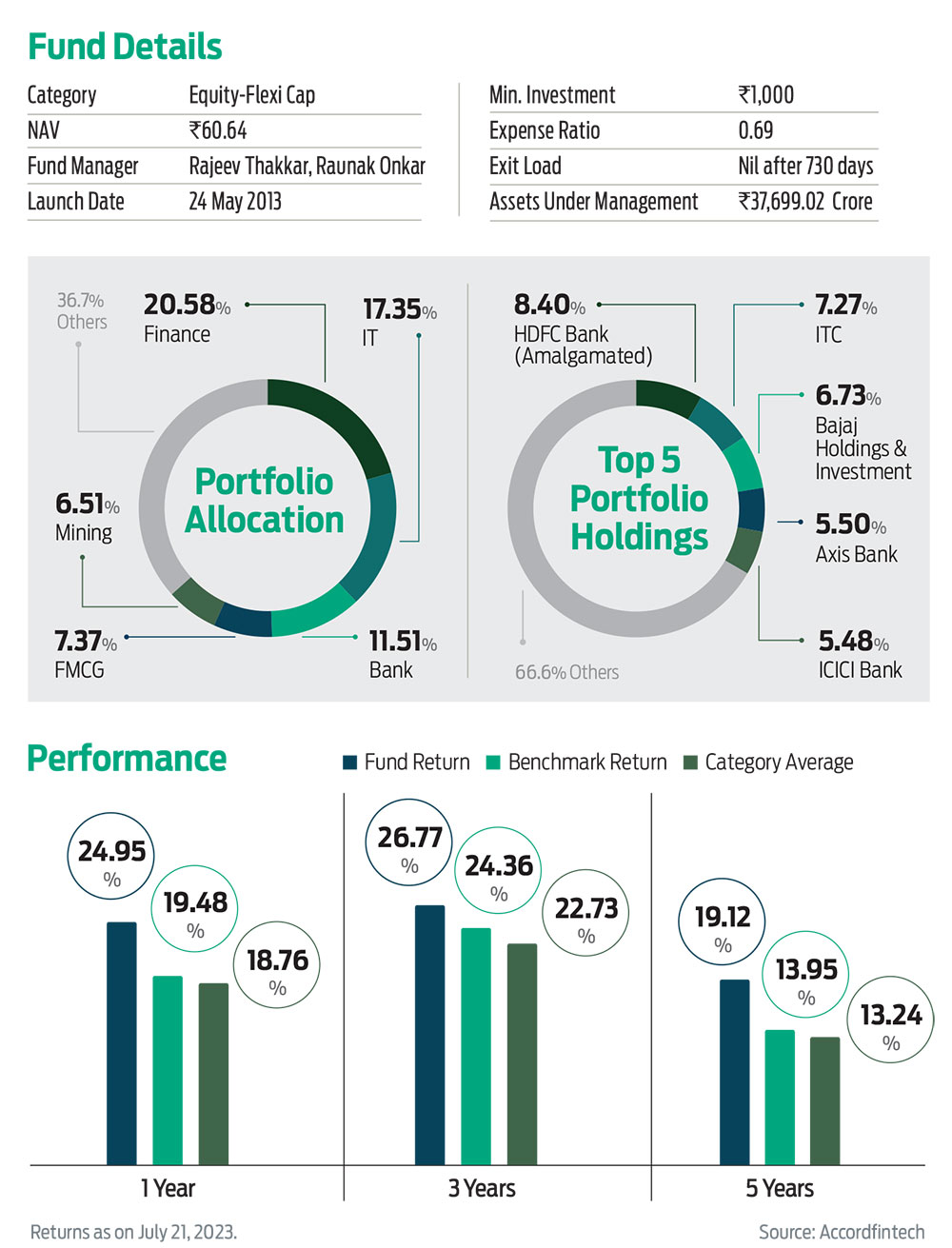

Portfolio

The fund invests at least 65 per cent of its corpus in Indian equities across market capitalisations and sectors. This helps the fund take advantage of equity taxation.

The remaining 35 per cent is allocated in foreign stocks and other financial instruments. At present, the scheme has invested 17.59 per cent in four foreign listed securities—Microsoft (5.34 per cent), Alphabet (4.85 per cent), Amazon (3.78 per cent), and Meta (3.62 per cent).

The scheme prefers to invest in quality businesses with high pricing power, high entry barriers, high return on capital, strong balance sheet, and a competent management. The fund manager prefers the buy-and-hold strategy in high-conviction stocks at attractive valuation instead of churning the portfolio to generate alpha. The lower portfolio turnover ratio reflects this. For one year, its average portfolio turnover ratio stands at 24.27 per cent compared to the category average of 60.75 per cent.

Performance

In the last 10 years, the scheme has delivered 19.57 per cent compared to the category average of 16.63 per cent. The scheme has the ability to reward investors handsomely if they remain invested for the long term.

kundan@outlookindia.com