Aparna Mohan, 46, who lives in Bengaluru, is turning traditional gender roles on their head. She is the head of her household that consists of her old and ailing parents. “We always get to hear that you need a guy to take care of the home. There is always doubt on the potential of women to manage work and home. But that’s not true,” says Aparna, who has a brother living in another city.

Aparna works as a technologist at a private firm and makes time to take care of her ailing parents—her father, Brijendra Mohan, 81, has cancer and needs constant care. “My mother (Nirmala Mohan, 73) is also old. Neither of them has any pension. But I enjoy the experience of being the bread-earner and taking care of my parents, single-handedly,” says Aparna, who was married for a short period several years ago.

Women are increasingly assuming the role of breadwinners in many families, some out of choice, some because they got widowed or separated from their husbands, and some simply because they earn more than the male members of the family.

“The number of single women is growing in India. Many choose to remain unmarried and this confidence comes with financial independence. There is a growing number of working independent women in India,” says Priyanka Bhatia, co-founder, Women On Wealth, a financial training firm for women.

The data available on women, especially in urban centres, is also encouraging and shows that more women are working and are not dependent on others for their financial needs.

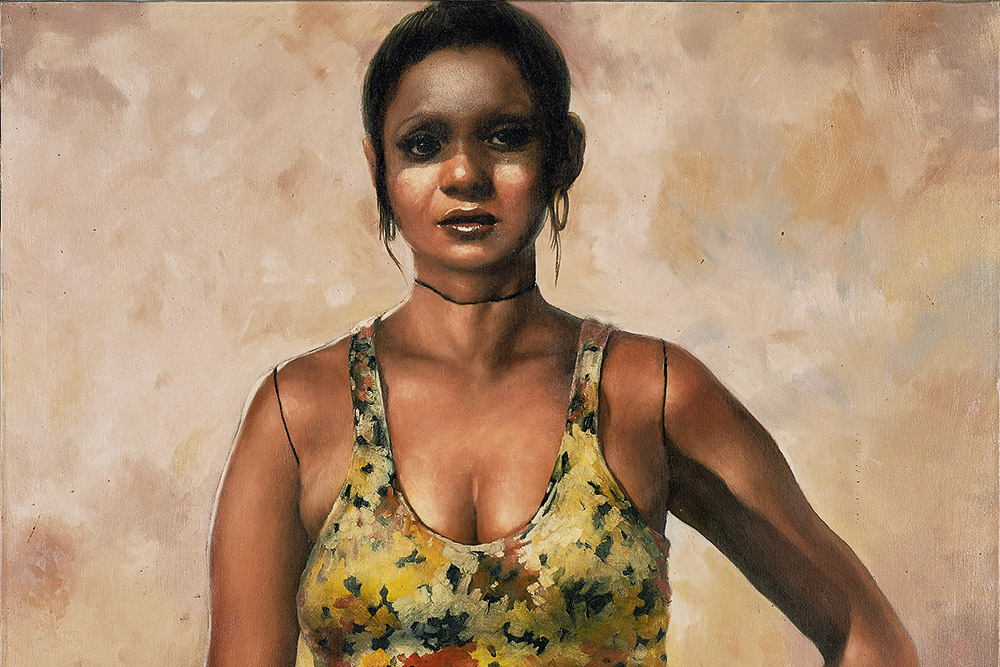

Anita Chandrakant Maniyar, 53, Jalgaon

Mother to three daughters, Anita (second from right in photo) took over her husband’s business and also started one of her own to increase the family’s earnings after her husband passed away in 2015 at the age of 48 years. All the children were studying and Anita was determined to fulfil their dreams. Over the years, thanks to her determination and sound planning, Anita has managed to fund her daughters’ education using loans, investments and savings. She also ensures that at least 10 per cent of her monthly earnings is put away into an emergency corpus. “When I started running my husband’s shop, I was criticised. Being a shop owner is a role designated for men in our area. But I did it for my daughters,” she says.

According to National Family Health Survey (NFHS) data for 2019-21, there were 1,020 women for every 1,000 men in India. This is for the first time that the number of women per thousand men has crossed 1,000. India has more women than men, first time on record since NFHS started keeping record in 1992.

The data further showed that the literacy rate among urban women is 83 per cent and that the number of women with an independent bank account has gone up by more than 25 per cent in 2021 as compared to 2016. In addition to that, as per investment bank Credit Suisse’s report published in 2020, women own 20-30 per cent of India’s $6 trillion household wealth.

Financial independence is a heady feeling, but even single super women taking care of dependants, need help. Planning well can take you that much further.

Strength To Strength

Though many women are assuming the role of the head of the household, challenges remain at every step, the biggest of which is a skeptical society that still sees men as the ideal candidates for the role.

Anita Chandrakant Maniyar, 53, transformed into a business owner from a homemaker a year after her husband passed away in 2015, to support her family of three daughters. It wasn’t easy. “When I took over my husband’s business, I got to hear a lot of criticism. Being a shop-owner is mostly a male-oriented job. But I knew I had to do that to ensure my daughters get the best education,” says Anita, who is based in Jalgaon, Maharashtra. Two of her daughters were in school and the third had just started college when her husband passed away.

Aparna Mohan, 46, Bengaluru

A technologist by profession, Aparna has been taking care of her elderly parents for the past few years. Aparna self-financed her MBA from IIM-Bangalore. Her financial dependents include her father, who suffers from cancer, and her mother. Aparna feels it can be difficult to manage everything but one can strike a balance between financial planning, family life and work. “Single working women who also manage households alone and take care of family have always been questioned. But I enjoy my journey and the experience I gather,” says Aparna.

When you are taking care of household expenses, career advancement can often take a backseat, but Aparna didn’t let that happen. She started doing an executive MBA from the Indian Institute of Management, Bangalore (IIM-B) in 2008 alongside her job. “Managing household finances, following your dreams and then finding time for home may seem difficult. But things do fall into place eventually,” mentions Aparna.

Sonali Pal, 44, depended on her husband for financial planning, then on her father and brother. The journey to independence was long-drawn for her but eventually she figured it out to support her son. Her father supported her when she lost her husband in 2012 after a prolonged illness. Her brother stepped in a few years later after their father’s demise. “Although I have been working since 1989, when I graduated, I got into a corporate job only in 2010,” says Kolkata-based Sonali.

Building A Secure Life

Another big challenge is building a financially secure life, especially in the face of social and emotional challenges. Here’s how a basic financial framework can be built.

Get Protection: Having an emergency fund is mandatory for every individual, irrespective of their profile and family background. “One should always maintain emergency funds equivalent to monthly expenses of six months,” says Mitesh Nagori, a practising chartered accountant and owner of CA Mitesh and Associates, a financial firm. Experts suggest keeping as much as one year of expenses in an emergency corpus in view of the uncertainty that the Covid pandemic created.

Anita is building an emergency fund and ensures that at least 10 per cent of her monthly earnings go into the kitty. Sonali invests in small savings schemes that can be liquidated in times of need.

Just like men breadwinners, women too need to find security for their dependents’ needs through insurance, which is the second step towards protection. It is essential to take life insurance to provide dependents financial support in case of an unfortunate event. Health cover for yourself and your family will take care of medical emergencies.

Don’t Lose Sight Of Your Goals: For Anita, her daughters’ education are the biggest goals and they are all near term. She has already successfully funded her eldest daughter’s post-graduation from a reputed university with the help of savings and education loans. The second daughter is in an under-graduate college and the youngest in Class XI.

“From the monthly earnings from my business, after all payments, I keep 20 per cent for investment. I make investments usually for short terms, so that I get some money at the end of three to four years,” says Anita.

Sonali Pal, 44, Kolkata

Sonali has been handling the household and raising her 16-year-old son single-handedly since 2012, after her husband passed away in April that year. Although her brother and father always remained pillars of support, becoming a “father” also for her son has not been easy. While she was working earlier too, being the sole earner meant she needed more income. So, Sonali joined the corporate sector. Ever conscious of her responsibilities for her son and towards herself, she is paying serious thought to retirement planning. “After I turn 60, I plan to start my own business, as we don’t have any pension these days,” she says.

Experts suggest that investing in mutual fund systematic investment plans (SIP) is a good option for long-term targets. “After securing money for (life and health insurance) policies, one can invest in SIPs in equity funds as that can give healthy growth,” says Nagori. Both Sonali and Anita invest in mutual funds and also have insurance policies.

A combination of debt and equity instruments will serve well. “If you are below 40 years, I would suggest a mix of equity and debt products, with a higher percentage of allocation in equity-based assets. Equity will help in building a bigger corpus and debt will provide safety,” says Sachin Parekh, a financial planner associated with Save N Protect Financial Planners, a financial planning firm in Mumbai. For older individuals with short-term goals, a debt-heavy portfolio that provides stability may work better.

Focus On Yourself

Fighting for yourself is also a challenge as most women are conditioned to keep their own requirements secondary to their families’ needs. “Often, guilt is passed to women, and they tend to deprive themselves as they want to put their family first. But women should put some money aside for themselves, for recreation or to pursue their dreams,” says Vivek S.G., founder of Wealth Craft, a financial planning firm based in Bengaluru.

Besides immediate needs, single mothers, daughters taking care of their parents or siblings, or single women responsible for their own finances should not ignore retirement planning. The earlier you start, the better it is. But the key is to not just rely on advice from friends and family. Some of the instruments such as fixed deposits and insurance policies, though popular earlier, may not be the best options for long-term goals like retirement. “Women are better savers and planners than men. They just need to keep in mind that they need to cope with inflation and manage taxes,” adds Vivek.

Apart from investing in equity, investments in Public Provident Fund (PPF) and National Pension System (NPS) can also be considered, says Nagori. Sonali invests in PPF and plans to get into business post retirement. She has already started to take small steps towards setting up one.

It takes a lot of courage, strength and perseverance to go it alone in a man’s world. The trick is to plan well, stay the course and live your life on your own terms.

***

Plan Of Action

Single women who have financial dependants must... ensure that they

- ...Ensure adequate life and health insurance

- Set aside funds for emergencies

- Pay particular attention to retirement planning

pushpita@outlookindia.com