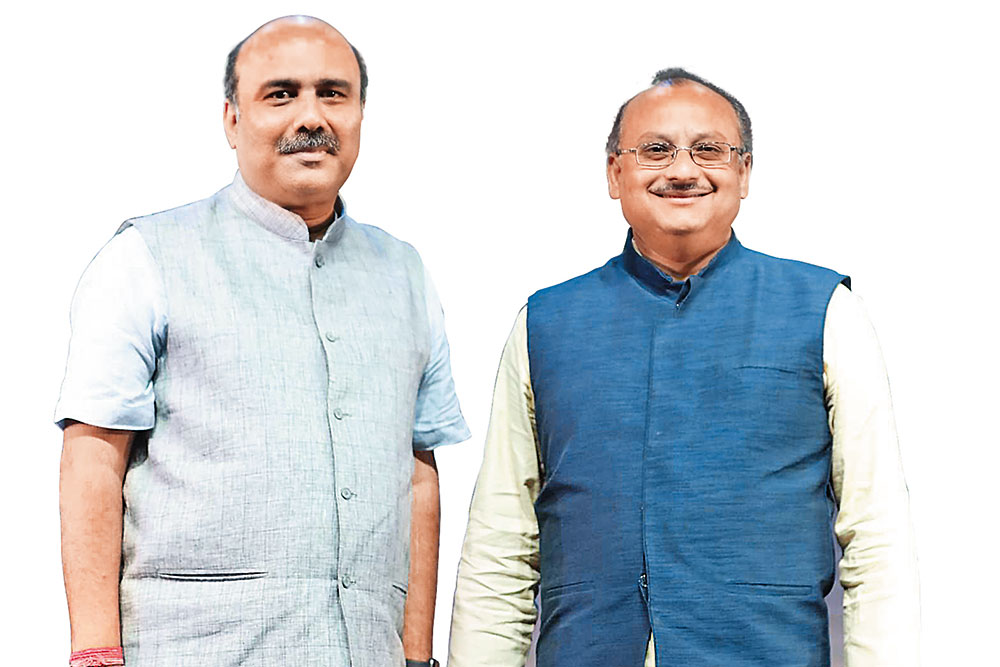

Jignesh Desai (L) and Neeraj Choksi (R) Co-Founders at NJ Group, talk about the company’s foray into the mutual funds business and the future of the mutual funds industry.

NJ Group started its journey in 1994 as a distribution business but has come a long way now. In October 2021, it also launched its maiden new fund offer, NJ Balanced Advantage Fund. Neeraj Choksi and Jignesh Desai, Co-Founders at NJ Group, talk about the company’s foray into the mutual funds business, their journey so far, the role of rules-based investing and the future of the mutual funds industry.

Q: Could you please let us know about your journey till date. Can you also share the scale you have achieved in terms of numbers?

We (Neeraj Choksi and Jignesh Desai) were roommates during our student days. Despite having family businesses, we wanted to do something of our own. We started in 1994 as equity brokers in those challenging days. Later we understood the importance of mutual funds as investment vehicles for retail investors and one fine day decided to focus solely on mutual funds. The market was huge and mutual funds were virtually unheard of in those days. Soon we realised that it was virtually impossible to reach households directly at the scale we wanted to. So, we decided to have a platform of sub-distributors in 2003. Today it is called as NJ Wealth financial products’ distribution network and the sub-distributors are known as NJ Wealth Partners. Our AUM (assets under management) in 2003 was around Rs 300 crore and by 2010, the AUM reached Rs 10,000 crore. It was also the year we became members of the stock exchange. Today, the number of active NJ Wealth Partners is over 23,000 and our AUM is over Rs 1.20 lakh crore in mutual funds, making us one of the largest mutual fund distributors in the country.

During this course of the journey, the NJ Group has also forayed into asset management, insurance broking and recently into lending/NBFC business in the financial services space. In the asset management space, we are today managing Rs 8,250 crore with over Rs 5,000 crore in mutual funds and over Rs 3,250 in PMS AUM (portfolio management service). In the insurance broking space, our life insurance book is around Rs 300 crore, while the general insurance book is around Rs 170 crore. In the PMS and insurance broking spaces, we are again amongst the leading players in the industry.

Q: You have the first-mover advantage of working in the B2B model of MF distribution. How easy or difficult is it to retain or onboard new distributors in a highly tech-driven market?

Let us look at it differently. It will be hard to find any student today aspiring to be a financial products or mutual fund distributor. This is even though the penetration of mutual funds in India is very low and there exists a huge opportunity for the country’s youth to offer intermediation services in financial products. It is only when people stumble upon this opportunity or when the same is explained to them that they join the business. While there is no entry barrier or capital required, the gestation period to see revenues is longer. Hence, retention is also a challenge and only the serious guys survive in the long term.

Technology has only made the onboarding process and business operations smoother for everyone. And at NJ Wealth, we have been at the forefront of absorbing technology in our business and empowering distributors with the same. Distributors can now achieve huge scales with technology without the need for any physical interaction. However, the core challenges in terms of distributor onboarding and retention haven’t changed much.

Q: You are associated with a large number of MF distributors as many of them are working on your platform. What kind of support are you giving them?

At NJ Wealth, the support on offer to distributors or NJ Wealth Partners is end-to-end. We have a dedicated set of managers at the branch level that is responsible for RTD - recruitment, training and development of our partners. Apart from the wide product basket of financial products available from day one, the platform also provides the necessary technology ecosystem to get the business going. There is a very strong focus on training partners and we can find sessions happening very frequently—both online and offline. Apart from this, there is also very strong marketing support with everything from print media to digital media which includes visiting cards, flyers to websites to digital marketing support provided by our team. The idea is to let the partners focus on customer acquisition and servicing while we take care of the rest.

Q: How challenging was the transition from being an MF distribution aggregator to an asset management company?

We see it as an evolution. We had started our business in 1994 by directly dealing with investors and switched to the network platform entirely in 2003. Over the years with our experience and learning, we felt we would offer products that made sense to investors. It was in the year 2010 that we launched PMS with discretionary products using data-driven and rule-based methodology. Today, NJ PMS, which is part of NJ Asset Management, manages over Rs 3,250 crore of assets, making it one of the leading portfolio managers in India. It was also the time when we started offering ready-made mutual fund portfolios called ‘MARS’ to investors which became very popular and today, the AUM in MARS stands at nearly Rs 13,000 crore. Thus, we felt that the time was right to share our philosophy and investment approach with the retail investors. From the business sense too, it made sense to diversify and expand our presence in the market. For us, this has been a gradual, well-thought process of evolution, backed by conviction and belief and not primarily driven by business considerations.

Q: What kind of MF products can we expect from NJ Mutual Fund?

NJ Mutual Fund, an NJ group entity launched its maiden new fund offer (NFO), NJ Balanced Advantage Fund, on October, 2021. This was very well received by investors and we managed to get over Rs 5,200 crore of inflows, the highest ever for any maiden NFO by any fund house.

If we look at the market today, it is dominated by actively managed funds and participants that focus on active management. As a result, we find that investors have their equity allocation entirely in actively managed portfolios where many viable options are available. Non-active investing has two very broad sub-sets—passive and rule-based investing. Passive is where popular indices are replicated. We are focused on rules-based investing where we are practicing what we call as rules-based, active investing. Here, the idea is to offer products that make use of market and financial data, economic parameters, etc. to find opportunities by using time-tested factors that contribute to performance, all without human biases. This type of investing is popular in developed markets but has yet to pick up in India.

Q: How do you plan to reach out to investors beyond the top 50 cities, especially rural India?

Having a physical network of branches is an economic decision and we would like to have as wide a presence as is economically feasible. Having said this, we forayed into smaller cities and even towns well before anyone else in the industry. At present, we do have a good number of branches beyond the top 50 cities. We are also expanding into smaller towns with ‘NJ Express Centres’ which are run by our associates where we are not present. Having a local presence does help in reaching out, recruiting and supporting distributors, especially in smaller cities and towns. They, in turn, can have a direct relationship with investors which would be otherwise difficult to replicate.

Having said this, physical presence or distance is not a limiting factor today. A person can be associated with NJ either as a distributor or as an investor with an NJ Wealth Partner from any part of the country. The entire customer onboarding, transactions and servicing can happen with the help of our NJ Wealth platform. Even during the pandemic, our partners continued to acquire new customers across India and expand their business, without much worry.

Q: Where do you see yourself in 5-10 years from now?

We see ourselves remaining as committed and as motivated as ever to serve the interests of our investor and distribution community, in whatever capacity we can. We hope to learn more, reach out to a much larger number of investors and offer them financial intermediation and products that will meet their financial objectives. If we manage to reach and meaningfully impact even 1 per cent of India’s households, we would feel we have made a difference.

Q: How do you see the MF industry in India in the next 5-10 years?

In the last 10 years, the average AUM of the Indian mutual fund industry has seen a five-fold increase to around Rs 38 lakh crore, as of November 30, 2021. In recent years, we have seen increasing participation of individual investors in the industry, given the growing awareness, financial inclusion, digitisation and improved access to banking channels. The SIP story too is becoming very popular. However, when you see the MF AUM to GDP ratio, we are just at about 15% today against the developed countries where it is over 75%. There is no comparison even when we compare the number of PAN holders against the MF investors in India. This is reflective of the large headroom available for structural growth.

We feel that today, we are only at the start of a long-term phase of exponential growth. We feel that the pace of change will only hasten with growing awareness, digitisation and ease of operations. The Indian mutual fund industry is amongst the top globally in terms of the regulatory framework and best practices. The Securities and Exchange Board of India (Sebi) has done a commendable job in not just regulating the industry but also guiding it and helping it grow. Where the industry can reach with this backdrop and the current pace is difficult to predict at this moment, but we are excited more than ever.

DISCLAIMER : Views expressed are the author’s own