Small-cap funds are known for delivering high returns, but there is a caveat. They deliver returns in the long term, say 7-10 years. Also, they are highly volatile in nature in the short run. Investors looking for a portfolio that has the potential to deliver superior returns at higher risk can consider buying the units of Nippon India Small cap Fund.

The fund comes with a proven history of delivering over the long term. In the last 10 years, the fund has delivered a compounded annual growth rate (CAGR) of 26.10 per cent, beating the broader market and beating the benchmark with almost double returns. Over the seven-year period, it has clocked 23.18 per cent, as against the small-cap fund category average return of 18.98 per cent.

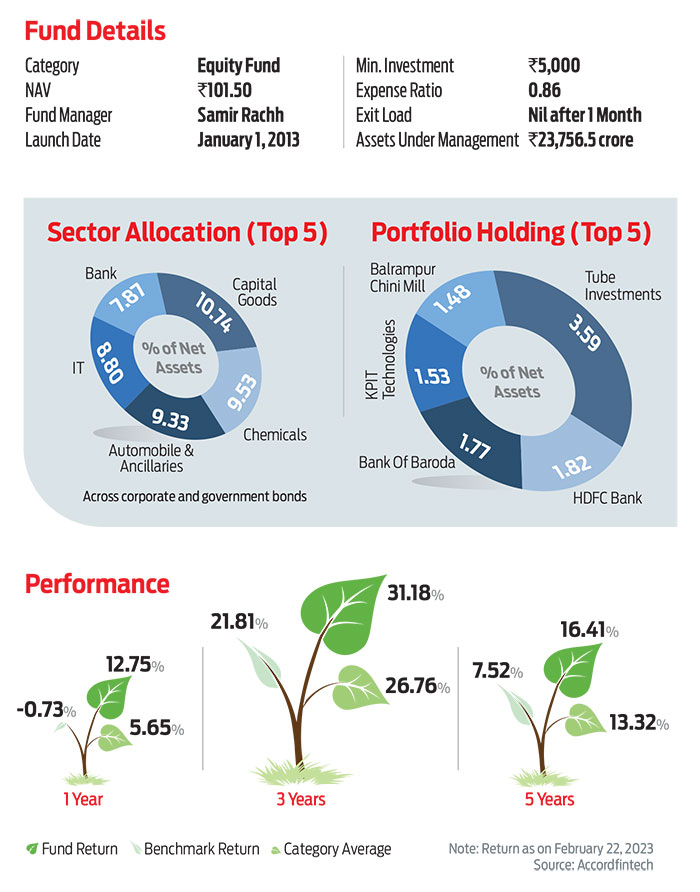

Portfolio

The fund follows prudent risk management measures like margin of safety and diversification across sectors and stocks with a view to generate relatively better risk-adjusted performance over a period of time. The fund manager prefers to build the portfolio with an optimal mix of growth and value. He also does not shy away from taking advantage of thematic play, when there is an opportunity.

For instance, the fund bought Bank of Baroda in March 2021, when the baking rally started, on the back of credit offtake. The stock delivered little above 50 per cent in the last one year. Many small caps turned out be multi-baggers in this period, which helped the fund to deliver superior returns. For example, the fund has been holding Tube investments since April 2018 and the stock has delivered over 850 per cent in the last five years and is now a mid-cap stock. As on January 31, 2022, the fund has invested across 167 stocks from 32 sectors. The fund stays true to its objective of remaining invested in small-cap companies. At present, the fund has invested around 68 per cent in small caps, 20 per cent in mid caps and 12 per cent in large caps.

Performance

On a yearly basis, the fund has outperformed its benchmark, Nifty Small Cap 250 TRI, with a decent margin in the last 10 years. It has posted 26.10 per cent return against the benchmark return of 13.35 per cent and category average of 20.20 per cent.

OLM Take

If you have adequately invested in large- and mid-caps and want to add a small-cap fund, you could consider Nippon India Small Cap.

kundan@outlookindia.com