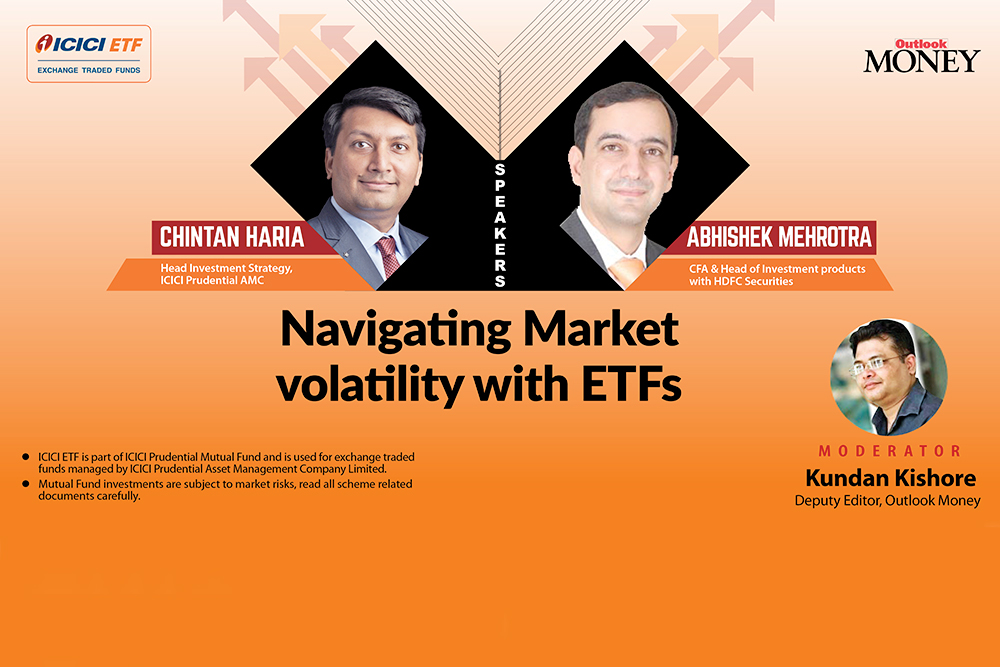

In a recent discussion with Outlook Money, Chintan Haria – head – product development and strategy, ICICI Prudential Mutual Fund, and Abhishek Mehrotra, head of investment products, HDFC Securities, spoke about the ways in which investors can navigate market volatility with exchange-traded funds (ETFs). They were in discussion with Kundan Kishore, deputy editor, Outlook Money.

Here are some edited excerpts from the discussion.

The Market Movement

For long, the interest rate was kept low, but now they are rising. That said, the rising interest rates won’t have much of an impact in India, and the inflation is also under control.

Chintan: “There is going to be volatility for the next one or two years. The good part is that there won’t be that much of an impact in India, because we never had low interest rates or nil interest rates, and inflation in India is pretty much under control.”

Abhishek: in the given scenario, investors will have to diversify themselves and reduce their leverage. An investor has to go through his/her risk profiling to understand how he/she should balance the risk, and what is the asset allocation? That done, the investors has to improve his/her skills about stocks and mutual fund analysis.

“We are having the data that 90 per cent of the people who are trading in Futures & Options have lost their money,” he adds.

Navigating volatility with ETFs

Exchange-traded funds (ETFs) have grown in terms of offerings in the last six-seven years. They also allow an investor to create a wide multi-asset portfolio within the ETF space.

Chintan: “Earlier you were restricted to probably having large-cap ETFs only in your portfolio. Now, you can have large-, mid-, small-cap or even sectoral or smart beta ETFs.”

One can also create a low volatile portfolio out of low-volatility ETFs. There’s also the option of gold or silver or debt funds.

Chintan: “The prominent sectors in India are banking, technology, pharmaceutical, auto, infrastructure and financial services.”

What Should You Do?

One should ideally avoid taking large weights in a single stock or a single theme to safeguard against volatility.

Abhishek: “Some stocks have proven to be very volatile as we have seen of late. Just to give an example, in 2021, information technology was performing well, but now it is not performing that well. So, if someone had invested heavily in IT, going by past performance, he may not be very happy with the kind of returns which he would have got.”

The essence is to diversify and not invest heavily into one sector or theme, even in case ETFs, so that in the event of a market downturn or volatility, one’s entire investment basket doesn’t get affected negatively.

Disclaimer

- ICICI ETF is part of ICICI Prudential Mutual Fund and is used for exchange traded funds managed by ICICI Prudential Asset Management Company Limited.

- Mutual Fund investments are subject to market risks, read all scheme related documents carefully.