SBI Small-Cap Fund

Small-cap mutual funds are riskier compared to their large- and mid-cap counterparts, as they invest in relatively smaller or nascent companies that may be under-researched.

They also have a high risk-reward ratio. The small-cap segments are good investment picks for long-term investors who have considered both returns as well as the risks. A word of caution though: small-caps should not form the foundation of your portfolio.

They should be included only to the extent permitted by your risk profile. Once you are sure about your risk-bearing capacity, you could consider including them. SBI Small-Cap Fund has a superior track record.

The fund manager prefers to diversify the portfolio in quality stocks across sectors to mitigate the risks—a strategy, which has worked in its favour. If you can endure high volatility, this fund has the ability to reward you handsomely in the long run.

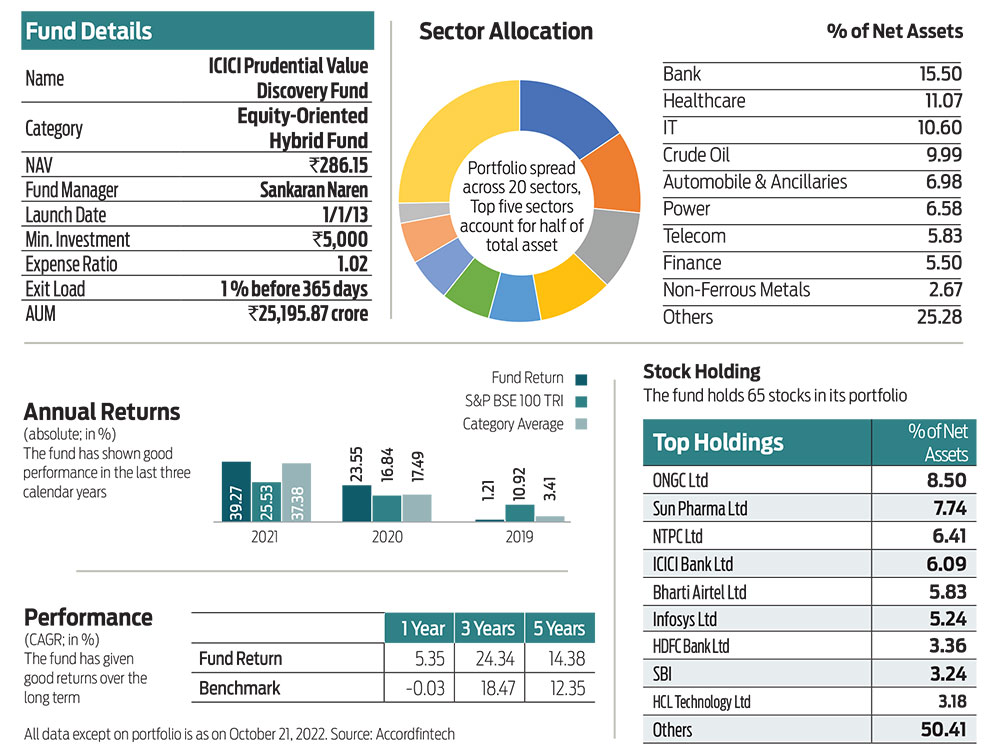

ICICI Prudential Value Discovery Fund

The fund has a long legacy of superior performance, and the huge corpus it has created for investors over the years is testimony to that. It is one of the largest and best performing funds in its category.

The fund invests in value stocks across market capitalisations and sectors. The fund conserves cash in the absence of value opportunity in the market. ICICI Value Discovery Fund is managed by Sankaran Naren, one of the most seasoned fund managers in the Indian mutual fund industry.

He is known for his value style of investing, which bodes well for the fund, given its objective. This fund is a decent choice for investors looking for capital appreciation by investing primarily in a well-diversified portfolio of value stocks.

The fund adopts a “bottom-up” strategy to invest in assest based on parameters such as price to earning, price to book value and dividend yield.