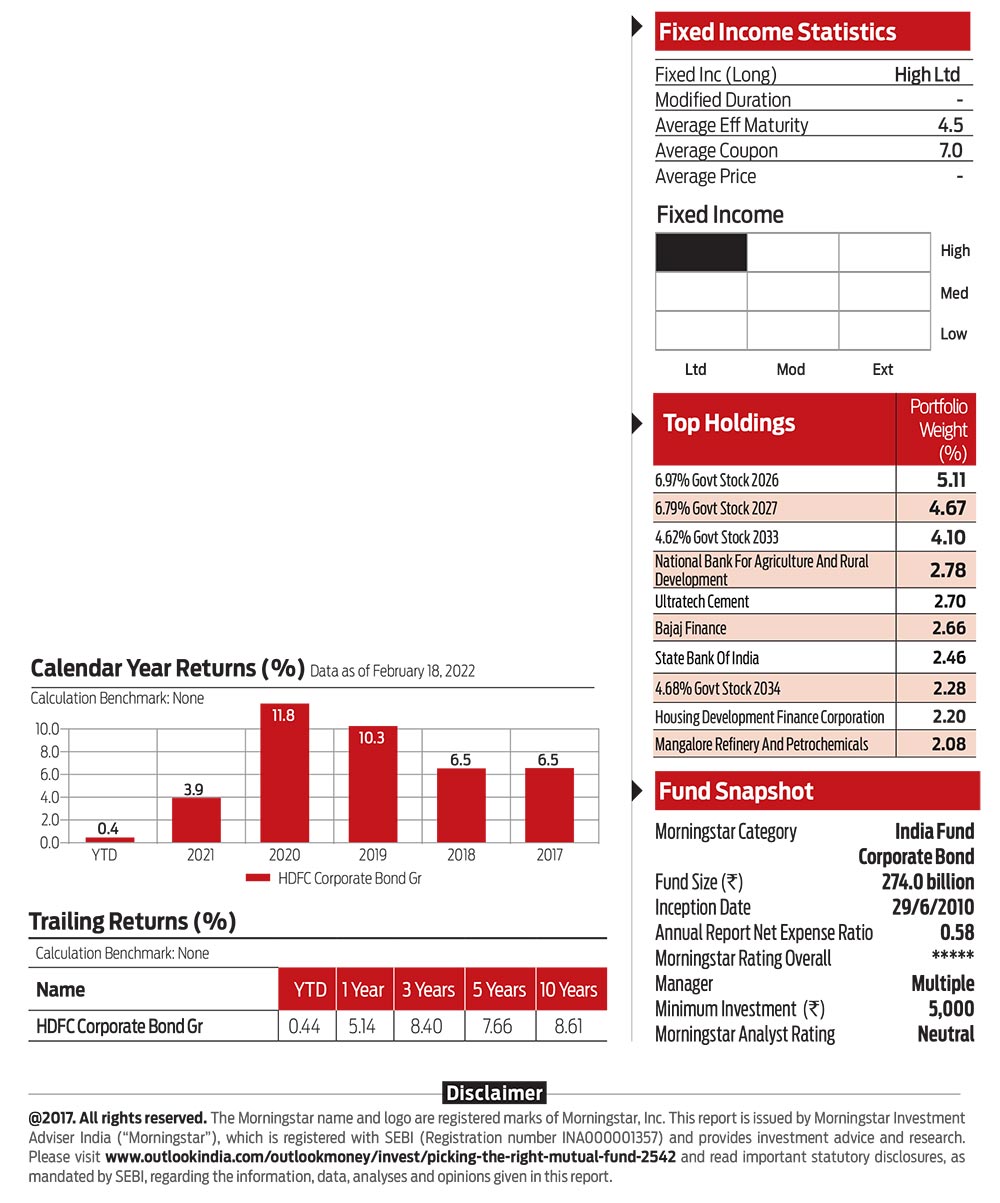

HDFC Corporate Bond Fund

Investment Strategy

Fund manager Anupam Joshi joined HDFC Mutual Fund in October 2015 and has been managing this fund since then. The fund house has a strong eight-member debt investment team comprising of experienced managers like Shobhit Mehrotra and Anil Bamboli, three credit analysts and two dealers.

The investment philosophy is to optimise returns without taking excessive duration or credit risk. Though the team takes duration calls, it is done with a measured approach without going overboard. This is largely a small portion of the portfolio to generate additional alpha, while most of the performance is driven by selecting securities offering attractive yields within the AAA-rated segment. Expectedly, the investment approach relies on fundamental research, which entails combining qualitative aspects with quantitative analysis.

The investment team prepares the coverage list with focus on the company management and track record, financial strength of the promoter group, and corporate governance standards. The team studies the company’s cash flow and relevant ratios–leverage, coverage and solvency. At this step, the team also draws on the expertise of its equity team. The fund company uses a proprietary model in which qualitative and quantitative inputs are used to arrive at a credit score for each issuer. This helps managers determine issuer-wise exposure, thereby acting as a risk-management tool for the individual portfolio and the fund company.

The emphasis on liquidity and risk control is borne out by the fund’s portfolio, where almost 100 per cent of assets are invested in AAA or equivalent rated securities. The team will build cash when there aren’t enough attractive investment opportunities and to ride out periods of volatility and uncertainty.

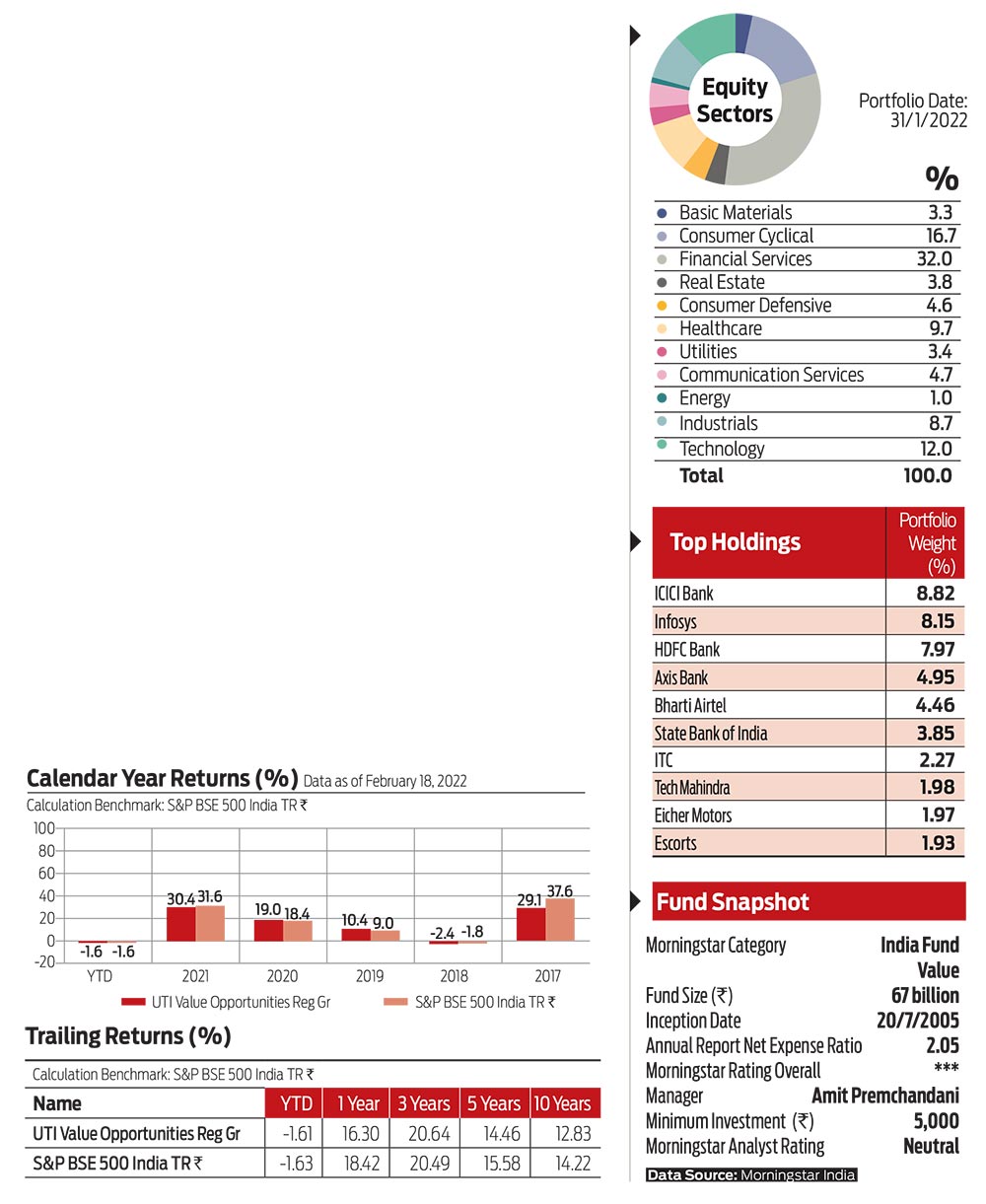

UTI Value Opportunities Fund

Fund Strategy

The fund is jointly managed by Vetri Subramaniam and Amit Premchandani. Given that Subramaniam now shares responsibilities as the chief investment officer, Premchandani has taken the lead on this fund.

The portfolio managers are backed by a large and a stable equity team that includes nine portfolio managers, with an average of two decades in the industry, and nine analysts.

The fund has more flexibility to position itself actively across the market-cap spectrum and has a value bent. The managers follow a mix of top-down and bottom-up approaches while taking aggressive sector positions.

The positioning is based on valuation considerations and medium-term growth prospects. The initial quantitative screening process identifies companies that have generated higher operating profits and demonstrated long-term return on equity. The managers emphasise on the trends and patterns discerned more from historical performance than from the forecasts.

For the qualitative aspect, they focus mainly on management quality, the company’s business model, and competitive advantages.

While selecting securities from the existing universe of 340 stocks, the portfolio managers follow a barbell strategy and invest in growth companies even at a premium if they believe the valuations are reasonable and the company has the potential to generate economic value through the cycle. They are also willing to operate on the other side of the spectrum–with the potential for mean reversion in valuation.

The robust investment process favours sectors that have a strong probability of surprising positively on both earnings and operating cash flow growth. The fund managers emphasise on relative valuations and look for potential for mean reversion, focusing mainly on depressed stocks with low return of capital employed and return on equity.