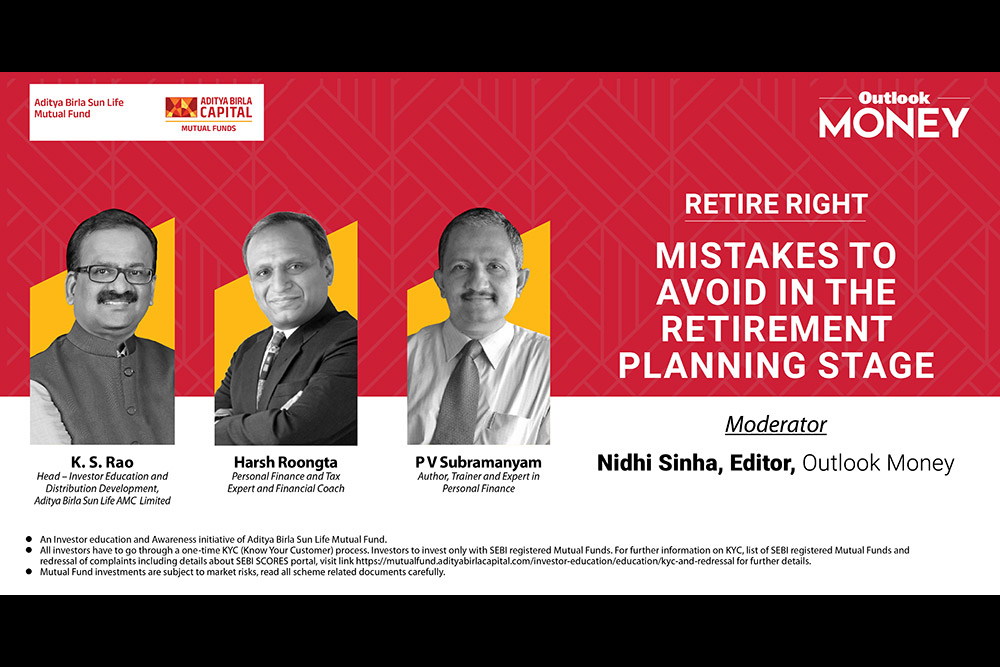

The latest episode of Outlook Money’s “Retire Right” series featured insights from top experts on “Mistakes To Avoid In The Retirement Planning Phase”. This session, moderated by Nidhi Sinha, Editor at Outlook Money, is part of the investor education and awareness initiative by Aditya Birla Sun Life Mutual Fund in association with Outlook Money.

The esteemed panel included K S Rao, Head of Investor Education and Distribution Development at Aditya Birla Sun Life AMC; Harsh Roongta, Personal Finance and Tax Expert; and P V Subramanyam, Author and Personal Finance Trainer. Each shared valuable insights on the importance of careful planning and the role of investments, particularly mutual funds, in securing a comfortable retirement.

Rao emphasised the significance of starting retirement planning early. “The earlier you start, even with small savings, the more powerful the compounding effect on your investments. Retirement planning isn’t just for those approaching 55; it should begin as soon as one starts earning,” he said. Highlighting common pitfalls, he warned against underestimating post-retirement expenses and the impact of inflation, stressing the need for diversified investment strategies.

Roongta added a broader perspective, stressing the need for a holistic approach. “Retirement isn’t just about wealth. It’s about health, purpose, and maintaining strong social ties. Neglecting any of these aspects can derail even the best financial plans,” he noted. He urged viewers to treat exercise and adequate sleep as essential as financial SIPs (Systematic Investment Plans).

Subramanyam highlighted the importance of seeking professional advice. “The biggest mistake is thinking you can do it all yourself. A financial planner can provide crucial guidance on asset allocation, taxation, and withdrawal strategies,” he explained. He also pointed out the necessity of having contingency plans for unforeseen medical expenses and market volatility.

The session concluded with a reminder from Sinha about the significance of a well-rounded approach to retirement planning.

The full webinar is available on www.outlookmoney.com. Watch it to avoid these common mistakes and pave the way for a financially secure and fulfilling retirement.