Company Name Lemon Tree

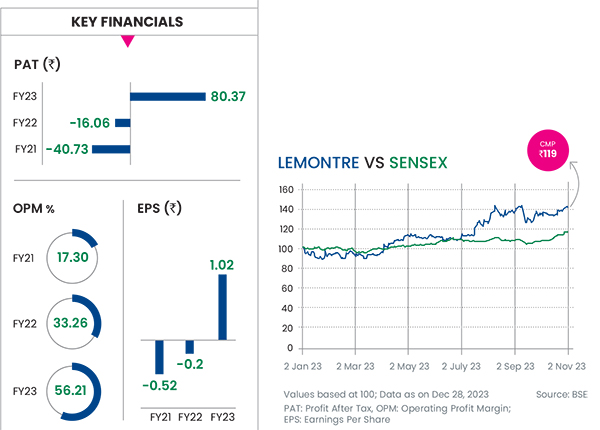

Current Market Price Rs 119

Calendar Year Return 42.09%

Lemon Tree Hotels is India’s largest hotel chain in the mid-priced hotel sector. It operates in the upscale segment and in the mid-market sector, consisting of the upper-midscale, midscale and economy segments.

Investing Rationale

Demand Surge: Factors, such as the rise of revenge tourism, an improved economic environment encouraging corporate travel, and the revival of mega weddings and cultural events have contributed to an upward trend. The demand surge is surpassing the current supply, which is not expected to catch up in the next 2-3 years. The present trend mirrors the sector’s last upcycle from 2004 to 2008, which was characterised by enhanced margins. This bodes well for domestic hotel players with robust pipelines and healthy balance sheets, who are well-positioned to capitalise on these upcoming opportunities.

New Launch: Lemon Tree has launched a 669-room Aurika Hotel in the luxury category near the Mumbai International Airport in October 2023 with an estimated capex of Rs 900 crore. This will help it establish a foothold in the upper upscale segment and flourishing micro market of Mumbai. Its earnings before interest, tax, depreceiation, and amortisation (EBITDA) from this is likely to be over 20 per cent of consolidated EBITDA.

Improved Income: Lemon Tree has a pipeline of 44 contracts across multiple brands and is likely to operate 5,671 managed rooms by the end of FY25. This shift towards an asset-light model could aid its margin.

Favourable Trend: The rise in business and international travel and momentum driven by enhanced occupancy, and contracts is expected to give a boost to its business. Our projections indicate that Lemon Tree will achieve a compounded annual growth rate (CAGR) of 28 per cent in revenue, 25 per cent in EBITDA, and 46 per cent in adjusted PAT with return on equity (RoE) improving to 21.5 per cent by FY25. It is currently valued at 16x FY25E EV/EBITDA, i,e,. at a discount compared to its peers.

Recommended by: Gautam Duggad, Head of Research, Institutional Equities, MOFSL