Equity index funds (excluding factor funds) saw a compounded annual growth rate (CAGR) of 72 per cent in five years, with their assets under management (AUM) increasing from Rs 3,000 crore in January 2018 to Rs 45,000 crore in January 2023, according to data from Morningstar India.

The number of index funds, too rose from 19 in January 2018 to 67 in January 2023, according to data from Morningstar India (excluding factor funds). In fact, 33 index funds were launched between 2021 and 2022.

Along with the number, even the type of index funds have increased. From large-cap to mid-cap and small-cap to sectors such as banking, information technology, pharma and manufacturing, index funds are now pegged to key indices.

That said, exchange-traded funds (ETFs), which are closely related to index funds, have been around in the sector space for many years.

Growing Basket Of Index Funds

Until 2018, a few index funds were launched against IISL Nifty 50, IISL Nifty Next 50 and S&P BSE Sensex indices. In September 2019, Motilal Oswal Financial Services lauched four new index funds—Motilal Oswal Nifty 500 Index Fund, Motilal Oswal Nifty Bank Index Fund, Motilal Oswal Nifty Midcap 150 Index Fund and Motilal Oswal Nifty Smallcap 250 Index Fund.

Index funds have had a long history in the large-cap space, primarily because generating alpha for large-cap equity funds is difficult. According to the latest SPIVA report, 89.1 per cent of Indian large-cap equity mutual funds underperformed their benchmark over a five-year period. In the large-cap space, a broader index fund based on the Nifty 500 index, such as the Motilal Oswal Nifty 500 Index Fund, can help you capture the broader market the way S&P 500 does in the US market.

The prospects have been brighter for mid-cap and small-cap categories. As many as 60 per cent of them managed to beat the benchmark S&P BSE 400 MidSmallCap Index over the five-year period ending June 2022, according to the SPIVA report (based on risk-adjusted return). But those who want to avoid complexity can choose from seven index funds in the mid-cap and five in the small-cap categories.

Last year, the Securities and Exchange Board of India (Sebi) also allowed fund houses to launch index funds in the equity-linked savings scheme (ELSS) category.

IIFL Mutual Fund has become the first fund house to launch India’s first passive ELSS Fund—IIFL ELSS Nifty 50 Tax Saver Index Fund. Navi Mutual Fund launched Navi ELSS Tax Saver Nifty 50 Index Fund in February 2023.

Debt Basket: There are debt index funds, too, known as target maturity funds (TMFs). More than 60 TMFs have been launched since 2019, with seven in December 2022 alone, on the back of hike in interest rates.

TMFs follow an index comprising government securities (G-secs), public sector utility (PSU) bonds or state development loans (SDLs), with their maturity aligned with the maturity of the underlying assets they hold. The returns are predictable because each bond, G-sec or SDL has a yield-to-maturity (YTM). The returns are also nearly the same as the YTM of the overall index, if held till maturity.

How To Choose Index Funds?

Index funds follow a benchmark in creating their portfolio in terms of stock selection and weightage. This helps investors to earn similar returns as that of the underlying benchmark.

For instance, a Nifty 50 index fund invests in 50 companies that comprise the Nifty 50 index. The returns in the index funds would be similar to what Nifty50 index earned in a given period.

But does that mean one can choose any Nifty 50 index fund by any fund house? No. That’s because even if the benchmark for a Nifty 50 index fund is the same, the returns may differ. This is because of the time lag in aligning the fund corpus with any changes in the index constitution—be it the change in weightage or index constituents.

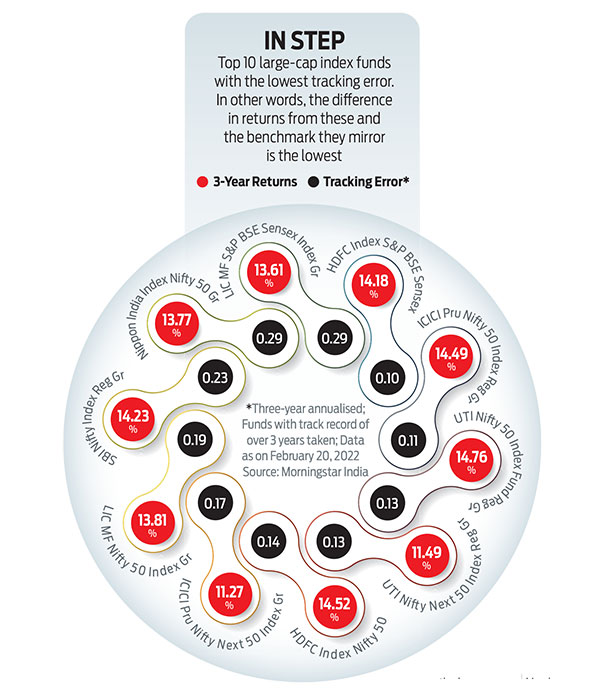

This phenomenon is called tracking error. The index fund’s overperformance or underperformance versus that of the benchmark is known as tracking difference. For example, UTI Nifty 50 Index Fund and Franklin India NSE Nifty 50 Index Fund—the two oldest index funds, which were launched in 2000—delivered 5-year CAGR of 10.87 per cent and 10.04 per cent, respectively, according to data from Morningstar India. This is -0.39 per cent and -1.22 per cent lesser than what benchmark IISL Nifty 50 TR delivered during the same period.

But why does this difference exist? That’s because tracking error in the Franklin fund (0.37) was higher than in UTI (0.13). In the long run, this difference can be huge. Gaurav Rastogi, founder and CEO Kuvera, says the lower the tracking error, the better it is, ideally it should be 0.1-0.2 per cent over a business cycle.

In reality though, there are huge differences in tracking over longer periods. For instance, Franklin India NSE Nifty 50 Index has a -1.27 per cent tracking error on a 10-year basis, while IDBI Nifty Index has -1.67 per cent over the same period, as on December 31, 2022, according to data from Morningstar India. The average tracking error of index funds in the last 10 years stands at -0.94 per cent.

Besides tracking error, expense ratios should also be considered.

Says Nirav Karkera, head of research, Fisdom. “One should select a fund with a strong track record of operating with the lowest tracking error and charging the lowest expense. Tracking error results in the fund’s performance diverging from the index, while expense ratio anyway chips off from the fund’s performance. Typically, asset management companies (AMCs) managing large index funds with a longer track record offer the dual benefit of efficient tracking and relatively lower expense ratios.”

Consider suitability, too. “One can pick from a basket of large-, mid- and small-cap index funds based on one’s risk appetite and goals. For instance, if someone is looking to invest for 10-plus years and has a high risk appetite, then he/she may invest in a small-cap index fund,” says Rastogi.

A better strategy would be to have one index fund in each category.

That said, sectoral funds should be used cautiously. “One should rupee average one’s index fund investments using systematic investment plans (SIPs). Sector or thematic index funds should be used sparingly and only when you have a strong thesis why the sector or theme will outperform in the next 3-5 years,” says Rastogi.

letters@outlookmoney.com