Mumbai-based entrepreneur and investor Anuj Munot (45) would like both his children—Vardhan (18) and Aaradhya (10)—to pursue their higher education overseas. “We want our chidlren to pursue both their under-graduation and post-graduation in universities overseas. Since my son is in Class XII now, we are already looking at colleges in the US for his undergraduate studies,” says Munot.

Munot has had this clarity since his children were much younger. So, when he started investing five years ago for this goal, he ensured that a part of his portfolio was investing in dollar-denominated products. Primarily, he has angel investments in start-ups and buys US-listed stocks. The latter, he says, will help him neutralise the side-effects of currency depreciation.

The number of Indian students who are seeking education abroad has been increasing. According to data from the Ministry of External Affairs, as of January 2021, there were more than 1.09 million Indian students studying in as many as 85 countries abroad. Of these, most of them are studying in Canada and the US, followed by the UAE, Australia and the UK.

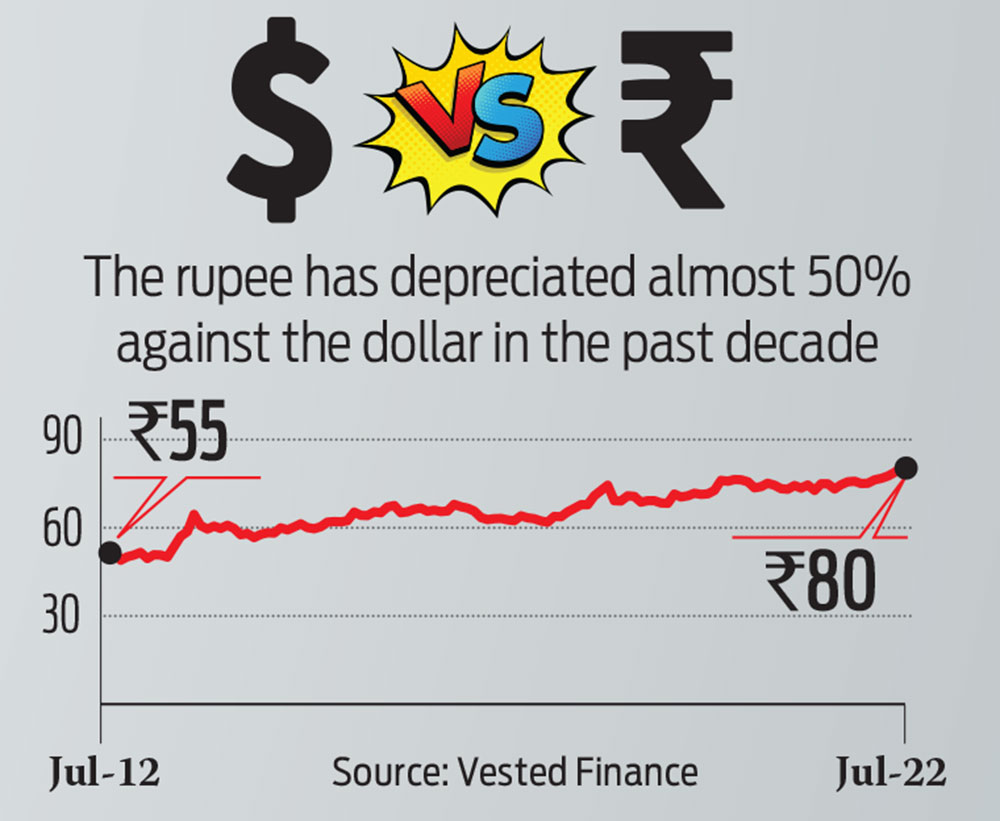

Keeping a part of your investment corpus in global assets makes sense for such a goal, considering the rupee’s depreciation against the dollar (see $ vs Rs ). That’s because currency depreciation along with inflation can severely dent the value of the corpus in the long run. Here’s how a depreciating rupee can affect the cost of foreign education, and how having global assets can counter that.

The Spectre Of Depreciating Rupee

The rupee has been on a significant slide against the dollar over the last few decades. In July, the rupee breached the 80-mark against the dollar for the first time. Over the past decade, the rupee has depreciated around 50 per cent compared to the dollar.

Worse, the slide is expected to continue. “We continue to see the rupee weakening against the dollar because the US Federal Reserve has embarked upon a restrictive tightening cycle. Hence, dollar supply is going to get short, which will impact capital flows into emerging markets,” says Dhananjay Sinha, head of strategy research and chief economist at JM Financial, an investment banking firm.

He adds that the Reserve Bank of India (RBI) has been running down the forex reserve buffer to defend the rupee. But if the dollar sustains for long, and if the trade deficit for India remains high due to high crude prices, the rupee may depreciate further. “We might be looking at 6-7 per cent depreciation in the short term (the rupee has already breached the 80 mark),” he says.

The Impact Of Depreciating Rupee

The cost of studying abroad, especially in the US, which is the most popular destination for Indian students, is roughly in the range of $10,000-50,000 for undergraduate courses, and $12,000-80,000 for post-graduate courses (pre-scholarship), according to data from APS Consultancy Services. In addition, there are living expenses that vary from location to location.

Says Anirban Sircar, chief executive and head counsellor of APS World Education, a consultancy firm for overseas education: “Institutions have refrained from raising tuition fees because of the pandemic. (As of now) any significant cost hike would be because of the higher exchange rate.”

Considering that the rupee has been depreciating constantly on a yearly basis, the cost is only likely to go up. “Every year, the cost of studying abroad (especially in the US) is rising, not just because of inflation, but also because the rupee is depreciating against the dollar,” says Viram Shah, co-founder and CEO, Vested Finance, an investment platform that enables Indians to invest in the US markets.

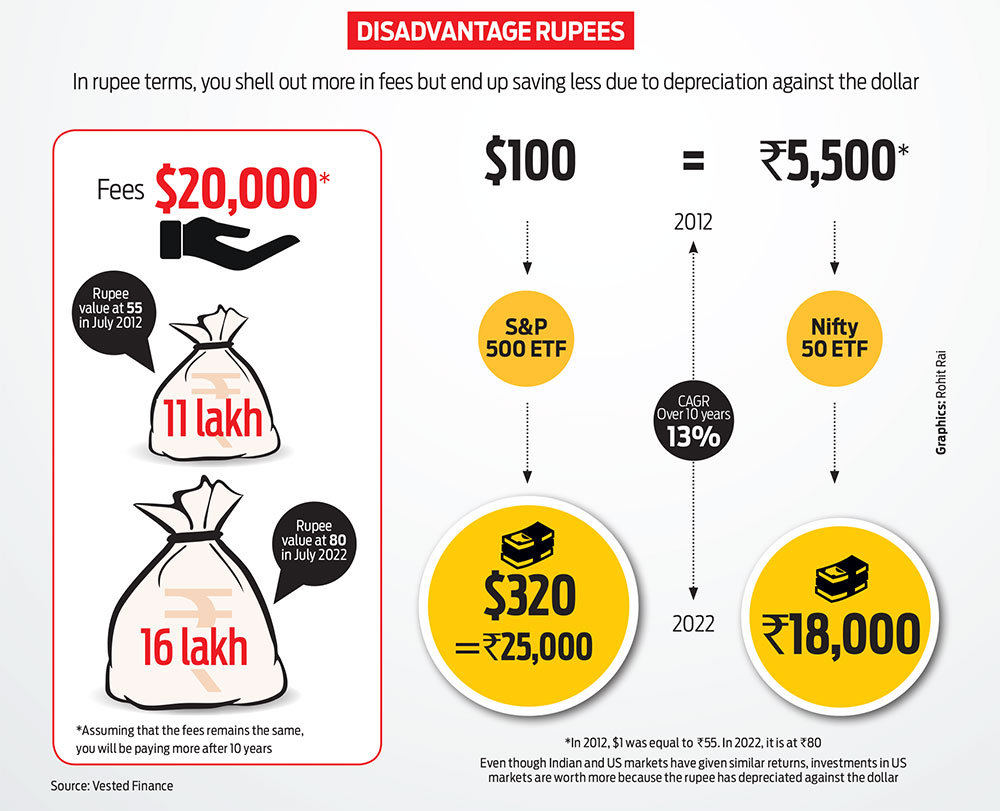

Here is an example of how the cost will go up. In July 2012, the rupee was about 55 against the dollar. Let us say that the tuition fees per year for an undergraduate course was $20,000 then. That would be about Rs 11 lakh (20,000 x 55). If the fees remain the same in 2022, this would amount to Rs 16 lakh, because the rupee is Rs 80 against the US dollar.

The difference is Rs 5 lakh more over a decade. If you factor in inflation, the cost will go up even further. Hence, when saving for education abroad, apart from inflation, one also needs to factor in the depreciating rupee.

How Global Investments Can Help

Children’s education is among the major financial goals for most parents. While one can always take an education loan, it nevertheless makes sense to regularly invest and create a corpus for higher education needs of children.

Anuj Munot, 45

He has been investing in dollar-denominated instruments as he plans to send his children for higher studies abroad

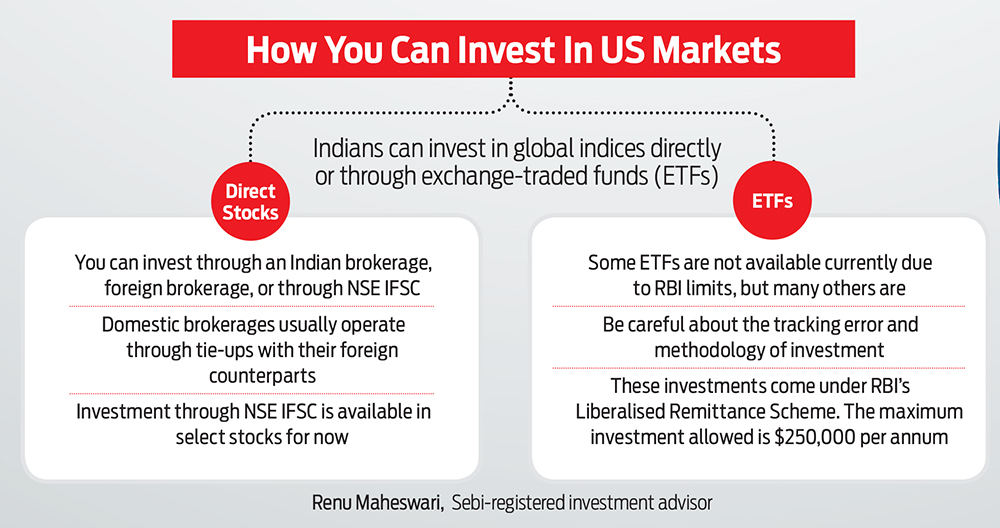

To offset the effect of rupee depreciation, one strategy that can help parents is investing in the global markets. While you can invest in markets such as China, Japan and the UK for overall diversification of the portfolio, the US is still the most significant market for Indian investors, and the dollar is still the strongest currency in the world, at least for now.

Says Renu Maheswari, a Securities and Exchange Board of India (Sebi)-registered investment advisor and chief executive officer and principal advisor, Finzscholarz Wealth Manager: “Investing in the US market is a good strategy for education overseas and for goals for which you need dollars. This provides a good hedge against rupee depreciation and inflation in the destination country. Also, the inflation rate for higher education is usually more than the core inflation rate in most countries.”

When you invest in dollars, you also withdraw in dollars or the dollar equivalent. “Investing in dollar-denominated securities can hedge Indians against the falling rupee. We feel it’s a good opportunity to invest in the US market after the current meltdown, especially from the perspective of diversification and for the foreign education of child,” says Neeraj Chauhan, certified financial planner (CFP) and CEO of The Financial Mall, a financial planning firm.

Here’s an example on how this can benefit you. Let’s say you had invested $100 in Nifty 50 and S&P 500 exchange-traded funds (ETFs) 10 years ago. Over this period, both the Nifty 500 and S&P 500 have delivered around 13 per cent annual returns each. In July 2012, the rupee was approximately 55 against the dollar. This means that your initial investment of $100 or Rs 5,500 in a Nifty 500 ETF would be equal to around Rs 18,000 now. However, your investment of $100 in an S&P 500 ETF would be worth around $320, which would be about Rs 25,000 now.

“This essentially means that though the Indian and the US markets have given comparable returns over the period, your investment in the US markets is worth more because the rupee has depreciated against the dollar,” adds Chauhan.

What Should You Do?

Maheswari says that it is important to invest in instruments that you understand and can track. Global investments can be affected by factors that are not domestic and that may be difficult to track for you.

“Investors should compare the intermediary charges while choosing this option. Also, they should have enough skills to pick the right stock at the right prices,” says Maheshwari.

Restricting exposure to a certain extent, according to your needs can help. “Invest 10-15 per cent of your equity portfolio from a diversification perspective. You could also invest in accordance to the corpus required to fund the overseas education of your child,” says Chauhan.

There are many ways in which you can build a sizeable corpus to fund your child’s foreign education goals, but global investing, especially in dollar-denominated instruments, is one way to make the rupee depreciation work to your advantage.

meghna@outlookindia.com