The common understanding about small-cap stocks is that most of them are available at throwaway prices and have huge potential for growth. But that’s not always true.

Some of these stocks are indeed available at cheap valuations, and that’s mostly because they are not much in demand, given that they are under-researched. While this opens up the possibility of price discovery and, thereby, an upside in the future, it also exposes the investors to risks, such as liquidity, non-discovery of the stock for a long period, or worse, failure of the company, owing to internal challenges, such as lack of funding or management, and leadership issues.

When Safir Anand, a Delhi-based intellectual property lawyer, business strategist, and investor, started his investing journey many years ago, he wanted to buy what was cheap. “The reasons were many. I could not afford the big stocks. I would look at small caps with a lower price-to-earnings ratio (P-E) and think that the P-E of the industry leaders were skewed and would be re-rated, and so on. The result was that I ended up with many duds across sectors, and the small capital I had disappeared into thin air. Over time, I learned many lessons.”

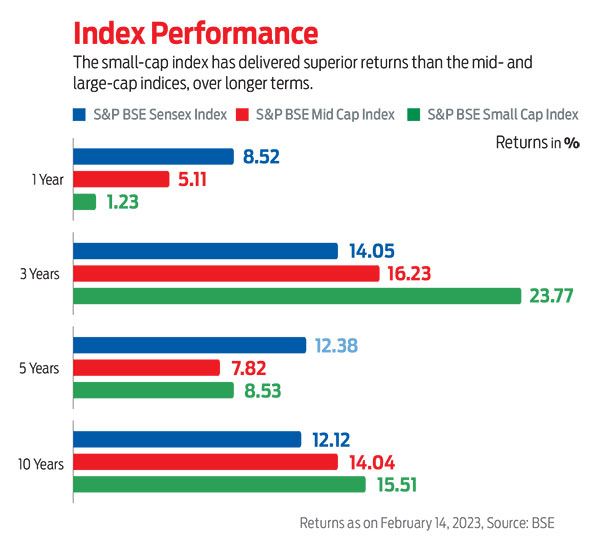

Investment in small caps is not necessarily bad, and several small-cap stocks have turned into multi-baggers in the past. However, since the small-cap universe is unlimited, it requires meticulous research, an eye for detail, and perhaps a little luck to pick out the jewels from the heap.

Both Sides Of The Coin

Some small-cap stocks on the Nifty Smallcap 250 Index have become multi-baggers over 10-15 years, while some have ended up eroding people’s investments.

Let’s take a look at few of the winners. Balaji Amines Ltd was worth Rs 33.57 per share on January 4, 2010; 13 years later, on February 13, 2023, it was at Rs 2,185.45, registering a compounded annualised growth rate (CAGR) of 6,410.13 per cent. Similarly, KEI Industries Ltd rose 4,794.44 per cent from Rs 33.30 to Rs 1,629.85 over the same period, and Granules India Ltd grew 3,044.19 per cent from Rs 9.09 to Rs 285.65, according to data from Ace Equity NXT, which provides financial data of listed and private companies.

But there have been several losers in the small-cap segment, too, even in the long term. In the same period cited above, Mangalore Refinery and Petrochemicals Ltd fell 32.49 per cent, from Rs 79.40 per share to Rs 53.60 apiece, while NLC India Ltd fell 50.59 per cent to Rs 79.35 from Rs 160.60.

Widening Opportunities

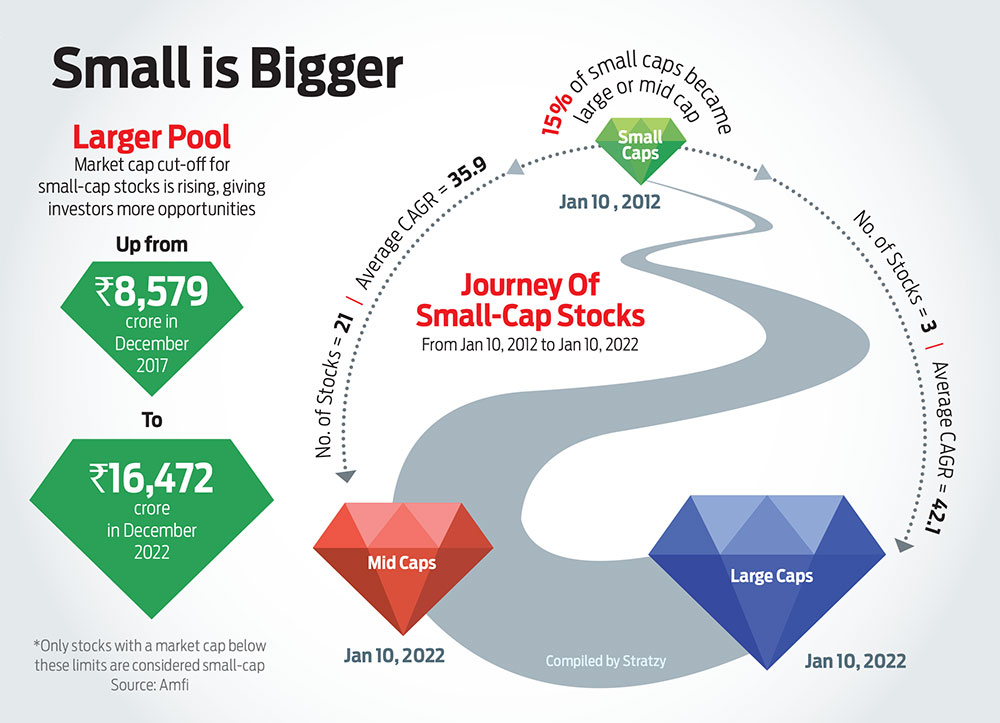

With the small-cap universe expanding and accommodating several larger companies than before, investors have more opportunities in the space now. Sample this: the market capitalisation cut-off for small-cap stocks is up from Rs 8,579 crore in December 2017 to Rs 16,472 crore in December 2022, according to data from the Association of Mutual Funds in India (Amfi). What this means is that the large- and mid-cap categories, which comprise relatively more stable companies, are pushing out companies that are, now occupying the top layer of the small-cap pie.

There is reverse movement, too. Between January 10, 2012, and January 10, 2022, three stocks on the Nifty Smallcap 250 Index became large-caps, 21 moved to the mid-cap segment, 72 stayed in the same segment, and 64 fell into the micro category, according to data from Stratzy, a Sebi-registered financial advisor and an AI-powered strategy trading app.

“About 15-17 per cent of the stocks have seen upward migration. In the past decade, 17 per cent of the stocks migrated from mid- to large-cap, and 15 per cent from small- to mid- and large-cap,” says Prashant Barwaliya, head of investments, Stratzy.

The three small-cap stocks to become large-caps were Cholamandalam Investment and Finance Company Ltd (CHOLAFIN), SRF Ltd (SRF), and PI Industries Ltd (PIIND), with current market valuations of Rs 54,712.03 crore, Rs 64,914.05 crore, and Rs 49,384.28 crore, respectively, as on January 10, 2022.

Those that became mid-cap were Supreme Industries Ltd (SUPREMEIND), Escorts Kubota Ltd (ESCORTS), Sundram Fasteners Ltd (SUNDRMFAST), and Kajaria Ceramics Ltd (KAJARIACER), with market caps of Rs 30,602.7 crore, Rs 28,069 crore, Rs 20,582.11 crore, and Rs 18,182.79 crore, respectively. Elsewhere, GLT Infrastructure Ltd (GTLINFRA), Strides Pharma Science Ltd (STAR), and Chennai Petrochemical Corporation Ltd (CHENNPETRO), fell into the micro segment, as data from Stratzy shows.

Data shows that 23 companies on the Nifty 100 index were new listings, those that were not on the exchange 10 years back, and the remaining 77 companies, generated 19.4 per cent returns. Of the 77 stocks, three migrated from small- to large-cap, delivering average returns of 42.1 per cent. Another 20 migrated from mid- to large-cap with average returns of 27.7 per cent, while 56 per cent of the stocks maintained their large-cap status at 15 per cent CAGR during the period.

Ajay Bagga, executive chairman, OPC Asset Solutions, says: “It’s a journey from an unknown species to the coveted one. Small-caps offer the advantage of multi-bagger, high growth potential—largely not covered by sell-side analysts. So, it takes a lot of primary research to study small-caps. They tend to offer the highest returns across market cycles.”

How Should You Choose?

The small-cap universe has become larger over the years, but not all of the stocks are winners. So, it is vital to study them closely.

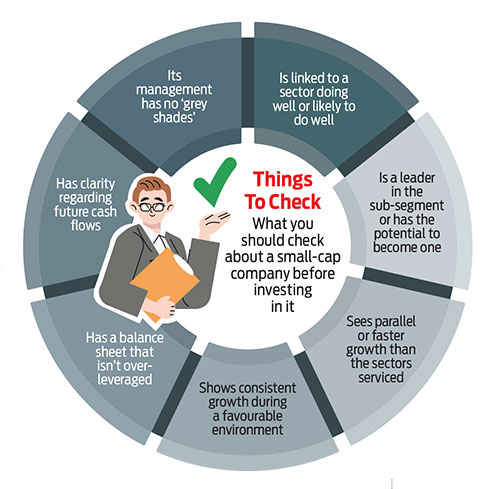

Says Ambareesh Baliga, an independent director on the board of Pantomath Capital Advisors Pvt. Ltd., and a strategic corporate advisor: “There is no single method to pick a small-cap stock. However, the broad guidelines I follow to identify a prospective candidate are that it should be connected to a sector doing well or expected to do well. Typically, the small-cap stock is from an ancillary to a larger sector, since the leaders in that sector would, anyway, be large caps.”

In addition, check if the company is a leader in the sub-segment, or, it has the potential to be one. It should see parallel or faster growth than the sectors it services and good growth in favourable conditions.

Since liquidity is a key concern for small caps, Baliga says: “The balance sheet should not be over-leveraged. If so, there should be clarity in terms of future cash flows, which can improve the debt-equity ratio.” In the event of a slump, they could face a fatal blow because of their precarious liquidity position. Says Deven Choksey, managing director, KR Choksey Pvt. Ltd: “Small caps always face a challenge in terms of liquidity. The lower the liquidity, the higher the propensity for a rally, and faster the chances of a fall in prices. This is a key element of small caps, and that is where they are manipulated in the market.”

Management issues are also important. Says Baliga: “We try to determine the ‘shades of grey’ in the management. It is important to verify our findings from the management, and communication, too, is watched with suspicion.”

Anand has come a long way from his early days in the stock market. He says: “Rather than looking at a company as cheap or small, one should look for qualitative factors. How skilled the management is, what difference is the company making, and how committed is it to making this difference either by equity, competence, or tie-ups? How does it allocate the limited capital it has to grow? And when it grows, does it belong to a sector with immense opportunity, so that even if it goes off track, it can again bounce back?”

Besides the management’s competence, strength, and scalability of the business model, one should also check if it’s supported by institutional or ultra high networth investors (HNIs). Meeting the vendors, customers, and competitors helps in the decision making, says Bagga.

Small caps’ liquidity situation improves quickly if the market-making activities start. Says Anand: “Small caps gave me a lot of returns since I started redefining my search matrix. They are subject to a larger patience and conviction test than known companies. The homework here is more yours than that of the institutions or rating agencies.”

It is also important to assess their performance regularly. “The pursuit of ‘small is beautiful’ to ‘small becoming big’ needs constant evaluation, and where you get a sting, start fact checks and be more agile. Diversification reduces chances of a mess-up,” adds Anand.

One should never get stuck with a company forever. It is good enough to stay attached to one as long as its growth trajectory remains high, possibly moving from a small- to mid- to the large-cap segment. A key differentiator is whether the company is widely accepted by investors, which creates natural demand, improved perception, and stock valuation, says Baliga.

Small caps give the advantage of catching the opportunity early and becoming a part of their growth story. Also, there is hope and optimism in the knowledge that large caps were once small caps. But there’s more than meets the eye, so look closely before dipping your feet in this large pool.

sanjeeb@outlookindia.com