The Indian equity market has been highly volatile since November 2021 due to selling pressure from foreign portfolio investors. After a sharp rally, the markets across the globe started tumbling when the US central bank, the Federal Reserve, indicated in December 2021 that it would start withdrawing measures it had extended during the pandemic.

The volatility intensified after the Fed announced the first hike in the benchmark interest rate by 0.25 per cent in March 2022. Russia’s invasion of Ukraine around the same time added fuel to the fire and the global markets reacted sharply, leading to an unprecedented price volatility. The Indian markets followed suit.

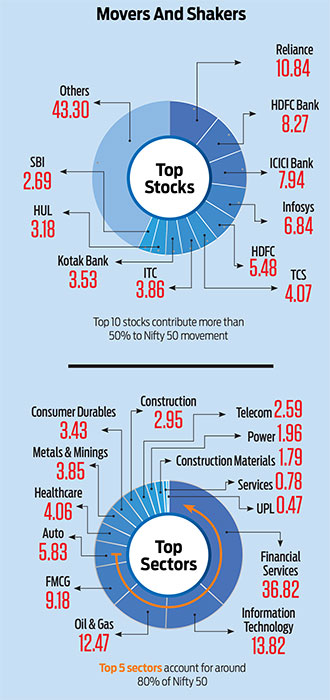

With such vulnerability witnessed in the past one year, we dissected the two major indices in the Indian market—NSE Nifty 50 and S&P BSE Sensex—to see which sectors and stocks are pulling them up or down.

The Index

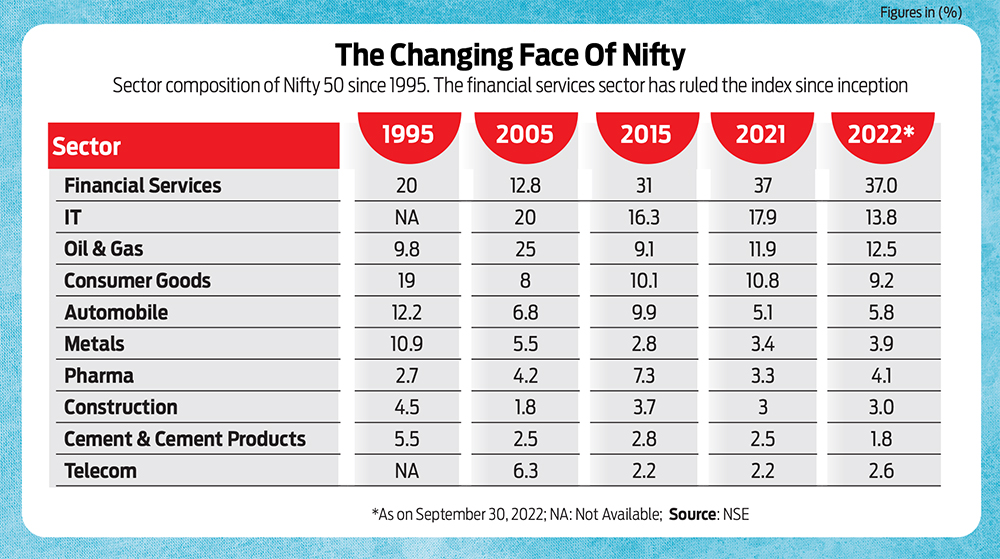

Before we delve deeper into the numbers, let us understand the composition of the Nifty and Sensex. The Nifty index represents about 66.8 per cent of the free float market capitalisation of the stocks listed on the National Stock Exchange (NSE), while Sensex covers over 40 per cent of the total market cap of the Bombay Stock Exchange’s (BSE) listed universe. These two indices measure the performance of the largest, most liquid and financially sound companies across key sectors of the Indian economy.

Besides these two broad market indices, India has market-cap-based indices, sector-based indices, etc. Stock indices, a hypothetical portfolio of securities, are a performance barometer of not just the stocks of a specific segment but also the economy.

Market Momentum

We looked at one-year data as on October 17, 2022. The Indian stock market suffered less during this period, compared to other global markets despite headwinds and an uncertain interest rate scenario internationally in the face of rising inflation. In this backdrop, we thought it’s pertinent to look at the stocks that helped maintain the upward momentum in the market, and the ones that dragged it down.

A deeper look at the numbers threw up some interesting results. The Nifty 50 is down by 4.81 per cent in the last one year, but 20 out of the total 50 stocks traded in the positive territory.

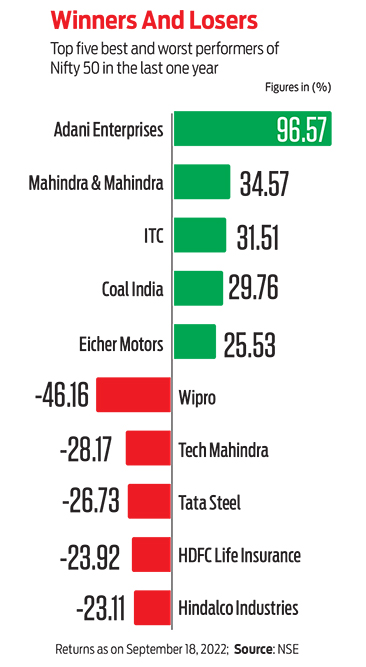

The difference between the best and worst performers, though, is huge—133 per cent. The newly added Adani Enterprises Ltd from the metal and mining sector is up by whopping 96 per cent and information technology (IT) stock Wipro Ltd is down by about 46 per cent. Domestic auto major Mahindra and Mahindra Ltd is at number two position among the best performers, with more than 34 per cent returns (see Winners And Losers).

The results are similar for the Sensex, but there is no vast difference between the best and worst performers, as Adani Enterprises is not a part of the exchange. The best performer on Sensex is Mahindra & Mahindra, and the worst performer is again Wipro.

We also broadened the scope of our research to cover a larger universe of stocks. For that, we considered Nifty 500, which is down 4.72 per cent, but has 187 stocks trading in the positive territory. Here, the difference between the best and worst performers is a steep 264 per cent. The best performer is debt-laden Shoppers Stop Ltd, leapfrogging 186 per cent, and the worst performer is Dhani Services Ltd, with -78 per cent. The broader the index, the wider is the deviation in returns, typically.

How Efficient Are The Indices?

The underperformance of a substantial number of active mutual funds compared to the indices’ performance shows the latter are highly efficient.

According to a report released on October 12, 2022, by S&P Dow Jones Indices, the world’s leading resource for indices and benchmarks, 90.91 per cent of Indian equity large-cap funds underperformed their benchmark index in the one-year period ending June 2022. In the same period, 27.45 per cent of Indian mid- and small-cap, and 75.61 per cent of Indian equity-linked savings schemes (ELSS) underperformed their respective benchmarks.

Fund managers who picked the right stocks and aligned their portfolios according to the changing market dynamics managed to outperform their respective indices. By the end of 2022, when the market started tumbling in anticipation of a rate hike, many mid- and small-cap funds aligned their portfolios to big names and that worked in their favour.

“Although the Indian mid-cap benchmark had its worst first half since 2013, active managers in the category had a great start to the year, with an underperformance rate of just 35.3 per cent, possibly benefiting by exposure to a few larger names in their portfolios,” says Benedek Voros, director, index investment strategy, S&P Dow Jones Indices.

This clearly shows two things. One, many fund managers failed to pick the gems. Two, the churning of stock constituents by the indices to weed out the laggards according to the market scenario has helped.

Typically, all the major indices review their constituents semi-annually in June and December. During the review, they replace the stragglers with the outperformers as per their internal procedure. “The exercise of reconstitution review does not necessarily mean replacement of stocks in the indices but to make the index more efficient by replacing inefficient scrips with highly efficient scrips,” says Abhilash Pagaria, head of alternative and quantitative research at Edelweiss Financial Services Ltd.

For example, recently, Adani Enterprises replaced Shree Cement Ltd in Nifty 50. Shree Cement has delivered -25 per cent in the last one year, while the new entrant has given 96 per cent returns. Historically, over 70 per cent of the Nifty 50 constituents have been replaced and only 12 stocks since inception are still a part of it.

The Way Forward

Despite global headwinds, the Indian markets have outperformed their global peers in achieving the upside and containing the downside, which has made experts bullish. “Global headwinds are an opportunity for India, and we see immense opportunities in the Indian market. On one side, India is going to be a global manufacturing hub as countries are looking outside China for a reliable partner, on the other, domestic investors are reposing faith in the growth of the economy, which is an added advantage,” says Anand Rathi, chairman, Anand Rathi Wealth, a financial services firm.

The way domestic investors provided the cushion when foreign institutional investors (FIIs) exited the country is a positive sign for the Indian stock market, he adds.

After two years of subdued festivities under the shadow of Covid, India is celebrating festivals with full fervour this year, creating higher demand across consumer segments.

The auto industry is a case in point. It expects October 2022 demand to be strong on the back of festive demand, after clocking robust numbers in September. As per data released by the Society of Indian Automobile Manufacturers (SIAM), the overall auto sales (wholesale) increased by 21 per cent year-on-year (y-o-y) in September 2022. The passenger vehicle segment grew 91.8 per cent y-o-y, although two-wheelers saw muted rural demand and logged a mere 12.8 per cent y-o-y growth. Three-wheelers, however, showed strong growth of 73.4 per cent y-o-y.

The fast-moving consumer goods (FMCG) segment is also witnessing high consumer demand. “Going forward, double-digit earnings growth (25.7 per cent compounded annual growth rate or CAGR) for the index over FY21-23E will be led by the auto space (low base), capital goods domain, metals space (firm product realisations and healthy profitability) and index-heavy BFSI (banking, financial services and insurance) space, which also includes the insurance sector,” writes ICICI Securities Ltd. (I-Sec), a subsidiary of ICICI Bank Ltd., in its report.

All this bodes well for the investors. If you are not comfortable cherry-picking quality stocks on your own, you may hug the index for efficient returns in the long term. Alternatively, you may rely on an efficient mutual fund with the help of a financial advisor

kundan@outlookindia.com