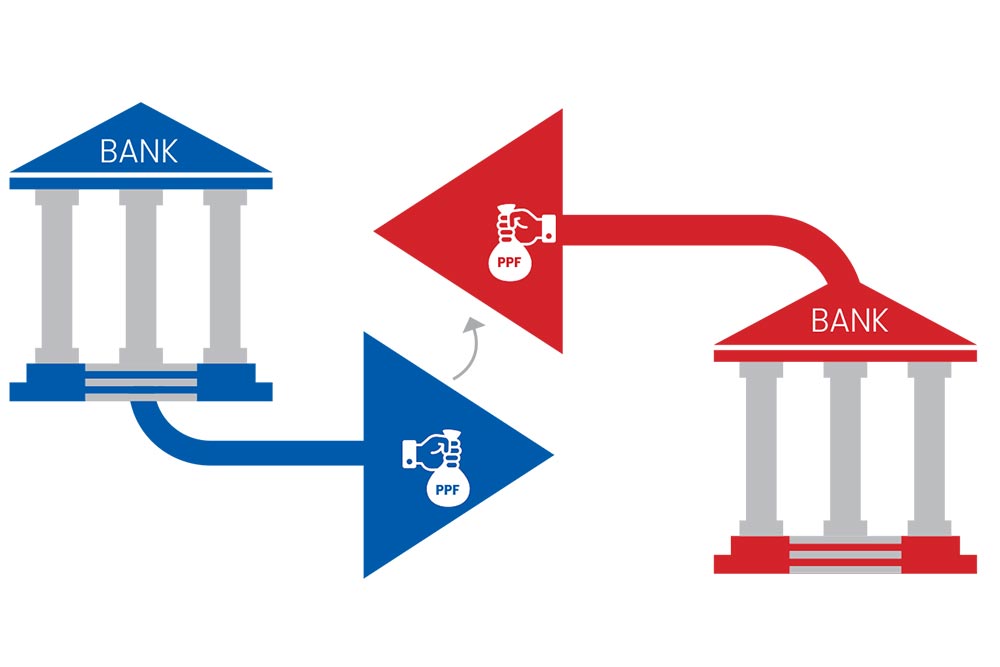

During the course of our working years, we often end up having multiple accounts across several banks. For instance, one may have a salary account in one bank, a Public Provident Fund (PPF) account in another and an inherited fixed deposit account in a third.

For the retired, it could become difficult to manage several accounts across different banks. To keep it simple, they may choose to keep all the accounts in a single bank for ease of operation. For instance, they may also want to transfer their PPF account to the bank in which they prefer to retain their savings and other accounts.

Even individuals who move cities may need to transfer their PPF accounts as not all services can be availed of online. For instance, you may have to visit the bank’s home branch for services such as partial withdrawal, change in know your customer (KYC) requests and so on. However, depositing or transferring money to the PPF account can be done online.

We give a step-by-step guide on how to transfer a PPF account from one bank to another.

What Is PPF?

PPF is an investment instrument that offers a guaranteed return. It enjoys the exempt-exempt-exempt (EEE) tax status, which means that you get a tax benefit at the time of investment, and there’s no tax incidence on the accrual amount or the final withdrawal amount at maturity.

PPF account comes with a lock-in period of 15 years, which can be extended further by a block of five years as many times as you want.

However, it allows partial withdrawal before maturity and even offers a loan facility, subject to terms and conditions.These and other benefits make PPF a sought-after option in the fixed-income category. Currently, it is offering a rate of interest of 7.1 per cent annually. The rate is announced quarterly.

Step-By-Step Process

1. Visit the bank’s branch or the post office where you maintain the PPF account and ask for the account transfer request form

2. Fill in details of your PPF account and that of the new bank, including name, and address of the branch where you want to transfer

3. Submit the transfer request form to the bank where you are maintaing the account. The new bank (where the account is to be transferred) may also initiate the process

4. Take the acknowledgement receipt to keep a record

5. The bank or post office, where you have the PPF account will verify the details and initiate the transfer process

6. It will send a certified copy of the PPF account, account opening application form, passbook, nomination form, specimen signature of the accountholder and a cheque or demand draft for the outstanding amount to the new bank

7. Once checked, the new bank will notify the accoutholder

8. In case of change in KYC, the new bank may also ask the accountholder to fill up a new account opening form

9. The new bank will open a PPF account and transfer the balance in it

10. The entire process could take up to a month