Delhi-based Anish Kumar’s (name changed) existing employer offers him a comprehensive group health insurance plan that covers his family as well as his parents-in-law. “I got my in-laws included in the policy after my wife decided to leave her full-time job and started working as a freelancer. My parents are covered under the Central Government Health Scheme (CGHS). My in-laws were previously covered by the health insurance policy provided by my wife’s employer. Since they are diabetic, it’s very difficult to get a retail policy for them,” says Kumar.

The possibility of spending a fortune on healthcare has become real for many people, post Covid. Taking a group health insurance cover can be an effective solution for people looking to secure their health-related finances, as healthcare costs go through the roof.

While employers are not bound by law to offer health insurance to their employees, a lot of them, including start-ups, are now offering group cover to attract talent. Even insurtech firms, such as Policybazaar, Pazcare, Plum and Onsurity, are co-creating group insurance products for micro, small and medium enterprises (MSMEs), small and medium enterprises (SMEs), and start-ups.

Most of the group insurance products are quite flexible. Some of the key features include no waiting period for pre-existing diseases or critical illnesses, basic maternity cover, and no pre-medical tests before the policy issuance.

That said, a lot of employers still cover only individual employees, and do not offer consultation, wellness and other benefits with their policies.

Increasing Demand

Post Covid, more and more people are realising the importance of having a health cover, and are choosing an employer accordingly.

Abhishek Mahato, founding principal officer at Pazcare, an employee benefits and insurtech platform, has an interesting story to share in this regard. One of their clients (an employer) hired a candidate at a senior leadership position. Before joining, the candidate asked the human resources (HR) if the group health insurance covers parents. Her father needed dialysis every month, which cost her Rs 50,000 every time.

She discovered later that the HR had given her incorrect information and her parents were not covered. “It created a huge ruckus. She would have gone back to her previous organisation. The policy renewal was lined up next month, and the employer added parental cover not just for her, but for other employees as well,” says Mahato.

New-age employees don’t just want a health plan, but one that gives wider coverage. For instance, most want a plan that covers their families as well. “Of all the group health insurance policies sold since we launched our group insurance business in July 2021, two-thirds of customers have opted for individual cover, while the rest went for family floater plans,” says Raghuveer Malik, business head, corporate insurance at Policybazaar.

Having a cover for the in-laws, even at extra cost, was one of the key parameters that Kumar was looking at when considering new job offers.

Filling The Gaps

In urban India, 80.9 per cent Indians do not have any type of medical cover, according to data from the Ministry of Statistics and Programme Implementation published in July 2020 as part of the report, Health in India: National Sample Survey 75th Round (July 2017 to June 2018). Only 8.9 per cent have a government sponsored insurance scheme, while 3.3 per cent have a government or public sector undertaking (PSU) employer cover. Only 2.9 per cent urban Indians have a non-government (private) employee-sponsored health cover and only 3.8 per cent urban Indians have retail cover, the data revealed.

Numbers show many employers are yet to traverse that extra mile to provide security to their employees, though some are making efforts.

More than 50 per cent of Policybazaar clients offering employee-only coverage, moved to offering family plans this year. “It is happening because employees/job candidates ask for it,” says Malik.

In case of Plum, 45-50 per cent clients offer a full-fledged cover; 30 per cent cover the employee and immediate family (wife and children), and 20 per cent give an employees-only cover.

Says Ashish Kumar Singh, chief HR officer, Meesho, an online shopping website: “Proportionately, a large number of people have started asking for employee benefits rather than fussing over in-hand salary, especially insurance benefits. A lot of young employees would ask if elderly parents or in-laws are covered.”

Moreover, additional benefits, such as free health check-ups, doctor consultations, preventive healthcare, free eye check-up, discounted medicines, dental benefits, and mental treatment are other benefits some employers are offering.

On top of it, some employers are taking efforts at being inclusive. For example, Meesho is offering coverage to same-sex and live-in couples, and siblings under group insurance plans. They also cover in vitro fertilisation (IVF) treatment.

Onsurity says it has witnessed an increased demand for wellness benefits for working women, especially maternity and IVF treatment-focused plans. “Maternity care as an add-on benefit has been in popular demand, especially for SMEs, which have in the past struggled to retain working women. SMEs even with an employee base of less than 10 are going for it,” says Yogesh Agarwal, founder, Onsurity.

In some cases, intermediaries are stepping in to fill the gaps. “Our insurance partner Onsurity offers to add up to 10 members of family, as per the definition of family by insurers. Later on, if employees leave their job, they can convert their group insurance plan into a retail plan,” says Ketan Krishna, head of human resources at RentoMojo, a rental platform.

Plum also gives employees the option to buy top-up covers at extra cost, at the time of onboarding. For its own employees, Plum offers some uncommon benefits, including cover for infertility, sterility and surrogacy (within maternity limit), newborn coverage from the first day, cover for Ayurvedic treatments and others.

What Should You Do?

Know Your Policy: Though more employees have been demanding holistic covers, few look at the details at the time of onboarding. A case in point being the example that Mahato mentioned earlier. When one joins a new workplace, health insurance is usually part of the reams of paperwork that is thrust upon you. Chances are that you would only skim through the policy at the time of joining. It is only at the time of claim that you would look at the details.

“When we did our market research before launching Plum, we discovered that 60 per cent employees who had insurance didn’t know about it. This is the core problem that we wanted to solve,” says Abhishek Poddar, co-founder and CEO, Plum.

Some new-age insurance brokers are looking to bridge this awareness gap and have devised apps to interact with employees and list out the policy features. Some put out screensavers and pamphlets at the premises, while others conduct induction session for the employees, and follow it up with phone calls, SMEs and emails.

Have Individual Policy Too: Experts advise having an individual health cover, besides the one provided by the employer, to take care of the gaps in periods of job loss or when people are switching jobs. But group health covers are now being seen as the first layer of protection.

“Buy a product with the right features, one with no more than 2-3 year pre-existing disease exclusion, and no room rent caps. Make sure that these are individual retail products with life-long renewability and not retail products on group platforms that do not have guaranteed renewability,” says Kapil Mehta, co-founder, SecureNow, an insurance aggregator.

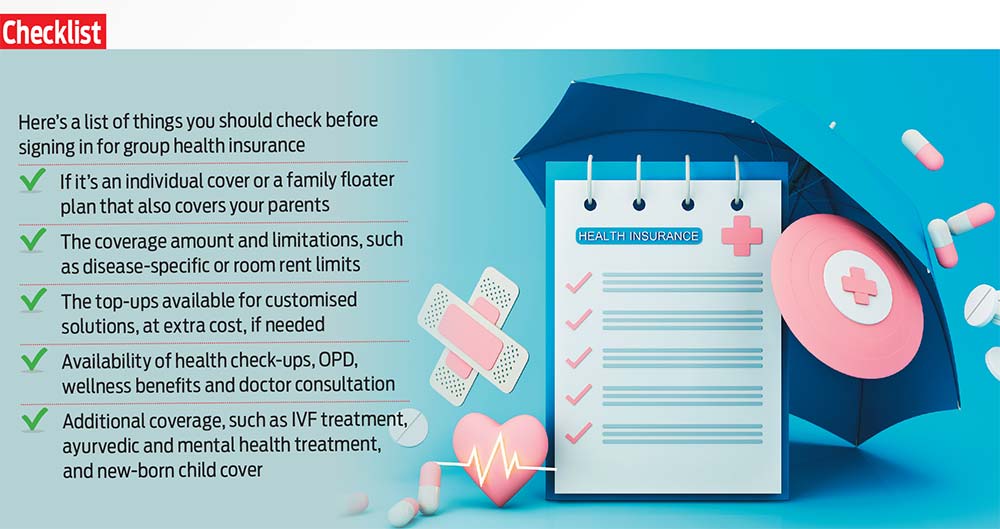

Ask Relevant Questions: If you have a group health insurance cover, don’t forget to ask the relevant questions--whether it is an individual or family cover, are there OPD and wellness benefits, is treatment for specific ailments available, are there any exclusions, among others.

Says Mehta: “Per se, group health plans are quite robust. The main issues are the hospitals, third-party administrators (TPAs), insurers and customers. For example, discharge from a hospital takes over five hours on an average. Similarly, reimbursement claims often require considerable paperwork to resolve.”

Still, a number of employers may not be providing the benefits that you seek. If you feel there are gaps, ask the employer or the insurer whether they can fill those at extra cost.

The author is a Financial Journalist