Of late, volatility has become one of the biggest worries for investors in risky instruments, such as equities and cryptocurrencies.

Among the most tracked global indices, the US S&P 500 index is down 11.69 per cent, Brazilian index BOVESPA has lost 24.81, and Hong Kong’s Hang Seng has lost 26.95 per cent in a year.

The Indian stock market, in comparison, has been resilient and is almost at the same level as last year, though it saw major volatility in the interim. The Sensex index, which closed at 53,140 points on July 16, 2021, is up 1.17 per cent at 53,760 on July 15, 2022. In the interim, the Sensex touched the historical high of 62,245 on October 19, 2021, and a low of 50,921 on June 17, 2022. In other words, the market went up 17.13 per cent between July 16, 2021, and October 19, 2021, but fell 18.19 per cent to touch a low on June 17, 2022.

Cryptocurrencies are also moving down with the market, but they have recorded far larger losses. Most cryptocurrencies, including Bitcoin and Ethereum, were down over 70 per cent from their peaks.

The erosion in portfolios is unnerving for investors, but volatility in equities is inevitable. “Volatility is part of the long-term investing journey. You can minimise it with better investment instruments and strategies, but you can’t weed it out completely,” says Umesh Mehta, CEO, Samco Mutual Fund.

Stock Portfolio Strategies

Equities and volatility go hand in hand but handling it right can help in minimising it.

Know When To Buy And Sell: It goes without saying that you should pick top-notch stocks, but if you end up reacting to the market movement, you won’t gain much. The best policy when you have quality stocks is to literally do nothing. Don’t get spooked by the volatility and sell at the wrong time.

Similarly, look for the right price when buying, and don’t get swayed by a rally. In 2008, ace investor Warren Buffett bought a large stake in oil company Conocophilips. At that time, oil prices were going through the roof at $100 per barrel. By 2009, crude oil price fell to around $30 per barrel and the shares of Conocophilips fell over 65 per cent.

Buffett made a multi-billion-dollar loss by selling the stock after the crash and acknowledged later in the annual report of his company Berksire Hathaway that he had bought the stock at the wrong price. “When there is a rally in the market, it is easy to get swept up in the rally and end up buying at the wrong price,” says Mehta. Avoid investing in a stock at a higher price out of excitement; rather look at its true potential.

Keep Your Portfolio Diversified: No stock or sector moves in only one direction. So, it’s better to have a diversified portfolio. Sanjay Nikam, 35, a Pune-based software professional, overloaded his portfolio with IT stocks post Covid, as contactless systems and digitisation became the buzzwords. “I invested all my savings into three IT stocks, and now my portfolio is down by over 36 per cent,” says Nikam.

To avoid such situations, you should avoid over exposure in a particular stock or sector, and invest in multiple stocks/sectors. For instance, to mitigate risk, the mutual fund (MF) industry does not allow schemes to hold over 10 per cent in a particular stock.

Overall Asset Allocation

It is important to make mindful decisions about your stock portfolio, but over exposure to equities will never enable you to ace the volatility game. Allocating your investments to different products can help you do so.

According to a report, Determinants of Portfolio Performance, published in the Financial Analyst Journal in 2005, asset allocation accounts for 91.50 per cent of portfolio success, followed by security selection (4.60 per cent) and market timing (1.80 per cent).

Illustrations: Saahil

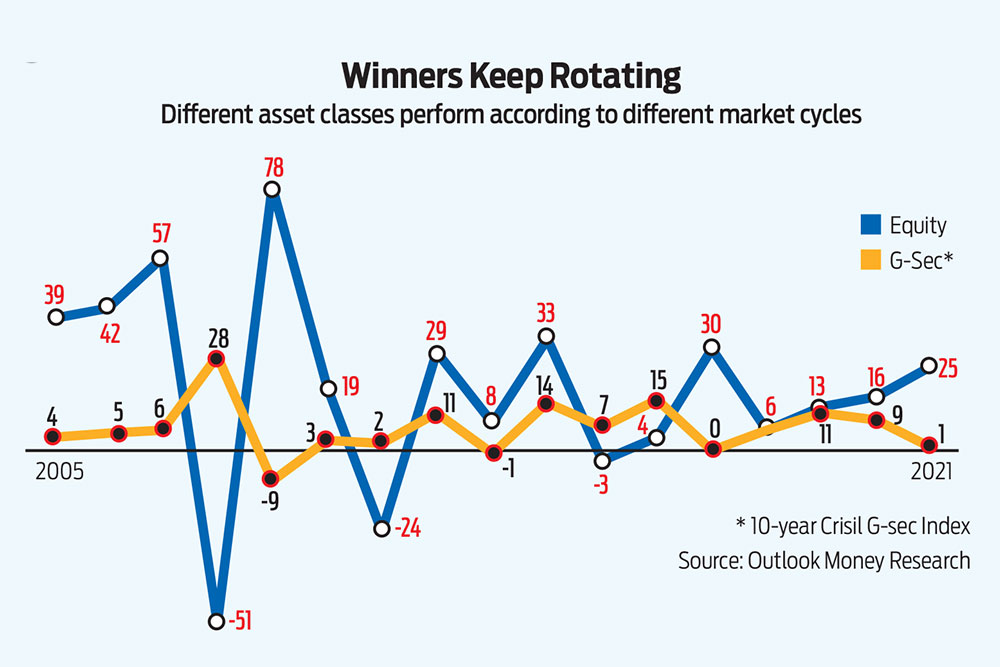

Asset allocation is important, because different asset classes perform differently in varying market conditions (see Winners Keep Rotating). For instance, during uncertainty in the markets, gold and silver typically, outperform equity. So, the loss in one asset, say, equities gets compensated by the gains in other assets, such as gold and debt instruments.

You can either do this independently by investing into different instruments or go with asset allocation funds, such as balanced advantage funds (BAFs). “They do dynamic asset allocation on behalf of investors in varied market conditions and help them ride market volatility,” says Chintan Haria, head of product development and strategy, ICICI Prudential Mutual Fund.

Once you are settled with broader or strategic allocation, and have understood how to handle it, you could look at tactical allocation, which if done right, can give a leg-up to your portfolio returns.

The objective of tactical asset allocation is to move among various asset classes within the boundaries of a well-charted range or framework to create an incremental source of return.

For instance, if your strategic asset allocation, you need to allocate 50 per cent of your portfolio to equities, but if you believe that a certain sector will do well, you can allocate a bit more, say another 10 per cent of the portfolio, to the sector to take advantage of the scenario.

Wrong moves, however, can erode your capital and even land you in debt.

***

Freedom From Laggards

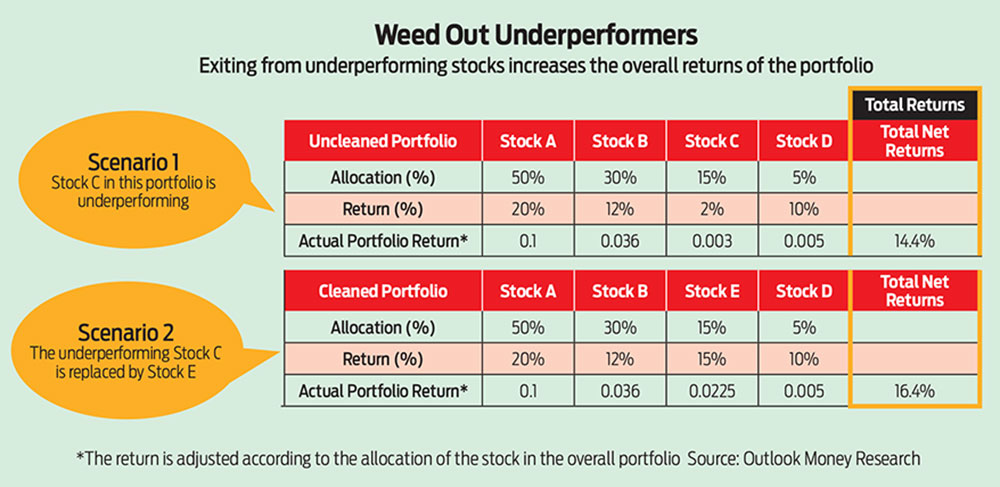

Market news, positive or negative, usually has a direct bearing on the performance of any stock. Underperformers can pull down the value of your portfolio, which is why spring-cleaning matters (see Weed Out Underperformers).

Before weeding out an underperformer, try and find out the reason. Look at whether the company itself is in trouble or is it an industry-wide phenomenon. “If a stock is not doing good and the industry (to which it belongs) is also not doing good, then it’s possible that the entire industry is going through a lean phase. In this scenario, it makes sense to hold on to the stock, especially if the industry is cyclical in nature,” says Vishal Wagh, research head, Bonanza Portfolio, a brokerage firm.

When it comes to equity mutual funds, it is difficult to predict whether last year’s market beating funds will continue their winning streak into the next year. Underperformance of a fund for a long period of time can be one of the triggers to sell it. Look at the fund’s performance on a relative basis (with benchmark and peers) and not only on an absolute basis. If the fund has underperformed the average of its peers and its benchmark for, say, four to six quarters, then it is better to exit the scheme.

kundan@outlookindia.com