But in this world, nothing is certain except death and taxes.” This quote by Benjamin Franklin, one of the Founding Fathers of the United States of America, holds true even today. If you are earning an income, you can’t escape paying taxes, after you have crossed a certain threshold.

Literally, there is no freedom from taxes, but minimising it and getting a handle on it so that you don’t get stuck in reams of paperwork and complexities of calculations, could provide some semblance of freedom.

“Tax is unavoidable. Hence, we have to take it as part and parcel of financial planning. If you’ve planned your taxes properly, you won’t feel the stress. The idea is to incorporate tax planning as a part of your bigger financial life goal, so that you do not feel stressed about tax,” says Kalpesh Ashar, certified financial planner and a Sebi-registered investment advisor,

In an ideal world, a simpler tax system would be the answer. “Freedom from tax is a notion that a taxpayer should have a simpler tax system, which reduces not only the cost of compliance, but reduces the uncertainties or convolutions regarding tax payments. Tax uncertainties, litigation, or multiple interpretation of law leads to tax worries. Therefore, a simpler tax system with less compliance and least uncertainties, that creates an innocuous environment, would be freedom from tax,” says Anita Basrur, partner, direct tax, at tax firm Sudit K Parekh & Co.

Zero Tax Is Possible For Some

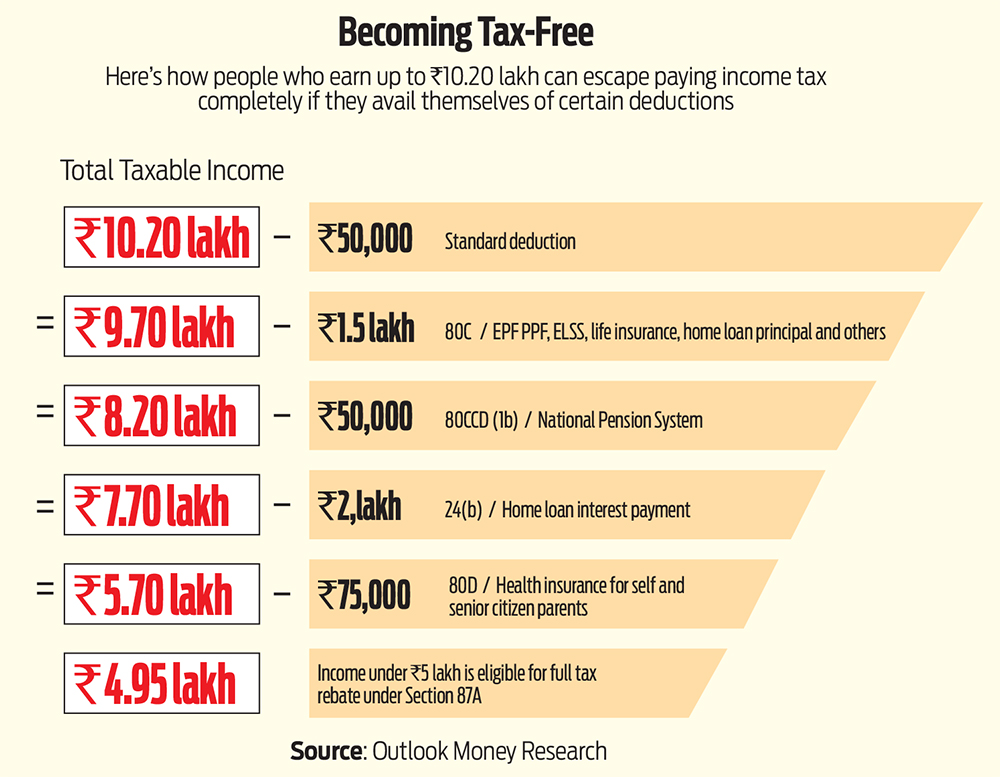

For people who earn above a certain income threshold, there is no escape from paying taxes, but for those below that, it’s possible. If you are thinking we are talking about the tax slab of less than Rs 5 lakh, until which no tax is applicable, the answer is no. People with income around Rs 10 lakh can avoid paying taxes, provided they avail themselves of most of the deductions available under the Income-tax Act, 1961.

Archit Gupta, founder and CEO, Cleartax, a tax portal, explains how. Say, you earn an annual income of Rs 10 lakh and an interest income of Rs 20,000 per year. According to the standard tax deduction rule, your taxable income will reduce to Rs 9.7 lakh.

You can further reduce the taxable income by Rs 2 lakh when you make tax-saving investments under Section 80C (deduction of Rs 1.5 lakh) and Section 80 CCD (1b) (additional deduction of Rs 50,000 on investment in the National Pension System).

If you have a home loan, your taxable income will reduce further—Rs 2 lakh on interest payment under Section 24(b).

If you have medical insurance for yourself and your family, the amount will reduce further by Rs 25,000. Additionally, you can claim an amount of Rs 50,000 if you buy medical insurance for senior citizen parents.

At the end of it, your taxable income will reduce to Rs 4.95 lakh. Once the income is below Rs 5 lakh, you are eligible for a full tax rebate under Section 87A (see Becoming Tax-Free).

If you avail yourself of other deductions, such as Section 80E for education loans or Section 80G for donations, you will be able to further reduce your taxable income. Thus, those with a salary slightly higher than Rs 10 lakh could also save themselves from paying taxes.

Choosing The New Tax Regime

While there is no freedom from paying taxes under the new tax regime, the fact that there are no deductions and exemptions allowed under it can free you up from collecting your proof of investments and other details while filing taxes.

“The new tax regime is different from the old tax regime in two ways. First, it has more slabs with lower tax rates, and second, all the exemptions that were previously available to taxpayers will be unavailable if they’ve chosen the new tax regime. Hence, if the advantage of lower rates in the new tax regime outruns the benefit of the exemptions and deductions available under the old tax regime, the taxpayer can then choose the new tax regime,” says Gupta.

If you are choosing the new tax regime, remember that you need to be more careful about your long-term financial planning, as there will be no incentive left to save and invest.

Minimising Tax

For those who cannot escape paying taxes, they have no other option but to plan their tax-saving investments well, but in a way that fits into their financial plan.

Keep In Mind The Tax Incidence On Switching Investments: “It is seen that 44 per cent of early career taxpayers pay heavy taxes mainly due to lack of understanding, including the tax impact at the time of selling an asset,” says Suneel Dasari, founder, and CEO at EZTax.in, an online income tax portal. Switching in and out of investments can increase your tax liability. For instance, equity redemptions attract taxation, and so do crypto investments.

Sync Your Long-Term Investments To Tax Liability: When you are younger, you need to sync your long-term investments with your tax liability.

Says B.M. Singh, ESOP expert and managing partner, BMSA, a consultancy firm that specialises in tax planning and financial management for start-ups: “This is because the effectiveness of compounding is evident only when you start investing during the formative years of your career. Statistics have underscored how investing more during the later years does not show the same effect as investing early.”

An efficient way to do that is to invest in equity-linked savings schemes (ELSS) that help you save tax up to Rs 1.5 lakh under Section 80C of the Income-tax Act, 1961.

Consider Your Fixed Expenses And Investments: If your investments in Employees’ Provident Fund (EPF) and life insurance, and expenses on home loan principal and children’s tuition fees together cover the Rs 1.5 lakh limit under Section 80C, you are sorted on the tax-saving front broadly. If you are one among them, you should simply focus on your financial goals instead.

Look At Your Needs: Keeping your overall portfolio in focus is pertinent. In case you have short-term goals, such as funding an education loan or providing a regular income in your retirement, your tax-saving investments should be in sync with your needs.

When nearing retirement, you could save on tax by investing in schemes specifically designed for senior citizens, such as Senior Citizen Savings Scheme (SCSS) and five-year tax-saving fixed deposits (FDs).

meghna@outlookindia.com