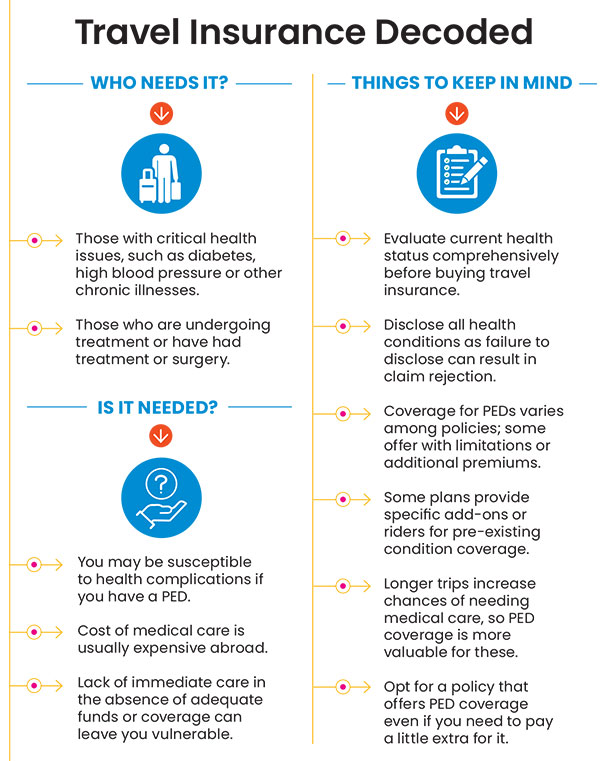

Though health insurance is usually a part of a travel policy, check if it covers pre-existing diseases or not, as medical costs in some foreign destinations can be inhibiting

Once you have made a budget and zeroed in on an international destination that fits into it, that’s not all the job done. Going on a vacation abroad doesn’t just involve having adequate money and ensuring timely bookings, but it is also about planning carefully and protecting yourself against risks. You wouldn’t want any setback to leave you and your family in a logjam abroad.

While it is mandatory to buy travel insurance if you are flying to certain countries, not all of them have that requirement. But it is crucial to buy travel insurance when you are going abroad, as it provides coverage for unforeseen events, such as trip cancellations, lost luggage, medical emergencies, and others.

Some airlines and aggregators have tie-ups with various insurers to provide travel insurance. Typically, most people tend to buy them, while some compare quotes from different insurers in order to buy the cheapest policy. But that may not be right, especially when you are travelling to a foreign land. Besides the cost, it’s also important to assess and check the features that the policy offers, especially related to health issues.

In most foreign countries, especially in the US, the cost of medical care can be exorbitant. Travel insurance can ensure access to quality healthcare without burdening you financially, but only if you know all the terms and conditions. Thus, it is advisable to do your research beforehand and not buy a policy at the last minute. Buying travel insurance in haste can be a costly mistake.

When it comes to the health insurance component, one of the major factors to check are the rules around pre-existing diseases (PEDs). Says Brijesh Unnithan, senior vice president, embedded insurance, Acko General Insurance, “Travel insurance that covers pre-existing conditions can be crucial if one anticipates the likelihood of medical care related to their existing health issues while abroad.”

We give you answers to some frequently asked questions about PEDs to help you make the right decision when buying a travel cover.

What Are PEDs?

PEDs in travel insurance refer to health issues or illnesses that a person has before obtaining an insurance policy.

Says Santosh Puri, senior vice president, health product and processes, Tata AIG General Insurance: “It encompasses chronic illnesses, past surgeries, ongoing treatments, or any other health conditions for which the insured individual has been diagnosed or has received medical care. It also includes any condition diagnosed or treated within 48 months prior to the policy’s effective date.”

Some of the common PEDs are diabetes and high blood pressure.

Does Travel Insurance Cover PEDs?

Coverage for PEDs varies as per the policy you choose. “Some policies may exclude coverage for pre-existing conditions, while others might offer coverage with certain limitations or on payment of additional premium,” says Girish Nayak, chief, technology and health, underwriting and claims, ICICI Lombard General Insurance.

Insurers might offer coverage for PEDs under specific conditions. For instance, they could stipulate that the policy is bought within a designated period after the initial trip deposit. This will prevent the insured from waiting until a medical issue arises before seeking coverage. Insurers might also consider covering PEDs if the condition has remained stable for a specific duration.

Certain travel insurance plans might also provide the buyers with a choice to buy an additional add-on or rider that is specifically designed for PED coverage. This option will allow individuals with such conditions to acquire extra coverage customised to their specific requirements.

In Which Situations Do PED Covers Work?

Manas Kapoor, business head - travel insurance, Policybazaar.com says that with a steep rise in PEDs across all age groups, many travel insurance products cover pre-existing medical conditions. “It typically covers life-threatening situations, which could strike during travel to any foreign destination. This means that coverage for PEDs is applicable when a pre-existing condition leads to a critical health issue endangering the policyholder's life,” he says.

For instance, if someone with Parkinson’s disease has a fall resulting in a critical situation requiring immediate hospitalisation and surgery to mitigate the life-threatening risk, the PED coverage will come into effect.

Is It Necessary To Disclose Them?

Disclosing PEDs to the insurer when purchasing travel insurance is crucial. It allows the insurer to accurately assess the risk, determine the appropriate coverage and premiums, and provide the best possible coverage to the individual.

So, before buying your travel insurance, comprehensively evaluate your current health status. Says Kapoor: “If you have ongoing medical conditions that require regular medication, treatment, or which might lead to life-threatening situations, or if you have any history of surgeries, having a PED coverage would be prudent.”

It is advisable to disclose all health conditions to your insurer rather than pondering whether a specific condition qualifies as a PED or not. Doing this will ensure transparent coverage that is best aligned to your health needs and will also reduce the risk of coverage gaps.

“If an individual misses out on declaring PED, their claim may be rejected if they need any medical treatment abroad. It’s wise to share the patient’s medical history and agree to a small increase in the premium beforehand. This ensures peace of mind and prevents the need to pay exorbitant charges abroad for medical expenses,” says Unnithan.

How Much Cover Will I Get?

It is crucial to ensure that policyholders opt for adequate PED coverage when buying travel insurance, as different plans have varying limits. Some plans might offer coverage equivalent to a percentage of the sum insured, like 10 per cent up to a specific limit, while other plans might cover PEDs up to the entire sum insured.

“Thus, it is important to understand these limits to ensure adequate coverage for potential critical situations related to pre-existing conditions during international travel,” says Kapoor.

“It is also important to consider the potential costs of medical treatment in the destination country and whether you need coverage for exacerbation of pre-existing conditions. Further, longer trips may increase the likelihood of needing medical care, making coverage for pre-existing conditions more valuable,” says Nayak.

So if you have a pre-existing condition, check your travel insurance thoroughly before going on your next trip.

meghna@outlookindia.com