For countless Indians, owning a house is a cherished dream, symbolizing progress and personal achievement. While the aspiration to own a home remains strong, the reality of high real estate cost means that many turn to home loans to bridge the gap between their dreams and current financial capacity. But what might initially seem like a reasonable solution can turn into a challenging financial burden.

The Problem

The twist in this story emerges when you consider the interest payment on home loans. As individuals make monthly payments towards their loans, a substantial portion goes toward the interest payment at least in the initial years.

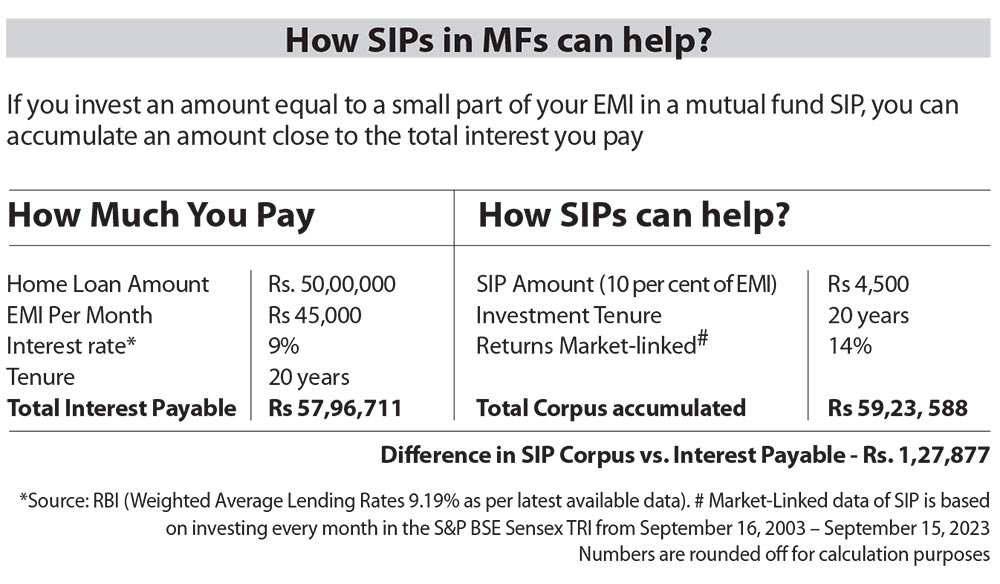

For instance, if you take a home loan of Rs. 50,00,000 for 20 years at an interest rate of 9 per cent, your equated monthly instalment (EMI) comes around Rs 45,000 per month. In the first five years, around 75 per cent of your EMI goes towards interest payments. It takes almost 12 years for the principal amount to supersede the interest amount.

Over time, this interest can accumulate to an amount that surpasses the principal itself. In the example mentioned above, for a home loan of Rs 50,00,000, you end up paying a total interest of Rs 57,96,711 over 20 years.

This startling revelation can be disheartening, making you feel as though you are paying much more than what you initially borrowed.

The MF Solution

The interest outgo on your home loan can be hard on your wallet. But guess what, we’ve got some good news and a solution for you, thanks to the power of mutual fund systematic investment plans (SIPs). You can use SIPs to make your home loan interest-free. SIPs ensure that you buy more units when the prices are lower and fewer units when the prices are higher.

Here’s what you can do. When your EMI starts, you can set aside 10 per cent of your EMI amount and invest in an SIP. Let’s understand using the example discussed above. If your EMI amount is Rs 45,000, you need to start an SIP of Rs 4,500 per month. If you do this and your money grows at an average annual compounded rate of 14 percent, similar to the returns delivered by the widely tracked index S&P BSE-Sensex which delivered 14.92 percent returns, over the past 20 years (from September 16, 2003, to September 15, 2023), as of September 15, 2023, you could potentially accumulate approximately Rs 59.24 lakh in 20 years. This effective investment approach is applicable to various loan amounts.

Equity investment can be a viable solution for long-term goals. So, if you are thinking about buying a house and getting a loan, remember that there are smart ways to handle the extra money you are made to pay as interest. With a bit of smart planning, you can make your dream of having a home more affordable and less stressful.

Disclaimer

The views expressed herein are based on internal data, publicly available information and other sources believed to be reliable. Any calculations made are approximations meant as guidelines only, which need to be confirmed before relying on them. These views alone are not sufficient and should not be used for the development or implementation of an investment strategy in any manner whatsoever. Taxation and other expenses have not been considered for SIP returns mentioned above. SIP does not assure a profit or guarantee protection against loss in a declining market. Past performance may or not be sustained in future.

An Investor Education and Awareness Initiative by SBI Mutual Fund.

Investors should deal only with registered Mutual Funds, details of which can be verified on the SEBI website (https://www.sebi.gov.in) under ‘Intermediaries/Market Infrastructure Institutions’. Please refer to website of mutual funds for process of completing one-time KYC (Know Your Customer) including process for change in address, phone number, bank details etc. Investors may lodge complaints on https://www.scores.gov.in against registered intermediaries if they are unsatisfied with their responses. SCORES facilitates you to lodge your complaint online with SEBI and subsequently view its status.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.