Come July and most salaried individuals and professionals get busy with preparations for filing their income tax return (ITR).

For salaried individuals, the process starts with getting Form 16 from their accounts department. It is essentially the tax deducted at source (TDS) certificate that corroborates the amount of tax the employee has paid on his income and which the employer has deducted from the salary.

Professionals, such as architects or medical practitioners, who may be contractually employed with clients or organisations, also need to secure their TDS certificates from all the respective employers for the financial year.

But this is just the tip of the iceberg. Any individual taxpayer will also need to get in touch with his/her bank for details on interest income from deposits and interest payment on home loan, and with his/her broker for any income received as dividends from stocks, mutual funds and others.

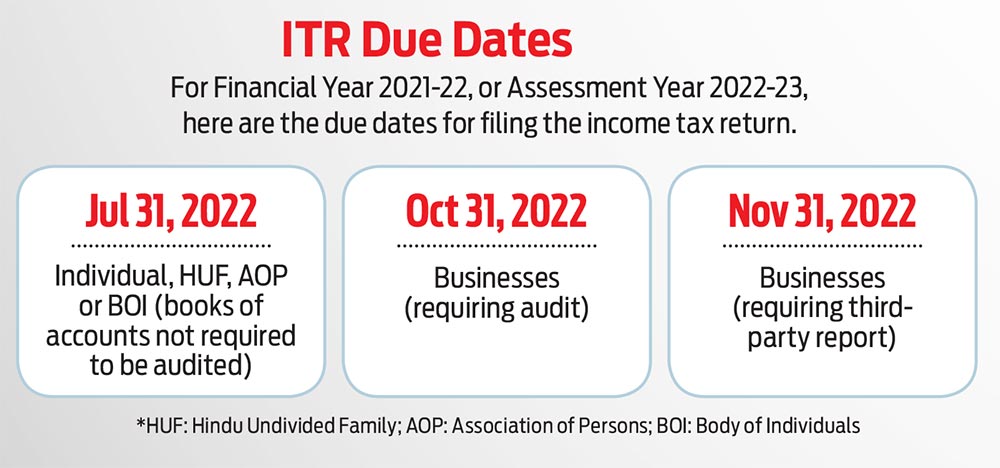

Finally, he/she will have to compile all this data and file the ITR by the due date as specified (see ITR Due Dates).

That said, most people find the tax filing process too complicated, and often take professional help from experts.

But now, with the income tax department making it compulsory to file returns only in the electronic mode, many taxpayers with basic understanding of tax provisions, often file their income tax return by themselves.

Says Akhil Chandna, partner, Grant Thornton Bharat LLP, an accounting and advisory organisation: “The pre-filling and filing of ITR service is available to registered users on the e-filing portal. The process to e-file ITR is quick, easy, and can be completed from the comfort of an individual’s home or office.”

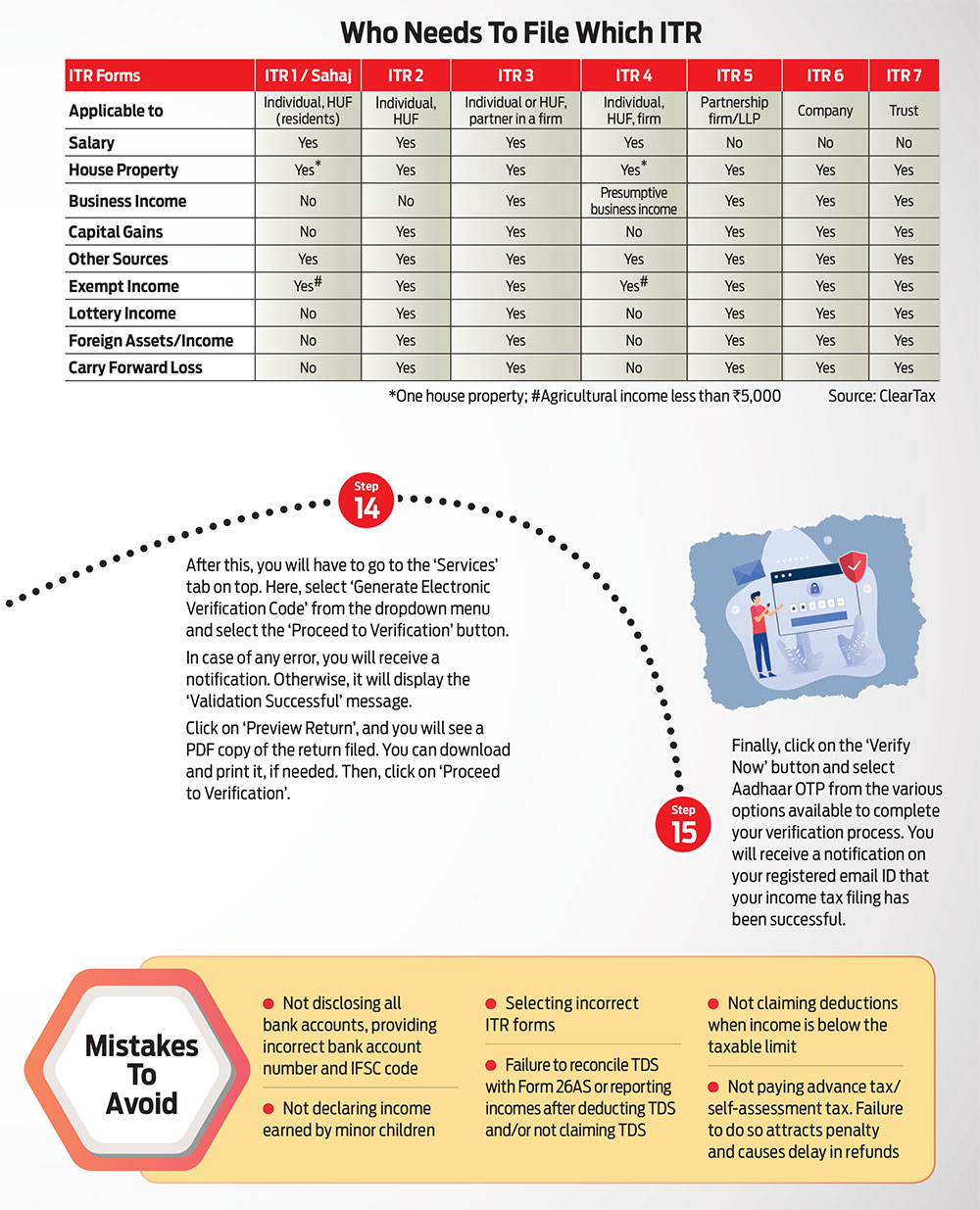

However, there are certain dos and don’ts to be followed, the most basic of which is to file your ITR within the due date. Failure to comply could lead to levy of additional interest, fee, and penalty (see Mistakes To Avoid When Filing ITR).

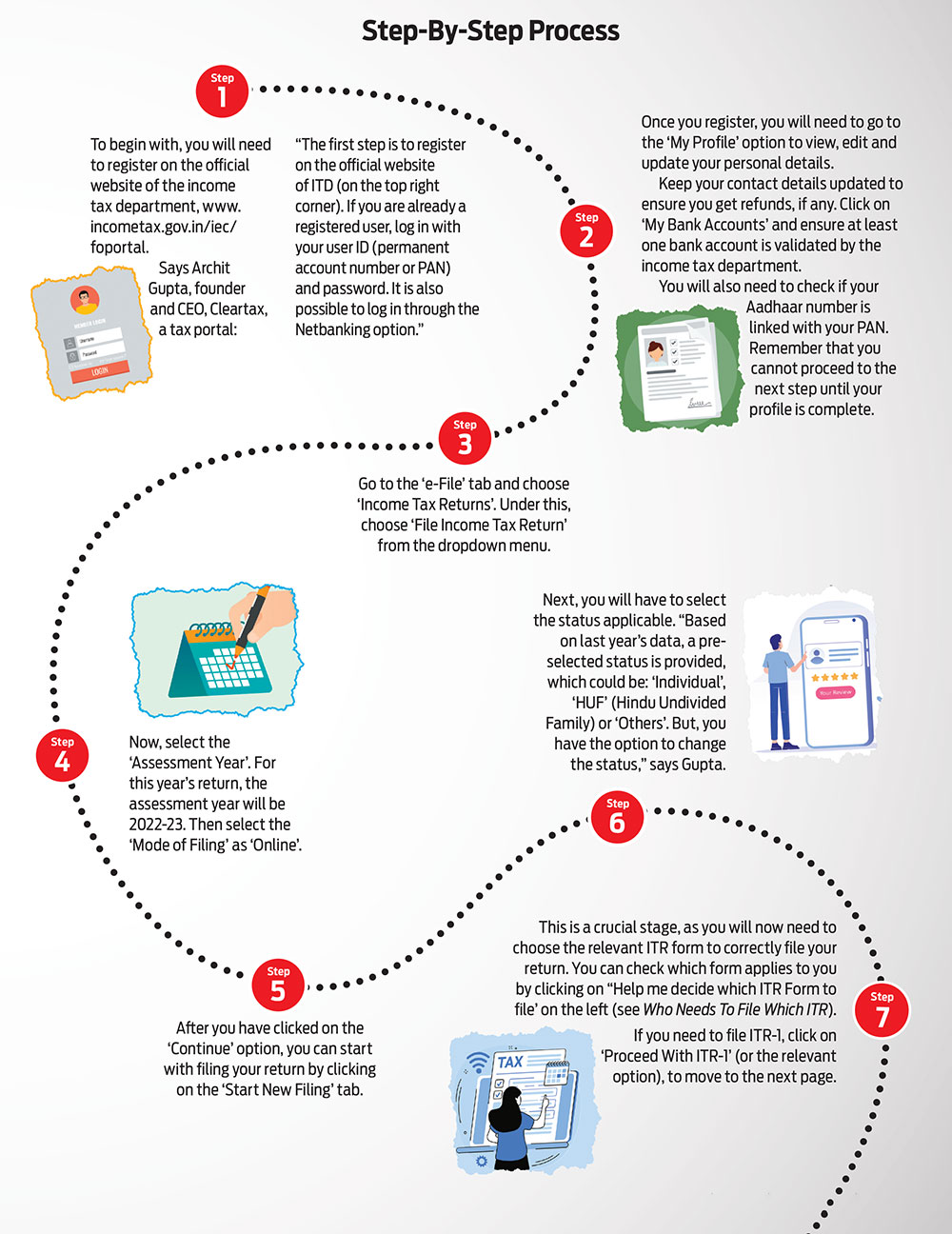

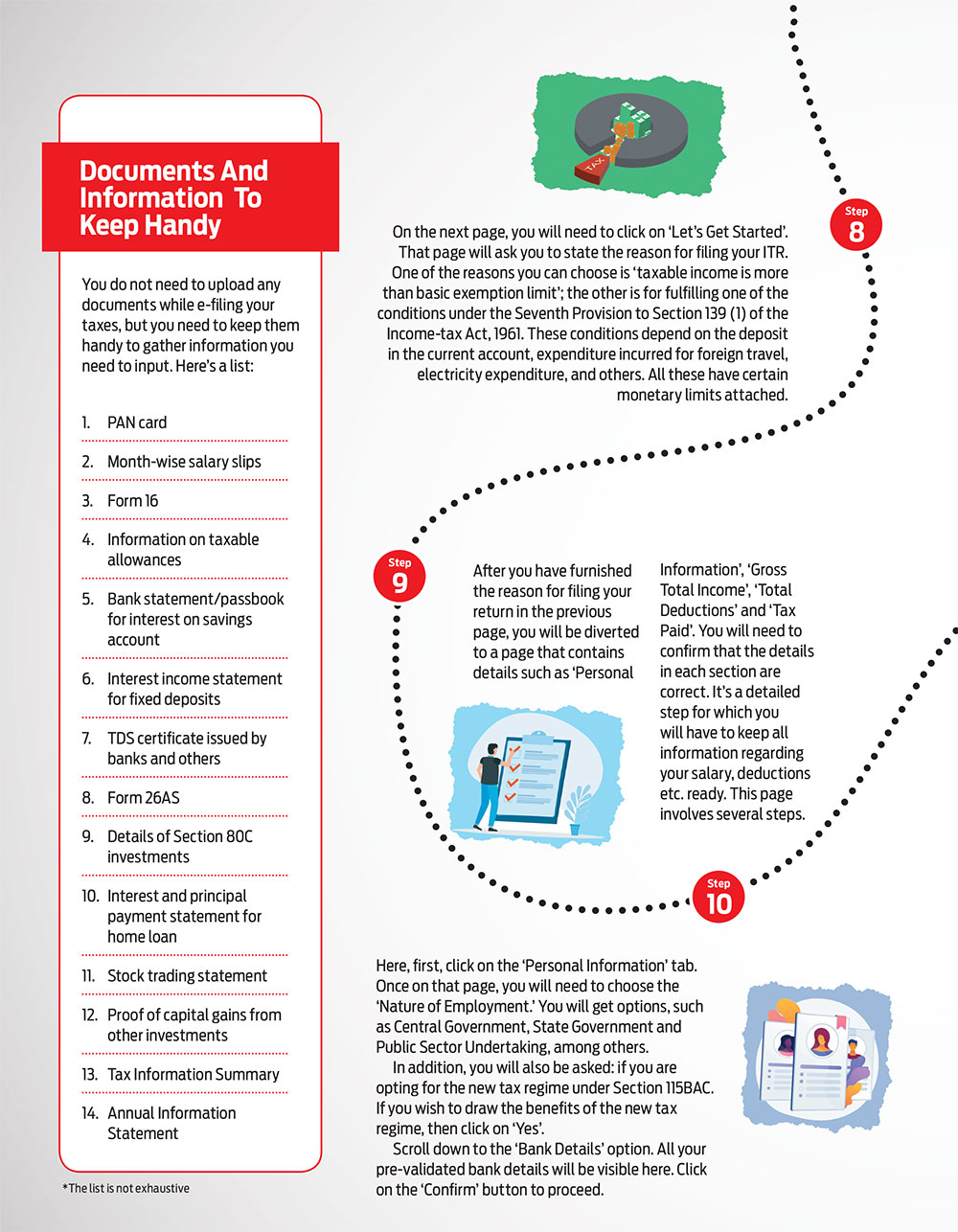

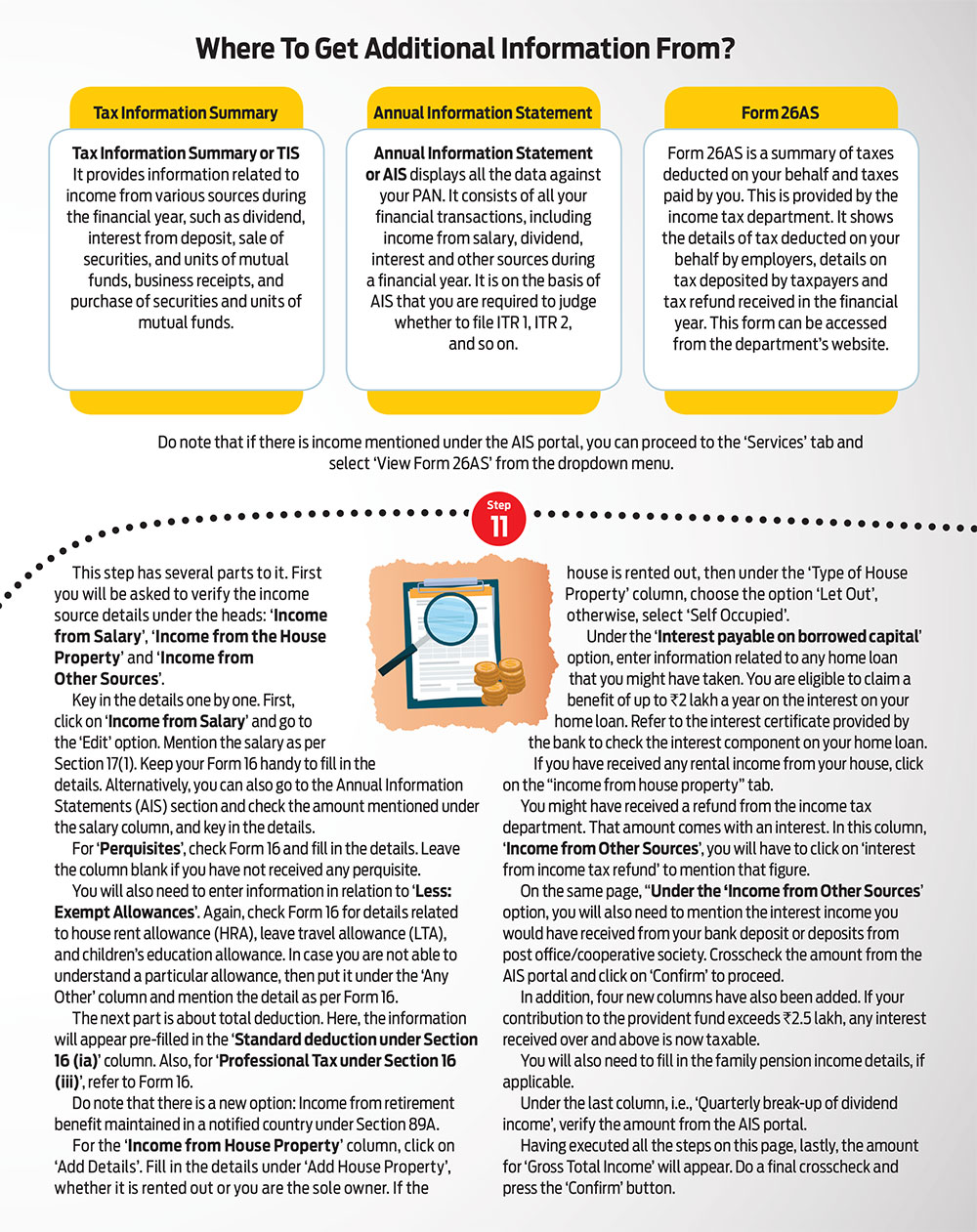

If you like to DIY, here is a step-by-step guide to help you file ITR this year. But do remember to keep all the information ready (see Additional Information, List Of Documents).

Graphics: Praveen Kumar .G

meghna@outlookindia.com