Special Features

Auto Renew: It ensures your SIP restarts automatically on completing the previous cycle, say a year

Pause: It helps pause the SIP for a certain period until you are ready to start again

Step Up: It will automatically increase the instalment amount or quantity periodically

***

Most of you would have heard about systematic investment plans (SIPs), with mutual funds popularising the term. Premium-payment insurance policies are now being mis-sold as “SIP investments”, and then there are stock SIPs as well.

With increasing interest in direct equity investment, stock SIPs are gaining popularity. According to Prime Database, the share of retail investors in the National Stock Exchange (NSE)-listed companies is almost the same as the share of domestic mutual funds, with 7.42 per cent and 7.75 per cent, respectively, as on March 31, 2022.

Stock SIPs allow you to buy shares of a particular company in instalments. You need to select the stock, the frequency, the duration of SIPs, the commencement date and the rest shall be done by your brokerage platform. You can either choose to invest a fixed sum or pick a fixed number of shares every month.

Like mutual fund SIPs, stock SIPs also help inculcate investing discipline, average out the cost, and returns and risk across market cycles. But before you get swayed by the apparent advantages of stock SIPs, let’s bust a few myths about them.

Myth 1

MF And Stock SIPs Are The Same

The Indian mutual fund industry has witnessed a surge in the number of SIPs in the past few years. As of October 2022, there were about 5.93 crore SIP accounts and the monthly SIP contributions reached a record high of Rs 13,041 crore in October.

Due to its popularity, the term SIP may inspire a sense of familiarity and relative safety in most investors, but that sense of comfort may not always be well-placed when it comes to stock SIPs.

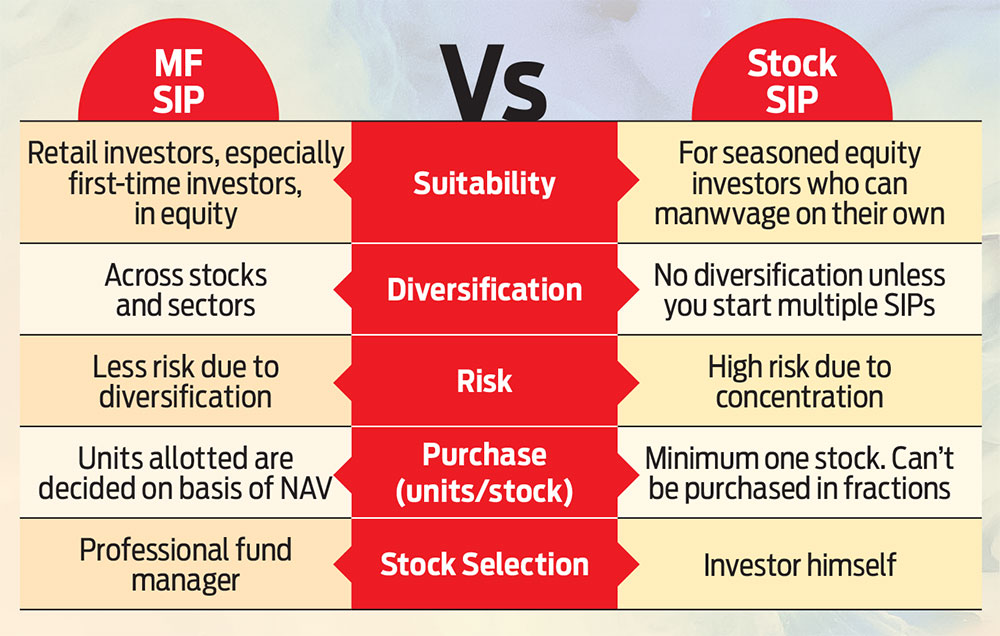

Stock SIPs are different from mutual fund SIPs. First, there is a difference in the way you invest. You can invest only a fixed number of a particular share through a stock SIP, unlike a mutual fund SIP where fractional units can be allotted as per the instalment.

Here’s how it works: In case of mutual fund, you would be allotted the number of units on the basis of the net asset value (NAV). For example, if you invest Rs 5,000 and the NAV is Rs 9.46, you will get 528.54 units. In case of a stock SIP, where the share price is Rs 9.46, you can buy 528 stocks with Rs 5,000, and the balance Rs 5.12 will remain in your demat account.

Second, a mutual fund SIP can help invest in different stocks, while a stock SIP invests in just one.

Third, while mutual funds are professionally managed, you are your own manager in a stock SIP.

In a mutual fund SIP, you sign up for a professionally managed portfolio. If the performance of some stocks in the portfolio drops after you start the SIP, the fund manager is expected to replace them with better alternatives.

When you opt for stock SIPs, you are your own fund manager. You will need to track the company’s performance and the sectoral outlook

all by yourself.

Says Sandip Raichura, CEO, retail broking, Prabhudas Lilladher, a stock broking firm: “In a mutual fund SIP, one is essentially taking a bet on a more diversified portfolio. Also, it is the fund manager who is overseeing the performance. So, that makes it a broader investment style.”

Myth 2

They Offer Better Returns

Stock SIPs have the potential to offer better returns only if you are a seasoned stock picker and have the skills to cherry-pick the right stock.

Stock SIPs could help multiply your money if you manage to pick a multi-bagger stock that outperforms the market on a multi-year basis. Usually, multi-bagger returns are possible if you can identify the stock early when it is relatively unknown, buy it at a low price and track its business regularly to ensure it is on course.

But finding such stocks is far from easy and will require you to track the company’s performance and the sector closely. Says Anup Bhaiya, managing director, Money Honey Financial Services: “Stock SIPs are for seasoned investors who understand the stock market dynamics well, and are confident of the respective stock’s performance.”

Assess if you can pick the right stock before expecting good returns.

Myth 3

They Offer Diversification

Diversification is the key to reducing equity risk in any portfolio. Stock SIPs help you buy a particular stock at different price points.

This averages out the cost of the stocks but does not offer any diversification benefit as it will help you accumulate a single stock.

It can lead to the risk of concentration of a particular stock in the portfolio. “Through a stock SIP, you are investing only in that specific stock. So, the risk of concentration comes into play. If for any reason, the stock is not performing, it will affect the return of your investments,” says Bhaiya.

Stocks or sectors that appear to be great buys at one point of time could turn out to be avoidable after some time. Hence, if you are not careful with your selection, you could end up amassing a stock that does not match with your portfolio requirement.

What Should You Do?

You should go for stock SIPs if you are convinced that a particular stock has the potential to outperform even the broader market. They will help you average out the cost in times of volatility and invest in a disciplined manner. But that would require research into the company’s fundamentals and other technical aspects, formulating a strategy, and regular tracking.

If you have the time and resources to do all that, then you can go for stock SIPs, otherwise stay away.

“Only those investors who have high confidence in a stock and wish to accumulate it should go for a stock SIP. New investors or investors who do not have time to study all these aspects should refrain from opening stock SIPs,” says Bhaiya.

Stock SIPs can be highly risky for the amateur investor, who may be better off with a mutual fund SIP, though selection of the right mutual fund is equally important.

***

Advantages

Builds discipline to invest regularly

Stops you from timing the market

Helps tackle market volatility better

Helps balance risk by rupee-cost averaging

Disadvantages

Not professionally managed

Choosing the right stock can be challenging

Can lead to concentration in a single stock

Doesn’t offer diversification

kundan@outlookindia.com