Suvadeep Datta, 43, an IT professional based in Bengaluru, has been using credit cards for a long time and efficiently. A personal setback followed by a nationwide lockdown, and it was a domino. He couldn’t pay credit card bills one after another and soon found himself in a debt trap. His credit card debt amounted to about Rs 14 lakh. What made matters worse was that he had a personal loan and a couple of other loans.

At a low point in life, disillusioned with regular recovery calls by collection agencies, he found out about FREED, a debt relief platform, through social media. The company took the matter into its hands and settled Rs 6.36 lakh out of Rs 14.12 lakh in six months. Datta also got a ‘haircut’ of 55 per cent (Rs 7.76 lakh) on his credit card loan.

Priti Singh, 27, a salesperson working in Mumbai, has a similar story to share. Due to a pay cut post-Covid-19, she couldn’t honour her debt obligations. So she settled one credit card bill with another until she was deep in a debt trap.

“My expenses went above my income, and I was clueless about how to manage my finances. Collection agencies started harassing me. They even called my parents and relatives,” says Singh, who later approached SingleDebt, the India unit of a UK-based debt management company. Singh owed Rs 3.5 lakh across four credit cards. SingleDebt negotiated on her behalf and managed to get a settlement at a 60 per cent discount on a loan outstanding on one credit card and waive off interest (to get credit score clearance letter) on another.

Priti Singh, 27, Mumbai-based salesperson

Due to a pay cut post-Covid-19, she could not honour her debt obligations. Soon, she found herself deep in a debt trap. She eventually sought professional help to get out of the situation.

“My expenses went above my income, and I was cluless about how to manage my finances. Collection agencies started harrassing me. They even called my parents and relatives.”

***

The last two years have been tough on many individuals who faced salary cuts or job losses during Covid, several of whom ended up with unwanted and unplanned debt, which was too huge to handle for them.

The problem of falling into a debt trap, though, does not just occur in unprecedented situations such as the pandemic. Debt is no longer a stigma in India. Millennials are comfortable taking loans, but not all of them can show impeccable credit behaviour. With new-age credit options, such as credit cards and buy now pay later (BNPL) schemes easily available now, falling into a debt trap has become as easy. Once in a trap, banks and collection agencies can hound individuals for loan recovery.

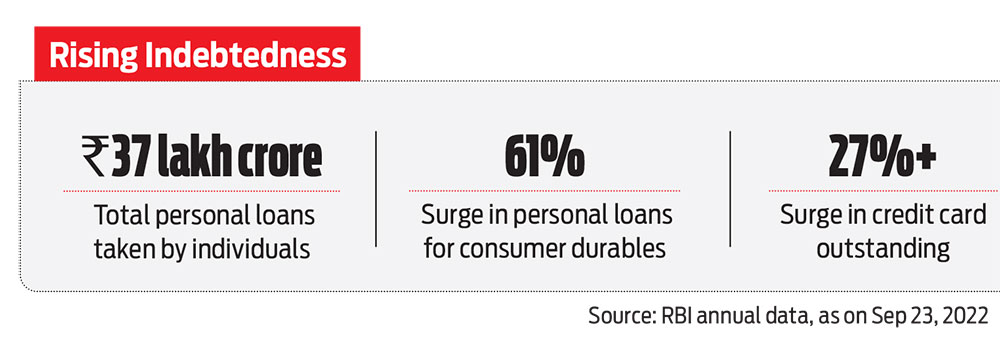

In fact, unsecured retail credit has surpassed banks’ credit to various industries. Data from the Reserve Bank of India (RBI) shows bank loan owed by enterprises (micro and small, medium and large) was Rs 32 lakh crore as on September 23, 2022, compared to Rs 37 lakh crore in personal loans for different purposes. Personal loans for consumer durables surged a whopping 61 per cent in a year, while credit card outstanding jumped over 27 per cent during the same period. With increasing growth in retail credit, defaults are bound to happen.

While some individuals may handle the problem independently, the situation can become overwhelming for others. In these situations, debt relief platforms can come to your rescue. Let’s find out how.

Help Is At Hand

In most cases, people intend to pay but are unable to work their way out of the financial quagmire they find themselves stuck into.

Debt relief platforms, such as SingleDebt, FREED, and Loan Settlement, are helping people get a second chance to mend their credit behaviour. In India, there are only a few players in debt or credit management in the retail space.

FREED has about 9,100 customers, of which 482 have been entirely debt-free, while 1,594 are partially debt free (one or more accounts settled) since its launch in August 2020. The company has settled about Rs 30 crore in debt since inception. The average debt enrolled per borrower has stayed around Rs 5.3-5.5 lakh per borrower.

The average loan outstanding for individuals is the same for SingleDebt—Rs 5 lakh across 5-6 loan accounts. “We settled 40,000 accounts since its launch in November 2018 for 6,000 customers. In terms of value, we settled Rs 6-7 crore in FY21-22, while Rs 11 crore has already been paid to creditors this year,” he says.

These companies work with lawyers, paralegals, and financial advisors to help those in debt. They handhold and provide support, suggest legal ways, negotiate on behalf of the clients, provide credit counselling, etc., to assist such individuals. They not only assist individuals settle their debt but also help them improve their credit scores.

Suvadeep Datta, 43, Bengaluru-based IT Professional

A personal setback and the Covid-19 lockdown adversely impacted his finances, leading him into a debt trap. What made matters worse was that he had a personal loan and a couple of secured loans.

“I felt guilty about not being able to pay off my dues. When I found out about the legal route through the debt management company, I went ahead with it. They also provided me psychological support to get through the tough phase of my life”

***

The debt management platforms are doing what banks should offer as a first step. According to Dubey, a collection agency recovering Rs 30 lakh a month is a fair sum of collection for the banks. “Debt management plans should be the first step for banks to recover money from borrowers instead of going to collection agencies. Banks should consider offering it to customers based on their financial condition. In fact, this is what RBI has mandated in its guidelines which hardly any bank follows,” says Dubey.

How Do They Work?

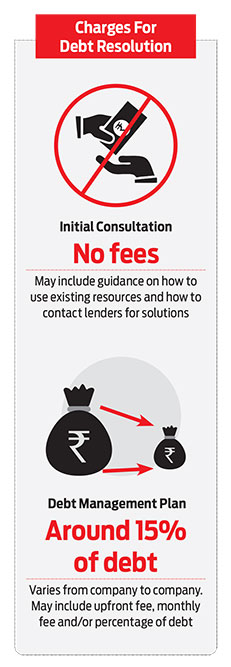

Every debt counselling centre has its own process. Most of these provide a free-of-cost initial consultation.

For example, SingleDebt has a three-layered process. In the first step, they guide borrowers on the loan resolution process after taking a detailed look at their overall finances. In the second step, they tell them to write to the bank asking for a solution as per the individual’s financial condition. At this stage, too, there is no charge.

If this does not work out, customers can opt for the third step, where SingleDebt onboards them. The company takes care of every minor issue by constructing a Debt Management Plan (DMP) at this stage. “We set up a DMP based on the borrower’s disposable income for unsecured loans after he/she meets eligibility criteria and submits proof of genuine struggle. We do some documentation around reasons for failing to pay EMIs, their existing financial condition, and the monthly outgo they can afford. We have our in-house team of lawyers who reply to legal notices and phone calls from banks or collection agencies,” says Sanjay Dubey, director, SingleDebt.

The initial counselling comes for free at FREED as well. “If we assess that the customers have the ability to save funds for resolving their debts, we tell them to do that. In most cases, however, they come to us only when they have exhausted all their options,” says Ritesh Srivastava, founder and CEO of FREED.

FREED then sets up a special purpose account for customers to accumulate funds each month before they have enough to start repaying. “It instils financial discipline in them. We don’t want repeat customers. As the balance is built up in that account, we begin negotiating the debts with creditors at favourable terms and start paying them off,” says Srivastava. FREED creates a single equated monthly instalment (EMI) for all loans.

The special purpose account gives lenders comfort that the payments will keep coming, and they are more amenable to settlements, he adds.

One needs to understand that ‘haircut’ is not one’s right. It is up to banks to offer it or not on a case-to-case basis. “Banks try to recover money by all means in the first three months since the borrower defaults on the payments to avoid the loan being classified as NPA. The banks need to write off the loan after six months. The recovery process remains rigorous. In many cases, if they are confident the borrower will honour the payments, they give discounts post six months of default as settlement to recover the written-off loans,” says Dubey.

How Do You Pay For It?

One of the first questions an indebted individual may ask is how they would afford to pay for professional services when they can’t settle their own debt.

As mentioned earlier, usually, the initial meeting is not chargeable. After that, the financial advisors/experts enrolled with such platforms get on a detailed call with the customer to get a grip on their financial situation.

After initial counselling, if the customer is confident enough to implement the advice independently, they may do that. Some platforms also help them identify funds lying in unidentified instruments that can be utilised for debt repayment. If not, the platforms handhold them in exchange for some fee.

How Much Do They Charge?

The prices vary for different customers. SingleDebt takes the first two months of disposable income (difference between monthly income and essential expenses) upfront to take care of legal notices and other paperwork and handle calls. Third month onwards, nearly 12.5 per cent of the loan outstanding goes as an account management fee.

FREED doesn’t levy any upfront fee but charges after the loan resolution is done, which is 10 per cent of the loan outstanding after you enrol in the program. However, they do have a monthly platform fee, which is Rs 649-1999, depending on the debt load enrolled for the program. “The monthly subscription fee offers a host of benefits to the customers such as pre-litigation support, trust account management, customer dashboard, regular budgeting and counselling, creditor call handling and harassment protection, etc.,” Srivastava says.

“The overall fee comes in at around 15 per cent of debt enrolled while customers end up saving about 55 per cent over the debt enrolled. So, we can say that we charge Rs 1 for every Rs 4 that customers save,” he adds.

Debt management firms mark the beginning of a much-needed change in the loan recovery process. While one must stay away from debt to the best of their ability, if indeed it has shaken your finances, help is available, though at a cost. After all, the paltry sum you would spend on these platforms is worth the mental and physical pain you could face for living in debt.

The writer is a Financial Journalist