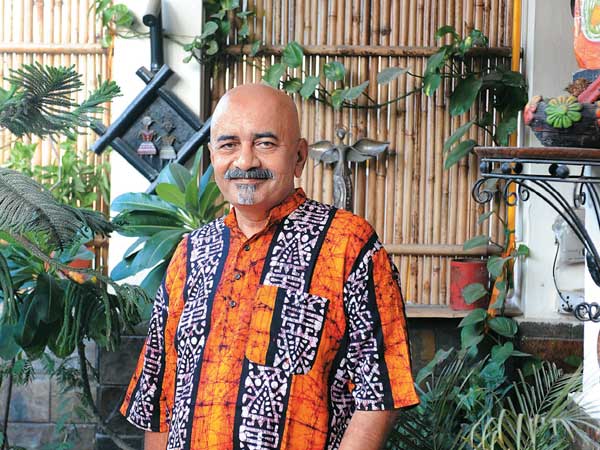

In 2005, Sachindra Singh invested a substantial amount in Mutual Funds (MF). But this was a bad investment for him as he did not gain anything and return on investment was less than desired. Worse, there was a lock in period so the money was locked in without any proper benefits for him on his investment.

This discouraged Singh, an entrepreneur, to move away from MFs and equity and look at the more time-tested asset class of real estate. At that time, as realty was in a boom, he started looking actively at this sector and bought a plot of land in Jaipur in 2006 with a monthly payment provision. Unfortunately, real estate market started falling and his investment did not see any gains.

A few years later, in 2010, he once again looked at real estate and invested in a Lucknow Development Authority Lottery Self Finance Scheme two bedroom flat for a decent enough amount. With the real estate market down, the project did not progress much over the years and he is slated to get possession of the flat this year, nine years after his initial investment.

Not losing heart, he again invested in real estate in 2013, this time, in a property in small town Palwal in Haryana, with a bank loan. He got possession soon and has put the flat on rent and is getting proper returns on his investment.

Despite the downturn he believes real estate is a stable form of investment and has lower risk than other asset classes. He has also put a lump sum in fixed deposits and does not want to tread the stock markets space, as he does not have much knowledge about the equity markets. He has also put in a decent amount per month in SIPs along with his wife but will continue to look at the FD route as it has low risk even if returns are lower than other asset classes. Plus, there is flexibility and available liquidity, which he needs for his son’s education.