When it comes to keeping things organised and disciplined on an institutional scale, there are few entities that do the job with as much finesse as the armed forces. Whether it is a border outpost in the remote north-east, a cantonment area in a hill town, an officer’s mess in an erstwhile Presidency town, or a cenotaph dedicated to war heroes in the middle of a cold desert, everything seems neat, well-kept and organised—right to the flower beds, manicured lawns, roads and painted walls.

The bedrock of financial planning, too, lies in discipline and being organised, but this aspect often takes a backseat for armed forces personnel due to the demands of their jobs and lack of adequate financial knowledge. While some financial safeguards are in place, something that is usually unavailable to civilians, armed forces personnel do need to close some chinks in their armour to secure their financial future. Here’s what can be done to build a stronger financial life.

Basic Armour

Provident Fund: The armed forces have dedicated provident fund authorities—the Defence Service Officers Provident Fund (DSOPF) and the Armed Forces Personnel Provident Fund (AFPPF)—for officers and non-officers, respectively. However, the employer (central government) does not contribute towards it, unlike in the Employees’ Provident Fund. Contribution is mandatory up to 6 per cent and voluntary up to 100 per cent of the basic salary.

Pension: One of the biggest benefits that armed forces personnel get is a defined pension from the government after retirement. This is 50 per cent of the last drawn salary.

Life Insurance: The three services—Army, Navy and Indian Air Force—also provide insurance covers in the form of return of premium plan. These are provided by the Army Group Insurance Fund (AGIF), the Naval Group Insurance Scheme (NGIS) and the Air Force Group Insurance Scheme (AFGIS), respectively.

The Navy, for instance, gives an insurance cover of Rs 50 lakh to each officer for a premium of Rs 5,000 per month that is to be paid by the officer. For non-officers, the sum assured is Rs 25 lakh for a premium of Rs 2,500 per month, according to the official website of the Indian Navy. This varies according to the service arm.

The premiums appear steep, but that is primarily because these are calculated considering various factors, and also have a savings element attached. These are no-questions-asked policies and offer the sum assured to the dependants, irrespective of whether the policyholder’s death is while on duty or otherwise. The only exclusions are suicide, immorality or intoxication. These policies also provide a disability cover, but with some exclusions. Besides, if an insurance policy is taken from another insurer with the same conditions of risk to life, the premium would be even higher.

This is a flat insurance that every serving officer and non-officer has to mandatorily pay for, irrespective of rank or posting. There is an additional insurance cover—for an extra premium—provided to those in higher-risk jobs such as pilots or those deployed in conflict areas.

The savings element of the policies means a percentage of the sum assured, which earns returns, will be given to the person as a lump sum at the time of retirement. It is calculated on the basis of the years of service put in.

Medical and Health Benefits: Another important benefit available is the health and medical facilities provided to serving and retired personnel and their dependants.

Ex-servicemen have to pay a lump sum (about Rs 1.25 lakh at present) at the time of retirement to avail this facility for self and dependants under the Ex-Servicemen Contributory Health Scheme (ECHS). Children are eligible for this facility up to the age of 25 years, or, in case of permanent physical or mental disability, irrespective of age and medical condition.

Chinks In The Armour

The facilities that the armed forces personnel get may seem like a lot but are often not enough to meet their financial goals. Therefore, one needs to make an effort to fill in the gaps. This is easier said than done because following a disciplined financial plan becomes especially difficult when work means frequent shifting of bases.

Disconnected Lives: When work is in areas where access to financial advisors is difficult, Internet connectivity is limited and even electricity supply is through generators, regular upkeep of investments is nearly impossible. “The initial career days were virtually free of Internet connectivity and mobiles; very few land lines were available. So, investments could hardly be monitored round-the-clock, except bank fixed deposits and provident funds,” says 56-year-old Capt. Rikeesh Sharma (Retd), Indian Navy, who now lives in Gurugram. “Share investments were frowned upon by service rules. One would generally rely on a friendly bank manager and/or LIC agent back home, who would usually be a close friend, a relative or a neighbour,” he adds.

Lack Of Continuity: Frequent transfers are a challenge. So, someone posted in, say, Delhi could get acquainted with a good financial advisor and start investing, but be posted within a year or two to, say, Mechuka in Arunachal Pradesh, where being in touch with a financial advisor regularly would be difficult.

In fact, maintaining continuity in other aspects of life is also a challenge. A former Army officer, who took early retirement and did not wish to be named, says at one point he was posted in north India while his wife, who was also in the Army, was posted in the east. “When things like school admission of the children had to be sorted, financial planning became the least of our worries,” he says. In such situations, regularity takes a backseat. “We had our Army PF and regularly contributed to it. Thankfully, we also had our life insurance, and medical and healthcare needs taken care of. I tried to dabble in shares, without any knowledge, and then lost track, as I got transferred. I decided against investing in shares. I did not know anything about debt, equity or goal-based investing,” the veteran says.

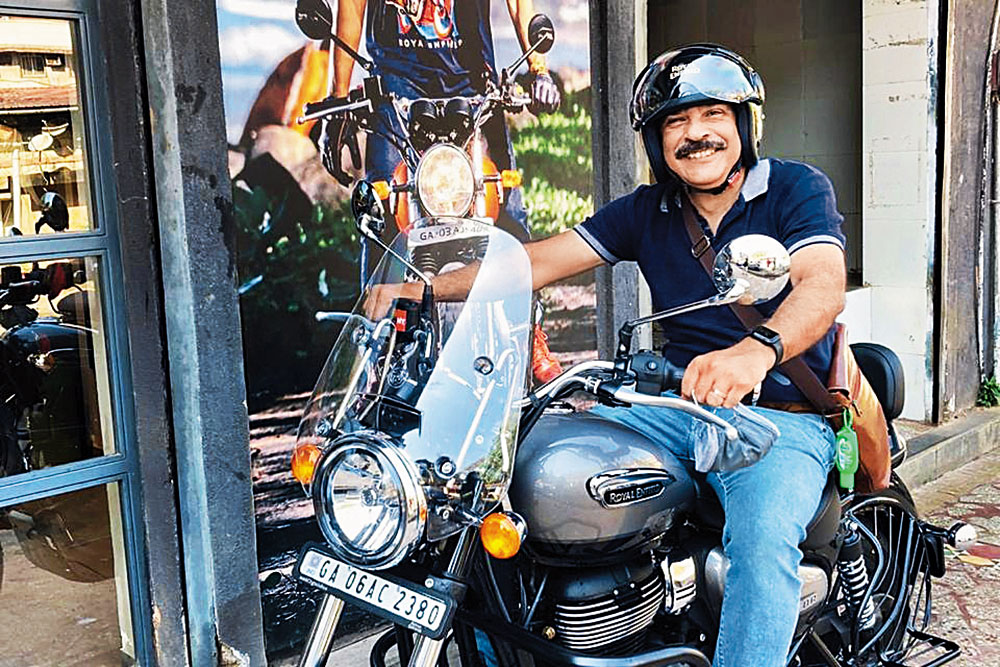

Capt. Rikeesh Sharma (Retd.), 56, Gurugram

The retired Naval officer rues the lack of connectivity during the beginning of his career. However, he feels that daily monitoring of investments should be avoided. Instead, appointing a financial expert to do that will lead to the right financial decisions.

“I began investing through insurance for the sake of tax avoidance without realising the enormity of inflation. Luckily, I managed to diversify my portfolio into equity”

Lack Of Financial Knowledge: Apart from lack of connectivity, field postings and 24x7 nature of the job leaves little time for planning or gathering adequate financial knowledge. Moreover, since officers usually join the services at around 21-22 years of age and the non-officers at an even younger age, the likelihood of having prior knowledge is also low. Limited interaction with the outside world can mean lack of exposure.

“I learnt about financial planning almost 10 years after leaving the Army. Now, I have made amends, and have taken to goal-based investing,” says the retired Army officer mentioned earlier.

Col. Sanjeev Govila (Retd), who now runs the Sebi-registered financial advisory firm, Hum Fauji Initiative, reminisces: “I was in the Army for 27 years, after spending four years at the academies (the National Defence Academy and the Indian Military Academy). I had very low awareness, not only about financial planning or investment, but also of its importance. I had no idea of the products, and neither did I realise their importance in one’s life.”

Sharma says he took the first step of financial planning—budgeting—early in life but that’s where the process ended for him.

Financial Mistakes: These include giving too much weightage to insurance in investment portfolios or not having enough protection.

“I began investing through insurance policies for tax avoidance, without realising the enormity of inflation. Luckily, I managed to diversify my portfolio into equity and kept insurance limited to medical and money-back policies,” says Sharma.

A serving Army officer, 37, who did not wish to be named because of service rules, said he initially made the mistake of mixing insurance with investment. “Later, as I gained more experience, I switched to mutual funds and then to shares, and also began alternative investment,” he says, adding that now he is reducing his exposure to equities with rising age and responsibilities.

Despite having insurance policies, the overall cover is often inadequate. The thumb rule is that the insurance cover should be 7-10 times of the annual gross income. “A senior officer will typically have about Rs 2-2.5 lakh gross income per month. If we calculate it to be Rs 24 lakh annually, a person should ideally have an insurance cover of Rs 2 crore annually. The AGIF is providing a cover of Rs 1 crore from April 1 (this year). Most officers probably don’t have the knowledge about taking adequate life cover,” says Govila.

Conservative Attitude: Another challenge is that the risky nature of the job makes many people conservative in their investment. Govila, for example, started taking interest in capital markets only later in his career and realised that “this was the biggest grey area we all men in uniform have”.

Plating The Armour

Armed forces personnel retire early—non-officers at 35-36 years of age, and officers around mid-40s to mid-50s. In essence, they have a shorter working life so the need is to start long-term financial planning as early as possible.

Boost Your Insurance Cover: Taking a disability insurance cover is the first step because “in case of 100 per cent disability, one gets 50 per cent of the death benefit. If the disability is less than 40 per cent, there is no benefit available from the insurance policy provided by the service organisation. Beyond 40 per cent disability, there is a certain percentage,” says Govila, adding that in some cases, people may have to leave the armed forces due to medical reasons. “So, taking independent disability insurance and critical illness covers are very important,” says Govila.

Officers who leave midway get a term insurance worth Rs 10 lakh from their respective service organisation. Therefore, there is a need to have adequate life insurance depending on individual requirements.

Diversify Investments: Avoid having an unbalanced portfolio, which is skewed towards equity or life insurance, for example. Diversify investments and go for customised financial planning as a shorter working life demands a more sustained long-term financial planning. Any extra allowance or bonus should be regularly invested as well. Ensure that investments are automated, for instance, through systematic investment plans (SIPs) so that remote postings do not result in discontinued investments.

Get A Financial Planner: Govila suggests that armed forces personnel hire a good financial advisor and remain in touch with them, either by phone, email or SMS. “They should avoid independent investments, such as stocks, that require constant supervision. Immediate job transfers could lead to them not being able to monitor, research or liquidate the investments,” he says.

Sharma agrees that a financial expert’s services can play a big role. “A competent financial advisor can look after all formalities and allow you to enjoy your life as your corpus grows. The daily bazaar (stock markets) monitoring only adds to tension. Let a professional do his job and let your funds grow under his watch,” he says.

Being disciplined and prepared is a motto that will also serve well in the financial lives of those who serve in the armed forces.

Change The Attitude: Most of our decisions, financial and otherwise, depend on our outlook. The importance of financial stability and strength cannot be ignored. “Money may not be everything in life, but it is essential. There is nothing chivalrous about being financially naïve or projecting little to no concern for money. This ethos acts as a barrier to learning about a lot of important things about finance,” adds Govila.

Update Your Will: A Will has to be made before being commissioned into the force. Usually, people make their parents the beneficiaries. “But this should get updated with marriage and starting a family,” says Govila. The Will should be updated regularly during the later years as well according to changes in financial lives.

***

10 Point Plan Of Action

Frequent transfers and remote postings can lead to a financial plan that’s built in fits and starts. Moreover, lack of time can lead to spur-of-the-moment decisions that are investment mistakes. Here are 10 points that can help you form an overall framework of goal-oriented processes to follow:

1. Start investing early

2. Learn basics of financial planning or get a financial advisor

3. Focus on goal-based planning

4. Get spouse involved in financial planning

5. Maintain proper documentation

6. Don’t mix investment with insurance

7. Evaluate need for additional insurance such as disability cover

8. Diversify investments; avoid a stocks-only approach

9. Automate investments and some expenses

10. Rejig portfolio over time according to needs

***

Mistakes To Avoid

1. Giving little importance to consistent financial planning

2. Dipping into PF to fund short-term goals due to lack of goal-based investing

3. Assuming that insurance covers, PF and some savings are adequate to meet financial goals

4. Being short on insurance that provides adequate coverage for life or disability

5. Not maintaining a diversified portfolio; being skewed towards insurance or stocks

6. Making little effort to understand financial concepts or find a suitable financial expert

s.sanyal@outlookindia.com