1. Set Realistic Financial Goals

- I want to accumulate a corpus of Rs 10 crore in 10 years. What is the best way to do it?

- I earn Rs 40,000 per month. I want Rs 1 crore in five years. Where should I invest?

We often receive questions like these at Outlook Money. The trouble in answering these questions is that such goals are unrealistic in many cases because of the circumstances or income levels of the individuals.

The goal-setting exercise is the foundation of any financial plan, but if they are not realistic and achievable, the structure can never be stable.

“We can use a financial calculator or an excel sheet to answer how much to invest per month to reach a certain financial goal. But the question is whether these figures are based on any realistic goals, or their investment surplus,” says Melvin Joseph, a Sebi RIA and managing partner of Finvin Financial Planners.

Fixing Your Goals

The best way to fix your financial goals is to visualise the string of events and achievements that you think can make for a fulfilling life.

These events could be a combination of quality time spent with your family which could involve watching a movie or eating out together periodically, taking holidays once or twice a year, securing your child’s educational future, and an independent retired life in your sunset years.

It could also be about travelling the world or contributing to the society through volunteering activity and securing your retirement.

Each life event will entail a cost, which you will need to plan for.

How Much Can You Afford?

Once you have fixed your financial goals, the next step would be to plan how to achieve them. This may not be a straight decision. While it is easy to decide upon a random number that you would want to save for, it needs to be in sync with your income and savings.

It’s critical to strike a balance between your spending and saving. If need be, rethink some of your expenses to be able to meet certain goals. Here’s where you will need to be realistic. If you set too big a goal, which you cannot achieve even if you save and invest your entire salary in the highest-yielding instrument, it will be counter-productive. “Such people will be scared of the huge investment required and they will end up not investing at all,” says Joseph.

Understand your risk profile, too. Putting all your money in equities, which are volatile, may not suit a person who gets rattled by every big or small movement in the market. Understand your priorities and risk profile to reach the goals.

2. Always Have An Emergency Fund

In the summer of 2020, when several millions lost their jobs and livelihoods because of the Covid-19 pandemic, the importance of having an emergency fund dawned upon many people.

Financial planners advise building an emergency fund that can take care of at least six months of expenses. Some advisors also suggest keeping a year of expenses.

Which Expenses Should You Add up?

To start with, you need to take care of basic expenses, such as food and house rent, and utilities such as electricity, water, gas, mobile and Internet connection. Those in their 30s or 40s would also need to keep aside children’s fees and other mandatory expenses.

Next on the list would be your equated monthly instalments (EMIs) for home, auto or other loans. You wouldn’t want your debt to spiral when you have no income.

During periods of emergencies, you could exercise the option of stopping or pausing your investments, such as systematic investment plans (SIPs) and recurring deposits, but you should keep servicing your life and health insurance policies.

You should also keep a small medical fund aside, as many health institutions require you to make an initial deposit even if you have a medical insurance policy running, which comes into play later.

Cutting Corners

While you may have other regular expenses, such as OTT subscriptions and gym or club membership, limit or put a stop to them when you face a financial emergency.

These and other expenses, such as eating out and taking vacations can be clubbed under discretionary expenses, which you can do without when you are stretched. “There is no need to include discretionary expenses, because the purpose of the emergency corpus is to cover mandatory needs, and life can continue even in the absence of discretionary items,” says Shashi Singh, founder, FinMyn, a financial planning firm, and a Sebi-registered investment advisor.

You should also stop using your credit card, though you would still need to service your existing and previous dues.

Where Should You Keep It?

The emergency fund should be kept in an instrument where it does not lose value, and should be readily accessible at any moment.

“The ideal investment option could be a combination of savings bank account, sweep-in fixed deposits and liquid funds. A good limit on credit cards can come in handy for spontaneous needs, but should be used only if it can be paid off in time,” says Singh.

When you are starting to build an emergency fund, it makes sense to pool all the surplus cash you may have for no specific purpose. This may include idle money lying in dormant savings accounts or cash lying in your almirah.

“Next will be to take out money from the monthly surplus on a priority basis till a sufficient amount is accumulated for this goal,” says Singh.

3. Start Saving For Your Children As Soon As They Are Born

As a parent, you would want the best for your child, and this would start right from the moment the little bundle of joy comes into your life.

For most people, in fact, one of the biggest financial goals is saving for their child’s education and future needs. Yet, most people start planning for it much later.

When children are younger, parents usually focus on the immediate expenses, some of which may not be strictly necessary. This could be buying fancy toys for the child or decorating and redecorating the child’s room at every growth stage. Higher studies, though important, seems to be too far in the future. “Let him first go to school. Who knows whether he/she will even take to higher studies or become a sportsperson or a musician,” is what you will hear most parents say.

The truth though is that the sooner you start investing for your child, the more you will be able to save for his or her needs. With the cost of education steadily going up, especially with the proliferation of private institutions and the aspirations to send children abroad for higher education, you need to give time to your money to grow.

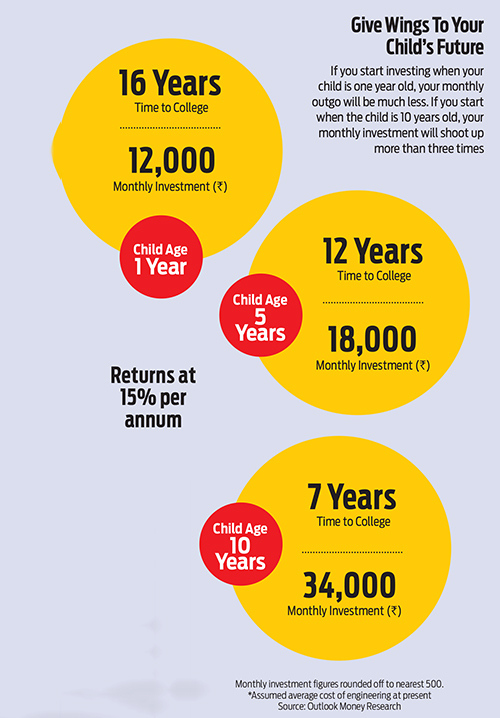

Sample this: the average fees for an engineering degree is Rs 30 lakh today, but considering a 7 per cent annual inflation every year, the cost will be nearly Rs 88 lakh by the time your child turns 17. If you start investing from year one, you would be able to achieve this goal with a monthly investment of a little more than Rs 12,000, assuming an average annual return of 15 per cent. If you start investing when the child is five, you will have to shell out around 50 per cent more at around Rs 18,000 per month. Start even later, say in year 10, and you will have to shell out around three times more, at around Rs 34,000 per month (see Give Wings To Your Child’s Future).

Choosing The Right Instrument

It is also important to choose the right combination of instruments for a long-term goal.

“The instruments can vary depending on how far away the goal is. If the goal is more than 10 years away, a higher component of equity (60-70 per cent), and the rest in debt will help. As the goal comes closer, the equity component will come down, and the debt component will go up. For a girl child, a small deposit scheme, such as Sukanya Samriddhi Yojana can be leveraged,” says Singh.

Often, parents make the mistake of investing in child-focused traditional insurance policies. These may not be the best choice for long-term investment, as traditional policies, typically, fall into the debt category of investments. In other words, in the long term, say 16-18 years, they may not give the rate of return that other instruments, such as equity would yield.

Instead, when deciding on the sum assured of an insurance policy, which you take for yourself with your children as nominee, take into account the estimated cost of their education as well and bump up the cover accordingly. The cheapest way of taking a large insurance cover is to settle for term plans.

4. Start De-Risking Your Portfolio Closer To Your Goals

If you have time on your side, investing in equity has many advantages. But you need to keep a close eye on the market once you are less than five years away from your financial goal.

When you reach that stage, you need to start de-risking your portfolio to ensure that the gains you have earned so far do not get wiped out. In other words, as you near your target, start shifting your investments from equity to debt.

This is important because a sudden meltdown in the stock market can bring down your portfolio returns drastically. The meltdown of 2008 and the market downturn later in 2020 are examples of how the market can get affected due to different factors, from macroeconomic events to health-related ones. Such sudden market movement can especially affect a long-term portfolio, which is typically built via equities that are considered among the most efficient instruments over longer periods.

Let’s understand through an example. Assume a parent needed to fund the child’s college education in 2020. If the parent had invested Rs 10,000 every month in an SIP in Axis Bluechip Equity Fund from August 2008 to August 2020, they would have made a corpus of Rs 28.70 lakh had they de-risked their portfolio in August 2018. However, if the parent had not been more watchful and continued their investment till 2020, when the market tanked due to Covid-19, and would have redeemed their investment in April 2020, when the session started, they would have had only Rs 19.10 lakh. Isn’t that a big difference?

De-risking, typically, applies to long-term goals, such as children’s education or retirement funding. These portfolios are built over several years, and their values are higher since these are big-ticket expenses.

How To De-Risk Your Child-Focused Portfolio?

If you are looking to fund your child’s education after 10 years or more, you would have a higher allocation to equities in the initial years.

Once the goal comes closer, you should reduce the weightage of equities and rebalance the portfolio towards debt instruments.

You can make use of tools, such as systematic transfer plan (STP), which lets you transfer your money from one asset to another in instalments. This will ensure that your returns are averaged out.

You should choose a combination of debt instruments, such as ultra short-term and liquid mutual funds along with fixed deposit accounts.

Just before admission, you need to move out the funds in a completely safe instrument, such as your savings account, which is easily accessible and makes it easier for you to transfer the fees, whenever required. Remember that many institutions may not leave a lot of time between the issuing of the admission list and the submission of the relevant paperwork and fees.

How To De-Risk Your Retirement Kitty?

If your portfolio is earmarked for retirement, you need to start reinvesting the money in lower-risk debt funds. When the time comes, you can initiate a systematic withdrawal plan (SWP) for the amount you need every month from this mode of investment.

You can also choose to de-risk a part of your portfolio that will last you for the next three to five years, while keeping a part of the corpus in large-cap funds to allow the total portfolio to keep giving inflation-beating returns. Discuss the bucket strategy with your financial advisor to implement this process efficiently.

Retaining equity exposure becomes easy if you can spare funds after providing for regular retirement income. This can also be followed if you receive fixed pension and only need some income from your investment to supplement that.

5. Don’t Ignore Your Own Needs

At an event organised in Gurgaon recently on holistic well-being, an adolescent psychiatrist asked the attendees, most of whom were parents, how knowing and participating in the struggles of their parents as children and going through phases of financial shortages had affected them. “Almost everyone said such incidents and experiences had made them stronger, mature and better individuals, and did not create a negative image about their parents in their minds,” says Amit Kukreja, a Sebi RIA and founder of amitkukreja.com, a financial advisory firm that organised the event.

Yet, most parents and even women are reluctant to share instances of shortages and financial pain with their children or family, and prioritise them over their own needs.

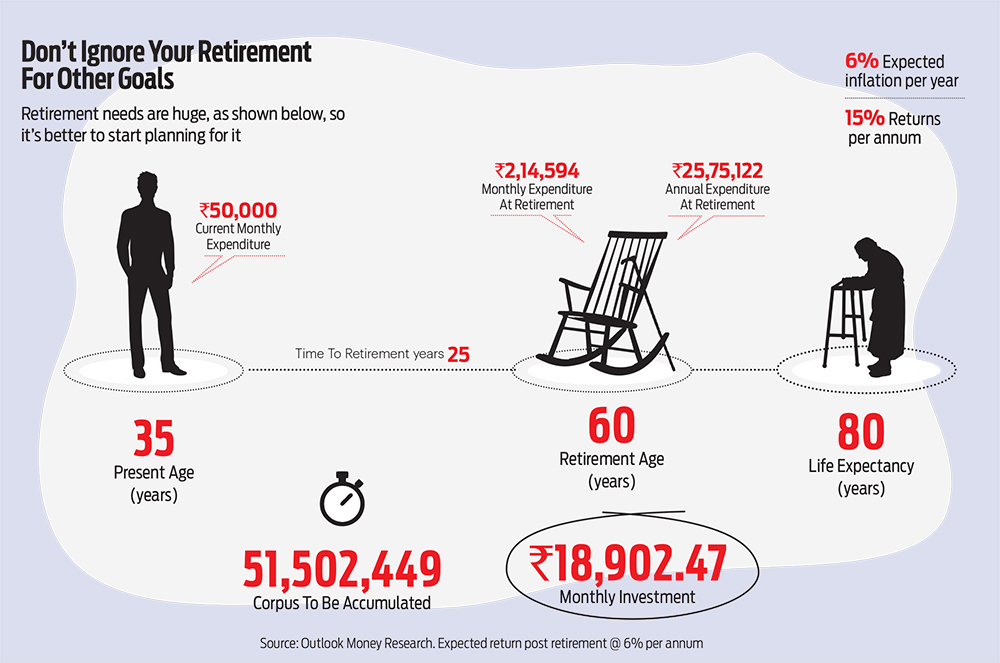

A classic example is retirement needs. It’s not uncommon to see parents dedicating all their savings to the higher education of their children and not keeping anything for a goal that can play an important role in how they spend their sunset years.

Sadique Neelgund, director, Network FP, a knowledge platform for personal financial advisors, and a certified financial planner, gives the example of an individual who has spent all his savings and has even taken debt from all possible sources to fund the overseas education of his son. “He took voluntary retirement, used up the money that he got from there. He even liquidated his Public Provident Fund (PPF) and other savings, besides selling his house and even his car to shore up the funds. The problem here is what will happen if the child doesn’t do well or chooses not to take care of his father at a later stage,” says Neelgund.

Have Open Conversations

Given the strong cultural practices in India, parents often find it difficult to prioritise themselves over the needs of their children. But it is important to have confidence in your child and let them go through a self-discovery phase.

“Introducing children to any kind of financial pain early on will only make them stronger and more understanding. Plus, you will be able to see them navigate it while they are living with you instead of doing it on their own at a later stage,” says Kukreja.

Let them try to figure out what they want to do with their lives within the resources available. State clearly if you do not have the financial capacity, but that doesn’t mean you leave them in the lurch. “You can assess how you can support them realistically. If you can’t afford the fees, take an education loan. Give them moral and emotional support to pursue their dreams, and have open conversations,” says Kukreja.

Put A Structure In Place

Such instances also arise when you have lack of clarity. “You start feeling anxious when you do not have clarity. Once you put a structure to the way you are thinking, you know your limits, which can be conveyed to children,” says Neelgund.

Goal planning can help structure your finances. “Putting a structure to your finances can make you comfortable with what you have without the feeling of guilt. Not everything will be clear at the beginning, but things will start falling into place over a period of time,” adds Neelgund.

Talking about the individual he spoke about earlier, Neelgund says if he had planned for his son’s overseas education right from the beginning, he may have been in a better position to fund his child’s education.

Enjoy The Journey

While being organised can help you achieve your goals, don’t forget to live a fulfilled life along the journey.

“While you cannot live today as if there is no tomorrow, you should not keep everything for tomorrow. What you can enjoy today, you may not be able to enjoy at the age 50 or 60. The trick is to balance today and tomorrow,” says Joseph.

Work with your financial advisor to have better clarity about the different goals and make sure your own well-being finds a place too.