1. Start Investing Early

It is not uncommon to see people putting off the decision to save and invest for later years—when they earn more money, or when they have spare money after taking care of their commitments, or, when they know what they need the money for.

That’s not the best strategy, though. Financial commitments and responsibilities only go up with time and increasing salary. So, you will never have extra to spare, unless you have the will to do so. Moreover, even if you don’t have any familial goals, retirement is a reality, no matter how far it seems.

In fact, the earlier you start investing, the better it is, even if it is a small amount. That’s because the power of compounding shows its magic only with time. “When people start out in their jobs, the investible money is less, but time is their best friend. So, it is advisable to invest whatever surplus amount young earners have. As they get salary increments and better jobs, they should increase their committed investments,” says Bhuvanaa Shreeram, a certified financial planner and co-founder of House of Alpha, a wealth management firm.

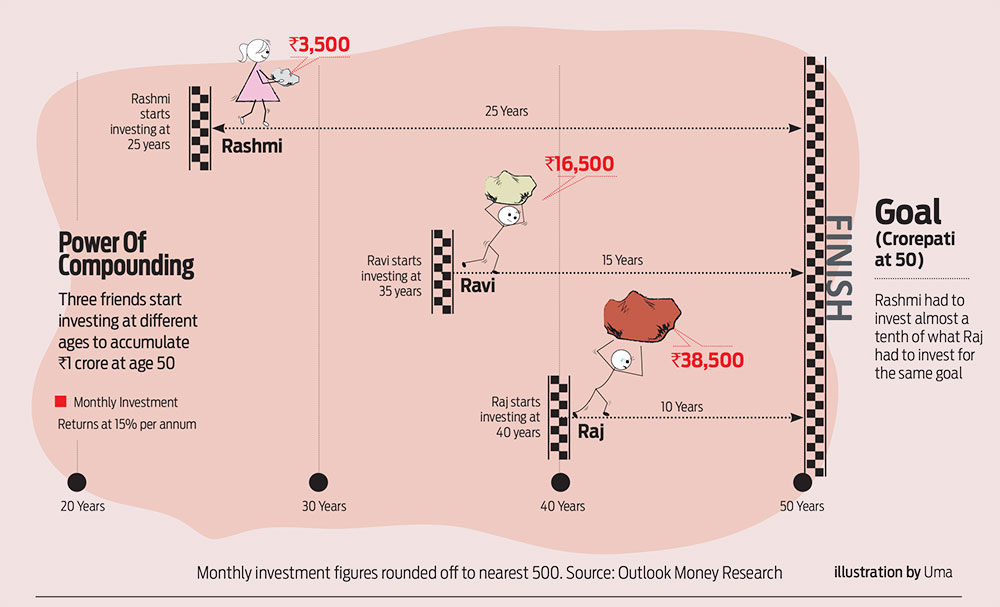

Here’s how compounding works its magic in the real world.

Suppose three friends—Rashmi, Ravi and Raj—start investing at different ages. Rashmi starts investing when she is 25, Ravi at 35, and Raj at 40. If they are all saving to accumulate Rs 1 crore at age 50, Rashmi will invest for 25 years, Ravi for 15 years and Raj for 10 years. To reach the same goal of Rs 1 crore, Rashmi will only need to invest around Rs 3,500 per month, Ravi will have to invest more than five times, and Raj more than 12 times (see Power Of Compounding).

Note that the difference in the total amount invested by the three is also huge.

Over 25 years, Rashmi would have invested around Rs 10.5 lakh, Ravi would have put in around Rs 30 lakh and Raj would have saved around Rs 46 lakh. In other words, Rashmi invested the least of money to reach the same goal. That’s because she had a longer term and the power of compounding worked in her favour.

2. Fit Saving Into Your Budget

The idea of starting to save early may seem enticing, but in practical life, it could seem impossible to save money in the first couple of years of your job. There could be multiple reasons for this—there could be debts to settle, such as an education loan, financial dependents to take care of, or desires and wants, such as buying the latest phone or gadget or car.

What can help you in this scenario is making a budget and ensuring that your ‘savings and investments’ find a place in that budget.

Shreeram of House of Alpha says that people need to sit with their income and expenses sheet, otherwise “they will not own their expenses, but rather their expenses will own them”.

To start with, make a list of your non-discretionary expenses. Organising them at the start of the month is important. “Create a plan and settle the non-negotiable expenses first, like child’s education fees, utility bills, and others,” says Shreeram.

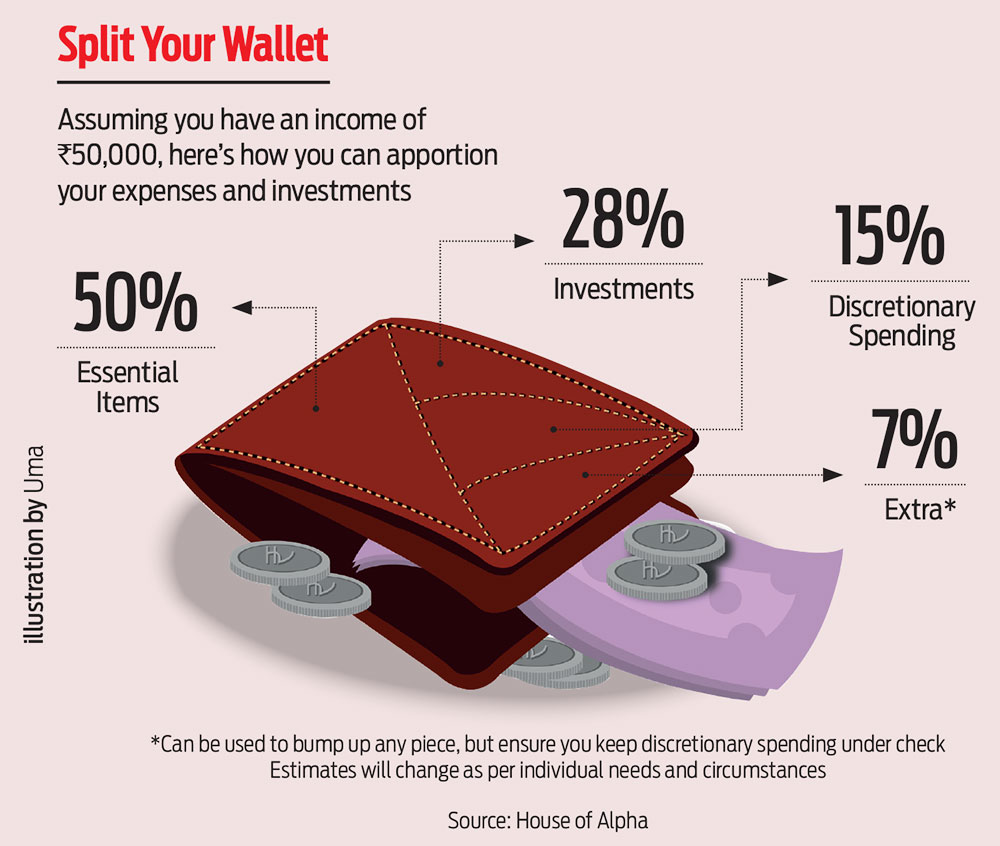

If that’s taking up almost your entire salary, look at where you can make adjustments, such as controlling your utility or petrol bills. “Control your expenses to the extent you can afford, and always organise and divide your expenses into groups,” says Shreeram.

Whatever is left with you can be divided into savings or investments and discretionary expenses. While you cannot ignore the non-negotiable expenses, such as paying off a loan instalment or utility bills, you can cap your discretionary expenses, such as eating out or impulsive shopping.

For people who can afford to do so, Shreeram advises keeping 50 per cent of the salary for regular expenses, and investing at least 15 per cent.

The list of things you want to spend on can be never-ending, so it makes sense to apportion a part of your salary to savings, before you firm up the discretionary spending list.

There is no harm in having an aspirational mindset, but when fulfilling those aspirations takes centrestage over saving for the future, then it could well become a problem in the long run.

3. Be Careful With Credit

Our mind works in mysterious ways. Let’s say your salary is Rs 80,000 a month and the latest iPhone model costs Rs 84,000. You would think twice before buying an iPhone. However, if someone tells you that you need to pay Rs 7,000 every month for 12 months, the iPhone suddenly looks affordable to you.

With the advent of easy-to-take-credit services, such as buy now pay later (BNPL), and credit cards, which require minimal or no paperwork, taking a luxury item or an expensive holiday seems easier. Even taking personal loans is easy now with the know your customer (KYC) process becoming Aadhaar-enabled and instant.

But there is a catch. Whether it is a credit card, personal loan or a BNPL equated monthly instalment (EMI), you need to make regular payments. If you take too many loans, you may find it difficult to service all the EMIs. The moment you default on your EMIs, the late fees or very high rates of interest will make that luxury item much more expensive than you initially thought.

Says Arijit Sen, a Sebi-registered investment advisor and co-founder of Merry Mind, a Kolkata-based financial advisory firm: “One should not ignore the family’s cash inflows and outflows. Impulsive buying pushes people to opt for loans. Delay in repaying high-cost loans may lead people into debt traps.”

Personal loan interest rates could be as high as 24 per cent, the rate of interest on credit cards could be as high as 42 per cent annually, while that on late payment of BNPL dues could be up to 30 per cent.

When you miss one payment, interest is charged, when you miss another payment, it adds up, and very soon you may end up with a debt burden that is difficult to handle.

“In today’s fast-paced world, one can easily obtain credit in the form of BNPL, credit cards, and even 10-second personal loans. While you may be tempted to avail of easy credit and splurge on things that you don’t necessarily need, just stop to think again. If an individual loves to shop compulsively for luxury goods, it’s quite easy for them to get into a debt trap, one that can often take years to clear,” says V. Swaminathan, executive chairman, Andromeda Loans and Apnapaisa, a loan distribution arm and its digital arm, respectively.

Is It Worth It?

Luxury goods are, by definition, expensive. The interest paid on such loans, typically, make them even more expensive.

Most luxury goods are bought either to boost self-esteem, including a feeling of accomplishment from hard work, or to gain acceptance from others. “Either way, getting into debt just to get such a feeling fulfilled, which at best would be temporary, would only bring long-term pain for short-term pleasure,” says Colonel Sanjeev Govila (Retd.), a Securities and Exchange Board of India (Sebi)-registered investment advisor (RIA), and CEO, Hum Fauji Initiatives, a financial planning firm.

What Can You Do Instead?

Saving for that coveted luxury good or holiday will ensure you don’t land in a debt burden and spend on what you can really afford. It’s just about delaying that gratification a bit.

“One of the best options to purchase luxury goods is to start saving a little every month very early on, so that it builds up over time,” says Swaminathan.

It’s certainly not wise to borrow money for things you cannot afford.

4. Maintain A Healthy Credit Score

Your credit score is an indication of your ability to repay your loans based on your past repayment activity.

Credit scores range between 300 and 900 points. A credit score above 750 is considered good and healthy, but a score below 600 indicates caution. A healthy credit score ensures that you get loans at the lowest rate of interest.

How To Keep Credit Score Healthy?

Pay Your Instalments On Time: Paying your dues on time is one of the fundamental steps to maintain a good credit score.

For instance, it is best to pay your entire credit card bill every time before the due date. If that’s not possible, pay as much as you can. “One, credit cards charge very high interest on the unpaid amount, thus increasing your burden. Two, they also give the impression of being credit-hungry,” says Adhil Shetty, CEO of BankBazaar.com, a financial services website.

Check Your Credit Score Regularly: Check your credit report at least once a quarter if not every month. “In times when BNPL and ultra-short-term credit has become common, it is wise to keep a close eye on your borrowing pattern,” says Shetty.

Regularly checking your credit score will help you spot discrepancies early on for you to take corrective steps. For instance, a couple of months ago, there were cases where loans were issued in the names of people who hadn’t applied for them. The unpaid dues got reflected in the credit report. “Checking your score regularly would have helped them flag the issue much earlier, and prevented their credit scores from being impacted,” Shetty adds.

Don’t Randomly Apply For Fresh Credit: Each time you apply for a loan or a credit card, the bank raises a query for your credit history. It is also advisable not to approach multiple banks with loan applications. Such frequent requests give the impression of being credit-hungry and can bring down your credit score significantly.

If your credit score is low, do not worry. Being disciplined when making your payments and keeping your credit behaviour in check can make and set things right for your credit history.

5. Organise Your Bills

Do you often miss payment deadlines and end up paying a penalty, or face inconvenience due to disconnection in service?

Well, automating your payments could help you overcome that problem. Whether it is paying your electricity or credit card bill, or, your child’s school fees, most services and expenses can now be put on the auto payment mode.

How Do You Automate Payments?

Various fintech apps and websites can help you in this matter. For instance, you can set up an autopay mandate on the BHIM UPI app for recurring payments, such as insurance premium or systematic investment plan (SIP) for your mutual fund investments. Fintech apps such as Mobikwik and Paytm offer the option of paying utility and other bills via the BNPL option or UPI’s autopay option, depending on the user’s choice and the supporting application’s operating conditions.

Some payments can be automated through your savings account as well, using the National Automated Clearing House (NACH) infrastructure.

Don’t Lose Control

While automating your payments and expenses can benefit you, you should ensure that you don’t lose track of how much you are spending and where. Shreeram of House of Alpha says over-reliance on automation of expenses and payments can be dangerous.

“Jot down the expenses somewhere and compare it with the previous month’s expenses to ensure they are under control,” she advises.

This is especially true when it comes to credit card bills, which may not be fixed every month, she adds.