1. Don’t Fall For Fads And Finfluencers

In September 2021, when Bitcoin prices crossed $65,000, cryptocurrencies became part of living room conversations. It became a craze to invest in them as they were seen to have the potential for earning quick and high returns.

Soon after, financial influencers or finfluencers were seen pushing products offered by certain crypto trading platforms on social media. For instance, four popular finfluencers were seen promoting curated products of Singapore-based crypto platform Vauld, which suspended its operations in June, leaving several investors in the lurch.

As of August 2022, Bitcoin is hovering at $24,000, and several investors have burnt their fingers.

Examples of following an investing fad were also seen during the dotcom bubble in 2000, when people flocked to related Information Technology stocks blindly. The bust that followed wiped out several investors’ money.

Says Abhijit Talukdar, a Sebi-registered investment adviser and founder of Attainix Consulting, an advisory firm: “If you don’t consider the suitability factor of an investment and run only after current fads, then it may erode your money.”

The Lure Of Fads And Finfluencers

In this day and age when traditional marketing has been replaced by social media marketing, it’s easy to get swayed by information provided on social media by finfluencers, or by ongoing fad.

The jargons in the financial landscape hook people to short and snappy videos produced by finfluencers that can be consumed through mobile phones. “We all want information when we go out to buy a product. As long as information, such as risks and benefits or simplification of products is being provided, it’s okay. The problem arises when there is dissemination of advice,” says Priya Sunder, director, PeakAlpha Investment Services, and a Sebi RIA.

As the popularity of an investment or idea increases and it becomes a fad, more of such videos and information start getting circulated, as was seen in the case of cryptos.

What the finfluencer community has done is at least spread awareness about products, but people still don’t know how to seek genuine advice. Sunder cautions, however, that since most finfluencers are not qualified, investors need to be prepared for risks if they are following such advice.

Lack of awareness along with the absence of a thriving advisory ecosystem contributes to this. Says Sadique Neelgund, director, Network FP, a knowledge platform for personal financial advisors, and a certified financial planner: “The younger generation is still not aligned to human advisors, and wants to do-it-yourself (DIY) because of lack of affordability and trust. Anyone and everybody will work with a financial planner the day they can afford one, find one, and trust one. At present, the demand and supply are not moving together because of India’s huge population.”

Who Should You Trust For Financial Advice?

It is always better to go to genuine advisors. Think of it as going to a doctor versus following a prescription that is given by an unqualified quack on a video on popular social media.

According to regulations by the capital markets regulator, the Securities and Exchange Board of India (Sebi), only Sebi registered investment advisors (RIAs) are authorised to give financial fee-only advice. “These individuals are heavily regulated and giving financial advice is serious business. It’s not meant to be like a game, or speculative, or exciting in any way. It is meant to be boring, but that is what works,” says Sunder.

To be able to advise someone, financial advisors need to consider the overall portfolio and life circumstances of an individual as the one-shoe-size-fits-all approach doesn’t work. “You are unlikely to recommend the same product or scheme to a 15-year-old as well as a 60-year-old. Likewise, a high-risk stock may work wonders for one individual, but won’t work for another,” says Sunder.

Neelgund cautions that though there is a large network of finfluencers, distributors and agents, not all of them can be trusted for genuine advice.

What Can Be Done About It?

Investors need to stay away from fads and need to be able to distinguish between genuine advice and a push product. Talukdar advises people not to chase returns, but rather focus on their personal financial goals. They also need to remember that “there’s no quick way to get rich”, says Sunder.

Experts say that corrective measures should be taken at the regulation level. “Anybody and everybody can put out short reels and videos on all kinds of money advice. It’s baffling how they can put the investing community at risk, particularly youngsters, and get away with it,” adds Sunder.

A spokesperson for Rachana Ranade, a Pune-based chartered accountant and one of the most popular financial influencers, said in an email communication, “Regulations on financial influencers has been the topic of discussion throughout the digital space… it is hoped that the concerned authority, i.e. Sebi, will take appropriate measures.”

2. Be Wary Of Costs And Commissions

There’s no such thing as a free lunch, this is a very well-known proverb. Needless to say, all investments come with a cost. Typically, these costs are charged in two forms: transaction cost and ongoing cost.

You pay the transaction cost when you buy or sell, like for instance, when you buy or sell shares or exchange-traded funds (ETFs) through a broker. Ongoing cost, on the other hand, is the one which you pay throughout the tenure of your investment. These include fund management charges by mutual funds, or, mortality and premium allocation charges by insurance companies. These charges are ongoing costs, which you incur as long as you remain invested.

Any type of cost affects your returns. That said, you cannot avoid certain costs. For example, the fund management charge you pay in a mutual fund is a cost that you pay for the skill of choosing stocks and investments that you may not be able to do on your own. Similarly, in a term insurance plan, you pay the mortality cost, which is basically a charge towards the risk to your life.

While you may not be able to avoid paying costs altogether, you should be wary of high-cost products that impact your returns in a big way.

So, here are some things to keep in mind on managing costs.

Split Insurance And Investment

A traditional insurance product is likely to have multiple charges apart from mortality cost that will eat into your returns. These could include charges on premium allocation, fund management, administration, and so on. A part of the premium will also go towards paying the distributor commission. Moreover, the insurance cover may not be adequate to provide you with complete protection.

Therefore, it is always advisable to keep your insurance and investment needs separate to save on cost.

Direct Vs Regular MFs

You can invest in mutual funds (MFs) from a host of online and offline sources. If you are comfortable with choosing your own funds and managing your own portfolio, you should invest in direct mutual funds, either directly through the fund house’s office or website or through the registrar and transfer agent (R&T). However, if you are not sure of your investing acumen then you can take the help of registered financial advisors who can help you choose the best funds.

Low-Cost Vs Full-Stack Brokerage

New-age brokers rely heavily on technology, and thus have a low operating cost, which translates into low brokerage on trades. Most discount brokerages do not charge any brokerage on investment, but only on intra-day trading for stocks, and, future and options buying. If you can spot the winners in the stock market on your own, then go for discount brokerages.

But if you are new to investment, it would be better to invest with full stack brokers, as their services can help you plan your wealth and finances. Scout for one which has lower charges and better services.

3. Align Investments With Tenure Of Your Goals

Investors often make the cardinal mistake of investing just for the sake of investing. This approach can, however, lead you into buying products that are unsuitable to your needs.

Just as you choose different modes of transportation to reach different destinations, such as a car to go to your office and a train or plane to go to another city, you need to board different investment vehicles to reach different financial goals depending on their tenure.

To be able to do this, you must first define your short-, medium- and long-term goals. Short-term goals are those that are to be achieved within a few months or 1-2 years, medium-term goals in the next 3-5 years and long-term goals beyond five years.

Debt For Short-Term Goals

To be able to fund short-term goals, such as accumulating the downpayment of your house or taking a holiday, you need to look at safer instruments because you need the money in a short span of time.

Capital protection should be your primary concern to cater to such goals. That’s why equities may not be suitable for such a time frame, as the markets are volatile in the short term. Fixed-income and debt instruments, such as bank fixed deposits and liquid mutual funds that are less volatile can provide relatively stable returns.

Hybrid For Medium-Term Goals

In the medium-term, inflation can eat into some of your returns. Therefore, your investments need both safety and growth.

The hybrid strategy of having a mix of debt and equity instruments can work best for such goals. The debt component will provide stability to the portfolio, while the equity portion can fetch the returns.

Ideally, you should keep the portfolio tilted towards debt. Also, increase the debt component as you inch closer to your goal.

Equity For Long-Term Goals

Typically, retirement and children’s higher education are goals that have a time horizon of 10 years or more.

Capital appreciation should be your primary concern for such goals. There is enough time for you to let your portfolio grow, which can happen via equity exposure. Over long periods, equities have the potential to outperform every other asset class.

If you lack the expertise to invest in equity markets directly, take the mutual funds route, or, consult a financial advisor. Here, too, as your goals get closer, start switching your investment to debt instruments to ensure capital protection.

4. Diversify Your investments

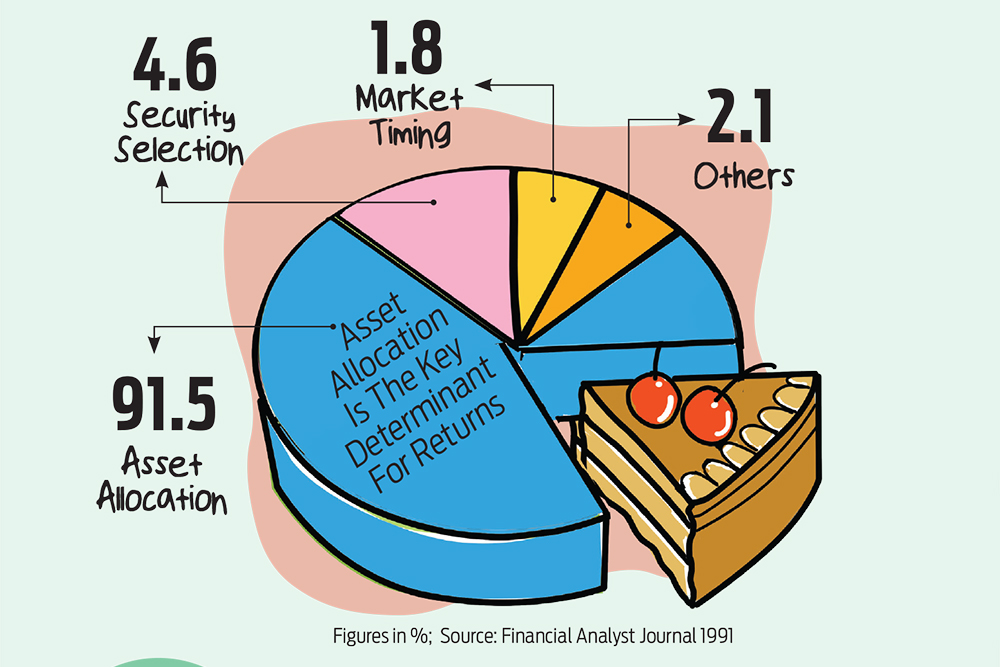

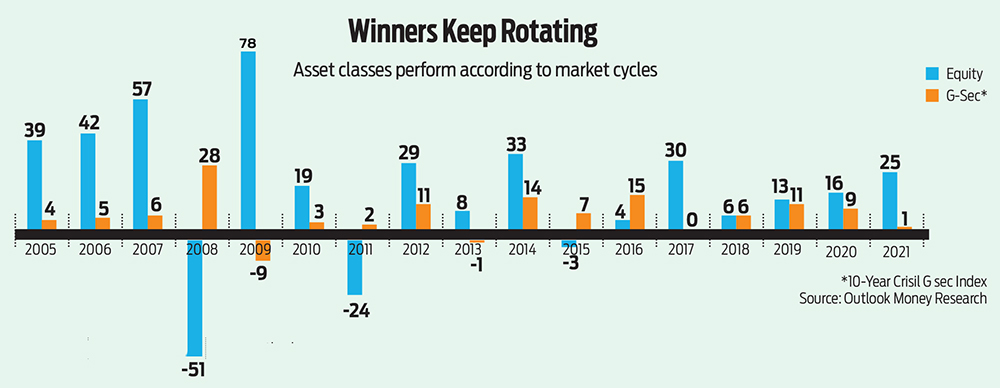

It’s been reiterated time and again that asset allocation is the key to creating wealth over your investment tenure. That’s because each asset class has unique characteristics as far as risk, returns and liquidity are concerned. The trick to make the most of asset allocation is to diversify your investments in various assets.

Investors often get confused between asset allocation and diversification, as these terms are often used in tandem. To put it simply, diversification is an extended version of asset allocation. Asset allocation is, typically decided according to the risk-taking ability of an individual along with the time horizon needed to reach a financial goal.

Diversification comes into play for the implementation of the asset allocation plan. That said, investors should diversify within asset classes, too, as it can bring down the portfolio risk factor drastically.

Let’s understand this with an example. Suppose you need to allocate 60 per cent of your portfolio to equities, you may not want to put all your money into a single stock or mutual fund. For example, if you invest Rs 10,000 in a single scrip and its price drops by, say, 50 per cent, the value of your corpus will fall to Rs 5,000. Now, let’s assume that the scrip forms only 20 per cent of your portfolio. Now, if the scrip falls by half, and the rest of your portfolio stays at the same level, the net impact on your portfolio will be limited to just Rs 1,000.

How To Diversify

Don’t diversify just for the sake of diversification. There should be a logic to it, which should flow from what you want from your investment and how much risk you are willing to take. For instance, if you are investing in stocks, you should make a basket of stocks picked from across sectors and market capitalisation.

Also, don’t over-diversify. Tracking too many investments within an asset can become very challenging. Besides, diversifying across similar instruments, such as having too many large-cap funds may not make sense either. Typically, having 2-3 stocks or schemes from one sector or market cap should be enough.

Asset allocation and diversification are the key determinants for your portfolio returns and can help you mitigate risk, so undertake these exercises wisely.

5. Keep Emotions Out Of Your Investments

Letting emotions drive your investment decisions can land you in trouble. The classic mistake that people make is buying at the peak and selling at the bottom due to emotions of greed and fear. “People end up doing that no matter how much you educate them. Only those who are wise enough due to past experiences or who have a financial advisor to ensure checks and balances are able to overcome such behaviour,” says Neelgund from Network FP.

When the stock market is in a bull run, investors are usually driven by greed; in a bear phase, fear comes into play when investors find losses in their portfolios.

“Emotions can play an adverse role in how you perceive your investments. If you are driven by greed, you are likely to attach more value to your investments than their actual worth. On the other hand, if you are driven by fear, you are missing out on a big opportunity to grow your money,” says Amit Kukreja, a Sebi RIA and founder of amitkukreja.com, an advisory firm. Such behaviour ultimately affects your overall financial plan, he adds.

The Greed Factor

When the market is in a bull run, typically, the emotion of greed takes over, and investors participate enthusiastically in a bid to make more and more returns. The upswing in the market leads people to be gripped by a recency bias, where they just look at the returns in the immediate past. What eggs on this behaviour is herd mentality, where they draw confidence by the behaviour of others.

“If you are driven by greed, you are likely to estimate a similar return, demonstrated by recent performance, forever, which is not going to be the case because the moment the market corrects, you will not see similar returns,” says Kukreja.

The Fear Factor

The opposite is true in a bear phase, when investors, typically panic and pull out their investments in the fear of losing more. This usually happens when you over-accumulate during a bull phase, and once the market corrects and the value of your investment falls, you are struck with fear. Loss aversion comes into play in the bear phase.

Adds Kukreja: “If you let emotions hold sway, once the market corrects, the fear factor will set in, and you will end up booking losses, or will end up holding even poor performers. In a bear market, you have the opportunity to buy, but because you are struck by fear, you are not able to make that investment decision, even if there is a mouth-watering deal which you could enter now.”

Balanced Decision

The only way to make a balanced decision is to keep your emotions in check. In such situations, correlating your investment decision and your financial plan is important.

Empirical analysis can help you make calculated decisions.

Adds Kukreja: “Rather than getting carried away by recent performance, look at past performance. Have a clear focus and ensure your investment decisions are aligned with your goals.”

Neelgund cites an example from Yogic Wealth, a book written by financial planner Gaurav Mashruwala that draws a correlation between people meditation and investing. It says that only people who have mental strength can navigate the ups and downs of the market.

6. Don’t Rush To Buy A House

It is not uncommon to find portfolios that are heavily skewed towards real estate. That’s because buying a house is a dream that everyone cherishes, so much so that it often becomes one of the first investment for people.

But does it make sense to rush into buying a house sooner than later? Here are two questions you should ask yourself before making that decision.

Are You Ignoring Your Other Goals?

A house is a high-cost investment, perhaps the largest in most portfolios, and if you haven’t thought enough about it properly, it could come at the cost of your other financial goals.

“It is important to plan for other important financial goals, such as retirement and child’s higher education,” says Melvin Joseph, a Sebi RIA and managing partner of Finvin Financial Planners.

If the equated monthly instalments (EMIs) do not leave enough room for investment towards your other goals, you could consider defering the decision. “Though the minimum downpayment required is, typically, 20 per cent of the property cost, it is better to have a higher downpayment to reduce the EMI burden,” says Joseph.

Make accumulating adequate downpayment a part of your financial plan. This will ensure that you are able to fund your other goals as well.

Will You Live In That House?

Investing in a house that you may not be able to live in can create multiple problems.

One, you would have to remotely manage and maintain it, which may not be easy. Two, you may have to pay EMIs as well as rent, which can affect your cash flows. Three, since it would claim a large part of your investment, your portfolio may not be diversified enough. Four, since it’s not liquid—it’s not easy to sell a property at short notice—you may not be able to fund your other goals with it.

“People are highly mobile these days. They move cities and even countries as their careers progress. It is better to stay on rent (and not buy a house) till the time you are clear on where you plan to settle down,” says Joseph.

Remember that the house you live in is, typically, not counted as investment as it is assumed that you would not sell it unless you are upgrading to a bigger or better house, or if there’s an emergency.

7. Marry Tax-Saving With Your Needs

For most people in India, tax saving is about buying multiple life insurance policies and investing the balance in small savings schemes. However, these instruments may or may not have a role to play in your overall financial plan.

For instance, if you have no financial dependants, you may not necessarily need a life insurance. Similarly, if you are in your 20s, you may want to invest in debt instruments with a lower lock-in period rather than in schemes such as Public Provident Fund (PPF) to fulfil your short-term goals, and in equities for your long-term goals.

Therefore, it is important to choose tax-saving options that allow you to not only minimise the tax outgo, but also build long-term wealth. The good part is that there are a variety of tax-saving options available under Section 80C, the largest and the most popular deduction basket available under the Income-tax Act, 1961.

For instance, if you want to create a protection net for your dependants, buying life insurance policies will also provide you with tax benefit. On the other hand, those looking for equity exposure can invest in equity-linked savings schemes (ELSS), which come with a lock-in of three years, while those looking for long-term debt investments for portfolio diversification can opt for PPF, which has a lock-in of 15 years. While each of these investments is eligible for deduction up to Rs 1.5 lakh, you can divide your investible corpus available under Section 80C among the various instruments as per your needs.

“The best time to start planning your tax-saving investments is at the beginning of the financial year. Most taxpayers procrastinate till the last quarter of the year, resulting in hurried decisions. Instead, if you plan at the start of the year, your investments can reap the benefit of compounding and help you achieve long-term goals,” says Archit Gupta, CEO and founder, Cleartax, a tax portal.

Things To Keep In Mind

The deduction limit under Section 80C is limited to Rs 1.5 lakh, even if you invest more.

Many expenses such as children’s tuition fees and home loan principal payment and mandatory investments such as Employees’ Provident Fund (EPF) are also eligible under Section 80C.

If these expenses and investments exhaust the Section 80C limit, you should invest only keeping your financial goals in mind.

An additional deduction of Rs 50,000 is available under 80CCD (1B) for investment in the National Pension System Tier-I account, taking the 80C limit to Rs 2 lakh.

You can avail yourself of deduction under other sections too. For example, health insurance premiums for self, family and parents are eligible for deduction under Section 80D, while interest payment towards home loan EMIs are eligible up to Rs 2 lakh under Section 24B.

8. Review Your Portfolio Regularly

Your portfolio should have a periodic review much like you should get a health check-up done at regular intervals. It is advisable to review it at least twice a year. Rebalancing and review are more relevant during a bull or a bear run.

Rebalancing During Bull Market

When share prices increase, the equity component of your total portfolio may acquire greater weight than you are comfortable with. Use the opportunity to weed out the duds in your portfolio. In case of a stock, if a company is consistently underperforming its peers, or you spot any fundamental problem with it, weed it out. Likewise, if a mutual fund scheme is consistently underperforming its benchmark and peers for the last 6-8 quarters, exit it for good.

During this phase, you might even get a good price for the stocks and funds that you are thinking of liquidating.

Next, see that your portfolio is balanced, and that it is giving you a play on the broad market stories. In a runaway market, it is tempting to move out of sectors that are not doing well, and enter the ones that are. Ensure that your portfolio is diversified.

Rebalancing During Bear Market

When the market falls, the equity component may fall below the desired weightage that you need to maintain to achieve your long-term financial goals.

However, rebalancing during this phase is more challenging. When the market enters a bear phase, typically, investors get swayed by the negative sentiment. Usually, the knee-jerk reaction to minimise losses is to sell your investments that are profitable.

Instead, your decisions should be based on your asset allocation that serves your financial goals. If the equity allocation has gone down, rebalance it with debt from your portfolio. Avoid making major changes in a bear phase.

Things To Keep In Mind

Before rebalancing, evaluate the related taxation and transaction costs.

Also, formulate a rebalancing plan. You might want to top up your equity with fresh investment during a bear phase, if it has gone below the desired level. Similarly, when there’s too much equity, you may want to book some profit and reinvest it in accordance with your asset allocation.

9. Automate Your Investments

Are you among those who wait for the stock market crests and troughs before investing or withdrawing your money? While that may work in your favour sometimes, the strategy may not always pay off. The market is unpredictable and it’s nearly impossible to time the market.

One way to ensure that the market doesn’t spring any surprises for you is to invest and withdraw systematically through automation. If you are a mutual fund investor, systematic investment plans (SIPs), systematic transfer plans (STPs) and systematic withdrawal plans (SWPs) can help you average out the returns. For other types of investments, you can set up a standing instruction or ECS mandate through your bank account.

SIPs

The biggest benefit of having an SIP is that it ensures that you invest a fixed amount every month. It is easier to save first and make do with the sum you are left with than going about the month’s expenses and saving what is left. In a lot of cases, the latter strategy may dent your savings amount.

The other benefit, of course, is that you keep investing, irrespective of the market conditions. When the markets are low, you end up accumulating more units, and vice-versa. At the end, the number of units in your account gets averaged out.

“Automating your mutual fund investments via SIP helps you avoid the stress of timing the market and creates a fixed mandate for you to invest periodically without having to spend the investible money into buying something else,” says Abhijit Talukdar, a Sebi RIA and founder of Attainix Consulting, a financial advisory firm.

STPs

STPs can be used when you have a lump sum that you want to invest in equities. Investing a lump sum in a staggered manner can help ride out market volatility. In such cases, the sum is usually parked in a debt fund and is systematically transferred to an equity fund of your choice.

STPs can also be used when you are rebalancing your allocation from equity to debt, or vice-versa.

SWPs

SWPs give the option of withdrawing a pre-determined part of your investments periodically. This can be used to get regular income, and can also minimise the risk of booking your profit at one go and seeing the market zoom up after that.

These can come handy for pensioners. “After building a sizeable corpus through investments spanning several decades, if they withdraw it all at once, the investment cycle will stop, and the money will not grow further. SWPs ensure that the balance keeps on growing even as you keep withdrawing bits from it ,” says Talukdar.

10. Declutter Your Investments

The quaint Japanese art of decluttering one’s desk finds resonance in the world of personal finance, too. In its extended form, it prompts a thorough cleansing of portfolios. It urges an investor to get rid of stocks that seem to lag forever, funds that have underperformed consistently, and insurance plans that add no perceptible value of any kind.

Portfolios frequently tend to have dark corners; the latter often appear as pools of persistent non-performers. Each pool adversely impacts the overall returns; performance is often sacrificed at the altar of bad decisions, or even legacy. Let us, for the sake of brevity, compress this into three sections—stocks, funds and insurance.

Stocks

A handful of dud stocks may just be sitting somewhere in your demat account, figuring religiously in your list of holdings every month, but marked almost forever in red. For all you know, these may be small-cap stocks. Many seem to have fallen out of favour—for want of a better word, their traded volumes would be poor.

Do you really have to carry such a chip on your shoulder? Or is it time to simply hack the non-performers?

These issues must be viewed through the prism of practicality. If the stocks in question are high-conviction bets, there is a case for bearing the old burden despite the pressure they evidently exert.

Mutual Funds

A similar story plays out in the case of funds as well, especially if the general market trends are not conducive enough. A persistent non-performer would probably not outsmart its benchmark index when the scenario is challenging (read Investor Sentiments Have Turned Negative).

In such a scenario, a comparison with its peers may be warranted. It is easy to compare portfolios, and a unit holder is free to redeem his/her position and switch to another fund in the same category if he/she so wishes.

The theory holds particularly true with equity or hybrid funds with decent equity exposure. Moreover, duplication must be avoided, as every fund category has a large number of competing products.

Insurance

Poorly chosen insurance plans make the worst kind of deadwood, especially because of their long holding periods. A typical endowment or money-back policy often poses a burden, and provides little succour to the insured. This mostly becomes evident when the policies require high premia payments.

Very often, as practical experience demonstrates, an individual ends up with multiple insurance products of the same genre. Collectively speaking, these may mean a large periodic outgo as traditional insurance is, typically, expensive. The idea here is to provide risk management solutions, not investment returns.

The same, however, does not apply to certain modern categories of unit-linked insurance plans (Ulips).

To-Dos

- Speak to your broker on the laggards. Most brokers provide analyst reports as well as their own distinctive calls. The latter would help you decide on the next course of action. If you have purchased on your own out of conviction, a second opinion might be necessary.

- Check your non-performing funds’ portfolios. Are the fund managers proactive enough? Have they changed their asset mix in keeping with the latest market trends? Have they altered weightages with a view to improve performance? These are some of the questions that you must ask to see if they align with your investment strategy.

- Your insurance plans need a comprehensive review. Are there valid reasons to terminate a few me-too policies? If you indeed take such a step, how much would you sacrifice in the process? That is a critical poser.

- High expenses are your collateral damage. If you decide to drop a few duds, what are the costs involved? A clear idea of these expenses is necessary.

- Taxes are the investors’ worst enemy. Sales, redemptions, premature withdrawals and the like could invite capital gains tax. The impact of genuine transactions aimed at profit-booking throughout the year must be monitored, and suitable tax-saving measures should be taken.

A portfolio is likely to remain ship-shape if certain basic norms are followed. Conscious investors would not allow it to happen in the first place, nor would they ignore the incidence of costs and taxes afterwards.