The exuberance that gripped the stock market after the lows of Covid seems to be continuing even three years on, albeit with small blips in the middle. While 2021 saw the Sensex touching the 60,000 mark for the first time in its history, it breached the 70,000 mark towards the end of 2023. The two broad indices, Sensex and Nifty, are hovering around record levels of 71,000 and 21,000, respectively, and investors are rejoiced to see gains in their portfolios.

Despite the surge, those who have been in the market long enough know how mercurial the markets can be. The year 2023 proved to be a good year from the investors’ point of view as they made decent returns. However, the journey of BSE Sensex from around 60,000 in January to its current peak of 71,000 has been far from smooth. Throughout this year-long trajectory, several factors disrupted the market’s positive momentum. These included rising interest rates, heightened geopolitical tensions, and increase in crude oil prices.

This begs the question: though 2023 has ended on a high note, what can one expect in 2024? We track the market movement in 2023 and analyse where the market is headed in 2024, besides giving you 10 stock recommendations from top analysts that can enhance your investing portfolio in the New Year.

The Year Gone By

The recent surge in the Indian stock market has resulted in a remarkable year-to-date gain of over 15 per cent, as on December 20, 2023. The volatility caused by global factors impacted investor confidence and introduced uncertainties, but the Indian market remained resilient. Also, the positive market sentiment led to a flurry of successful initial public offerings in the primary market, and many more are in the pipeline.

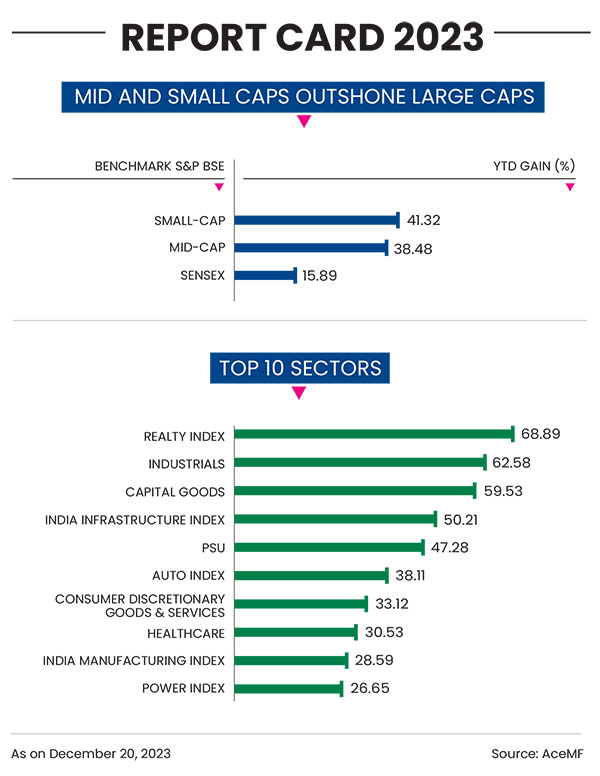

Though large-cap stocks showed strong performance, mid- and small-caps stole the show throughout the year. The BSE Midcap index notched an impressive 38.48 per cent return, and the BSE Smallcap surged by nearly 41.32 per cent on a year-to-date basis, as on December 20, 2023 showcasing outstanding growth.

The BSE Sensex clocked 15.80 per cent in comparison. The top five sectoral indices gave returns of more than 47 per cent—with BSE Realty Index clocking the highest at 68.89 per cent, followed by BSE Industrials at 62.58 per cent, BSE Capital Goods at 59.53 per cent, BSE India Infrastructure Index at 50.21 per cent and BSE PSU at 47.28 per cent (see The 2023 Report Card).

Investors had more reasons to cheer as India reached another milestone with a $4 trillion market capitalisation. The combined market capitalisation of stocks listed on the BSE and the NSE surpassed the $4 trillion mark on November 29. India now joins the ranks of the US, China, Japan, and Hong Kong, becoming the fifth country to achieve this significant feat.

The overall market capitalisation on the BSE reached Rs 333.29 lakh crore (equivalent to $4 trillion), and the NSE touched Rs 334.72 lakh crore. Notably, the $4 trillion market cap surpasses India’s GDP, which is currently at $3.62 trillion.

The transition from $3 trillion to the $4 trillion mark took just 30 months, between May 2021 and November 2023. It is noteworthy that it took over 10 years for BSE-listed companies to reach the $2 trillion mark in July 2017 from $1 trillion in May 2007.

Says Ashish Gupta, chief investment officer, Axis Mutual Fund: “India’s entry to this club is a reflection of the strides the economy has made over the past few years and it is now among the top 5 globally.” He adds that India is now also the fastest growing large economy, and at this pace will contribute to 10 per cent of global growth this year.

Meanwhile, foreign institutional investors (FIIs) also reposed their faith in the Indian equity market along with domestic institutional investors (DIIs). India became a preferred destination for FIIs who poured in Rs 1,04,972 crore, while DIIs invested in excess of Rs 1,71,184 crore in the 11 months till November 30, 2023 (see FIIs Vs DIIs). FIIs have invested Rs 58,624.31 crore in December 2023 (up to December 20, 2023) alone, which is more than 50 per cent of the total investments in the last 11 months. It may be noted that from January to November, DII inflows were largely positive, barring two instances—in the months of May and July, when it dipped slightly.

The Year Ahead

With key economic events like the Reserve Bank of India’s (RBI’s) monetary policy review and the US Federal Reserve policy out towards the end of 2023, experts suggest the focus will now shift to domestic events, including the interim budget, vote on account, and the upcoming general elections in 2024.

These events, coupled with global developments, geopolitics, interest rate trends, oil prices, bond yields, US Presidential election in 2024, and the activities of FIIs and DIIs are likely to influence the market dynamics in the first half of the calendar year 2024.

Experts view the Indian equity market optimistically, while indicating that the rate hike cycle has concluded. “In real terms, Asia is a clear outlier for growth, and hence, a key source of alpha opportunities—particularly in India, which is Morgan Stanley global equity strategists’ top region for investment,” writes research firm Morgan Stanley in its latest global insight report. The report adds: “We expect growth to track at around 6.5 per cent over the next two years, supported by sustained momentum in domestic demand. Macro stability is likely to improve and remain within the comfort range. We expect a shallow rate cut cycle in 2024. General elections in May 2024 are a key risk.”

General Elections—The Key Event: After hitting the $4 trillion mark, the benchmark indices scaled further highs as seen by the spectacular rally on December 4, 2023 on the back of the ruling party’s resounding victory in three of the five states (Rajasthan, Chhattisgarh and Madhya Pradesh) that went to polls this winter.

The win in these three states has given analysts the confidence that the ruling party is likely to repeat another term. “Political continuity is the most likely outcome in the upcoming national elections due in May 2024. This augurs well for our key thesis of a capex and housing up cycle over current decade driving higher GDP growth and attractive market returns,” writes Jefferies in its report, The Election Playbook, in August 2023.

The analysts at Jefferies have outlined three scenarios:

- BJP Majority Government (Probability: 70 per cent): If the Narendra Modi-led BJP secures a majority, there’s a high likelihood of continued strength in the capex cycle, driving robust economic growth and positive investor sentiments.

- Modi-Led Coalition (Probability: 20 per cent): In this scenario, there might be an increase in populist pressure.

- Weak Coalition (Probability: 10 per cent): This is the least likely scenario, but it would lead to a market fall of more than 10 per cent.

The Morgan Stanley report has similar views on the 2024 general elections. “If the current government wins the election with a clear majority, then the market could gain 0-5 per cent in the three months after the election. If the government does not win a clear majority and a coalition government is formed, the market may fall by 5-25 per cent. If the BJP government loses and the leading party gets fewer than 200 seats, forming a weak coalition that would mean little power, and the stock market could crash by 40 per cent. It would be the worst-case scenario,” the report says.

Historically, from 1991, whenever a majority government has come back to power, the markets have delivered positive returns in the next six month barring 2019. In this case, only six months after the elections, the pandemic spoiled the market mood. Similarly, one year after the results, the markets delivered positive returns five out of eight times since 1991 (see Election Market Dynamics).

What’s In Store For Investors?

The Indian equity market is at a record high. The valuation has gone up, but at the same time, higher growth in earning has brought it under control. The index gains this year were backed by earnings growth. With Nifty50 earnings up by about 13 per cent from the beginning of 2023, market valuations held more or less steady despite rising stock prices. The Nifty50 price-to-earnings (P-E) ratio was just over 22.71 times by December 20, 2023, almost at the same level where it started the year.

Experts are of the opinion that earnings growth is likely to moderate in the coming year. “The year 2024 is likely to be a year where earnings growth will moderate versus 2023 to still solid mid-term growth. With earnings remaining healthy, 2024 could be another year of healthy returns, although returns could be lower than 2023 as some frontloading of returns might have happened,” says Ashutosh Bhargava, fund manager, and head, equity research, Nippon India Mutual Fund.

“Healthy sustained earnings growth could be the single-biggest factor for the Indian market to attract flows. Flows from international markets are set to increase,” he says.

In terms of sectors, Bhargava finds risk reward in favour of the banking segment. “Select public sector banks still have material value. We are also positive on large banks, hospitality, power utilities, capital goods and healthcare as our preferred sectors going into 2024,” adds Bhargava.

Other experts hold similar views. “While India’s structural story remains strong, we expect a cyclical slowdown in growth in the year ahead,” says Suyash Choudhary, head, fixed income, Bandhan Mutual Fund.

Despite the positive outlook for the Indian economy, investors must remain vigilant. This becomes especially important when there are indications of overvaluation in specific segments (see Report Card 2023) of the broader market and signs of exuberance, as observed in some recent initial public offerings (IPOs). In such a scenario, it is crucial to approach investments with caution.

To make your life easier, we approached top investment experts and managed to convince them to sift through the large universe of stocks and recommend a few for you. Despite all odds, experts see tremendous growth opportunities across sectors. The suggested stocks are from a variety of sectors, but two of the 10 stocks were picked from the banking sector.

Happy investing and Happy New Year!

kundan@outlookindia.com