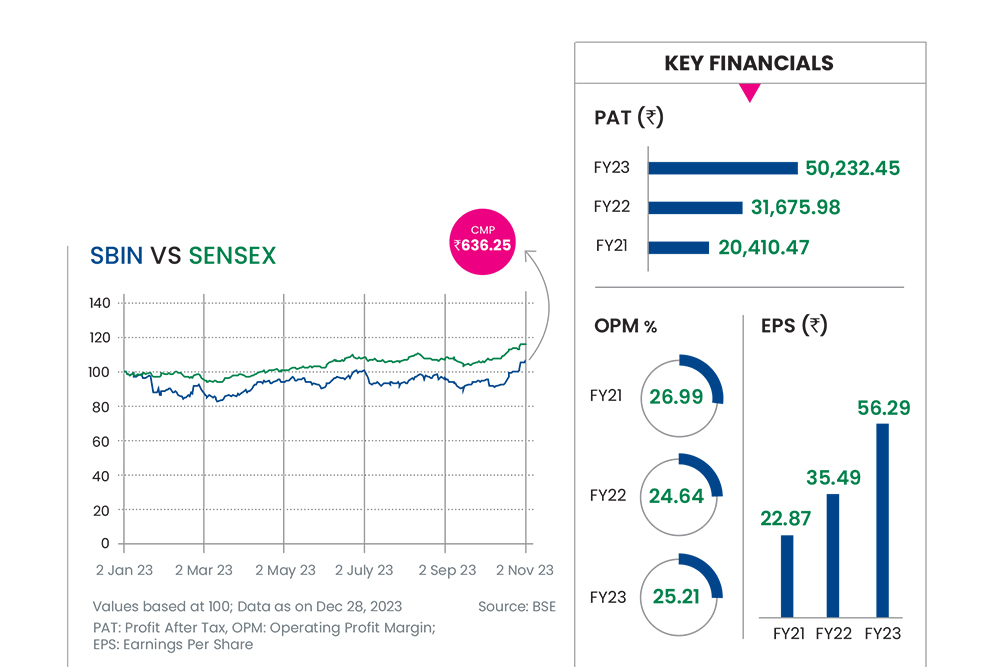

Company Name SBI

Current Market Price Rs 651

Calendar Year Return 6.35%

***

India’s largest bank, State Bank of India has had a robust performance of late, propelled by steady business, revenue growth and controlled provisions. SBI continues to focus on building a superior loan book, as evident in a steady decline in stressed assets, improving provisioning coverage ratio (PCR) and robust loan growth (13 per cent year-on-year (y-o-y) for Q2FY24).

Investing Rationale

Robust Asset Quality: Asset quality has remained well under control with constant moderations in both gross non-performing assets (GNPA) and net non-performing assets (NNPA) ratios. These are metrics used to assess the health of a bank’s loan portfolio and overall stress pool. SBI has witnessed 97bps/16bps y-o-y decline in GNPA/NNPA to 2.55 per cent and 0.64 per cent in Q2FY24. Slippages have been under control and the management expects the trajectory to continue.

The restructured SME book has also come down to 4.4 per cent from 6 per cent in Q3FY23, and the bank expects it to decline to 3-3.5 per cent, which should keep incremental slippages in check. Overall, SBI has done well in maintaining controlled credit cost. Also, the migration to expected credit loss (ECL) framework will have limited impact of Rs 50 billion over the next five years as asset quality has improved. The asset quality performance is strong with consistent improvements in headline asset quality ratios, while the restructured book is under control at 0.6 per cent.

Operational Efficiency:

A gradual ramp-up in digital lending via YONO is also resulting in operational efficiencies and will lead to moderation in cost ratios. Operational expenses have been running elevated due to high wage provisions affecting pre-provision operating profit (PPoP) growth. Net interest margings (NIMs) have declined in recent quarters and the management has worked well towards keeping margins stable (3-5 bps downside bias) as the bank has tools in place to mitigate the impact of the rising cost of deposits.

SBI is expected to deliver FY25 return on assets (ROA) and return on equity (RoE) of 1.1 per cent and 18.3 per cent, respectively. The bank is well poised to deliver little more than 1 per cent RoA on a sustainable basis.

We estimate the loan growth momentum to remain healthy as capex cycle improves, particularly after the general elections. The bank has reported improvement in asset quality, with PCR improving to 75 per cent (99.6 per cent on the corporate book) in Q2FY24. Controlled restructuring with low SMA (special mention account) pool would further keep credit costs under control. The stock is trading at 1.0x FY25E adjusted book value and is a preferred pick.