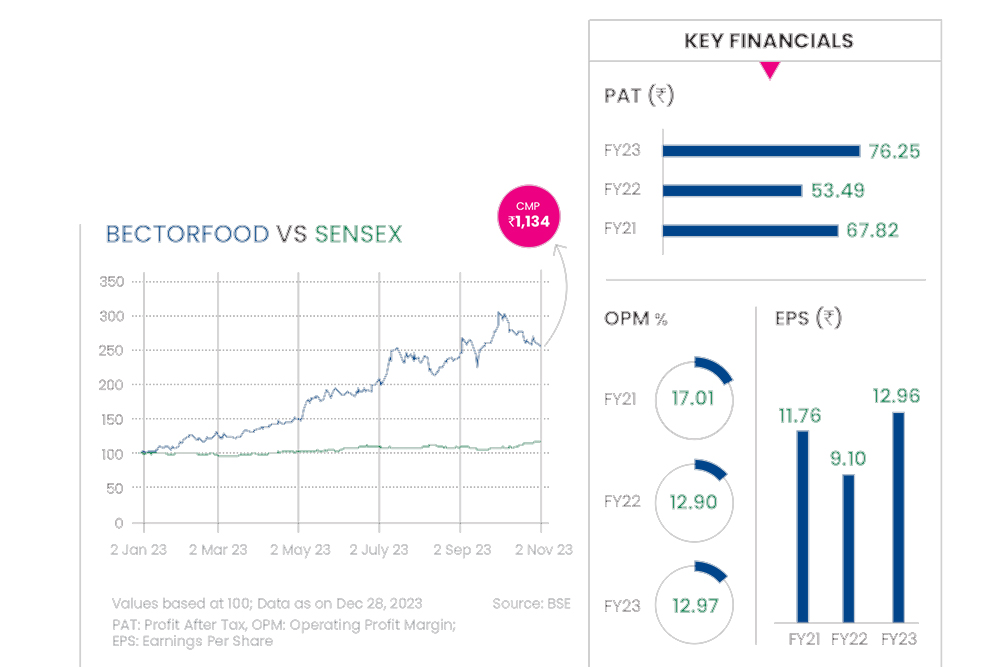

Company Name Mrs. Bector's Food Specialities

Current Market Price Rs 1,563

Current Market Price 161.66%

Mrs. Bectors Food Specialities (Bectors) is one of the fastest-growing companies in the premium and mid-premium biscuits and bakery segment in India.

Investing Rationale

Strong Portfolio: Bectors manufactures and sells biscuits in the premium and mid-premium segments, including a variety of cookies, creams, crackers, and digestives under the brand name “Mrs. Bector’s Cremica”. In the bakery segment, it sells various types of premium products in savoury and sweets categories under the “English Oven” brand.

Premiumisation: The company has been continuously focusing on premiumisation of its portfolio over the past two years, which has significantly improved its gross margin profile.

Expansion: Historically, Bectors had a strong presence in North India for its biscuits and bakery products, but now they intend to leverage their brand and expand in other regions of India.

Wide Distribution: Bectors distributes biscuits across 28 states and four Union Territories (UTs) in India, through its widespread network of super stockists and distributors. The company also uses its in-house developed automation tool Peri to increase productivity of the super stockists and distributors.

Exports Opportunity: Bectors exports “Cremica Brand” and “private label” to 69 countries and had a 12 per cent share in export in CY19. In exports, the company intends to focus on developed and emerging markets, such as Australasia, Europe, East and South Africa, the Middle East and North Africa (MENA) region and North America.

Product Development: Bectors has sourced manufacturing equipment from Denmark, Italy, Germany and the US to manufacture differentiated and high-quality products.

Growth: With strategies in place, the company is focusing on transforming itself into a pan-India biscuit and bakery player in the coming years. This will help the company to post a decent set of numbers in the coming years. Strong earnings growth coupled with stable working capital management will help its return profile improve substantially in the coming years. However, stiffer competition from top players or new entrants in the space and a significant rise in raw material prices would act as key risks in the coming years. We believe that Mrs. Bectors Food is well positioned to capitalise its relationships with large institutions to accelerate new product launches and innovation. In the branded breads segment, the company is likely to benefit from its relationship with reputed quick service restaurants (QSRs). We recommend buy with a target price of Rs 1,330 at 34x FY26.