The investment philosophy and the calls made by fund managers often has a great bearing on the performance of a mutual fund. So, what one needs to look for is consistency in the fund’s performance. Kotak Debt Hybrid is one such fund. When we picked this small-sized fund in 2022, it was ranked 4th or 5th in terms of performance. Now, it leads the charts on a one-year basis.

Portfolio

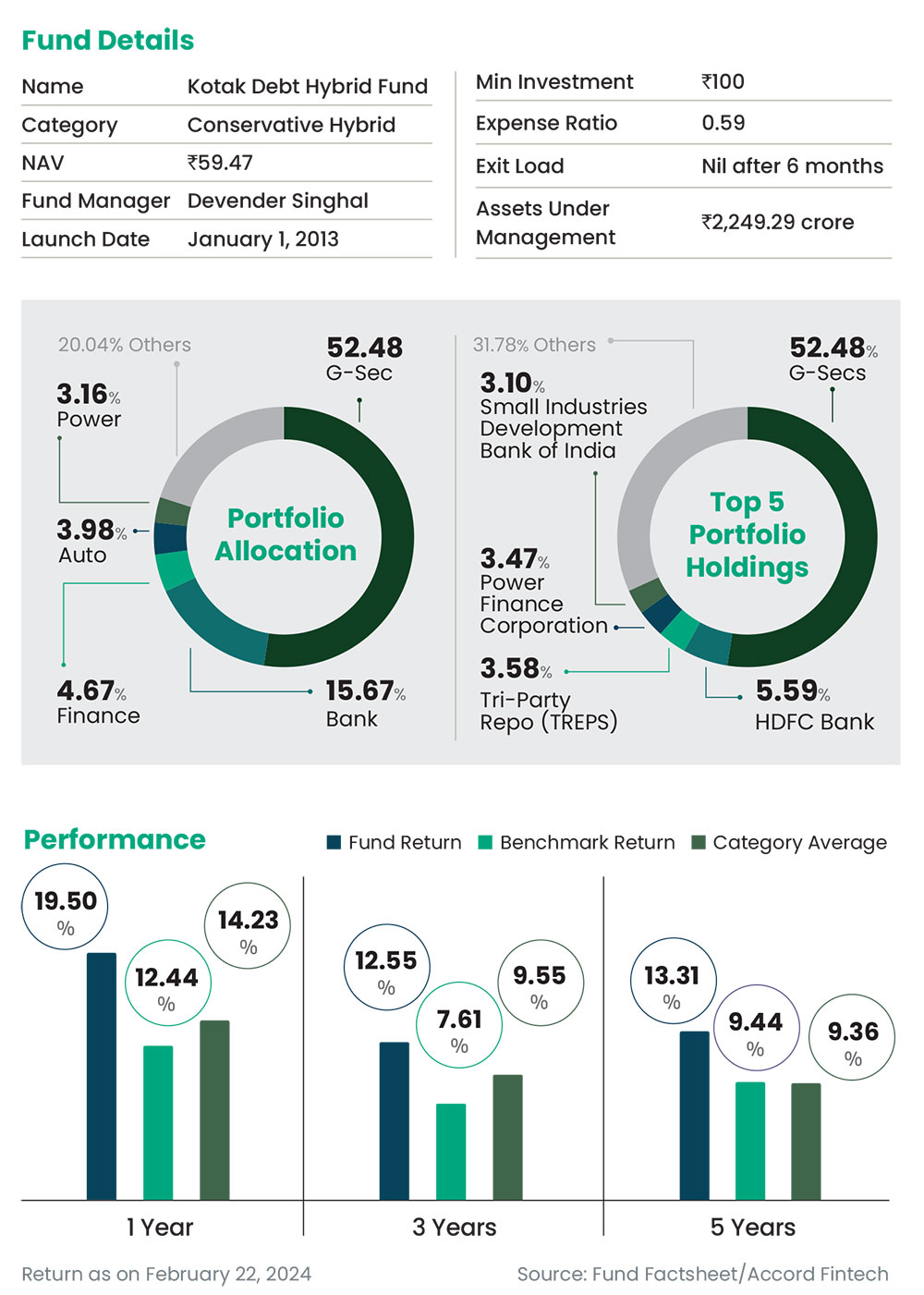

The fund invests a maximum of 25 per cent in equity against the usual 15-20 per cent by other funds in the category. This higher allocation towards equity enables it to deliver better returns, but at the same time adds to its risk factor as well.

Compared to other debt hybrid funds, it adopts an aggressive strategy, and this has provided investors with handsome returns.

In terms of portfolio construction, on the equity side, the fund prefers to follow a core and a dynamic portfolio where some allocation is held for the longer term and the rest is actively churned.

For fund managers, delivering better returns and containing the downside is always a challenge. The debt portfolio of the fund has a diversified mix of government securities (G-secs) and high credit debt instruments at the shorter end of the curve and money-market instruments. However, the fund manager prefers to allocate more in G-secs. This helps the fund manager shield the scheme from credit risk.

Performance

The fund delivered 12.55 per cent annualised return over a three-year period against 7.61 per cent return clocked by its benchmark. The fund has beaten its benchmark and its category average consistently, over one-, three- and five-year periods. In the last five years, the fund has outperformed its benchmark and its category average with decent margin on a yearly basis. Over the five-year period, the fund delivered 13.31 per cent return against the category average of 9.36 per cent.

OLM Take

This fund is suitable for conservative investors who intend to make inflation beating returns with lower volatility.

kundan@outlookindia.com