Bharat Shah, Executive Director, ASK Asset & Wealth Management Group, Swarup Mohanty, Vice Chairman and CEO, Mirae Asset Investment Managers (India), Ritesh Kumar, MD & CEO, HDFC ERGO General Insurance, K.S. Rao, Head of Investor Education and Distribution Development, Aditya Birla Sun Life AMC, Chinmay Dhoble, Head-Retail Liabilities & Branch Banking, IDFC FIRST Bank, and Nidhi Sinha, Editor, Outlook Money, at the lamp lighting ceremony to inaugurate the event

***

The two-day Outlook Money 40After40 Retirement Expo opened in Mumbai on January 23, 2024. The first-of-its kind unique event dwelled on the ever important topic of retirement planning. But rather than being just a platform for information, it was oriented towards celebrating the exciting phase of retirement.

Importance Of Retirement Planning

Outlook Group CEO Indranil Roy stressed on the importance of retirement planning in his welcome address. He said this is especially important for a country like India, which has such a large young population. He also presented data from a survey conducted by Outlook Money and Toluna that had interesting insights on retirement preparedness.

V. Vaidyanathan, MD & CEO, IDFC FIRST Bank

Indranil Roy, CEO, Outlook Group

Nidhi Sinha Editor, Outlook Money

Nidhi Sinha, editor, Outlook Money, emphasised on the need to start early and plan smartly towards creating a corpus for retirement. “You should start investing for retirement as early as possible to make your investment journey smoother. If you haven’t started already, it’s never too late. There are strategies to start planning for retirement at any stage. But if you are around 40 already, know that the clock is ticking,” she said. She added that seniors also need to explore options, such as senior living, and focus on their wellness and health needs.

Build Innings Steadily

V. Vaidyanathan, managing director (MD) and CEO of IDFC FIRST Bank, said retirement planning is similar to a well-crafted innings aimed at building a solid score in a 50-overs one-day international cricket match. He said batsmen who accumulate runs only in the later overs often falter. Still, many people make the mistake of overlooking retirement planning until the later stages of their career, leading to potential financial calamities. “The real risk lies in outliving one’s resources, which many senior citizens could face as their number is expected to double by 2050. The cessation of regular income in retirement makes it imperative to manage expenses smartly,” he said.

Need For Advice

Ananth Narayan Gopalkrishnan, whole-time member of the Securities and Exchange Board of India (Sebi), spoke of the pitfalls and mistakes that people are prone to make in personal finance and retirement planning, narrating a personal anecdote of the troubles he faced.

V. Vaidyanathan, MD & CEO, IDFC FIRST Bank in conversation with Suchetana Ray, Editor, Outlook Business

Deepak Mohanty, Chairman, Pension Fund Regulatory and Development Authority (PFRDA)

Ananth Narayan Gopalakrishnan, Wholetime Member, SEBI

Madan Sabnavis, Chief Economist, Bank of Baroda

He spoke of the fundamental mistakes he had committed by failing to understand the importance of income, expenses, and savings early, adding that it is important to envision the financial future, considering inflation, investment returns, and one-off expenditures, such as education and healthcare. One should not postpone retirement planning until retirement beckons, and neither should one shy away from taking professional help if it so requires, he added.

(R to L) Krishan Mishra, CEO, FPSB India; Ajit Menon, CEO, PGIM India Asset Management; Vishal Kapoor, CEO, Bandhan AMC and Nilesh Shah, MD, Kotak Mahindra Asset Management, in coversation with Nidhi Sinha, Editor, Outlook Money

“Financial planning demands a close examination of one’s financial landscape, extending beyond the present. While many of us know our current expenditures, the exercise of forecasting for the next five, 10, or even 50 years is often neglected. I have come to believe that the term retirement planning might be misleading. Let’s reframe it as financial planning, a concept applicable to everyone, regardless of age,” he said. “Plans will inevitably evolve, but having a framework allows you to adapt and understand the shifting dynamics of your financial journey. So, as we embark on this odyssey, let’s embrace the mantra of financial planning and navigate the complexities with foresight,” he added.

Anup Bagchi, MD & CEO, ICICI Prudential Life Insurance

Pension Matters

Deepak Mohanty, chairman, Pension Fund Regulatory and Development Authority (PFRDA), asserted the importance of having a pension account in one’s savings portfolio. It’s as important as having a balanced meal, he said.

“Why should you have a pension as part of your savings portfolio? Because it is like an Indian thali, you need a little bit of everything. It should have a healthy mix of savings, equities, mutual funds, pension accounts, etc., to make it a wholesome meal. Pension should be on the menu of the saving portfolio,” Mohanty said.

Sashi Krishnan, CEO, National Pension System (NPS) Trust said that our behavioural biases towards money often decides the way we spend for instant gratification rather than saving for retirement. The fact that life expectancy has increased by almost 26 years in the last five years implies that more people will live longer after retirement. As for the NPS corpus, it is around Rs 11 lakh crore from about 700,000 subscribers, which is very low for India given its GDP and population.

Bharat Shah, Executive Director, ASK Asset & Wealth Management Group

Wealth Creation And Market Mantra

Bharat Shah, executive director, ASK Asset & Wealth Management Group, emphasised on the importance of building wealth as a sacred duty. He said India is at the cusp of a great economic expansion and people must take benefit of the opportunities at hand and build their wealth.

Sankaran Naren, chief investment officer of ICICI Prudential Mutual Fund, underscored the dangers of glossing over the pitfalls in a rising market. He said investors often make mistakes in a bull market when the stock prices soar, and over-optimism leads them to throw caution to the wind and overload portfolios with equity to maximise gains.

(L to R) Vasanth Kamath, Founder & CEO, Smallcase Technologies; Anshul Arzare, MD & CEO, YES Securities (India); Deepak Shenoy, Founder & CEO, Capitalmind Financial Services; and Sushant Bhansali, CEO, Ambit Asset Management, in conversation with Nidhi Sinha

He explained how the market behaved during a bull and a bear run over the years, and advised people to practice asset allocation. “In the 34 years that I’ve seen markets, the biggest mistakes don’t happen when markets are flat; mistakes happen when markets are at extremes, either at very low or high,” he said. He added that in 2020, when the markets were low, people sold their holdings which was a mistake.

Sankaran Naren, Chief Investment Officer, ICICI Prudential Asset Management

Saurabh Mukherjea, founder of Marcellus Investment Managers, highlighted how 100 million families in India are heading for a retirement disaster because they are not saving enough. He gave an example of a family of age 40 years living on an income of Rs 25 lakh a year, devoid of luxuries and extravagant trips abroad. Assuming retirement at age 60 and a retired life of another 25 years, they would need around Rs 1.1 crore per annum in their retirement years, which translated into today’s money would mean a corpus of at least Rs 6 crore.

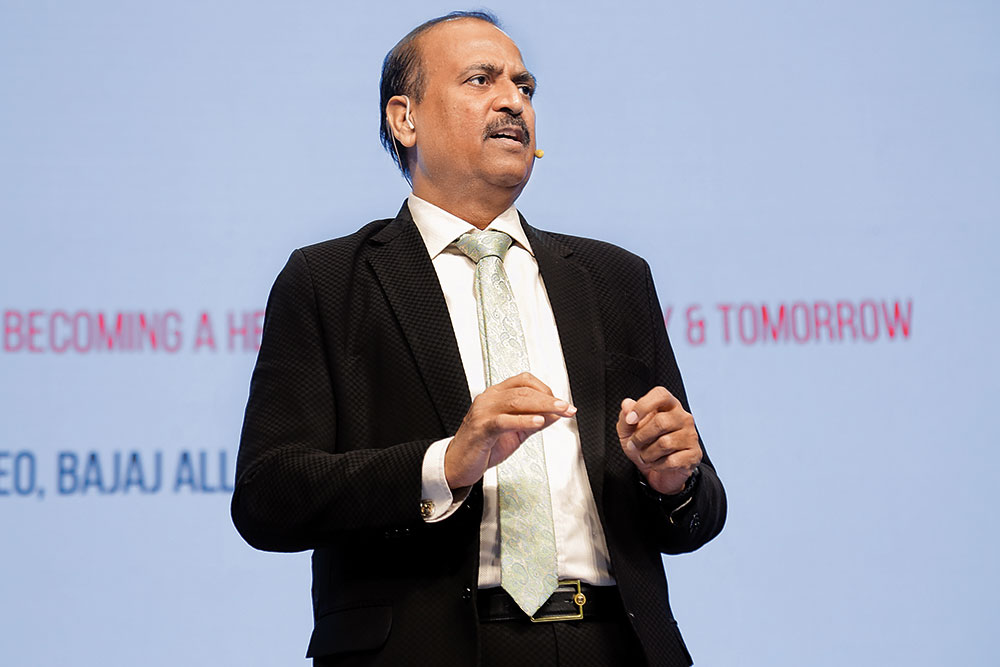

Tapan Singhel, MD & CEO, Bajaj Allianz General Insurance

“If you invest a lump sum of Rs 90 lakh at 40 and compound it at a post-tax rate of 10 per cent per annum for 20 years, you will reach a substantial amount. This straightforward path requires clarity of thought and a disciplined approach. However, people might aim for quick gains, attempting to build a Rs 1 crore lump sum between the ages of 40 and 50, and exposing themselves to higher risks,” he said.

At a panel discussion titled The Mantra for Wealth Creation, speakers highlighted on the importance of understanding the mantra for wealth creation in one’s quest for financial prosperity.

(L to R) Swarup Mohanty, Vice Chairman & CEO, Mirae Asset Managers (India); Kamlesh Rao, MD & CEO, Aditya Birla Sun Life Insurance; Vibha Padalkar, MD & CEO, HDFC Life Insurance, in conversation with Nidhi Sinha

Deepak Shenoy, founder and CEO of Capitalmind Financial Services advocated for a disciplined approach towards investing. Anshul Arzare, MD and CEO of YES Securities (India), expressed concern over the growing trend of trading over investing, particularly in the futures and options (F&O) segment. He urged the younger generation to adopt a long-term approach, emphasising on the importance of value investing. He also cautioned against emotional investing, and encouraged rebalancing, while highlighting the need to keep a healthy lifestyle.

Vijay Chandok, MD & CEO, ICICI Securities in conversation with Deepika Asthana, Co-Founder & Director, Eleveight

Sushant Bhansali, CEO of Ambit Asset Management highlighted the importance of thorough research and personal viewpoints in addition to following a financial planners’ advice. Vasanth Kamath, founder and CEO of Smallcase Technologies, stressed on the importance of disciplined investing and simplicity in portfolio management. He encouraged investors to identify good companies for long-term investments and advised against chasing specific sectors

Saurabh Mukherjea, Founder, Marcellus Investment Managers

Economic Growth

Madan Sabnavis, chief economist, Bank of Baroda, spoke of the importance of the quality of economic growth rather than the speed of its progression. He said it was important to reduce the number of people below the poverty line, emphasising the role of government social welfare subsidies. He said India’s per capita income, currently standing at a modest $2,400 per head (around Rs 1.78 lakh), which highlights a critical need for equitable distribution of economic benefits, as nations with lower economic rankings boast significantly higher per capita incomes.

Shrinivas Khanolkar, Head, Products, Marketing & Corporate Communication, Mirae Asset Managers (India)

Wealth Preservation

At a panel discussion on the critical subject of post-retirement financial strategies, industry leaders Swarup Mohanty, vice chairman and CEO of Mirae Asset Managers (India), Vibha Padalkar, MD and CEO of HDFC Life Insurance, and Kamlesh Rao, MD and CEO of Aditya Birla Sun Life Insurance spoke on the subject of wealth preservation and growth in the post-retirement phase.

Sashi Krishnan, CEO, National Pension System Trust

Padalkar said that at a macro level, inflow stops and outflow continues and increases because of inflation, which could pose a problem if one has not adequately planned.

Rajit Mehta, MD, Max India

Rao spoke on the need to balance one’s corpus and stagger one’s investments over different asset classes, as one cannot and should not time the market.

Tara Singh Vachani, Executive Chairperson of Antara Senior Living & Vice Chairperson of Max India

Mohanty said that the biggest ticking bomb in India is retirement planning or the lack of it. “Just 6 per cent of Indians have a pension. Right? The rest will create a bunch. That’s the situation we are in. And trust me, we’ve had these very evolved discussions in a fund house like ours; people in Mumbai are clueless about how much money they will need to stay in Mumbai post-retirement!” he said.

(L to R) Sadique Neelgund, Founder, Network FP; Sandeep Jethwani, Co-Founder, Dezerv; Lovaii Navlakhi, MD & CEO, International Money Matters; Dhruv Mehta, Chairman, Sapient Wealth Advisors & Brokers; Vivek Rege, Founder & CEO, V R Wealth Advisors, in conversation with Amit Trivedi, Co-Founder, Osat Knowledge

Planning Matters

Anup Bagchi, MD and CEO, ICICI Prudential Life Insurance said that retirement planning can seem like a maze, and so it is important to plan it carefully, including protecting oneself against debt, and laying the foundations for a sound financial health, among others. Attaining self-sufficiency in managing healthcare and nursing needs is also very important, he said.

K.S. Rao, Head of Investor Education and Distribution Development, Aditya Birla Sun Life AMC

Vijay Chandok, MD and CEO of ICICI Securities said that the concept of retirement is hugely underpenetrated and underserved in India despite the increase in longevity, which is worrisome indeed. People should not ignore the aspect of longevity in retirement planning, which is a complex process and requires proper assessment of various needs and wants, such as health, child’s education, house, car, and so on.

Amitabh Singh, Postmaster General (Mails and BD), India Post

At a panel discussion on the theme of The Last Milestone, panellists highlighted on the importance of careful planning and strategic decision-making.

Dhruv Mehta, chairman of Sapient Wealth Advisors and Brokers, highlighted the significance of a well-established retirement corpus and the challenges one might face without adequate financial planning. He urged individuals to start early in life to secure a comfortable retirement. He also suggested considering options like extending working years or reducing monthly expenses for those without a planned retirement corpus.

Devdutt Pattanaik Indian Mythologist, Speaker, Illustrator and Author, in conversation with Chinki Sinha, Editor, Outlook

Lovaii Navlakhi, MD and CEO of International Money Matters, stressed on the importance of accounting for unexpected costs when planning a retirement corpus, and advised for creating an emergency retirement fund to handle them.

Sadique Neelgund, Founder of Network FP, shared his experience of starting investments for retirement early in his working years. He highlighted the role of a retirement fund to tackle medical emergencies and cautioned against relying on children or parents as a backup plan.

Manoj Bajpayee, National Award Winning Actor in conversation with Chinki Sinha, Editor, Outlook

Sandeep Jethwani, co-founder of Dezerv, explained the cost considerations in retirement planning, and stressed on the importance of consolidating multiple portfolios into a single data sheet for efficient portfolio management. He also warned against overlooking expenses when building an investment portfolio, and emphasised the need for regular portfolio reviews.

Vivek Rege, Founder and CEO of V R Wealth Advisors, said that one should have clarity in managing funds during incapacity or while passing on the corpus to nominees. He highlighted the significance of structuring funds in a single or joint name to avoid confusion during life events, including the need to facilitate the smooth inheritance of the retirement corpus.

Mithali Dorai Raj, Former Captain, Indian Women’s Cricket Team, in conversation with Mitrajit Bhattacharya, Columnist, Author, Publisher, Content Producer

Need To Be Happy

Tapan Singhel, MD and CEO of Bajaj Allianz General Insurance pointed out that while India is growing economically, seniors, are becoming increasingly unhappy and lonely. India needs a comprehensive wellness strategy and people do not need a humongous amount of wealth to be happy, he added.

He also called for making insurance cheaper and mandatory so that people don’t end up in poverty for medical expenses.

Neelesh Misra, Journalist, Author, Storyteller, Scriptwriter, Lyricist

Tara Singh Vachani, executive chairperson of Antara Senior Living and vice chairperson of Max-India emphasised the importance of providing seniors with a sense of relevance in her conversation with CB Ramkumar, vice chairman and board member for the Global Sustainable Tourism Council.

“Seniors want a sense of relevance. We studied what people want to feel as they get older. Is it to be cared for? Is it safety or security? Is it mental or intellectual stimulation? Is it spiritual stimulation? We found that they want the feeling of relevance. One of the important steps is to let them choose how they want to age and what they want to have in their old age. They want to have that luxury,” Vachani said.

Dinesh Mohan, Senior Age Model and Actor

Life Lessons

Mithali Raj, former captain of the Indian national women’s cricket team underscored the importance of understanding the nuances of finance early in life so that one can effortlessly make the switch from a working to a retired life, which happens rather early for sportspersons. She also spoke of the need to keep oneself physically fit in their retirement years.

Authors Devdutt Pattnaik and Neelesh Mishra regaled the audience with snippets from mythology and a storytelling session on the need to be courageous to take decisions.

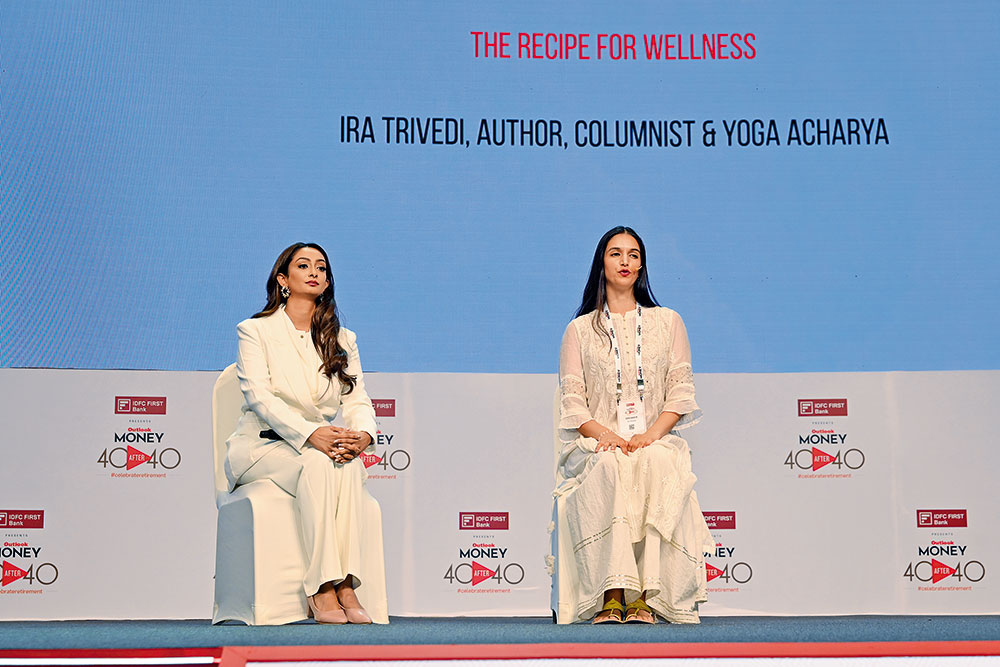

Ira Trivedi, Author, Columnist & Yoga Acharya (Right)

Acclaimed Bollywood actor Manoj Bajpayee, who was one of the special guests at the expo, spoke of the choices he made in his professional career, highlighting the significance of decision-making that goes towards shaping one’s future.

Noted wellness expert and yoga trainer Ira Trivedi advocated five pillars—exercise, nutrition, sleep, relaxation and positive thinking for holistic health for one’s overall well-being.

Senior model-actor Dinesh Mohan shared his incredible journey of recovery from extreme depression to a successful career in the world of glamour and entertainment at an age when one is usually written off.