Some distributors and agents use spiels such as promising returns comparable to mutual funds to emotional manipulation to mis-sell Ulips. Here’s how to watch out for the red flags

When Kolkata-based Aranya Sen, 72, booked a fixed deposit (FD) with his bank in 2022, he had no idea he was buying a unit-linked insurance plan (Ulip). It was only later that he realised that he was mis-sold a Ulip in the guise of an FD.

“It was my bank’s relationship manager (RM) who lured me into investing in this FD, convincing me about its high, assured return. Only when I had put in the money, I found it was a Ulip. I do not need this. I have been mis-sold,” says Sen. He opted to invest in an FD for regular income and guaranteed returns.

Mis-selling means selling someone something that is not the right fit for his/her needs. For instance, if you are going to Canada in winter and someone sells you a jacket that is just about right for Delhi winters, that is mis-selling. When it comes to financial products, mis-selling usually happens through someone you trust, which could be an agent or a distributor.

The scourge of mis-selling remains common in India. The case of Yes Bank is well known. The bank triggered the write-off of AT-1 bonds, which were allegedly sold as FDs with the potential of giving higher returns than regular FDs. The risk that AT-1 bonds carry was misrepresented to the buyers, a lot of whom were senior citizens. The other widely mis-sold product are insurance products. Though they give guaranteed returns, the real returns after factoring in inflation are, typically, non-competitive.

Among these, Ulips take the cake when it comes to mis-selling, with the rising equity culture in India.

“First, they provide higher commissions to agents, thus creating a potential conflict of interest where the focus may shift from meeting the client’s benefits to maximising commissions,” says Chethan Shenoy, director and head - product and research, Anand Rathi Wealth.

Commissions for endowment policies are typically in the range of 20-35 per cent in the first year, while in Ulips, it could be 10 per cent or more. In contrast, the cost of mutual funds is 0.5-2 per cent annually, while FDs have nil commission.

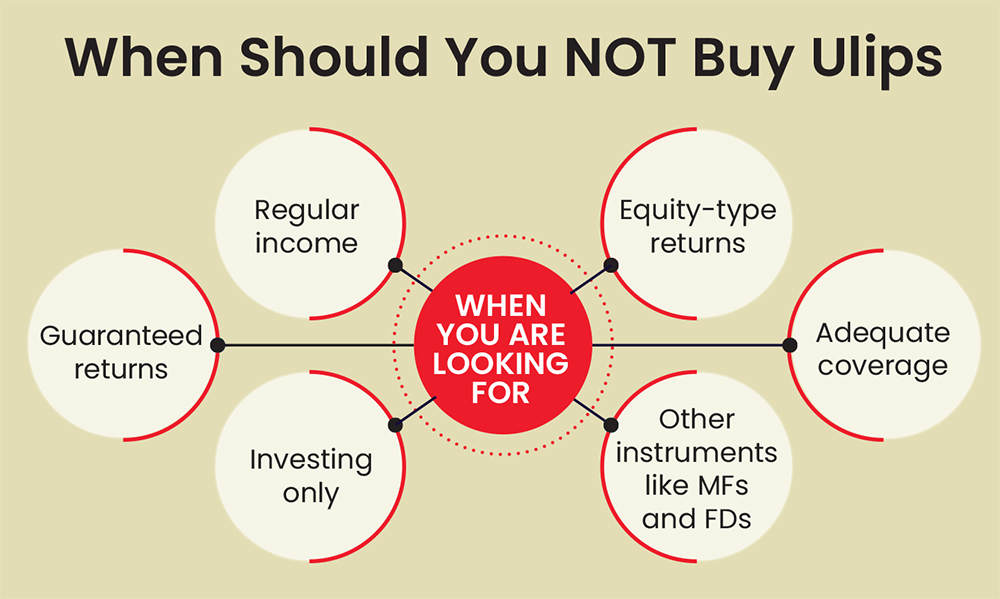

Let’s understand what makes Ulips prone to mis-selling and what you should do to avoid being mis-sold.

Key Mis-selling Pitches

They Are Like Mutual Funds: Ulips offer a mix of life cover and investments, making it essential for potential buyers to thoroughly understand the product.

The investment part of a Ulip invests directly in market-linked securities through internal fund managers. When showcasing the performance of Ulips, agents often use terms like “new fund offer” (NFO) and “net asset value” (NAV), which are usually associated with mutual funds (MFs). This confuses investors.

“Ulips are sold as an alternative to MFs. That is the primary method of mis-selling. When you sell Ulips as MFs, then people tend to believe that the returns from Ulips can be comparable to those from MFs,” says Anant Ladha, founder, Invest Aaj For Kal, a financial advisory firm.

In reality, even well-performing Ulips may have returns less than most MFs because of the costs and commissions associated with the former, he adds (Read: How Ulips Compare With MFs).

One needs to understand that the liquidity and charges in both products are completely different. Ulips, typically, come with a five-year lock-in while MFs can be sold at any time.

Most Ulip salespersons do not disclose that the loading in Ulips is much higher than in the case of mutual funds. In the case of MFs, the typical expense ratio is below 2 per cent for equity funds. “In the case of Ulips, the loading is 60 per cent for a 20-year Ulip, which implies 3 per cent annualised loading,” says Ladha.

In Ulips, there is complexity in terms of charges, including premium allocation charges, mortality charges, fund management charges, policy administration charges, fund switching charges, partial withdrawal charges, premium redirection charges and premium discontinuance charges, subject to conditions.

The majority of people are not able to understand these charges and only enquire about fund management charges. Since these charges are in MFs too, they mistake Ulips for MFs.

“When selling Ulips, salespersons focus on the lump sum that one will get after 20-30 years, which appears large, but yields actual returns of only 6-7 per cent. On the other hand, opting for equity through MFs can get you around 12-14 per cent return in the long term,” says Shenoy.

They Give Better Returns Than FDs: Since they provide guaranteed returns, FDs are popular with investors, despite their drawbacks like taxability at the marginal tax rate.

Ulips cannot guarantee returns as their investment is market-linked. However, the pitch used is that Ulips have the potential to give higher returns than FDs, with the guarantee of a sum assured.

It is also important to understand that the nature of Ulips and FDs are different. Ulips are flexible—you can switch between different types of investments based on the market conditions. This flexibility gives you a chance to earn more, but there is market risk involved. On the other hand, the returns from FDs are guaranteed and, therefore, predictable.

But there are some aspects that tilt the scale towards Ulips. One, you can avail of tax benefits on premiums, as well as on the maturity amount. FD returns are taxable and only specified 5-year FDs can help you save tax at the time of investment. Besides, Ulips come with an insurance cover, though at a cost.

Says Suhas Harshe, money coach at MoniYogi Suhas Harshe, a financial planning firm: “Often, agents mislead people by presenting insurance policy documents as FDs, pointing out shared features like the company logo. They frequently skip showing the benefit illustration, which is required to display returns at 4 per cent and 8 per cent, according to the Insurance Regulatory Development Authority of India (Irdai) rules. Ulips offer investment options in conservative, balanced, or aggressive funds. Misleadingly, agents highlight the highest returns from aggressive funds and compare them to FDs.”

“Since FDs usually have shorter durations, up to five years, and Ulips are for longer periods, the misrepresentation involves comparing the maturity amount of a shorter-term FD with a longer-term Ulip, suggesting higher potential lump sum. Agents may imply guaranteed returns by showcasing impressive historical returns without disclosing the market-linked nature of these returns, falsely presenting them as FDs,” adds Harshe.

Emotional Manipulation: The salespersons usually use emotional spiel to lure customers, i.e., if something were to happen to the breadwinner. “Emotional pitch is used for your wife, for your child’s education, to camouflage the low return lock-in,” says Rathi.

However, term insurance suffices for that need as it offers the highest sum assured at the lowest cost.

The Tax Allure: The allure of tax benefits on premium payments (under Section 80C of the Income-tax Act, 1961) and tax-free maturity proceeds (under Section 10(10)) adds another layer to the selling strategy.

To qualify for tax advantages upon maturity, the premium should be less than 10 per cent of the sum assured for policies purchased between April 1, 2012, and February 1, 2021. For policies bought before April 1, 2012, the maturity amount will be exempt from tax if the annual premium is below 20 per cent of the sum assured. Regarding plans purchased after February 1, 2021, tax exemptions on maturity require the total premiums paid to be under Rs 2.5 lakh.

Says Shenoy: “The most common sales pitch for Ulips is an investment mode whereby you get the dual benefit of life cover coupled with tax benefits. The tax benefits on premium and returns highlight the deal.”

Seniors most Vulnerable

Unsuspecting senior citizens are one of the softest targets. A relationship manager at a well-known private bank, who does not wish to be quoted, acknowledged that senior citizens are their main target customers. “They are often pitched single premium, or guaranteed income policies, which may not align with their needs,” says Rathi.

Also, having their money locked up for five years, which is the lock-in for Ulips, may not be a good idea. Senior citizens are more susceptible to these sales pitches, especially since they may not have much idea about new-age financial products.

“Also, seniors often don’t receive life cover of 10 times the annual premium, leading to taxable funds on maturity or surrender under Section 10(10D),” adds Rathi.

What Should You Do?

To start with, one should not mix insurance with investment, whether it is an endowment plan or a Ulip. Pure term plans can take care of protection, and investments can be made independently through various equity and debt products.

“Opting for a simple term plan for life cover and considering mutual funds or equity-linked savings schemes (ELSS) for investment returns and tax benefits is a more informed approach,” says Rathi.

There are other things one should avoid as well. “Never buy insurance from a bank. Ulips are largely sold by banks under pressure of sales targets,” says Ladha. He also warns that one should not fall into the trap of single-premium Ulips. Ulips and traditional plans have three modes of premium payment—regular, limited period, and single. The last involves making a single payment for the entire term and is usually a large sum. “Single-premium Ulips are usually mis-sold as fixed deposits with higher returns and tax advantage,” says Ladha.

Understanding these distinctions can empower investors to make sound decisions and avoid potential Ulip-related pitfalls.

meghna@outlookindia.com