Indian women have been remarkable savers but still, women’s participation in household finances has been mostly limited to managing everyday budgets on a fixed sum that is shared with them. Women are either not allowed to take money decisions on their own or do not feel confident enough. The latter can be perhaps solved by working to spread financial literacy among women.

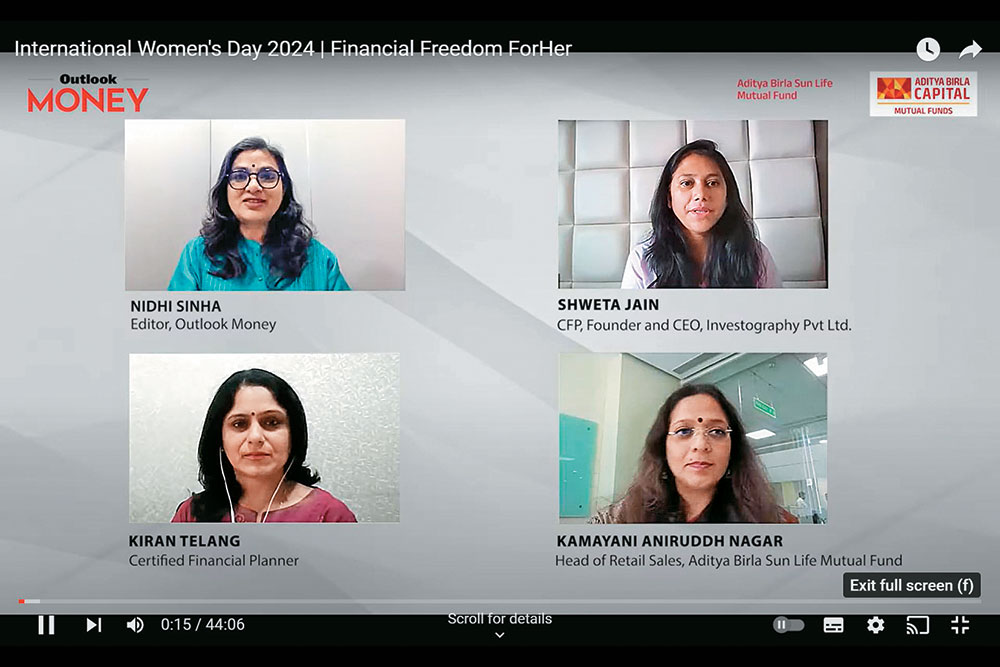

On the occasion of International Women’s Day, Outlook Money along with Aditya Birla Sun Life Mutual Fund organised a webinar to discuss how financial literacy can empower women. The panellists for the discussion were Kamayani Aniruddh Nagar, head of retail sales, Aditya Birla Sun Life Mutual Fund; Kiran Telang, certified financial planner (CFP), a Sebi-registered investment advisor and an author; and Shweta Jain, CFP and founder and CEO, Investography Pvt Ltd, and an author. The session was moderated by Nidhi Sinha, editor, Outlook Money. Here are the edited excerpts from the discussion.

Starting with the discussion on financial literacy, Nagar emphasized the universal importance of financial literacy, particularly for women. She argued that women’s inherent skills in managing household economics could translate into more sophisticated financial planning and investment decisions, given the right knowledge and encouragement.

Jain highlighted the crucial first steps young women can take as they embark on their career journeys. From understanding the value of budgeting to establishing sound financial habits, she outlined a pathway for the younger generation to embrace financial literacy, balancing their immediate desires with long-term goals.

Telang focused on the often-overlooked segment of homemakers, stressing their potential to significantly influence household financial health. By taking charge of budget tracking and participating in financial decisions, they can play a pivotal role in wealth creation and management, she said.

The discussion also highlighted the challenges faced by women in equity investment, underscoring the importance of education in navigating the complexities of financial markets. With women increasingly participating in equity investing, the panellists underlined the need for platforms that offer easy access to financial knowledge and trustworthy advice.

Perhaps the most powerful moments of the webinar were the personal stories shared by the panellists, illustrating how financial independence has shaped their lives and the lives around them. These narratives underscored the profound impact that financial literacy and independence can have, offering inspiration and a call to action for women everywhere.

As the webinar concluded, it was clear that the journey toward financial literacy and empowerment for Indian women is both necessary and urgent. The discussions laid the foundation for a future where women are not only participants but leaders in their financial journeys.