Once you have accumulated a decent corpus in your working life, the next big task should be to smartly deploy it across different schemes through a bucketing strategy so that your regular expenses are taken care of while your corpus keeps growing. This will ensure that you do not outlive your corpus

For those who retire with a sizeable corpus, it’s very easy to get tempted into spending it on fulfilling some of their dreams—travelling around the world, buying a bungalow, acquiring a lavish lifestyle, and so on. But it would be wrong to assume that just because the sum seems large, the struggles are over, and one can retire in style.

To accumulate a sizeable corpus is like solving only one part of the puzzle. The other part is about deploying the savings in a way that it lasts a lifetime, while allowing you to pursue hobbies you could not take time out for during your working life.

If you don’t do the calculations right at the beginning, you stand the risk of outliving your savings. To be really able to retire peacefully, you will need regular cash flow, while also ensuring that your corpus grows at the same time, so that you don’t fall short later. In other words, you will need to maintain the same rigour in money management in your retirement years as you did in the accumulation or investing phase.

One way to ensure that is to resort to the bucketing strategy, which is recommended by most financial planners. Says Lovaii Navlakhi, a Securities and Exchange Board of India (Sebi)-registered investment advisor and managing director (MD) and chief executive officer (CEO) of International Money Matters, a Bengaluru-based financial advisory firm, “Planning for retirement is filled with anxiety and uncertainty as you know that you do not have additional income to pump in to recover from any downside in your investments. Hence, it is prudent to have a multi-bucket strategy during this tenure.”

Let’s understand how bucketing strategy works and how you can use it effectively in your retirement years.

How To Create Buckets?

Simply put, bucketing is all about allocating your corpus into different instruments across different time buckets to ensure adequate and uninterrupted access to funds.

The first step would be to estimate your regular expenses and assess cash needs in the short, medium, and long terms. While doing that, consider your corpus size, lifestyle, living cost, health status, income source, and debt, among others. You can create as many buckets as you want to, but financial planners generally recommend 3-5 buckets for short-, medium- and long-term cash needs.

Short-Term Bucket: You may create the first bucket for cash needs in the next one-and-a-half years to three years after retirement. It can include liquid funds, short-term fixed deposits (FDs), treasury bills, arbitrage funds, or other assets that are highly liquid and offer guaranteed returns. Growth would be the secondary factor here, as the main idea is to ensure financial security.

Says Navlakhi: “The aim will be to replenish this bucket every 3-6 months so that it is perpetually filled. At each 3-6 month interval, review the amount required, taking into account inflation, change in expenses, and other factors.”

Dilshad Billimoria, a Sebi-registered investment advisor and founder, MD and principal officer at Dilzer Consultants, suggests five buckets for short-, medium-, and long-term expenses and capital growth. Out of these, she says, the first two should be for the short term. “The first bucket can be in liquid funds for emergencies in the next 24 months, while the second bucket can be in liquid funds for expenses in 1-3 years,” she says.

Medium-Term Bucket: As you move beyond the initial timeframe, create a second bucket for the next 3-5 years. When you start investing, this will be a medium-term goal. The idea here is to generate modest growth without taking undue risks. “This bucket can be used to generate cash flow by way of returns so that the first bucket is replenished. The avenues today could be equity savings funds or balanced advantage funds,” she says.

Billimoria adds that the third bucket can be invested in hybrid funds for requirements over 3-6 years, while the fourth can be in asset allocation funds for 6-10 years.

One can also include government schemes like the Senior Citizens Savings Scheme (SCSS), besides high-quality debt products in short- and medium-term buckets, she says.

Long-Term Bucket: One should also set up a third bucket for cash needs for 10 years and beyond. The focus should be to generate inflation-beating returns.

It is important to understand how inflation works and multiplies your expenditure in the future. For instance, if your current monthly expenses are Rs 60,000, after 20 years, they will inflate to Rs 1.92 lakh, considering an inflation of 6 per cent throughout the period. This change in the value of money shows that you cannot ignore capital growth for the long-term bucket.

Since this bucket is 10 years away, and you will have more time to grow your assets, you can add a couple of equity funds here, like flexi-cap, multi-cap or asset allocation funds, to the overall mix of investments. “The third bucket is to generate extra returns in good times that can be used for a rainy day—this not only implies the timeframe when equity markets fall, but also the period when debt or fixed income returns are below the rate of interest prevailing in the market,” says Navlakhi.

Experts recommend allocating only about one-third of the total assets to equity to ensure safety of the corpus, which is critical in retirement years, since it is assumed that there is no further income flow.

How To Use The Buckets?

In the bucket framework, it’s essential to have a clear withdrawal plan so that you don’t go into an aggressive spending mode and bring financial instability to your life, especially in the initial retirement phase.

Financial planners generally recommend annual withdrawals of no more than 4-6 per cent of the portfolio returns for an average middle-class retiree. The simple math is if the portfolio returns are 7 per cent and withdrawals are 5 per cent, it is favourable for you. You will still have 2 per cent to replenish the liquid buckets or invest in growth instruments in the long-term bucket to generate inflation-beating returns.

But consider another scenario. If the expenses are more than the returns, you might start using your reserve corpus to meet the shortfall. In that case, you will shrink the original corpus and its subsequent returns, thus making your financial situation untenable in the long run.

It goes without saying that the higher the returns, the longer your corpus will last. Navlakhi explains: “If the corpus of Rs 1 crore earns 8 per cent per annum, the funds will last 20 years, because inflation will double the expense of around Rs 50,000 every 12 years. If, however, the client’s risk profile is higher and we can generate 10 per cent annually on the portfolio, the funds will last 26 years. What is important here is to also consider surprise expenses, such as a medical emergency or home medical assistance as one ages. We are also seeing a marked increase in life expectancy, which will need to be provided for.” This scenario highlights that the corpus must grow to meet your cash needs with inflation.

Navlakhi adds, “In this above example where one has a corpus of Rs 1 crore and wants the funds to last for 40 years into his/her retirement, and also doesn’t want to take undue risks—earns 8 per cent per annum return on the portfolio—the monthly expenses will need to be Rs 30,000 for the math to work out.”

Billimoria explains the process through an example. If an individual has around Rs 3.4 crore at retirement, the first bucket can have about 12 per cent of the total assets, the second can have around 18 per cent, the third can have 17 per cent, the fourth can have 18 per cent, and the fifth bucket can comprise about 35 per cent of the overall corpus. After allocating to each bucket, you must set up a withdrawal plan to generate monthly income.

However, this is where it can get tricky, and you will need to do some math to ensure you are getting the returns as expected and do not overspend. Otherwise, you may deplete your corpus quickly and outlive your retirement savings.

How The Math Works

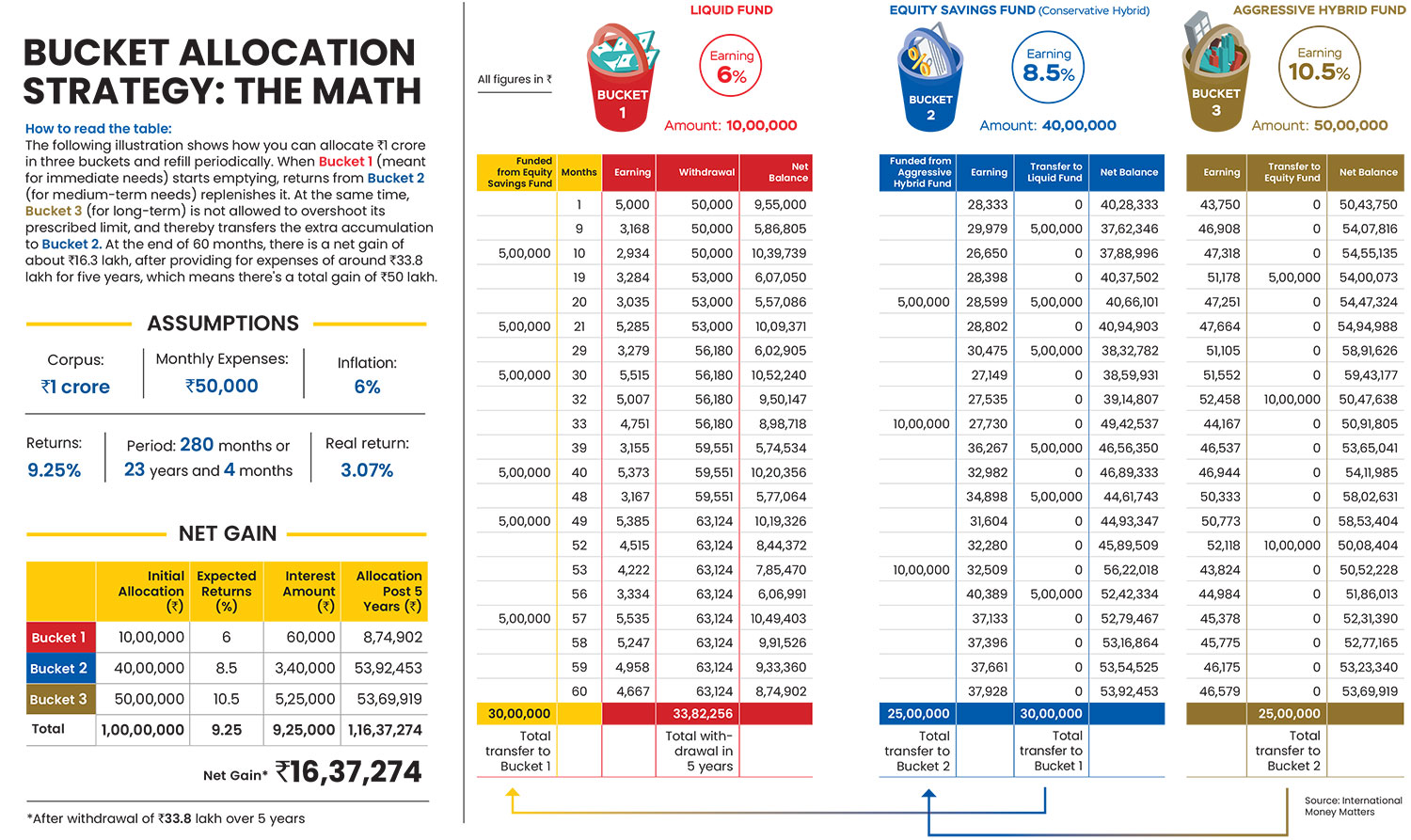

Let’s take Navlakhi’s example to see how the math works. Let’s say you have a retirement corpus of Rs 1 crore of which Rs 10 lakh is invested in liquid assets in the first bucket, earning 6 per cent per annum; Rs 40 lakh in equity savings funds (conservative hybrid) in the second bucket at a return of 8.5 per cent annually, and Rs 50 lakh in aggressive hybrid funds in the third bucket at a return of 10.5 per cent. If the weighted portfolio return is 9.25 per cent per annum, annual inflation is 6 per cent, and monthly expenses are Rs 50,000, the funds will last for 280 months or over 23 years. If it has to last 30 years at the same rate, the monthly expenses will have to be reduced to Rs 42,500.

Bucket Management: Every time, the first bucket of liquid funds reduces to about Rs 5 lakh (from the initial Rs 10 lakh), another Rs 5 lakh is added to it from the conservative hybrid fund (from the medium-term bucket). According to the calculation, in the first 60 months, the amount is refilled six times to Rs 30 lakh.

Likewise, every time the conservative hybrid bucket drops to below Rs 35 lakh (from the initial Rs 40 lakh), money from the aggressive hybrid scheme (long-term scheme) is moved to the conservative bucket.

Also, every time the aggressive hybrid value crosses Rs 60 lakh, the fund is recalibrated to Rs 50 lakh by moving the excess to the conservative fund. Overall, Rs 25 lakh was moved in the first 60 months from the aggressive hybrid to the equity savings fund.

After 60 Months: Based on the above assumptions, the values of the liquid, conservative hybrid and aggressive hybrid schemes will move from Rs 10 lakh, Rs 40 lakh and Rs 50 lakh, respectively, to Rs 8.7 lakh, Rs 53.9 lakh and Rs 53.6 lakh, resulting in a weighted average return of 9.23 per cent per annum. After providing for Rs 33.8 lakh as expenses in the first five years, the value reaches Rs 1.16 crore—a total gain of about Rs 50 lakh.

What Should You Do?

You will need to review the portfolio periodically—ideally at the beginning of every year. If needed, you will also have to rebalance the bucket and reconsider your expenses.

Then, after setting aside the expenses, you will need to reinvest the surplus in the respective time buckets in the same way as before to meet your cash requirements for the next year and beyond. This cycle of allocation and growth can continue each year to generate regular income.

For instance, at the start of the fifth year, expenses, which started at Rs 50,000 monthly, are up to Rs 63,000 per month because of inflation.

Navlakhi says that after 10 years, “expenses will be up to Rs 84,000 per month, while total withdrawal for expenses will be Rs 79 lakh and the total value of the portfolio will be Rs 1.27 crore. In the last 5-10 years, which is after 15-20 years, the expenses will be greater than the earning and the corpus will start dropping.”

The bucket strategy will help you create a diversified portfolio so that when the chips are down, you can earn regular income from the fixed-income and low-risk buckets, while when the markets are up, you can reload the corpus by riding the stock market gains.

sanjeeb@outlookindia.com