Mr. Vijay Gupta, 68, is a private sector professional. His wife Geeta Gupta (61) and his 30 years old son Rajat are part of the family. Despite being a late investor in mutual funds who started investing post he attained 60 years of age, Mr. Gupta is a happy investor given the better than expected returns. He has developed a liking for mutual funds as one of the best vehicles to generate long-term wealth. However, this was not the case until he met Mr. Abhishek Mittal, his mutual fund distributor.

Investment Preference before Mutual Funds

Mr. Gupta has been a highly conservative investor. He never wanted to take risks and thus preferred investing only in residential real estate properties and banks’ fixed deposits. It could possibly be because of his lack of awareness about the risk-adjusted return mechanism in-built in modern investment tools like mutual funds. He continued with the traditional investment avenues till he entered his 60s. But things were set to change soon.

Meeting with Mr. Mittal

In 2018, when Mr. Gupta met Mr. Mittal, the latter explained why all eggs should not be kept in one basket as asset concentration risk can be hazardous. Mr. Mittal explained in depth why investment should be inflation-beating and liquid to ensure one not only creates wealth but can utilise the amount when needed. Mr. Gupta had never thought on these lines when it came to his investments. Mr. Mittal told him about several types of mutual funds which are suitable for different sets of investors. “I explained in detail how schemes for conservative investors can yield better returns, provide superb tax efficiency and can be highly liquid,” says Mr. Mittal. This ignited interest in Mr. Gupta and he was convinced to start his first investment in Mutual Funds under the guidance of Mr. Mittal.

Investment Strategy

A seasoned professional in mutual fund distribution, Mr. Mittal understood that Mr. Gupta was ultra conservative with a low risk appetite. Thus, equity investment was not at all under consideration as preserving the capital while adding value addition of growth was his priority. To begin with, Mr. Mittal explained about the bond markets. “Unless my investor is well aware where his money is going to get invested and how that particular asset class behaves, I am never in a haste in taking investors on board,” says Mr. Mittal. He educated Mr. Gupta about the advantages of investing in bond markets through debt mutual funds. “I told him about the experienced fund managers who manage investors’ money, the diversification in investment, tax efficiencies and the most important of all - the compounding nature of returns,” narrates Mr. Mittal.

The Beginning of Investment

Mr. Mittal encouraged Mr. Gupta to start with a smaller amount and learn how the investment works. “Often, unless investors are not confident, they don’t invest more. So the best way to start Mr. Gupta’s investment journey was by offering him a taste of mutual funds,” pinpoints Mr. Mittal. As years passed and the investor could see the returns in the short-term bond funds, which were several basis points more than what a plain vanilla banking product would have offered, Mr. Gupta’s confidence and learning was on the rise. As a result, within two years by 2020, the bulk of his corpus was moved to the debt category of funds.

Strong Hand Holding during the 2020 pandemic and the Debt Crisis

The investments were doing good till the pandemic hit the country in April, 2020. Though the stock markets tanked heavily, Mr. Gupta’s debt portfolio was reasonably stable. However, when the crisis hit the debt schemes of one of the largest fund houses, there was panic all around among investors. Mr. Mittal had the realisation that this was the time to take investors into confidence. “We took all our clients including Mr. Gupta through a detailed review of the underlying securities held in the debt portfolio and recommended to stay invested while adding more funds. It was more about handling investors’ emotions and keeping them on the wealth creation track. Further, given the sharp corrections in the equity segment, we recommended suitable allocations to equity schemes,” recalls Mr. Mittal. Such a timely exercise did help in restoring confidence of Mr. Gupta. “As a result, not only did he stay put, he also took advantage of market panic and invested more in Credit Funds while in equity we offered him bluechip equity funds,” adds Mr. Mittal.

Present Situation

Continuous services to investors while maintaining transparency with clear and relevant communication, Mr. Mittal managed to navigate Mr. Gupta through different cycles. He ensured his investor’s portfolio is well diversified with suitable and appropriate asset allocation. As on date, Mr. Gupta’s portfolio has a healthy mix of equities, bonds and gold. In between, incremental allocations to stocks through large cap diversified equity schemes helped him participate in the India growth story. He is content with double-digit compounded returns in his portfolios. “I thank Mr. Mittal as such incremental growth in value may not have been possible in the traditional sets of investments,” says Mr. Gupta.

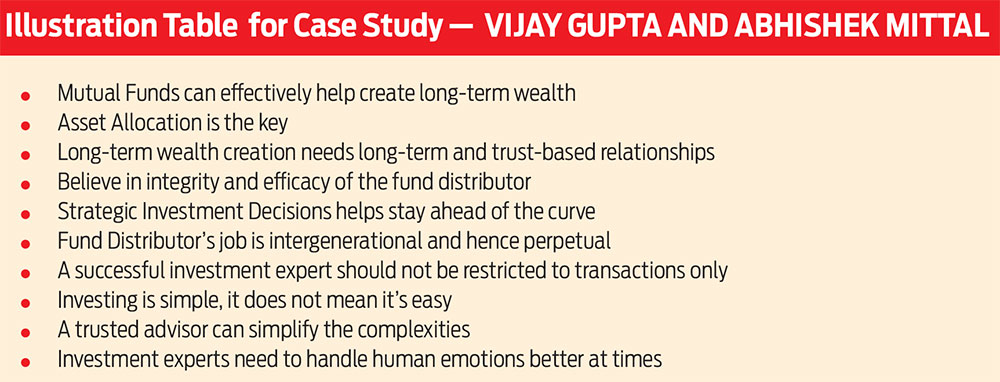

Lessons Learnt

For Mr. Gupta, the learning curve is much steeper as his journey resulted into a mature investor from a naive one. “My biggest learning over the last more than half a decade with Mr. Mittal is I must trust him and his decisions. Since he has more domain knowledge about investing I have no option but to believe in his integrity and efficacy,” says Mr. Gupta.

On the other hand, Mr. Mittal believes that every investor is unique and so was Mr. Gupta. “I am not only in the business of transactions but in managing wealth which is intergenerational and thus perpetual. I take my profession as an opportunity to simplify complexities. Mr. Gupta has been quite supportive and understood the nuances of investments quite well. Without his support we could not have come thus far,” says Mr. Mittal.

Both agree that it is the trust-based long-term relationships which result in successful wealth creation. “Without each other’s understanding and expertise, the journey would not have been so fruitful. We will go far ahead,” they conclude on a happy note.

Abhishek Mittal, Partner, Fermat Prime Enterprises Pvt. Ltd

Disclaimer

The financial journey of Vijay Gupta and his family is based on the “personal view and experience” of Abhishek Mittal, Partner, Fermat Prime Enterprises Pvt. Ltd and should not be construed as professional investment advice. No one should make an investment decision without first consulting with their financial advisor and conducting research and due diligence.

Disclaimer

The views are personal and are not part of the Outlook Money editorial Feature.