When it comes to the world of investing, one man shines like a beacon above everybody else—Warren Buffett. Even now in his 90s, his annual letters and address to Berkshire Hathaway shareholders are eagerly awaited by shareholders and others alike. We dwell upon his investing philosophy in the Indian context and pick out a stock from the Nifty 500 list that fulfils his criteria of quantitative screening and shortlist one that you might find want to consider

Is there any sports or movie star or social worker or anyone for whom you have such high regard that you would travel to a small town in another country to listen to the person once a year? Not just travel to that destination, but also to stand in line for a few hours before entering the stadium or hall. In the world of investments, one such enigmatic person is Warren Buffett; around 40,000 people from around the world travel to Omaha, Nebraska, when he addresses his company Berkshire Hathway’s annual shareholder meeting. The event is no less than a mega performance by superstars.

Buffett is the richest person in the world who has made all his wealth from investing. His fan club includes investors from many countries, and there are more than a dozen books on him and his investment style.

We try to dissect his performance, explore his investing strategy to shortlist some stocks, and based on that, recommend one that you may consider buying.

Dissecting The Performance

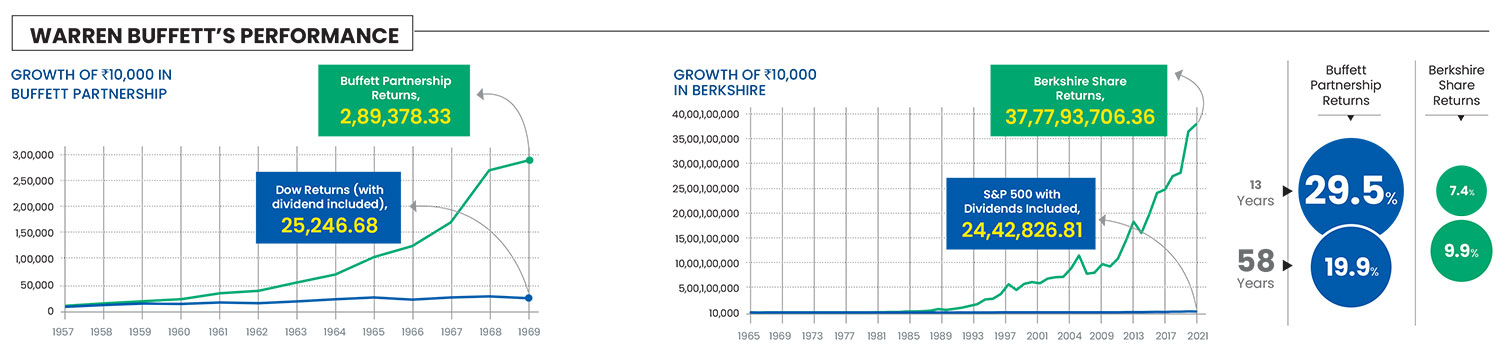

Buffett ran his investment partnership from 1957 to 1969, and reaped returns of 29.5 per cent compared to 7.4 per cent from the Dow Jones index (including dividends). After that, he moved to managing investments through Berkshire Hathway full-time. He bought full control of the company in 1965, becoming the largest shareholder, and moved his entire net worth into the company in the 1970s. Between 1965 and 2022 (58 years), if someone had invested Rs 10,000 in Berkshire in 1965, the value of their current holding would be Rs 37.77 crore, growing at the pace of 19.9 per cent per annum. During the same period, the S&P 500 (including dividends) went up to only around Rs 24 lakh or 9.9 per cent (see Buffett Performance).

Looking at Buffett’s partnership letter and management commentaries in the Berkshire annual reports, it is clear that he evolved with the market.

His early investment approach was primarily quantitative, focusing on stocks trading below their liquidation value which he later referred to as “Cigar butt approach to investing”. That is where you try and find a pathetic company, which sells so cheap that you think there is one good puff left in it. In his 1962 letter to partners, he detailed his portfolio strategy, which is divided into three main segments: generals, work-outs, and control situations. Each category plays a distinct role in his investment strategy, contributing uniquely to the overall performance of his portfolio.

Buffett says that ‘generals’ are undervalued stocks, held without influencing company policies, reflecting a mix of safety and growth potential, but mirroring the broad market trends. ‘Work-outs’ focus on specific corporate events, offering predictable outcomes often contrary to market trends, with Buffett leveraging for enhanced returns. In modern finance, many fund managers refer to this strategy as special situations. ‘Control situations’ involve Buffett gaining significant influence in a company, focusing on long-term direction rather than immediate returns. Nowadays investors employing a similar strategy are referred to as activist investors.

Acquisition of the now ubiquitous Berkshire Hathway was part of the controls that he had acquired in 1965 and then converted into an investment vehicle that has housed some of the famous companies of the US. In total, there are 73 direct subsidiaries of Berkshire Hathway. Some of these subsidiaries also have many companies within them.

It is important to note that implementing a control situation is very difficult in India. Rajeev Thakkar, chief investment officer and director, PPFAS Mutual Fund, says, “In the West, if a CEO or the management is not acting in the shareholder’s best interests, they get voted out by activists. In India, usually, either a business is family-owned or is a subsidiary of a multinational corporation, or the government is the majority shareholder; in such a situation, activist or minority shareholders cannot do much to change the way a company is run.”

In Berkshire Hathway, he evolved his investing style further.

As his portfolio expanded over time, he gradually shifted towards high-quality investing. This shift was driven by two main factors: first, the diminishing quantitative opportunities by the late 1960s and the inflated market conditions. Second, the realisation that the high returns came from qualitative investing by understanding the dislocations and extreme reactions in the market. In Buffett’s own words, “Interestingly enough, although I consider myself to be primarily in the quantitative school (and as I write this, no one has come back from recess—I may be the only one left in the class), the really sensational ideas I have had over the years have been heavily weighted toward the qualitative side where I have had a ‘high-probability insight.’ This is what causes the cash register to really sing. However, it is an infrequent occurrence, as insights usually are, and, of course, no insight is required on the quantitative side—the figures should hit you over the head with a baseball bat. So, the really big money tends to be made by investors who are right on qualitative decisions but, at least in my opinion, the more sure money tends to be made on the obvious quantitative decisions.”

Vikas Gupta, CEO of OmniScience Capital Advisors, says, “Warren Buffett has evolved continuously. In his early partnership, he was doing net-to-net to risk-arbitrages, and even moving towards quality-based investing. The buy-and-hold approach attributed to him is a misconception, as he is buying and holding forever, only controlling companies or large ones that are still growing, that he need not sell.”

Learning From Buffett

Buffett is renowned for his generosity in sharing knowledge through annual letters to Berkshire Hathaway shareholders and through other public communications. His writings not only report on financial performance, but also offer insights into his investment philosophy, making complex concepts accessible to a broad audience. This educational approach has made Buffett a mentor figure for investors worldwide, democratising investment wisdom and guiding both novices and seasoned professionals in navigating the complexities of the stock market.

In July 12, 1966, in his partnership letter, Buffett humorously reflected on the futility of market guessing, prompted by partners’ calls during a Dow decline from 995 to 865. He questioned their sudden clarity in May, pondering why they didn’t foresee it in February, and highlighted the uncertainty of predicting future market movements. Buffett emphasised the persistent lack of clarity in market forecasting, contrasting the silence after market gains with the sudden calls for caution during declines, underscoring the unpredictable nature of the stock market. His last letter to the partners contained a reading of municipal bonds and how to invest in them.

In 1991, he explained to the media and highlighted the dangers of debt and leverage, warning investors about the risks they pose to businesses. By 2001, Buffett was emphasising on the importance of understanding a company’s intrinsic value and had reprinted the Owners Manual. Then, in the 2002 annual letter, he tutored readers on derivatives. In 2008, amid the financial crisis, Buffett emphasised the enduring value of Berkshire’s diverse portfolio of businesses and investments, highlighting their resilience even in the face of severe economic challenges. In 2014, Buffett highlighted the importance of long-term thinking in investment decisions, cautioning against the short-term market predictions.

Hitesh Zaveri, senior vice president and head–listed equity alternatives, Axis AMC, says that Buffett’s letters to shareholders are a great educational resource. “They are easy and free to access on Berkshire Hathaway website and all of them are lucidly written and remarkably educational,” he adds.

How To Select Stocks Using Buffett’s Strategy?

Although Buffett’s journey and evolution are insightful, the key question remains: how can we profit from it? Drawing from his writings spanning four decades, Robert G. Hagstrom authored The Warren Buffett Way, while Mary Buffett, his daughter-in-law, wrote Buffetology.

While there are overlaps between their approaches, some aspects of stock selection differ.

To adapt Buffett’s principles to the Indian retail investors’ context, we’ve consolidated and modified them, creating an approach and a checklist for Buffett-style investments.

The Checklist: This has three primary parts, followed by a fourth additional section.

First is the quantitative screen to see if one should spend time studying the company. Second is the qualitative study to determine if one should value it or if the business is too hard to understand. Third is the valuation study to see if an investor should buy it piecemeal or invest aggressively. This exercise has to be done every time you are adding a stock to the portfolio or planning to sell it. The fourth additional section is for your reference so that during moments of panic, it can assist you in seeking clarity.

Quantitative Screen: It’s about studying the company.

1. The company must have a history of 10-15 years.

2. The return on equity (RoE) of the company must be above 12 per cent consistently in the last 10 years or over 15 years. If you are taking 15 years, then the company should have reported an RoE above 12 per cent in at least 12 years.

3. Remove any company where earnings per share (EPS) has been negative in the last 10 years.

4. EPS growth should be positive in at least 8 out of the last 10 years. And this should be above 12 per cent.

5. Gross profit margin should be above 15 per cent in the last 10 years in each year (for financial services companies consider net profit margin).

6. Long-term debt should be less than two times the net profit plus depreciation (applicable for non-financial services companies only).

Qualitative Study: This will help determine if the company makes it to the watchlist.

1. Is the business simple and understandable?

2. Do you understand how the product works? Buffett thinks if you don’t understand the work, then you will not be able to determine when it will go obsolete.

3. Why do you and other consumers prefer the product? What motivates its use or non-use for you? What drives your decision to invest in a company whose product you personally don’t use?

4. Is the management candid with its shareholders?

5. Does the management resist the institutional imperative? (The management is not offering products just because other competitors are. The management is doing something different from the rest and is able to explain its rationale.)

6. Is the company free to raise prices with inflation?

7. Are people likely to use this product 20 years down the line?

Valuation Study: It should be done once a year.

1. For retained earnings, how did the company deliver?

2. What is the (earnings yield + EPS growth rate) compared to the government securities (G-sec) yield?

3. What is the value of the business?

4. Can the business be purchased at a significant discount to its value?

Event-Based Questions: If the company has had bad publicity, ask four questions.

1. Is the company’s stock price suffering from a market panic, business recession, or an individual calamity that is curable?

2. Based on your qualitative study, what would be the solution, and is the company taking such steps?

3. Do ground research: have a conversation with the shop that always sells the product, and see if there is any change.

4. Redo the qualitative study and visit the previous notes to see if anything has changed dramatically.

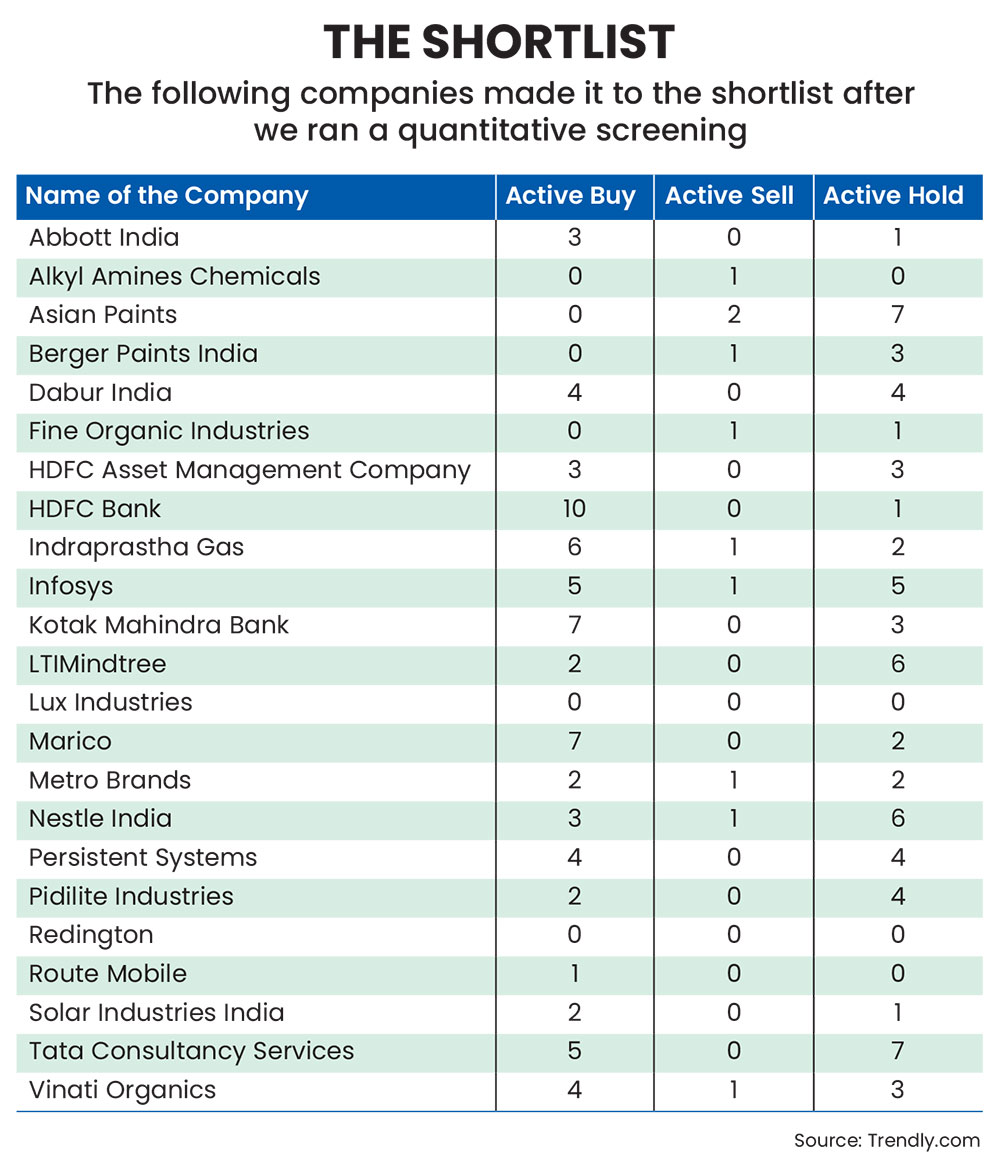

We took the annual data of the Nifty 500 stocks for the last 15 years from Accord Fintech. We managed to complete the quantitative screening to shortlist stocks that fulfil the criteria (seeThe Shortlist). Based on this, we found one interesting stock that you may consider, though it is crucial to consult a financial advisor before you buy a stock. We are using it as a sample to showcase how the checklist can be used to determine whether to buy it or not.

***

HDFC Bank

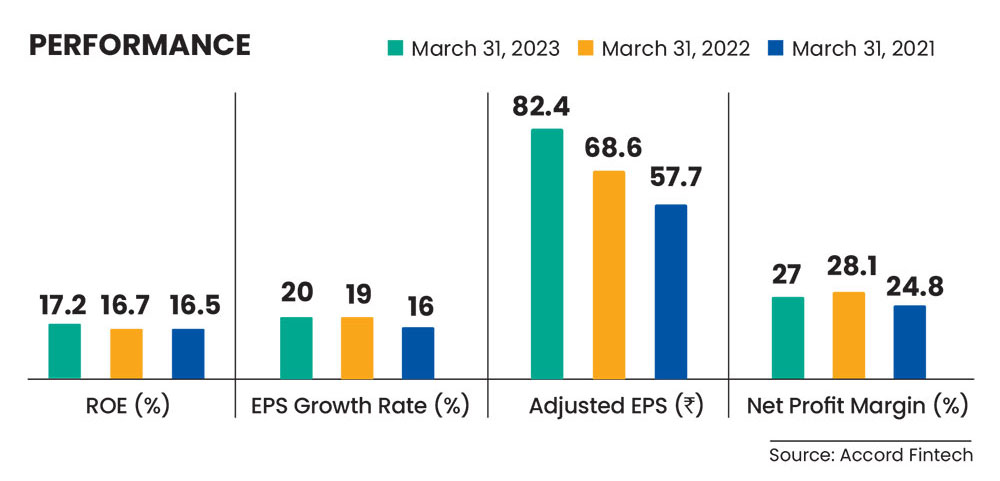

Why HDFC Bank? Since the stock has corrected by 17.8 per cent from its peak, and many research analysts have recommended it, and it has qualified for the basic quantitative screening as per the checklist above (see Performance), we see merit in it.

Qualitative study

1. Is the business simple and understandable?

Yes

2. Do you understand how the product works?

(Buffett thinks that if you don’t understand, then you won’t be able to determine when it will go obsolete.)

Yes. Banks have three major sources of income. They take deposits from customers and give loans at higher rates of interest. Thus, earnings are the difference of interest received (from the loans given out) and the interest paid (to depositors). For all the third-party products that the bank sells, it gets a commission. It also invests and trades.

3. What customers, employees and analysts say?

Customer 1: In my family, we have an account with most of the major banks, we didn’t have one with HDFC Bank, so we opened it. The service was fast, and I didn’t think there was any problem. I need to maintain `25,000 in the account, which I think is not a problem for me.

Customer 2: They cut down the benefits of the account. Currently, it is a salary account. If I switch jobs, then I will shut it down.

Customer 3: I felt the service was okay, but the balance requirement didn’t make much sense. And they deduct fees too often. Their loan service is the best. I had multiple bank accounts that are tagged as lifetime zero balance, so I shut the HDFC Bank account.

Former bank employee: The bank’s challenge is that they don’t do feasibility analysis and open full branches. There are some locations where we have three branches within a kilometre. Each time a new branch opens, we don’t get as many new customers, but rather some of the old customers move to the new branch. Ideally, each branch should be evaluated from a strategic point of view. At times, only a branch extension should be opened for client servicing if there is enough business. Clients prefer to be with a bank for three reasons: (1) it’s near their home or office; (2) past in-branch experience is good and shows convenience; and (3) they have a sense of security that the bank will not shut down and the money is safe.

Now, the first one is not applicable to the new online generation. However, small-to-medium businesses and few old-school customers prefer visiting the bank. Clients who visit the branch tend to be extremely loyal and won’t leave. The other set will be floating. The problem of excess branches could be resolved in a few years. When I left, they had started taking steps in that direction, but as the organisation is large, it may take time.

Research analysts: The overall consensus is that the stock price has an upside. Analysts also agree there is near-term difficulty for the bank, but expect it to recover gradually.

4. Is the management candid with its shareholders?

There is no explicit instance to show if the management is candid, or it is evading questions by giving wrong responses to the shareholders.

5. Does the management resist the institutional imperative?

HDFC Bank CEO, Sashidhar Jagdishan, had said in one of his interviews, that “we will let go of some business if we think the risk-reward is not making sense”. In other words, they don’t follow the industry norms if it doesn’t align with their long-term goals.

6. Is the company free to raise prices with inflation?

The deposit side of the business may come under temporary pressure during an inflationary period. Given its long history and having seen multiple cycles, the bank will manage.

7. Are people more than likely to use this product 20 years down the line?

It’s a regulated space. Unless the bank doesn’t make a big mistake, it’ll have an important role in the economy.

8. Are there any favourable long-term prospects?

Yes. Banking services are an essential feature for a growing economy. Also, as the sector is regulated, a competitive threat emerging without detection is not likely possible. This very strength can be the bank’s Achilles heel, as the regulatory overhang can be dangerous making the profitability questionable.

Valuation Study

1. How did it deliver?

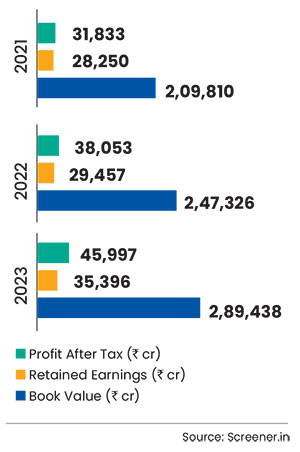

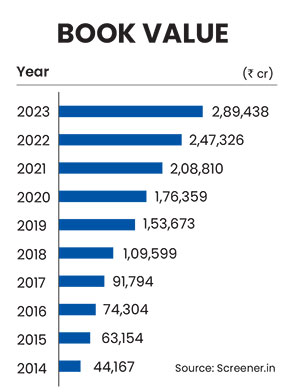

The book value has increased more than the cumulative of the retained earnings over the last 10 years. Since the growth is more than 1 per cent in non-adjusted retained earnings, the stock fulfils Buffett’s litmus test: “The gain in the market value of the company should exceed the sum of retained earnings.”

2. What is the business value?

Doing discounted cash flow is difficult for banks. The alternative method must be used to value the business, which is to check if the current price-to book (PB) value (see Book Value) is less or close to long-term PB value. HDFC Bank is available at one of the best prices in its history.

3. Can it be purchased at a significant discount?

Yes. It is available at a discount.

What Should You Do?

In the 2008 Berkshire Hathaway annual meeting, Buffett discussed his strategy for investing in banks. He said, “So much depends on the character of the institution, which will probably be a reflection, to a great degree, of the type of CEO you have. I think you should know something about the culture of the management and the institution to make a firm buy decision on a bank, and that’s hard to do for 99 per cent of the banks.”

HDFC Bank’s advantage is its long history and its culture of often correcting itself and focusing on regulation and customers. From a data perspective, many things are going well for the bank. This is a good time for investors to buy the stock. The bank’s stock may remain range-bound for a year or two or till there is a deposit slowdown for the banking sector. So, this will be the best time to accumulate and build a position in the portfolio.

*Investments in securities markets are subject to market risks, consult your advisor before investing.

The author is a Sebi-registered research analyst