Numbers don’t lie, and certain numbers can be scary. According to a study by the Indian Council of Medical Research–India Diabetes (ICMR-INDIAB), published in medical journal The Lancet in June 2023, 101 million Indians are diabetic and 136 million are pre-diabetic. The numbers, the study says, are much higher than earlier reported figures. The World Health Organization (WHO) estimates that 77 million Indians above 18 years are diabetic and nearly 25 million are pre-diabetic.

“India is consistently retaining its position as the global capital for diabetes. It is a lifestyle disease with long-term multisystemic complications which requires a holistic treatment. Managing and treating diabetes-related complications can be expensive, especially during hospitalisation and it can put a strain on one’s finances,” says Madhumathi Ramakrishnan, senior vice-president, Star Health and Allied Insurance.

Given the rising incidence of diabetes in India and the steep associated costs, buying a health insurance to cover hospitalisation is advisable, especially if you have a family history of diabetes. But which policy should you buy? Should you go for diabetes-specific plans or settle for a regular policy? We have tried to answer these questions by exploring diabetes-specific plans and comparing them with regular health insurance plans to help you decide.

What Makes Them Different?

Diabetic-specific plans are customised to provide specialised benefits and services that cater to the unique requirements of diabetics. Diabetes patients need regular blood glucose monitoring and medical prescriptions. They are also susceptible to high risk for diabetic neuropathy, vision loss, stroke, cardiovascular diseases, and other health ailments.

These plans may encompass coverage for diabetic education programs, nutritional counselling, and specialised diabetic management tools and resources. They also cover diabetes-related expenses, such as on surgeries, kidney problems and others.

Type 1 diabetes is an autoimmune condition where the body’s immune system attacks and destroys insulin-producing cells in the pancreas. This results in a lifelong dependence on insulin injections for blood sugar regulation. Type 2 diabetes is primarily linked to lifestyle factors, such as poor diet and physical inactivity, leading to insulin resistance. People afflicted with this rely on medication, diet, and exercise to keep diabetes in check.

Comprehensive health plans, while providing extensive coverage, may not offer disease-specific customisation.

Who Are They Meant For?

Typically, diabetes-specific plans are designed for individuals with Type 1 diabetes, those who develop diabetes before the age of 30, or those with severe diabetic conditions.

So, if you have diabetes, a diabetes-specific health plan will be better. Says Parthanil Ghosh, president of retail business, HDFC ERGO General Insurance: “Diabetes health insurance plans are specifically designed for people who are already diabetic.”

Of course, it is subject to the patient’s condition and the level of severity. “We recommend a plan with day 1 coverage by undergoing the required pre-policy medical test. Day 1 covers are usually available to those with no end organ damage with lesser premiums when they undergo pre-acceptance tests,” says Ramakrishnan.

“Also, those with a family history of diabetes may buy diabetic-specific plans as they are more likely to be affected by the disease,” says Siddharth Singhal, business head of health insurance, Policybazaar.com, an insurance aggregator.

Which Policy Do I Choose?

As diabetes is covered under a regular health policy you may ask: why should I buy a diabetes-specific plan?

Says Singhal, “Choosing between a regular plan and a diabetes-specific health insurance will depend on the severity of their condition. Most people (80-85 per cent), with moderate diabetes can go for a regular health plan. However, they should disclose their pre-existing condition, including the severity, HbA1c levels, and the age at which they were diagnosed.”

A regular health plan covers hospitalisation costs, including for diabetes, and reimburses it up to the limit insured. “For the rest 15-20 per cent who have moderate to severe diabetes, high diabetes, or Type 1 diabetes (which is often not accepted in regular health plans), there are diabetes-specific plans,” says Singhal.

Waiting Period: When diabetics enrol in a regular health policy they are considered as customers with a pre-existing disease (PED). Regular health policies cover PEDs only after a waiting period of 2-4 years.

Says Ghosh: “A few products are designed specifically for diabetics, where diabetes is not considered as a PED. So, these products would have a waiting period for PEDs applicable for diseases other than diabetes.”

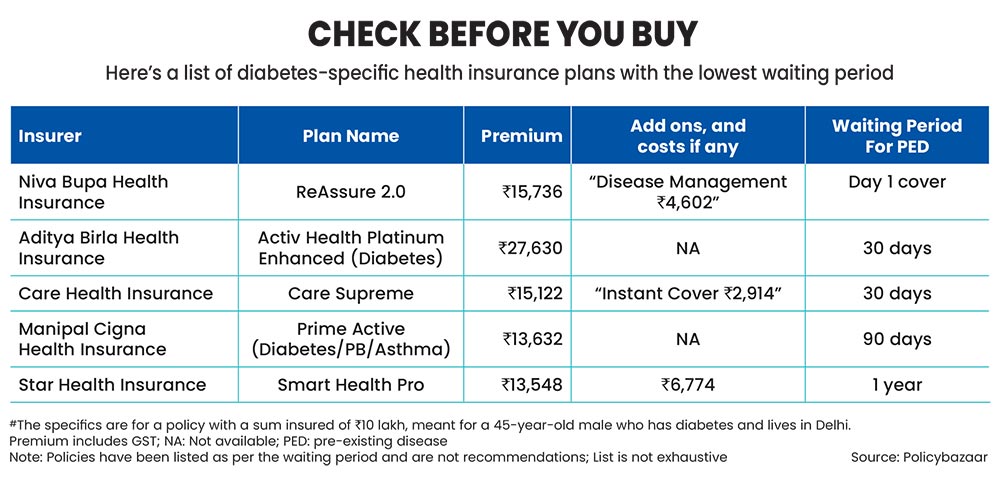

However, diabetes specific plans may have a waiting period from 30 days up to four years, though some plans offer coverage from Day 1. So one must consider the waiting period when selecting a diabetes policy.

Premiums: Diabetes-specific plans have a higher premium because they offer customisation and relatively low waiting period. “These may also include benefits of a regular health plan, such as accidental injuries and critical illnesses. So, their premiums are comparatively expensive,” says Girish Nayak, chief - technology and health UW & claims, ICICI Lombard.

What To Keep In Mind

Opt for a policy with a shorter waiting period. Be vigilant about co-payments or sub-limits, as they can impact out-of-pocket expenses, and lastly, make complete disclosure of your past and ongoing medical treatments to avoid any disputes arising out of your claim.

If you are buying a regular health plan, check if it includes coverage for diabetes-related complications.

meghna@outlookindia.com