Steady Income Necessary

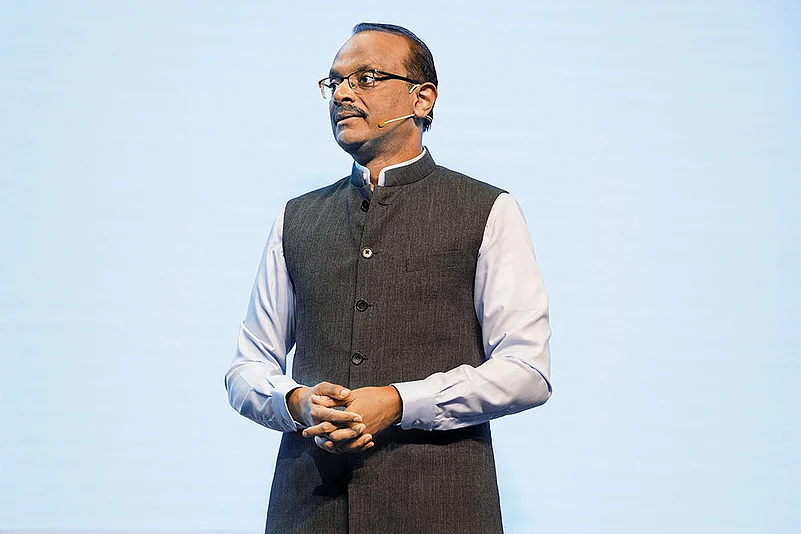

The second edition of Outlook Money’s 40After40 Retirement Expo got off to a great start in New Delhi with the theme address by V. Vaidyanathan, managing director and CEO of IDFC FIRST Bank. He said senior citizens are “young” and what was 60s earlier is now the 80s.

“With life expectancy and level of fitness rising, 80 is the new 60,” he said, adding that it is all about how one approaches his or her life. “It is you versus what you were 20 years ago, approach life with curiosity,” he said.

He acknowledged the contribution of seniors in our society, adding that senior citizens add a lot of value throughout their and our lives. “They have supported us during tougher times, particularly in the India of the earlier century. In the 80s, 90s, and early 2000s, India was a very tough place to do business, except for the last 10 years of India’s reforms. Through those circumstances, they have earned legal income and have supported all of us. So, our role is to be sensitive to their feelings, hear them better, and give them as much company as we can,” he said.

He said senior citizens often feel the loss of relevance with age, and not having a steady source of income after retirement compounds the problem.

“That’s because when they were in their 30s, 40s and 50s, like all of us, they were also working hard, and there was so much action in life. Once their daily routine gets disrupted, they don’t know what to do with their time, and sometimes medical issues come up,” he said.

IDFC FIRST Bank Seniors App

Vaidyanathan stressed the need for smart retirement and financial planning and gave a detailed demo of IDFC FIRST Bank’s mobile app and its latest features for senior citizens, which help them in financial and investment planning in a safe and secure way. “It is one of the most innovative and upcoming banking apps in India,” he said.

While talking about the usefulness of the app, he said, “In my generation, for example, we still have our elderly parents live with us. But people now go to work and study at far places, and they are not with them (elderly parents) to help.” The app can help seniors make their own choices, he added.

Senior-Friendly Apps

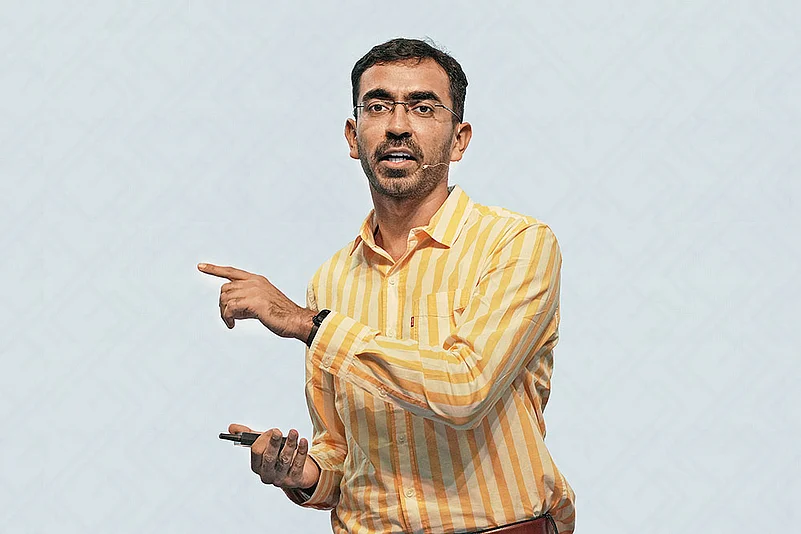

Chinmay Dhoble, head of the retail liabilities and branch banking, IDFC FIRST Bank mentioned how they are offering inclusive retirement solutions and proprietary tools, including creating different sections in their app for senior citizens.

“If you want to invest in a fixed deposit, it’s a two-click journey. Unlike other banks’ applications, where you have to select the tenure and rate, our app will tell you the best possible rate window and tenure. We have a three-in-one account, which enables investment in mutual funds, fixed deposits, and gold-based investments,” he said.

He said the bank uses a proprietary tool called Ace mutual funds, which looks at the future potential of the underlying assets of funds to come up with a curated list of mutual funds. This method differentiates their wealth management approach from others who use past returns to choose mutual funds. The selection of the top five Ace mutual funds depends on the investor’s category or risk profile, he added.

Volatility Can Measure Risk

Investors are getting more complacent in the market due to better risk-to-return ratios. But they should instead look closely at risks and volatility, said Ananth Narayan Gopalakrishnan, whole-time member, Securities and Exchange Board of India (Sebi).

“Better risk-to-return in the last FY has led to market complacency. Last year, the volatility index (VIX) was 10 compared to 28 per cent returns. Also, in FY24, there was a demand-supply mismatch between capital inflow and fresh initial public offerings (IPOs), but there was no mismatch in FY23. This is a sign of market complacency,” he said. He said the sole focus on returns has led to underestimating the importance of understanding and managing risk in the market journey.

Risk-O-Meter An Insufficient Measure Of Risk

He explained why the risk-o-meter in a mutual fund’s offer document is an insufficient measure of risk.

“Return is the point-to-point measure of where we started and where the journey ended. Risk measures how bumpy or smooth the journey was. Often advisors tell you don’t worry about the journey, worry about the returns, as markets always end up higher over long time period. This is bad advice,” he said.

He said to measure risk or the bumpiness of a ride one has to take into account volatility. “Volatility tells you how much the daily returns vary by. The volatility of Nifty of this year is 16 per cent, a decent number for equity markets. In some individual stocks in Nifty, it goes to 25-30 per cent. Some mid- or small-cap stocks show volatility over 50 per cent during this period,” he added.

“We should internalise the measure of volatility and learn to see risk and returns in tandem. The risk-o-meter is a poor substitute for actual volatility,” he added.

Why Risk-O-Meter Fails: He said the volatility of a stock can skyrocket immediately when market gets a whiff that a stock doesn’t have sufficient liquidity. Investors may then start immediately selling it to the best possible bidders, and the stock would plummet. The stock specific illiquidity is not flagged by the risk-o-meter, though it factors in the illiquidity on a category basis.

Further, the risk-o-meter doesn’t take into account the risk tolerance of a specific investor.

“A young investor with long investment horizon to reach retirement can earn better returns from high-risk equities, while the strategy should be exactly the opposite for a senior citizen. Risk-o-meter only takes into account historical data and asset allocation, ignoring the future volatility of a stock; including the effect of immediate geopolitical situations and macro economic fluctuations,” he said.

Last month, Sebi had proposed to use six levels of colours ranging from Irish green to red for risk-o-meters. It also mandated that any changes in the risk level of a scheme or benchmark was to be communicated to unitholders.

F&O Frenzy

He also spoke on the increasing craze among young investors to trade in futures and options.

“The more you trade, the less you make, because of brokerage, transaction charges, and others,” he said, adding that investors should instead diversify across asset classes and rebalance their portfolio on a timely basis as that can generate more wealth over the long term rather than speculative trading.

He added: “Sebi is not against F&O and speculative trading. We want F&O for better price discovery, risk hedging and increased market depth.”

He said Sebi only wanted to restrict the increased frenzy in index options on expiry day as many investors use them like slot machines at a casino.

Bull Market Always Wins In The End

After Thursday’s mayhem in the market, how are you folks feeling?” Shankar Sharma, founder of GQuant, asked the gathering. As the crowd cheered, “Bullish”! Sharma, known as the Big Bear of Dalal Street, replied: “The mother of all bear markets is dead.” He then walked the attendees through the 100 years of crashes, starting with the ‘Wall Street Crash of 1929’.

1929: The Great Depression; Index Decline: 89 per cent

Reason: Stock market speculation, bank failures, and monetary policy.

1946-47: WWII Recession; Index Decline: 23 per cent

Reason: Post-war inflation, economic adjustments, and rates.

1957: Eisenhower Recession; Index Decline: 19.4 per cent

Reason: The tightening monetary policy by the Federal Reserve and a decline in industrial production.

1962: The Kennedy Slide; Index Decline: 27.1 per cent

Reason: Inflation, rising interest rates, and Cuban Missile Crisis.

1973-74: Oil Crisis; Index Decline: 48 per cent

Reason: Oil embargo, inflation, and a recession-driven by high unemployment and stagnation.

1987: Black Monday; Index Decline: 22.6 per cent in a day

Reason: Computerised trading, illiquidity, and concerns about rising inflation and interest rates.

2000: Dot-com Bubble; Index Decline: 49.1 per cent

Reason: Bubble in technology stocks, exacerbated by the 9/11 attacks and corporate scandals like Enron and WorldCom.

2007-09: Financial Crisis; Index Decline: 56.8 per cent

Reason: Collapse of the US housing market, mortgage crisis, and the failure of financial institutions.

2020: Pandemic; Index Decline: 33.9 per cent

Reason: Covid-19

2022 Bear Market; Index Decline: 20 per cent

Reason: Rising inflation, Federal Reserve interest rate hikes, and global supply chain disruptions.

Reasons For Bear Markets

Shankar highlighted five major reasons behind bear markets.

Excessive Speculation: He cited the 1929 and 2000 market crashes.

Geopolitical Conflict: He cited the example of the Yom Kippur War led to an oil embargo in the 1970s, which led to a bear market.

Inflation and Monetary Tightening: Rising inflation often led to monetary tightening by central banks, which could impact the market.

Excessive Leverage: He cited the example of the 2007-2008 financial crisis, where excessive leverage among banks led to a downturn.

Pandemics and Global Crises: The Covid-19 pandemic was a classic example of this, he said.

The Solution

Sharma said the world has devised solutions to tackle bear phases.

Speculation: Over time, valuations have become more reasonable.

Banking: Regulators have imposed strict norms on banks and large brokers to prevent a 2007-8 crisis.

Inflation: The world has better supply chains to tackle inflation.

Wars: Markets have been resilient even in the face of ongoing wars.

Oil: The world understands that crises are shortlived, and hence the reactions are less panicky.

Pandemic: The world found a solution within six months.

The Villain Always Dies

Sharma said that humans have mastered the art of neutering bear market villains. “Speculation, inflation, war, disease, we have dealt with them all! In short, we can deal with Pran, Prem Chopra, Gulshan Grover, Dr. No, etc. The hero (the bull market) always triumphs in the end,” he said, except if a whole different villain comes along.

Focus On Skilling Is The Key

Arvind Virmani, economist and full-time member, Niti Aayog, who was also the chief guest, spoke of his vision of India becoming a high income country by 2050, and an upper middle income country by 2030.

“There is a vision of Viksit Bharat. It is shared by everybody. It’s not the government’s vision. It is my vision. But we are well placed to become a high income country by 2050. We are on way to improving our relative gross domestic product (GDP), GDP per capita, employment and income distribution, while reducing poverty,” he said.

New Opportunities

Virmani said there are lots of opportunities in India available now as compared to earlier. The working population ratio is also growing, which means that there are more jobs available, he said.

In comparison, the working population in other high income countries, such as Japan, Germany and the US is declining, he added.

Seize Advantages

He said India must take the advantage of a growing working population and the increasing working opportunities to improve its GDP, GDP per capita, while simultaneously reducing poverty and distributing income.

He added that multinational corporations are important in this respect as they create and support an entire ecosystem.

Challenges Ahead

As with any journey to growth, challenges existed in India’s growth journey too, and some of them still remain, however old, he said. He added that the quality of basic education and skilling needs to be improved across India.

“There was not enough focus on actual teaching. Skilling has to be improved,” he said.

He said that bureaucratic hurdles as a remnant of socialist legacy still remained, however negligible.

Pension: A Long Way To Go

For the retired, pension is one guaranteed source of income that provides financial security, dignity and peace in old age.

Unfortunately, in India, pension is limited to government employees. It was on the backdrop of this that the National Pension System (NPS) was launched, making the transition from a defined pension to a contributory pension (where individuals contribute for creating a pension corpus for themselves), said Deepak Mohanty, chairperson, Pension Fund Regulatory Development Authority (PFRDA).

Key Initiatives Of PFRDA

Mohanty highlighted the initiatives taken by PFRDA for the growth of the pension sector in India.

These include enhancing the employees’ contribution from 10 per cent to 14 per cent, flexibility to choose central recordkeeping agencies (CRAs), mode of payment (including Bharat BillPay), same day investment of contribution (T+0), penny drop verification, balanced life cycle (BLC) fund, where the equity exposure is limited at 50 per cent, but begins tapering at age 45 instead of 35, among others.

Where India Stands

He said though NPS is a low-cost and flexible scheme, efforts are needed from all to join NPS for achieving pension saturation.

“Our current pension asset to GDP ratio is 16.5 per cent, while the same for the US, the UK and Australia, is over 100 per cent. If we talk of Scandinavian countries, it will be more than 400 per cent. This shows the Indian pension industry is still evolving, and we have a long way to go,” he said.

The Power of Equities And Strategies That Can Shield You Against Risk

Accordingly, one should decide to diversify one’s portfolio appropriately across various time frames, investment options, and asset classes, he added.

He said there are no good or bad days for investing. “In the last 20 years if you missed out on the best 10 days of the markets, your returns would go down by 47 per cent. Similarly, if you missed the 10 worst days, your returns would be up by 52 per cent,” he said.

“If one misses the opportunity to invest on the worst day and invests later at a higher level, the difference in returns could be significant in the short term. But as the stay extends to a few years, the difference between the best and the average return lessens,” he added.

Vishal Kapoor, CEO of Bandhan AMC, highlighted that equities can help beat the effect of inflation on the retirement corpus. He then explained this through an example: If a person invested Rs 1 lakh in a debt fund 15 years ago, the returns would be only 4.7 per cent, or a corpus of Rs 2 lakh. If he had invested it in equity, the post-tax returns would be 12.5 per cent, or a corpus of Rs 7.5 lakh.

Kapoor, while making a presentation on a retirement study conducted by Bandhan Mutual Fund and Toluna, highlighted the power of SWPs in providing regular income post retirement.

Speakers also highlighted that one should not see equity as a sure-shot way to create wealth.

Anish Tawakley, Co-CIO Equity, ICICI Prudential AMC gave the example of small-cap funds saying that the market was at an extreme valuation in 2008 and if one entered small-cap space in 2008 and held on till January 2020 (NSE 100 was flat over the 12-year period, and NSE 50 Small Cap was down 30 per cent over the period).

Harsha Upadhyaya, CIO Equity and Debt, Kotak Mahindra Asset Management said investment patterns during periods of volatility depend on one’s risk appetite.

“Those who have experienced equity markets over long periods and have created reasonable wealth would continue with volatility. If anybody had invested pre-Covid and stayed during that disruption would probably continue, because they know that even once-in-a-lifetime kind of a disruption has not led to erosion in their wealth,” he said.

He said that the only segment which is vulnerable to market shocks would be those who have come in the past three-and-a-half years, because markets have been a one-way street during this phase.

Mahesh Patil, CIO-Equity, Aditya Birla Sun Life AMC explained the concept of risk-reward—the higher the risk, the greater is the long-term return from the asset.

“There could be periods where equities can give negative returns. But as you increase the time horizon, the risk goes down,” he added.

Neelesh Surana, CIO-Equity, Mirae Asset Investment Managers (India) mentioned why index funds stand out among equity funds. “Indian markets have done well over a long period of time. We’re talking about 15-16 per cent compounding because the GDP is growing,” he said.

“Mutual funds obviously are among the best products for retail investors and index funds make a lot of sense,” he added.

Plan Wisely, ‘Live’ Life In Old Age

What is the right time to retire? Is it possible to realistically retire at 40? That was the topic of a panel discussion at the Outlook Money’s 40 After 40 Retirement Expo.

Bhuvanaa Shreeram, co-founder, House of Alpha, said financial freedom wasn’t so much about money, but time. “The freedom of being able to spend your time the way you want is financial freedom. So if you have the choice to work or not work or do what you choose, that is freedom in the real sense,” she said.

Dilshad Billimoria, founder and chief financial planner of Dilzer Consultants, said that one has to be disciplined with setting budgets and goals if one wants to achieve financial freedom at 40. “If you’re able to systematically save and invest over a period, then with the power of compounding, you can definitely achieve financial freedom,” she said.

Plan, Understand Inflation

Priya Sunder, director of PeakAlpha Investment Services, said that one should think of retiring with a concrete plan, “not just for the money, but also for one’s time.”

She added that one should not start retirement planning with a calculator, but with a ‘calendar’. “Unless you know what you’re going to do with your time in retirement, all the money you save will go to the hospital; it will not go to your holidays, it will not go to your children,” she added.

Billimoria emphasised on the need to understand one’s current lifestyle and living expenses and accordingly start planning for one’s retirement years. She even cited examples of people who had invested solely in bank deposits without having any clarity on the concept of inflation and had approached them saying they had exhausted their money.

“Unfortunately, today, the majority of investments still consist of fixed deposits. People do not realise that with inflation, their real return is actually negative, and so, they need to invest in asset classes that give them inflation-adjusted returns,” she added.

Advice For Gen Z

Sunder said that youngsters should think about themselves, including their likely expenses at the age of 75 and plan for it now. “How do they plan to take care of that dependent person? The things that you do today must be done to take care of yourself at that age. The earlier you start, the better it is,” she added.

Connection Matters

Speakers at an agetech panel also highlighted how the rapid digitalisation in the past few years has brought in complexity or the older folks, but at the same time also empowered them in many ways.

They also lamented how there existed a wide space in businesses catering to senior citizens, though some entrepreneurs have tapped into this space through business modelled on agetech.

Ashwini Kapila, managing director, business development and partnerships, GetSetUp, narrated his personal experience of seeing his retired parents that led him to associate with this venture meant for the elderly.

“I saw my parents maintaining an active lifestyle after retirement. I realised that the elderly needed something to keep themselves busy and gainfully employed (not monetarily, per se). It was then that the three founders of GetSetUp decided to fill this gap with three aspects in mind—financial well-being, health and wellness and social connection,” he said.

Raghunandan K.S., founder and CEO, Elders India, said it was during his stint with the IT industry, when he was posted abroad, that he realised how difficult it was to take care of his ageing parents. He decided to come back as he was the only son and start something that could take holistic care of the elderly. He also decided to make corporates a stakeholder in this venture.

Salil Datar, founder, Simpli5, said that during his career with the banking industry he realised that the elderly also needed mental and emotional support and not just financial well-being.

“Banks were using digital means to cater to the millennials. I realised why can’t digital be used to cater to the specific needs of seniors? During Covid, I saw my parents struggle. I decided let’s take baby steps to keep digital simple for the elderly,” he said.

Learning From Peers

Kapila said that seniors need connections to stay active, healthy and also learn from peers.

Raghunandan said the needs of seniors are very complex, and understanding it is half the solution. “There is an awareness issue. Unlike in the past, today, if the child moves to another city for a job, the aged parents might have to come and stay with the children. The problem is that the parents will find it difficult to explain what exactly they need, and neither will the children be able to understand the concerns and needs of their parents,” he added.

Busting Myths

Sarthak Ahuja, director, NIAMH Ventures, a chartered accountant by qualification, and a well-known motivational speaker and educator, dispelled some popular myths on investment.

Advice For Gen Z

He said since a lot of Gen Z prefer work-life balance, they should ideally start saving early. “A lot of them love a work-life balance. So, they might prefer having a side gig, and not be subservient to an organisation. So, the sooner they start saving, the better it may be, because life can be harsh.”

He also spoke of the existing white space in businesses catering to the needs of seniors and listed a few that were successfully serving the aged. “Youngsters can tap into the segment,” he said.

His Own Investment Mantra

He said he invests in Nifty50 for the long term, because even if the market crashes, the impact would be negligible. “I invest 50 per cent in equities, 30-40 per cent in real estate and the rest in liquid funds and gold,” he said.

Follow For Fun Only

Pranjal Kamra, founder of Finology Ventures, and a Sebi-registered investment advisor (Sebi-RIA), is a well-known finfluencer with a large following on social media, especially among the Gen Z.

So, his own admission of not having social apps, and advice to Gen Z to not follow influencers blindly was a revelation.

“I don’t have a single social media app on my phone, not even YouTube. Recently, I met a CEO of a unicorn, and he uses a feature phone. He doesn’t use WhatsApp. Now, I am figuring out ways out of WhatsApp,” he said.

He said a lot of influencers are promoting lottery and betting apps, which is leading to mis-selling. As such, Gen Z should “follow influencers for entertainment only and not for education,” he said.

Gen Z Problem - Early Debt

Kamra said he saw one major problem with Gen Z. They are happy to splurge and comfortable with buying things on EMIs.

“I think this is really dangerous because at 25 years of age, you don’t want to be trapped in this cycle of paying EMIs,” he said.

The Retirement Question

He said Gen Z need to understand the concept of inflation and realise how much they will require 12-15 years down the line. That will help them determine the right corpus.

Right Age To Retire

He said retiring early will lead to compromises on lifestyle.

“If you say you want to retire at 35 or 40, you need to understand how much monthly investments you would need to do for the next 10 years. If you are unable to do it, it will lead to sadness and sorrow. But if you actually end up being that disciplined, then you are compromising on your lifestyle and your family’s lifestyle in your peak years.”

Invest In Your ‘X’ And Well-Being

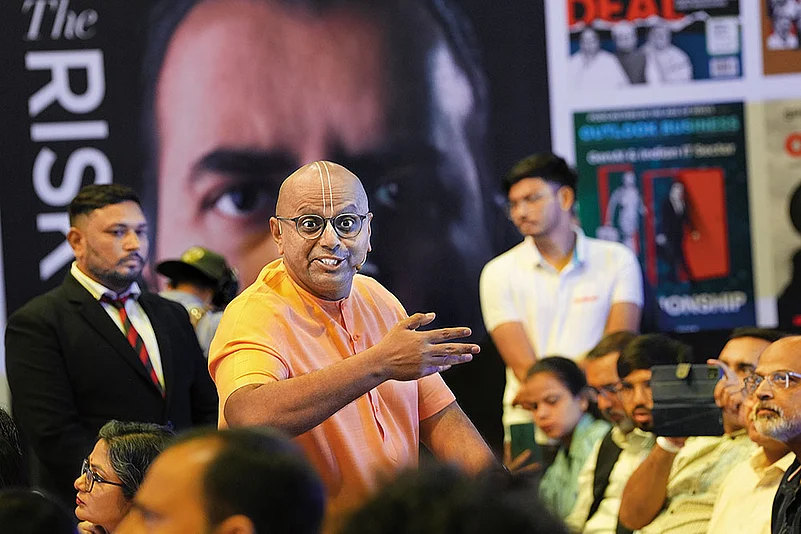

A financial planning expo is not the likely place where you would find a monk. So, when engineer-turned-monk Gaur Gopal Das stood among the crowd, his signature smile softening the room, and his words laced with humour to disguise the weight of what he was about to say, it sunk in deep.

“If you are born poor, it’s not your problem. But if you die like that, without having invested or planned properly for the future, that’s a blunder,” he said.

Das spoke on the subject of the “path to holistic happiness”, taking the audience through a blueprint on how to navigate the middle ground between birth and death.

“Spiritual leaders talk about the beginning and the end of life, but what about the in-between? That segment—where we live, work, struggle, and thrive—requires careful investment,” said.

Pi And X

Das dwelled on the mathematical concepts of pi and x to present thoughtful insights on freedom and peace of mind.

“The ‘pi’ of uncontrollable forces like economic instability and unpredictable markets, will always be there. But our ‘x’, the variables we can control and change, such as how we save, invest, and spend, is where our power lies,” he said.

Invest In Health

Das also spoke about taking care of health, which, he said is as important an asset as our bank accounts. “By the time we reach 40, 50, or 60, the poor choices we make today could leave us physically wrecked. Invest in your ‘x’ and your physical well-being. What good is financial stability if you are too unhealthy to enjoy it? Investing in nutritious food, regular exercise, and restful sleep are the keys to ensuring that your golden years are not just financially secure, but also physically fulfilling as well,” he said.

Beat Stress

He said that no amount of money or fitness can help if our minds are in turmoil. “Can you change a deadline that is not in your hands? Can you change a toxic colleague? But you can change how you respond to it,” he said.

He said simple solutions, such as mindfulness, meditation, and journaling can help as they calm the mind, provide clarity, and help you turn loneliness into solitude.